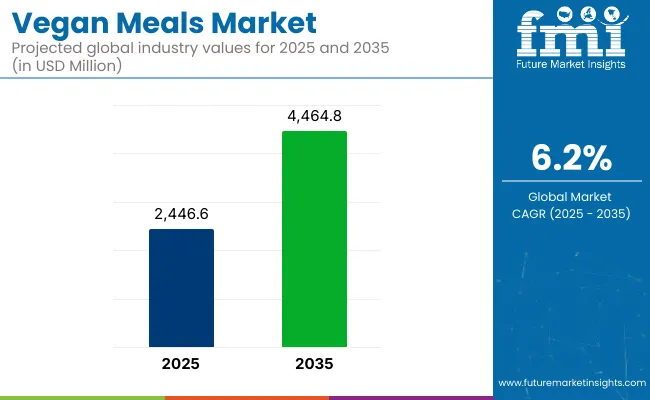

In 2025, the global vegan meals market size is assessed at USD 2,446.6 million and is forecasted to witness steady growth, reaching USD 4,464.8 million by 2035, reflecting a CAGR of 6.2%. The rising preference for plant-based diets has intensified as consumers increasingly link personal health with planetary health.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 2,446.6 million |

| Projected Market Value (2035F) | USD 4,464.8 million |

| Value-based CAGR (2025 to 2035) | 6.2% |

This surge in interest stems from the growing awareness around animal welfare, environmental sustainability, and the benefits of reducing meat consumption. Vegan meals have thus emerged as an accessible entry point for consumers transitioning to flexitarian, vegetarian, or fully plant-based lifestyles.

The market expansion is being propelled by rapid innovation in product development, improved taste and texture of meat substitutes, and expanding retail availability. Demand for frozen and ready-to-eat vegan meals has surged due to their convenience, particularly among working professionals and students.

However, premium pricing and perceived nutritional gaps in some processed vegan products have limited broader adoption across price-sensitive populations. Industry players are addressing these concerns by reformulating recipes for cleaner labels, fortifying with proteins and micronutrients, and leveraging whole-food ingredients. Key trends include global cuisines being veganized, the rise of private label offerings, and a shift toward eco-friendly packaging formats.

By 2035, the market is expected to mature with an influx of nutritionally optimized, value-added vegan meal options targeting specific dietary needs such as keto, high-protein, and allergen-free. Retail will continue to be the leading sales channel, while foodservice adoption will gain momentum with vegan meals being normalized on mainstream menus.

Technological advancements in food processing, especially in texture and flavor enhancement, are likely to influence future product launches. The integration of smart labeling and carbon footprint disclosures may also redefine consumer trust and transparency expectations within the segment.

The above table indicates comparative study of six-month variation in CAGR from base year (2024) up to date and from current year up to now year (2025) in vegan food global market. Comparison indicates overall variation in performance and gives trend in realisation of revenue, thereby giving stakeholders clear vision of trend in growth for the year. H1 includes Jan to June and second half, i.e., H2, is Jul to Dec.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.7% |

| H2 (2024 to 2034) | 5.9% |

| H1 (2025 to 2035) | 6.0% |

| H2 (2025 to 2035) | 6.2% |

Growth of the company is to increase at 6.0% CAGR in half 2025 to 2035 and accelerating growth in the second half of the period at a 6.2%. During the second phase, H1 2025 to H2 2035, stepwise CAGR will increase. The industry's performance for H1 2025 was 30 BPS better, and for the latter, from the time H2 2025, the company experienced an improvement of 20 BPS compared to its previous valuation.

Plant foods business is ready to experience a decade of humongous growth on the back of growing consumer awareness, wellness, and global demand for ethnicity- and sustainability-focused foods. With increasing technology savvy in the production of plant foods, further avenues of distribution, and R&D investment, the business will flourish.

Frozen vegan means hold a share of 41.5% during the forecast period. In contrast, shelf-stable vegan meals are projected to account for approximately 18.6% of the global vegan meals market in 2025. These meals play a pivotal strategic role in expanding accessibility, especially in emerging economies and regions with limited cold chain infrastructure. Their long shelf life, ambient storage requirement, and low distribution cost make them highly relevant for e-commerce, institutional catering, and disaster relief food programs.

Regulatory agencies such as the USA Food and Drug Administration (FDA) have placed emphasis on shelf-stable product safety through low-acid food regulations (21 CFR Part 113), which have been increasingly adopted by producers of retort-packaged vegan entrees.

Leading companies including Loma Linda (Atlantic Natural Foods) and Tasty Bite (Mars, Inc.) have continued to expand their shelf-stable vegan lines by incorporating clean-label formulations and globally inspired flavors such as Korean BBQ jackfruit or Indian lentil curry. These products meet rising demand from flexitarians seeking convenience without compromising on ingredient integrity.

Their presence is also expanding through club stores and military procurement channels. Continued innovation in high-pressure processing and aseptic packaging is expected to enhance the nutritional retention and sensory quality of shelf-stable meals, enabling further market penetration across both developed and developing economies.

Ready-to-eat means account for 44.3% in 2025. Meal kits with vegan offerings are expected to hold a modest yet fast-growing 9.7% share of the vegan meals market in 2025. Positioned at the intersection of convenience, nutrition, and culinary exploration, these kits have carved out a niche segment among urban, digitally engaged consumers. Major D2C brands such as Purple Carrot and Green Chef (a HelloFresh brand) offer fully plant-based or vegan-friendly meal kits that combine pre-portioned ingredients with easy-to-follow instructions.

In the UK, Mindful Chef has capitalized on vegan meal kit trends by aligning with The Vegan Society standards. This format enables real-time customization, freshness preservation, and consumer empowerment through DIY cooking, while still ensuring portion control and reduced food waste. Regulatory alignment with nutritional labeling laws, such as those under EU Regulation 1169/2011, has been critical in ensuring transparency regarding allergen-free or organic claims.

Additionally, sustainability-conscious packaging and carbon-neutral delivery models have gained prominence as brand differentiators. Although currently limited by cost and logistical complexity, subscription-based vegan meal kits are expanding their reach through retailer partnerships and omnichannel strategies. As cold-chain logistics improve and regional production hubs scale up, the accessibility and affordability of vegan meal kits are expected to improve significantly by 2035.

Tier 1 consists of a group of leading companies that are of significant size, brand dominance, and global market penetration in the vegan food space. To capitalize on the growing demand for plant-based ready meals, these companies have high brand equity and large investments in advertising, developing new products, and expanding geographically.

Nestlé, for instance, through its Garden Gourmet and Sweet Earth brands, sells a host of vegan meals - including frozen entrees, bowls and plant-based proteins - across North America and Europe. Conagra Brands is another major player, having acquired top vegan brand Gardein, which has a wide breadth of frozen meals, meat alternatives and snacks available at leading supermarket and foodservice channels

Tier 2 - brands with reasonable revenue compared to tier 1, but with significant market share in certain areas, especially health focused or premium. For example, Amy’s Kitchen has cultivated an enthusiastic following for its organic, non-GMO vegan meals like burritos, lasagnas, and grain bowls, which are sold all over North America and parts of Europe.

Quorn Foods, famous for its mycoprotein-based products, is somewhat along the same track, also expanding into vegan meals and frozen entrees, appealing to sustainability and clean-label consumers. These companies mostly differentiate themselves through differences in ingredients, ethical sourcing, and advertising to targeted demographics like health-conscious or environmentally conscious consumers.

Tier 3: Emerging and small players start to become popular via direct-to-consumer sales, subscription meal plans and local retail partner These are usually low distribution, high creative companies that are more articulated through social media, influencer marketing, and sustainability narratives.

For example, allplants is a UK-based brand that delivers frozen chef-made vegan meals straight to your door, focusing on plant-based gourmet meals. One such example is Veestro, an American vegan meal delivery service that offers fully cooked, ready-to-heat meals. These Tier 3 firms are often designed for busy professionals and flexitarians seeking convenience, health benefits, and ethical consumption, prioritizing artisanal quality and personal experiences.

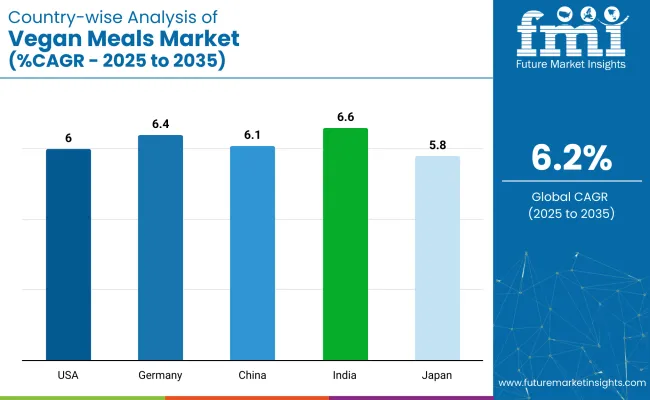

The following table shows the estimated growth rates of the top five territories. These markets are set to experience high consumption through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 6.0% |

| Germany | 6.4% |

| China | 6.1% |

| Japan | 5.8% |

| India | 6.6% |

USA demand for vegan meals is growing due to the rise in health-conscious and environmentally minded consumers. Increasing popularity of flexitarian and vegan diets has driven innovation in ready-to-eat vegan meal products, in response to consumer demand for plant-based alternatives. In fact, retailers, supermarkets, and online retailers expanded and made vegan meals even more available. Moreover, the clean-label trend has prompted producers to launch organic, non-GMO, and preservative-free alternatives, which will also propel the market growth.

Germany is leading across Europe in the adoption of plant-based food, having a well-established vegan culture and higher investments in food innovation. They want clean, ethical, and high-protein vegan meals, and grocery store offerings from traditional brands and startups have expanded to meet demand.

Supermarkets and organic food retailers are constantly increasing their plant-based offerings, with vegan meals becoming more available. Market growth has also benefited from government support for both sustainable food production and plant-based nutrition.

With greater awareness of plant-based nutrition and an expanding population of middle-class Chinese, demand has surged for vegan meals. It is in this context, of growing urbanization and disposable incomes, that consumers crave convenient and nutritious meal solutions that can be integrated with traditional Chinese eating patterns. The growth of the e-commerce and food delivery sector has also contributed to the market growth. The market outlook has also been bolstered by government initiatives encouraging plant-based protein as an alternative sustainable food source.

The increasing demand for vegan meals in Japan has also been boosted by the country’s emphasis on health, longevity, and functional foods. As part of this, consumers look for foods originating in traditional Japanese, yet with health value, especially plant-based foods.

Convenience stores and supermarkets, along with online grocery platforms, have seen a boost in their plant-based meal offerings that now serve an ever-growing consumer base. Japan’s stringent food safety requirements and high expectations for quality sourcing also guarantee that vegan meal options are top tier.

India's cultural leaning toward vegetarianism and a growing awareness of veganism have driven the growth of the market for vegan meals. Factors such as health consciousness, environmental sustainability concerns, and the influence of the Western diet have driven this expansion in the market.

Over time, with the growing demands on restaurants, grocery stores, and online platforms, convenience became a driving force leading to the introduction of vegan meal options. Moreover, the government initiatives promoting plant-based diets as a part of sustainability drive have also bolstered the market landscape. As India’s population grows and its urban density continues to increase, the market for plant-based meals is set to keep expanding.

The Vegan Meals market is getting very competitive with the leading players BYOND MEAT, IMPOSSIBLE FOODS, AMY'S KITCHEN and NESTLE expanding their market share through brand awareness, product innovation or through partnership. The companies are meeting growing demand for plant-based convenience foods by launching a wide range of ready-to-eat meals, frozen dishes and meat alternatives.

Enable producers to stay competitive with more traditional meal providers by appealing to both vegan and flexitarian shoppers with an exciting array of flavors and cuisines. As a way to stand out, manufacturers are also putting emphasis on getting new products and premiumization on the market. High protein, allergen-free, and gluten-free vegan meals are being introduced out there. Also, ethnic-influenced dishes, like vegan curries, burritos, and Asian bowls, are gaining traction and expanding the market. Innovation in packaging is also significant.

Eco-friendly, microwaveable, and resealable packaging by brands helps aid convenience and sustainability. Transparent labeling accompanied by claims like “non-GMO,” “organic” and “no artificial additives” are helping companies gain the trust of health-conscious consumers.

For instance:

The global vegan meals market is projected to grow at a CAGR of 6.2% during the forecast period.

The market is estimated to reach approximately USD 4,464.8 million by 2035.

The ready-to-eat (RTE) vegan meals segment is expected to witness the fastest growth due to increasing consumer demand for convenient, plant-based food options.

Key growth drivers include rising adoption of plant-based diets, increasing awareness of environmental sustainability, and expanding availability of innovative vegan meal options in retail and food service sectors.

Leading companies in the market include Amy's Kitchen, Inc., Beyond Meat, Inc., Daiya Foods, Inc., Danone SA, Eden Foods, Inc. & Plamil Foods Ltd

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA