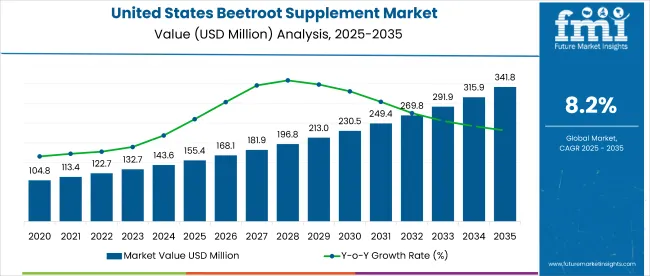

The USA beetroot supplement market is worth USD 155.4 million in 2025 and is expected to reach USD 341.8 million by 2035, reflecting a CAGR of 8.2%. This growth is being driven by increasing awareness of cardiovascular health, a growing preference for plant-based products, and the widespread use of beetroot supplements in sports nutrition.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 155.4 million |

| Projected Value (2035F) | USD 341.8 million |

| CAGR (2025 to 2035) | 8.2% |

In addition, the rising incidence of lifestyle-related diseases such as diabetes and hypertension is pushing consumers toward functional foods and supplements. Innovations in flavor formulation and clean-label packaging are further propelling the demand for beetroot supplements in the United States.

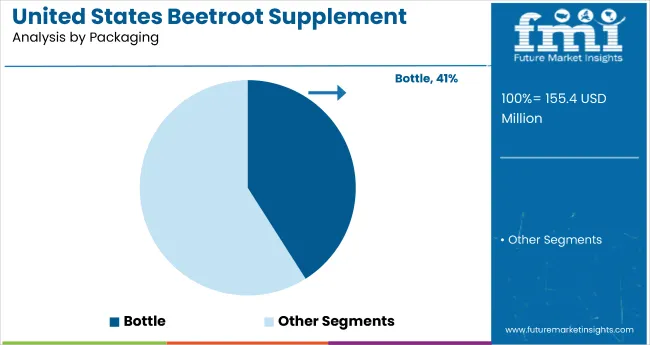

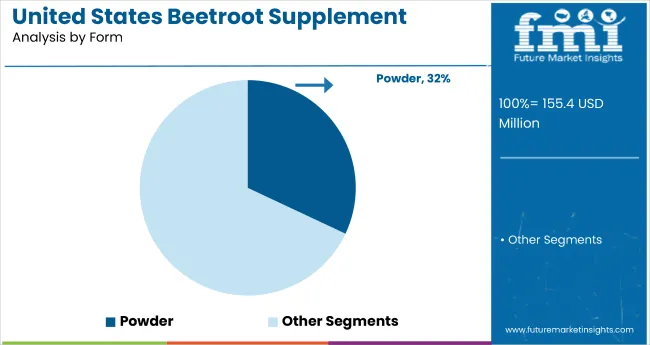

The powdered segment is anticipated to lead the form segment in the beetroot supplement market, accounting for 32% of the market share in 2025. This dominance is attributed to its ease of mixing, versatility, and higher consumer acceptance due to flavor masking techniques. Meanwhile, Bottled packaging is projected to maintain its lead with a market share of 41% in 2035, supported by better shelf life and product visibility.

The market holds notable shares across multiple parent categories. It accounts for 3.5% of the overall dietary supplements market, driven by rising health awareness. Within the sports nutrition segment, it holds around 4.2%, primarily due to its use in endurance and performance products.

In the plant-based supplements market, beetroot supplements represent roughly 5.8%, fueled by the vegan and clean-label trend. It also accounts for 2.7% of the cardiovascular health supplements market, supported by clinical claims related to heart health. These shares are expected to grow steadily through 2035 as consumer demand increases.

Looking ahead, the USA beetroot supplement market is likely to benefit from advancements in nutrient bioavailability and flavor enhancement technologies. Government recommendations promoting vegetable intake and heart health awareness are expected to further support market penetration.

Companies are investing in clinical validation and certifications to improve trust and broaden appeal. Partnerships with fitness influencers and lifestyle brands will likely continue shaping consumer behavior and driving consistent sales growth. Additionally, the growing popularity of personalized nutrition is anticipated to open new opportunities for targeted beetroot-based formulations in the coming years.

The market is segmented by claim, packaging, distribution channel and form. By claim, the market is divided into vegan and regular. By packaging, the market is segmented into bottle, can, jar and sachets. By distribution channel, the market is segmented into store-based retailing (dollar stores, grocery stores, mass merchandiser, club stores, convenience stores, forecourt retailers, drug stores & pharmacies and others, and online retailing (company website, gross merchandiser). By form, the market includes liquid, powder, capsule, tablet and gummies.

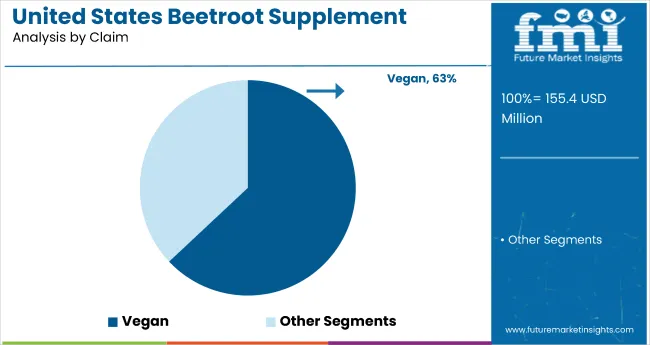

Vegan beetroot supplements are rapidly gaining traction as consumers opt for plant-based lifestyles. Between 2025 and 2035, this segment is expected to remain the most lucrative under claims, accounting for a 63% market share in 2025. The shift toward cruelty-free and dairy-free nutrition continues to appeal to health-conscious Millennials and Gen Z consumers, especially in metropolitan areas.

Bottled packaging will continue to dominate the market through 2035, holding an estimated 41% market share in 2025. Bottles offer durability, extended shelf life, and allow branding to stand out on retail shelves. The secure sealing ensures product stability, particularly in liquid and powdered beetroot supplements. Brands are increasingly investing in sustainable and recyclable bottle formats to attract eco-conscious consumers.

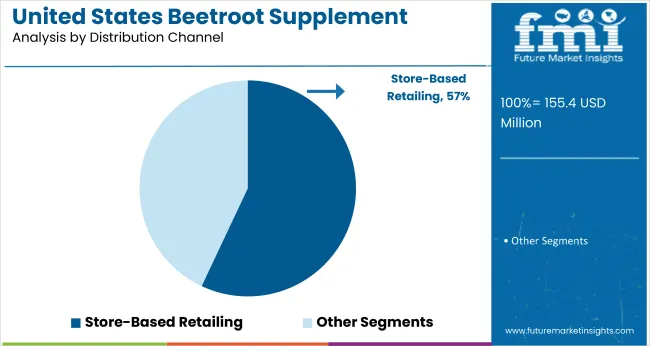

Store-based retailing leads distribution, projected to hold 57% of the market in 2025. Among the sub-segments, grocery stores are the most profitable, driven by high footfall and the increasing shelf presence of health-focused supplements. Shoppers prefer physical stores for immediate purchases and product assurance. Retail partnerships, endcap displays, and bundling with other health goods are being used to boost in-store conversions. Promotions and in-person consultations also play a role in enhancing consumer trust.

Powdered beetroot supplements will continue to lead the form segment, accounting for 32% of the market share in 2025, and are expected to maintain this dominant position through 2035. Powders offer customizable dosage and are ideal for blending with smoothies, water, or workout drinks. Flavored powders mask beetroot’s earthy taste, boosting repeat usage. The segment benefits from flexible packaging options, longer shelf life, and lower transportation costs compared to liquid supplements.

Recent Trends in the United States Beetroot Supplement Market

Challenges in the United States Beetroot Supplement Market

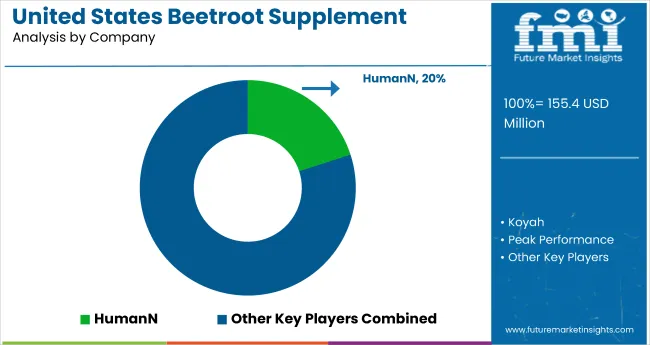

The USA beetroot supplement market is fragmented, with numerous players competing across price tiers, distribution channels, and formulation types. Companies such as HumanN SuperBeets, BioBeet®, KOS, and BulkSupplements lead in brand recognition and innovation, while niche players like Koyah and Organifi cater to specialty nutrition audiences. These players are leveraging online platforms, health influencer collaborations, and proprietary formulations to strengthen their market share.

Key strategies involve introducing new delivery formats (gummies, chews), investing in clinical validation for cardiovascular health benefits, and partnering with sports nutrition retailers and DTC platforms. HumanN and 1MD Nutrition are focusing on premium blends backed by scientific trials, while KOS and Horbaach are expanding into value-based multichannel sales. Meanwhile, clean-label certifications, flavored variants, and bundled health kits remain popular tactics for consumer retention.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 155.4 million |

| Projected Market Size (2035) | USD 341.8 million |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD million / Volume in Metric tons |

| By Claim | Vegan, Regular |

| By Packaging | Bottle, Can, Jar, Sachets |

| By Distribution Channel | Store-based Retailing (Dollar Stores, Grocery Stores, Mass Merchandiser, Club Stores, Convenience Stores, Forecourt Retailers, Drug Stores and Pharmacies, Others), Online Retailing (Company Website, Gross Merchandiser) |

| By Form | Liquid, Powder, Capsule, Tablet, Gummies |

| Countries Covered | United States |

| Key Players | BioBeet®, HumanN SuperBeets, Koyah Beet Whole-Root Powder, HumanN BeetElite, Peak Performance Organic Beet Root Powder, BulkSupplements Beet Powder, Bronson Beet Root, 1MD Nutrition CardioFitMD, KaraMD Ultra Beets, Organifi Red Juice, Self Evolution Beet12, KOS Organic Beet Root Capsules, Horbaach Beetroot Capsules, and Natural Fuel Power Beets |

| Additional Attributes | Dollar sales by value, market share analysis by segments, and channel-wise analysis |

The global United States beetroot supplement market is estimated to be valued at USD 155.4 billion in 2025.

The market size for the United States beetroot supplement market is projected to reach USD 330.4 billion by 2035.

The United States beetroot supplement market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in United States beetroot supplement market are liquid, powder, capsule, tablet and gummies.

In terms of claim, vegan segment to command 56.3% share in the United States beetroot supplement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

United States Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA