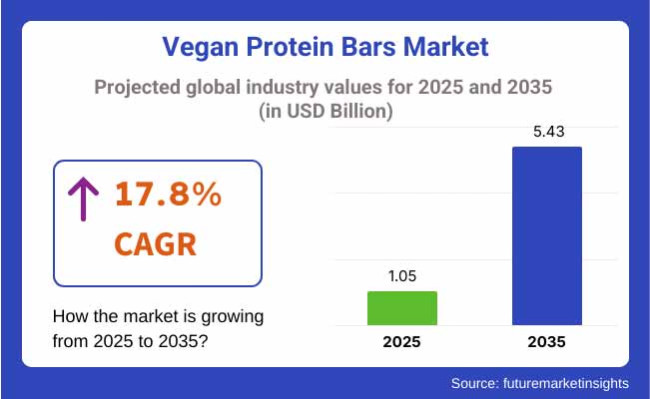

Global demand for vegan protein bars is forecast to soar from USD 1.05 billion in 2025 to USD 5.43 billion by 2035 at a CAGR of 17.8%. The trajectory reflects three reinforcing shifts: heightened public awareness of plant-centric, protein-focused nutrition; sharp growth in flexitarian and lactose-intolerant populations; and the escalating search for ethically aligned, grab-and-go snacks. Plant-based and clean-label trends are already reshaping a regional market projected to double this decade.

Formulators are widening their protein palette beyond legacy pea, rice, and hemp. Pumpkin-seed, sunflower-seed, and algae isolates now appear in SKUs that boast complete amino-acid profiles while addressing allergen concerns. 88 Acres, for instance, positions seed-powered bars as top-eight-allergen-free to win shelf space in school lunch programs Amazon. At the premium end, adaptogenic inclusions-ashwagandha, lion’s-mane, and cordyceps-are being blended with low-GI sweeteners to appeal to the bio-hacking crowd. Sustainability arguments strengthen adoption.

A 2024 life-cycle analysis in the Journal of Cleaner Production reported that plant-protein bars generate 45 percent fewer greenhouse-gas emissions than dairy-based counterparts when measured cradle-to-distribution, reinforcing corporate ESG narratives. Brands are moving to monomaterial flow-wraps or compostable cellulose films to satisfy forthcoming extended-producer-responsibility rules in the EU and several USA states.

E-commerce and print-on-demand copackers enable micro-brands to scale rapidly; Shopify data show vegan bar SKUs growing at double the site’s overall food-and-beverage merchant rate in 2024. Influencer-led launches dominate social feeds, mirroring strategies that powered Quest and RXBAR in the previous decade.

Brad Charron, CEO of plant-based bar maker ALOHA, told The Food Institute in September 2024, “Plant-based isn’t a fad; it’s a fundamental shift toward cleaner, more responsible nutrition, and our triple-digit growth proves the consumer is voting with their wallet.” The Food Institute Investor confidence echoes that view: venture funding directed at alt-snack startups topped USD 600 million in 2024, with several rounds earmarked specifically for high-moisture extrusion lines that improve bar texture without dairy binders.

With broadened protein sources, credible environmental credentials, and tech-enabled direct-to-consumer reach, vegan protein bars are positioned to transform from niche gym fuel into a mainstream, multifunctional snack segment, quintupling in value and reshaping on-the-go nutrition through 2035.

The organic segment of the vegan protein bars market is projected to dominate, capturing a market share of 59.4% by 2025. Growth in this category is driven by rising consumer demand for clean-label nutrition, free from synthetic additives, genetically modified organisms (GMOs), and pesticides. Organic vegan protein bars typically feature USDA- or EU-certified ingredients, attracting consumers increasingly attentive to ingredient transparency and environmental impact. Natural sweeteners such as agave, dates, or maple syrup replace refined sugars, appealing strongly to health-conscious consumers and those with dietary sensitivities.

Companies market organic bars emphasizing ethically sourced ingredients, sustainable production practices, and compostable packaging, aligning strongly with consumer preferences for environmental responsibility and digestive compatibility. The organic segment attracts significant attention from retail and e-commerce channels, notably within sports nutrition, weight management, and diabetic-friendly categories due to their functional, health-oriented positioning.

Although conventional bars remain cost-effective and widely available, organic bars justify premium shelf space by generating higher consumer loyalty, particularly among dedicated vegan and health-focused consumers. These factors collectively drive sustained market leadership and growth of organic vegan protein bars.

The chocolate-vanilla flavor segment is anticipated to dominate the vegan protein bars market, securing a market share of 63.1% by 2025. Its dominance is driven by broad consumer appeal, offering balanced sweetness and an indulgent yet familiar taste profile. This flavor combination effectively satisfies consumer cravings for dessert-like snacks while providing essential protein and sustained energy, meeting consumer demands for functional yet pleasurable snacking. Chocolate-vanilla bars often include functional additions such as almonds, chia seeds, or protein crisps, enhancing texture and nutritional value.

Consumers widely prefer this flavor due to its versatility, suitable for multiple eating occasions, including pre-workout boosts, post-workout recovery, and mid-day snacks. The broad consumer base includes fitness enthusiasts, active millennials, busy professionals, and school-aged children, ensuring strong market presence.

Brands frequently innovate by launching limited-edition variants like mocha-vanilla or double chocolate-vanilla swirl, further attracting diverse consumer groups. Despite competition from indulgent flavors like chocolate-caramel, chocolate-vanilla maintains a superior market position due to its perception as a healthier, lower-sugar option. Its timeless and mass-market appeal continues driving its dominance within wellness and performance nutrition segments globally.

Due to a strong fitness culture, growing adoption of vegan and flexitarian diets and high consumer spending on functional foods, North America holds a dominant position in the vegan protein bars market. The United States dominates the region with key players, wide-ranging product portfolios, and increased proliferation via health stores, gyms, supermarkets, and e-commerce. Market growth is also supported by clean-label demands and plant-based awareness campaigns.

Europe isn't far behind, with Germany, the UK, and the Netherlands showing robust interest in high-protein plant-based snacking. The region's sustainability focus and ethically sourced ingredient preference both drive the growth of vegan protein bars. Innovation in texture and flavor (applied to eco-packaging variant) has enhanced consumer experience, complementing the oily product, which is consumed daily by urban and healthy consumers.

Rising awareness about health among people, urbanization, and changing dietary preference among Indian, Australian, Japanese, and South Korean users is providing an impetus for Asia-Pacific to emerge as a high-growth region. Plant-based snacking is becoming increasingly popular in fitness communities and also among the young urban consumers, although traditional protein sources still dominate. In developed and developing nations alike, e-commerce growth and foreign brand entries are broadening the horizons of the sector.

Challenges

Ingredient sourcing, flavor masking, and consumer perception remain critical obstacles.

While the market has shown significant momentum, challenges remain around the taste and texture of the formulations, particularly those based on pea or legume proteins. And technically, it can be a challenge to keep the clean-label appeal while also ensuring shelf stability and palatability.

The slow adoption of more sustainable proteins, especially in developing markets, is also hampered by limited consumer knowledge about alternative proteins and their effectiveness.High pricing and competition from traditional protein snacks are still big hurdles.

Opportunities

Functional innovation, flavor variety, and tailored nutrition are driving market evolution.

Consumers be it superiority seekers or global nomads, have varied expectations leading to diversified possibilities in the market such as fortified vegan protein bars supplemented with vitamins, adaptogen, prebiotics and superfoods. Increasing demand for customized protein bars focused on individual health demands like muscle recovery, weight management, and energy boosts. New flavor developments such as spiced, tropical or savory bars, gluten-free certifications and packaging innovations that focus on sustainability cater directly to eco-conscious customers.

From 2020 to 2024, the vegan protein bars market experienced a surge in product launches that was prompted by the fitness boom, consumers increased interest in plant-based living and a pandemic-driven push for immune supportive, shelf-stable foods. Brands leveraged social media trends and digital marketing to foster brand loyalty, and retail partnerships ushered plant-based snacks into the mainstream. Also, the market was mostly focused in North America and hemmed in by few regions in Europe with limited flavor and basic nutritional profiles.

In the next financial year, accumulated demand will shift to high-performance, nutrient-rich formulations devoted to specific consumer goals. Cleaning ingredient sourcing, transparent labeling, and formula-strategy methods to duplicate the taste and satiety of dairy-based bars will boost product differentiation. Integration with wellness ecosystems be it fitness applications, personalized subscriptions, smart packaging will be a major trend, expanding consumer engagement and retention.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Basic plant-based labeling standards |

| Consumer Trends | Interest in healthy snacking and low-sugar alternatives |

| Industry Adoption | Startups and DTC brands driving innovation |

| Supply Chain and Sourcing | Regional pea and rice protein suppliers |

| Market Competition | Fragmented market with niche offerings |

| Market Growth Drivers | Veganism, fitness culture, and dietary shifts |

| Sustainability and Impact | Compostable wrappers and low-carbon sourcing in early stages |

| Smart Technology Integration | Basic online retail expansion |

| Sensorial Innovation | Limited to chocolate and nut-based flavors |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Detailed nutritional labeling, allergen regulations, and clean-label certifications |

| Consumer Trends | Preference for goal-oriented nutrition, performance-driven bars |

| Industry Adoption | Entry of major FMCG firms and supermarket private labels |

| Supply Chain and Sourcing | Global sourcing of seed, nut, and microalgae proteins |

| Market Competition | Consolidation with premium and functional focus |

| Market Growth Drivers | Functional wellness, climate-focused diets, and personalized nutrition |

| Sustainability and Impact | Fully circular packaging, carbon-neutral production, and traceable sourcing |

| Smart Technology Integration | Subscription models, QR-tracking, and app-connected wellness ecosystems |

| Sensorial Innovation | Fusion, international, and savory-sweet hybrid bars with improved texture |

With a flourishing fitness culture, rising vegan population and growing demand for plant-based convenience foods, the USA is the leading market for vegan protein bars, accounting for over half of total worldwide sales. Big sports nutrition brands are introducing high-protein vegan bars aimed at athletes, gym-goers and health-conscious millennials. California and Texas food tech startups are using pea and brown rice and hemp proteins to improve flavor and texture.

According to SPINS, some of the all-time top sellers of this genre of snack have been invented by retailers like Whole Foods and Target to expand shelf space, and e-commerce continues to propel subscription-based protein snack models. FDA guidelines on clean labeling and non-GMO certification also influence product innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 18.2% |

In the UK market, a strong growth is supported by the growing adoption of plant-forward diets and exercise-focused snacking. Consumers are looking for high-protein and low-sugar vegan brands that are aligned with sustainability targets. Major supermarket chains including Waitrose and online platforms such as Ocado are now marketing private-label vegan bars containing oat, quinoa and pumpkin seed protein.

Urban lifestyle trends, as well as the impact of vegan influencers and athletes, are encouraging brand loyalty. There has also been opportunities for local-formulation and international expansion of vegan nutritional products with post-Brexit regulatory adaptations.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 17.6% |

Driven by growing awareness of plant-based diets and EU Green Deal initiatives, EU countries are stepping up production and consumption of vegan protein bars, alongside the growth of vegan certifications. Germany, the Netherlands, and Sweden are emerging innovation hubs, where brands are already rolling out allergen-free, soy-free versions based on chickpea- and lentil-derived protein.

Clean-label, eco-friendly food packaging has been pushed as the EU's food labeling standards and sustainability requirements are aiding the same. Health food specialty chains and organic markets across the bloc are devoting more shelf space to protein-dense vegan snacks. Cross-border logistics a growth area in smaller markets like Austria and Portugal.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 17.9% |

Among such global markets, Japan's Vegan Protein Bars market is growing thanks to an upward trend for health-conscious aging populations, a demand for functional foods, and innovations in compact and convenient nutrition formats. Domestically, native ingredients including matcha, adzuki beans, and black sesame are being included in protein bars, resonating with both local and international markets.

In Tokyo and Osaka, bars that cater to vegans have also become popular among young professionals and athletes. Wellness initiatives funded by the government and increasing numbers of vegan cafés are creating an environment conducive for a segment of market. Japanese brands are eating up the competition with high-quality packaging and a focus on flavor harmony.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 17.3% |

The vegan bar segment in South Korea is booming, fuelled by the growing gym culture, a rise in vegan K-pop endorsements, and social media-promoted wellness trends. Imported and locally-made bars made of mung bean, pumpkin seed and soy protein now fill Seoul’s convenience stores and specialty health retailers.

Data-based companies in food tech are enhancing product personalization and keeping track of consumer nutritional necessities. National food-tech policies are putting government emphasis on plant-based innovation, allowing local companies to scale production. Older demographic groups are also using vegan protein bars as school and work snacks.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 18.0% |

The rise of plant-based eating, on-the-go lifestyles, and clean-label nutrition all converge to make vegan protein bars an area of high demand. Pea, rice, hemp and chia protein blends, sugar-free binders, adaptogens, and functional ingredients are among the innovations that are changing product offerings.

With gut health, muscle recovery, and energy increasingly front-of-mind for athletes, wellness seekers, and flexitarian consumers, companies are growing portfolios with indulgent, but health-forward, bars. Texture, flavor masking and shelf stability remain core areas of innovation and competition.

Market Share Analysis by Key Players & Vegan Protein Bars Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Clif Bar & Company | 14-17% |

| RXBAR (Kellogg’s) | 11-14% |

| No Cow | 9-12% |

| Orgain | 7-10% |

| GoMacro | 6-9% |

| Other Vegan Protein Bars Providers | 38-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Clif Bar & Company | In 2024, launched the CLIF Builders Plant Protein+ with probiotics and B12; in 2025, rolled out oat- and lentil-protein bars for endurance athletes. |

| RXBAR (Kellogg’s) | In 2024, introduced its first fully vegan RXBAR with pea protein and dates; in 2025, launched vegan RX Minis for portion-controlled snacking. |

| No Cow | In 2024, updated formulas with monk fruit sweetener and prebiotic fiber; in 2025, added seasonal flavors like ginger chai and chocolate orange. |

| Orgain | In 2024, debuted protein superfood bars with greens and turmeric; in 2025, partnered with gyms and smoothie bars for co-branded functional bars. |

| GoMacro | In 2024, added kids’ Vegan Protein Bars line with lower sugar; in 2025, introduced high-protein macro-balanced bars for sports nutrition retail. |

Key Market Insights

Clif Bar & Company (14-17%)

Clif Bar remains a category leader with deep penetration across natural food stores and sports nutrition chains. In 2024, its Plant Protein+ line featured probiotics and B12 targeting vegan endurance athletes. By 2025, it expanded its offering with lentil- and oat-based protein blends that improved amino acid profiles and digestion rates.

Clif has also reinforced its sustainability narrative with compostable wrappers and carbon-neutral production initiatives. Its ambassador-led sampling campaigns in college athletics and trail-running events strengthen brand loyalty among active consumers.

RXBAR (Kellogg’s) (11-14%)

In 2024 RXBAR made a big move into plant-based, with its first vegan product, harnessing its strong positioning in clean-label nutrition. RXBAR goes mini-As consumers shifted to workplace wellness and grab-and-go, RXBAR followed suit with smaller, portion-friendly SKUs featuring simple ingredient lists in 2025.

Its marketing emphasizes transparency and taste with a focus on three-to-five ingredient formulas. The brand’s direct-to-consumer subscription growth and new flavors (chocolate sea salt, blueberry almond) hit snackers looking for function and indulgence

No Cow (9-12%)

No Cow continues to attract fitness-forward vegans and keto consumers through low-carb, dairy-free protein bars. In 2024, it reformulated to include prebiotic fiber and monk fruit for improved digestion and taste. By 2025, its limited-edition seasonal flavors like ginger chai and chocolate orange gained cult popularity, particularly in digital fitness communities.

No Cow invests heavily in influencer partnerships and bundle customization, offering flavor-curated packs online. Its strong community presence among CrossFit and HIIT gyms supports repeat brand engagement.

Orgain (7-10%)

Orgain combines clinical nutrition with plant-based innovation. In 2024, it launched superfood protein bars integrating greens, turmeric, and pea protein to appeal to health-focused professionals. By 2025, it forged B2B partnerships with gyms, smoothie bars, and coworking wellness hubs, creating co-branded functional offerings.

The brand emphasizes medical advisory board-backed formulations and has focused marketing efforts on digestive health and inflammation reduction. Orgain also expanded its footprint in pharmacy retail chains across North America and Europe.

GoMacro (6-9%)

Founded in 2004, GoMacro is an organic, clean ingredient vegan bar with a powerful ethical identity. In 2024, it branched into kid-friendly vegan protein bars, offering low sugar, allergen-friendly ingredients. In 2025, GoMacro introduced macro-balanced bars designed for the sports nutrition retail space, focusing on delivering carb, fat and protein balance.

Its direct-to-store delivery (DSD) expansion and farmer support initiatives helped bolster retail relationships and local sourcing credibility. It’s this ongoing commitment to family-owned transparency that fuels consumer trust.

Other Key Players (38-45% Combined)

A dynamic group of plant-based startups and functional snack innovators are expanding the Vegan Protein Bars space. These include:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.05 billion |

| Projected Market Size (2035) | USD 5.43 billion |

| CAGR (2025 to 2035) | 17.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Testing Types Analyzed (Segment 1) | Nature (Organic, Conventional), Flavor (Chocolate-Vanilla, Chocolate-Caramel, Others) |

| Applications Analyzed (Segment 2) | Fitness & Sports Nutrition, Weight Management, General Wellness, Convenience Snacking |

| End Users Analyzed (Segment 3) | Athletes, Fitness Enthusiasts, Vegans, Flexitarians, Working Professionals |

| Regions Covered | North America, Europe, Asia Pacific |

| Countries Covered | United States, United Kingdom, Japan, South Korea, Germany, Netherlands, Sweden |

| Key Players Influencing the Vegan Protein Bars Market | Clif Bar & Company, RXBAR (Kellogg’s), No Cow, Orgain, GoMacro, LÄRABAR, Raw Rev, Bhu Foods, TRUWOMEN, Misfits Health |

| Additional Attributes | Focus on Clean-label, Plant-based, Non-GMO, Gluten-Free, and Allergen-Free Claims |

| Customization and Pricing | Available upon Request |

The overall market size for the vegan protein bars market was USD 1.05 billion in 2025.

The vegan protein bars market is expected to reach USD 5.43 billion in 2035.

The demand for vegan protein bars is rising due to increasing consumer focus on plant-based nutrition, growing interest in functional snacking, and the popularity of clean-label, organic products. Chocolate-vanilla flavor combinations and the appeal of organic formulations are further driving market expansion.

The top 5 countries driving the development of the vegan protein bars market are the USA, Canada, Germany, the UK, and Australia.

Organic formulations and chocolate-vanilla flavors are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Ingredient Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Ingredient Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Nature, 2023 to 2033

Figure 27: Global Market Attractiveness by Flavor, 2023 to 2033

Figure 28: Global Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Nature, 2023 to 2033

Figure 57: North America Market Attractiveness by Flavor, 2023 to 2033

Figure 58: North America Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Flavor, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Flavor, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Flavor, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Flavor, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Flavor, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Ingredient Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Ingredient Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Ingredient Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Flavor, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Vegan Protein Bars in EU Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Vegan Flavor Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA