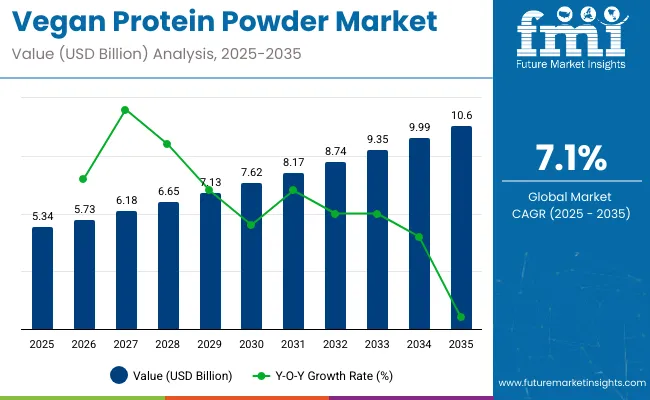

The global vegan protein powder market is projected to be expanded from USD 5.34 billion in 2025 to USD 10.6 billion by 2035, reflecting a CAGR of 7.1%. This growth is being fueled by increased awareness of plant-based diets and heightened concerns around environmental sustainability and ethical sourcing.

A rising preference for dairy-free and allergen-free supplements is being observed, especially among health-conscious individuals and fitness-focused demographics. Shelf space for plant-based protein powders is being expanded by major retailers in both developed and emerging markets.

Multiple plant-based protein sources-such as pea, rice, hemp, and pumpkin seed-are being incorporated into product formulations to improve amino acid profiles and consumer appeal. Functional ingredients, including probiotics, antioxidants, and superfoods are being added to enhance health benefits. In 2025, innovations in food technology are being utilized to improve mixability and reduce the chalky texture that has traditionally limited repeat purchases. Flavor profiles are also being enhanced to cater to mainstream taste preferences.

Digital platforms are being relied upon to drive direct-to-consumer sales. Subscription-based models and customized protein blends are being offered by both legacy brands and newer entrants. The influence of wellness influencers and digital communities is being utilized to increase product visibility. In markets such as the United States and Germany, interest in organic and minimally processed protein powders is being translated into retail demand, prompting reformulations and certifications by manufacturers.

Recent trends have further shaped the market. In 2024, The Vegetarian Butcher, a Unilever subsidiary, launched its vegan recovery protein line for athletes, signaling further market diversification. AI-driven personalization is being implemented to create blends that align with users’ dietary patterns and gut health.

Eco-friendly packaging innovations such as compostable sachets and refillable tins are being adopted to reduce plastic use. Market leadership is being maintained by companies including Orgain, Vega (Danone), Garden of Life, NOW Foods, Nutiva, and Myprotein. Their strategies are being adapted to emphasize transparency, environmental impact, and functional health.

Per capita consumption of vegan protein powder is rising globally as consumers seek healthier, plant-based alternatives to traditional protein sources. This growth is driven by increased awareness of sustainability, personal wellness, and dietary preferences such as veganism and lactose intolerance. Vegan protein powders are now widely used in fitness, wellness, and general nutrition products.

Vegan protein powders are regulated to ensure safety, quality, and accurate labeling for consumers. As these products are often consumed as dietary supplements or food ingredients, they must comply with both food safety and nutritional labeling standards across different regions. Certifications also play a key role in building trust among health-conscious and ethically driven consumers.

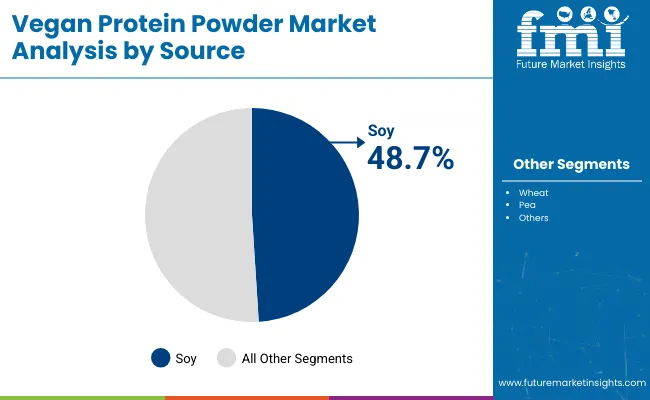

In 2025, soy protein is projected to be retained as the most dominant source in the vegan protein powder market, with a value share of 48.7%. This position is being sustained due to soy’s complete amino acid profile, high digestibility, and broad formulation adaptability. Its use is being widely observed in clinical nutrition, sports recovery formulas, and weight management supplements.

The ability of soy protein to support muscle development, promote cardiovascular health, and aid in metabolic efficiency is being increasingly acknowledged by both manufacturers and consumers. Soy-based protein powders are being distributed by key industry players such as NOW Sports, MyProtein, and Orgain, with many products being fortified with vitamins, minerals, and digestive enzymes.

Due to its affordability and accessibility, soy is being favored across global markets, especially among vegan, vegetarian, and flexitarian populations. As a result, soy protein is being positioned as a foundational component in the plant-based nutrition industry, with its stability, efficacy, and consumer acceptance ensuring its continued investment.

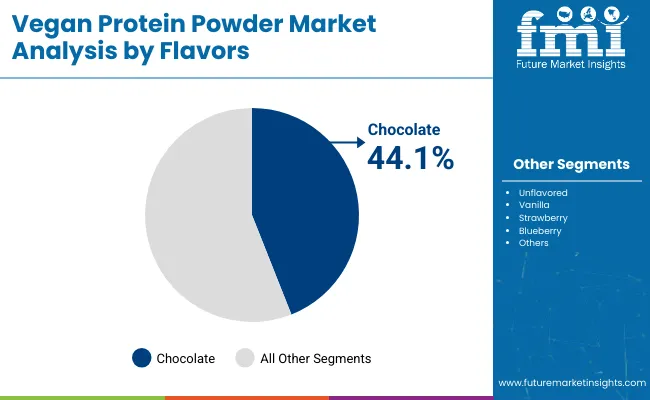

In 2025, chocolate flavor is expected to be maintained as the leading flavor in the vegan protein powder market, accounting for a 44.1% value share. Its popularity is being driven by its ability to mask the naturally bitter or earthy flavors of plant proteins, making it an ideal entry point for new users.

Its broad appeal is being reinforced across fitness-focused and general wellness consumers alike. Chocolate-flavored formulations are being offered by companies such as Vega, Garden of Life, and KOS in various forms, including powder mixes, RTD shakes, and baking-compatible blends. Variants featuring dark chocolate, organic cocoa, and stevia-based sweeteners are being introduced to cater to changing dietary preferences and clean-label demands.

As taste continues to be identified as a key factor in consumer satisfaction and repeat purchases, chocolate is being positioned as the most reliable and enjoyable flavor experience. Its dominance is expected to be further reinforced as product innovation and flavor enhancements are continuously explored within this category.

The North America market dominates the global market due to the presence of a well-established fitness culture, coupled with high demand for plant-based substitutes, and widespread network of direct-to-consumer (DTC) brands. Now the USA leads in volume and innovation, though global interest is growing whether among athletes, vegans or active-aging consumers. Canada has growth in urban wellness and wellness cafés in organic and allergy-friendly protein powders.

Rising populations of vegans and awareness of sustainability, as well as regulatory alignment around clean-label claims are driving Europe’s market. Vegan protein powders being associated with sports, beauty from within and meal replacement being widely consumed by the countries like Germany, UK, France, Netherlands, and Sweden. Demand for low-carb, gluten-free, and sugar-free formulations is driving premium product growth, and sustainability-certified proteins (Soil Association, EU Organic, etc.) are also reaching new levels of visibility.

The Asia-Pacific region is projected to be the most lucrative, buoyed by growing health awareness, to seamless integration of plant-forward diets into localized trends and an increasing prevalence of protein fortified functional beverages.

China and India are large markets, with burgeoning demand in fitness nutrition, vegetarian traditional diets, and lifestyle disease management. Japan and S. Korea are pioneers in innovation, including the pursuit of flavourful, beauty-boosting, and gut-friendly plant protein powders, particularly by female consumers and the greying population.

Challenges: Sensory Limitations and Price Sensitivity

But even as they grow in popularity, vegan protein powders are not without their complaints, often related to gritty mouthfeel, off-notes and lower leucine levels than found in whey. Formulating for complete amino acid profiles and desirable tastes without synthetic additives remains a technical hurdle. Further motion towards premium plant-based protein products might drive consumers in emerging markets wanting value-additions or subsides without seeing them.

Opportunities: Functional Blends, Clean Labeling, and Sustainability

This segment is further evolving with the launch of multi-source protein blends (e.g., pea + rice + hemp) to provide balanced nutrition with an improved texture. Moreover, clean-label certifications (organic, vegan, kosher, allergen-free) and carbon-neutral production claims are now essential differentiators. Surging interest in personalized wellness, gut-health-friendly protein sources, and sustainably sourced proteins are projected to bring new opportunities in the clinical nutrition, eSports, and elderly care segments.

From 2020 to 2024, the vegan protein powder market observed a growing market, driven by the plant-based lifestyle market, rise of fitness consumers, and heightened awareness surrounding dairy and allergen sensitivities. Proteins from pea, brown rice, hemp, soy, and pumpkin seeds are now mainstream in formulations, and blends that deliver a complete amino acid profile have gained traction.

Consumer preferences moved toward clean-label, non-GMO, gluten-free and sustainably sourced foods. But flavour masking, gritty textures and limited solubility have always been directions for formulation development, particularly in ready-to-mix applications.

Towards 2025 to 2035, the market will evolve through biotech-enhanced protein isolates, precision fermentation and personalized nutrition systems. AI-assisted blend optimization, adaptogen-infused recovery formulas, microbiome-friendly protein powders are all set to take center-stage.

And sustainable sourcing, carbon labeling, and upcycled ingredients will be in keeping with ethical consumption trends. Vegan protein powders are moving from niche to mainstream as demand expands from fitness into holistic wellness, into aging, into medical nutrition, to vegan protein powders with differentiated formulations for performance, recovery, cognition, immunity.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and organic/vegan labeling norms; allergen disclosures for soy. |

| Technological Innovation | Use of pea, rice, hemp, and soy protein isolates; natural flavour masking systems. |

| Industry Adoption | Popular in fitness, weight management, and sports recovery markets. |

| Smart & AI-Enabled Solutions | Limited use in formulation and basic digital fitness integrations. |

| Market Competition | Led by Vega, Orgain, Garden of Life, Nuzest, and emerging clean-label startups. |

| Market Growth Drivers | Rise in veganism, lactose intolerance, clean-label trends, and fitness culture. |

| Sustainability and Environmental Impact | Sourcing transparency and shift away from dairy proteins. |

| Integration of AI & Digitalization | Product recommendation engines and e-commerce personalization. |

| Advancements in Product Design | Basic chocolate/vanilla powders, RTM blends, and single-source formulations. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Tighter rules on heavy metal testing, amino acid profile verification, carbon footprint declarations, and personalized nutrition labeling. |

| Technological Innovation | Precision fermentation proteins, enzyme-treated blends for improved digestion, and AI-assisted flavour and texture customization. |

| Industry Adoption | Expansion into senior health, gut health, brain function, children’s nutrition, and functional meal replacements. |

| Smart & AI-Enabled Solutions | AI-driven protein blend customization, real-time nutrient tracking apps, and microbiome-compatible protein recommendations. |

| Market Competition | Competition from biotech food innovators, subscription-based personalization brands, and functional wellness platforms. |

| Market Growth Drivers | Growth fueled by health optimization, digital health integration, zero-waste sourcing, and functional food convergence. |

| Sustainability and Environmental Impact | Mainstream adoption of upcycled ingredients, regenerative agriculture-based inputs, and carbon-neutral protein production systems. |

| Integration of AI & Digitalization | AI-native blend development, blockchain-tracked ingredient sourcing, and app-linked protein timing optimization based on activity levels. |

| Advancements in Product Design | Multi-source adaptogenic blends, hydration-integrated powders, collagen-boosting vegan options, and bioavailable smart nutrition packets. |

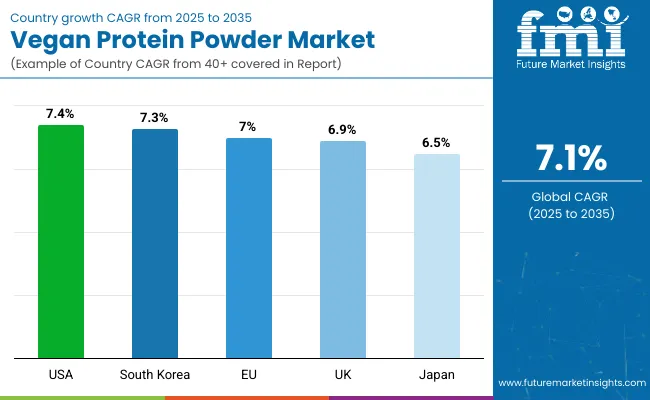

This is the up-and-coming USA vegan protein powder market! An area that keeps on expanding, this vegan market is driven by plant-based life style adoption, fitness focused consumer behaviour, and clean label sports nutrition demands. Pea, rice, hemp, and soy protein powders are frequently used in post-workout shakes, meal replacements, and functional beverages.

Brands have already been playing up allergen-free, non-GMO, and sustainably sourced formulations to reach a wider demographic. E-commerce and DTC models have widened access to niche and personalized products, while celebrity endorsements and influencer campaigns have raised brand visibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

The UK vegan protein powder sector, for example, is showing steady growth, propelled by the mainstreaming of plant-based eating and solid appetite for eco-friendly wellness products. Gym-goers, athletes and health-conscious consumers are asking for plant-based protein options infused with superfoods, adaptogens and digestive enzymes.

Hybrid eating and government support for meat reduction are supporting category growth. Sustainable packaging, plastic-free scoops and carbon-neutral production practices are also helping to foster consumer loyalty for UK brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.9% |

The EU vegan protein powder market is largely driven by clean eating trends and ethical consumerism, with Germany, the Netherlands, and Sweden as front-runners. So, organic certification, sugar-free formulations, and specificity in the sourcing of ingredients are key differentiators in this competitive landscape.

In the sports nutrition and weight management sectors, use of blended plant proteins is growing to enhance amino acid profiles and palatability. Manufacturers operating in the EU are also investing in precision fermentation and protein extraction technologies to increase nutritional value and sustainability.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.0% |

Japan’s vegan protein powder market is creeping forward with respect to aging population dynamics, developing fitness culture and preventative health trends. Soy protein still reigns as the most frequently used ingredient, although newer players are coming out with blends of pea and brown rice protein for improved digestibility and texture.

Use of vegan proteins is being featured more than ever in convenience store RTD/products, meal kits and online wellness solutions. And Japanese brands focus on subtle flavours, smooth texture, and gut-friendly formulations, just to appeal to the local taste.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.5% |

The vegan protein powder market in South Korea is growing rapidly, inspired by urban wellness trends, K-beauty nutrition cross-genre complete competitions and an increase in gym memberships. Interest in plant-based protein supplements to aid recovery, weight management and skin health is largely driven by young professionals and fitness influencers.

Local brands are introducing high-end blends with collagen boosters, antioxidants and probiotics. Government initiatives and programs promoting plant-based diets and local sourcing are accelerating the emergence of animal protein alternatives in powdered formats across online and specialist retail channels.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

With the global population embracing plant-based diets, the demand for clean-label nutrition continues to grow and more consumers are seeking sustainable, allergen-free protein alternatives, the vegan protein powder marketplace is experiencing strong growth.

Soy protein is the most prominent vegan protein used in meal replacement products, functional foods, and sports nutrition. Important market drivers comprise trends regarding fitness and wellness, the rise in number of individuals with lactose intolerance, advancements in protein blending, and growth in e-commerce and direct-to-consumer channels.

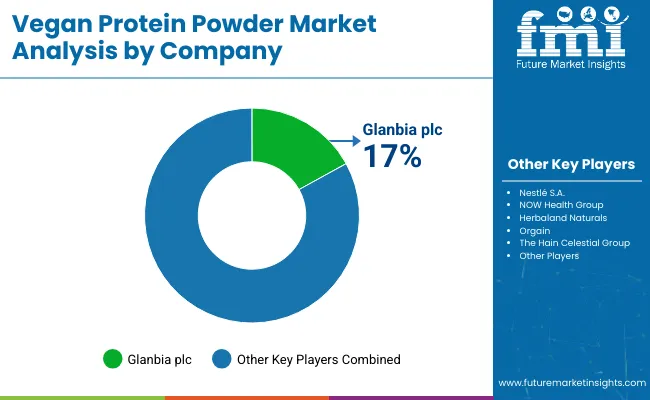

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Glanbia plc | 17-21% |

| Nestlé S.A. (Garden of Life) | 14-18% |

| NOW Health Group, Inc. | 11-15% |

| The Simply Good Foods Company (Quest, OWYN) | 9-13% |

| Orgain, Inc. | 7-10% |

| Others | 23-28% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Glanbia plc | In 2024, Glanbia expanded its Optimum Nutrition Gold Standard Plant® protein range with added BCAAs, probiotics, and adaptogens targeting sports and performance consumers. |

| Nestlé S.A. (Garden of Life) | As of 2023, Garden of Life introduced Raw Organic Protein & Greens , a USDA-certified organic, vegan, and non-GMO formula combining pea, sprouted grains, and vegetables. |

| NOW Health Group, Inc. | In 2025, NOW Foods launched a vegan pea and brown rice blend with enhanced amino acid profiles and digestive enzyme support for high-protein meal replacement shakes. |

| The Simply Good Foods Company | In 2023, OWYN and Quest expanded their plant-based protein powder lines with low-sugar, allergen-free SKUs catering to keto, paleo, and clean-eating consumers. |

| Orgain, Inc. | As of 2024, Orgain rolled out its Simple Plant Protein™ line , a minimalist five-ingredient formula using organic chia, brown rice, and pumpkin seed proteins for clean-label shoppers. |

Glanbia plc (17-21%)

Market leader in sports and active lifestyle nutrition, offering multi-source vegan protein formulations with functional health boosters and wide retail distribution.

Nestlé S.A. (Garden of Life) (14-18%)

Strong in organic and traceable ingredient sourcing, Garden of Life focuses on premium vegan blends for health-conscious and immunity-focused consumers.

NOW Health Group, Inc. (11-15%)

Known for high-quality, affordable plant protein powders with transparency in ingredient sourcing and strong retail presence in natural product channels.

The Simply Good Foods Company (9-13%)

Offers clean, low-allergen, and ready-to-mix vegan protein powders under Quest and OWYN brands, appealing to fitness, diabetic, and wellness-oriented consumers.

Orgain, Inc. (7-10%)

Focuses on clean-label and family-friendly plant protein solutions, leveraging organic certification and DTC channels to build brand loyalty.

Other Key Players (Combined Share: 23-28%)

A wide range of emerging brands and private-label producers are fuelling innovation in multi-protein blends, flavour masking, and functional fortification, including:

| Report Attributes | Details |

|---|---|

| Estimated Global Industry Size (2025) | USD 5.34 billion |

| Projected Global Industry Value (2035) | USD 10.6 billion |

| CAGR (2025 to 2035) | 7.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Protein Sources Analyzed (Segment 1) | Soy Protein, Pea Protein, Wheat Protein, Rice Protein, Others |

| Flavor Types Analyzed (Segment 2) | Chocolate, Vanilla, Unflavored, Others |

| Form Types Covered (Segment 3) | Powder, Ready-to-Drink (RTD), Bars |

| Distribution Channels Covered (Segment 4) | Online Retail, Health Food Stores, Supermarkets, Specialty Stores |

| Regions Covered | North America; Latin America; Europe; Asia-Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, China, India, Japan, South Korea, Australia |

| Key Players Influencing the Market | Glanbia Nutritionals, Nestlé S.A., NOW Health Group, Herbaland Naturals, Orgain, The Hain Celestial Group |

| Additional Attributes | Dollar sales by protein source and flavor, emerging trends in fermented and hybrid proteins, regional consumption patterns, clean-label product innovations |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for the vegan protein powder market was USD 5.34 billion in 2025.

The vegan protein powder market is expected to reach USD 10.6 billion in 2035.

The demand for vegan protein powder will be driven by increasing consumer preference for plant-based nutrition, rising awareness of food allergies and lactose intolerance, growing fitness and wellness trends, and innovations in flavour, texture, and protein blend formulations.

The top 5 countries driving the development of the vegan protein powder market are the USA, Germany, Canada, the UK, and Australia.

The soy-based protein segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Flavors, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Flavors, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Flavors, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Flavors, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Flavors, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Flavors, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Flavors, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by Flavors, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Flavors, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by Flavors, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Flavors, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by Flavors, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Flavors, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by Flavors, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Flavors, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by Flavors, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Flavors, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Flavors, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Flavors, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Flavors, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Flavors, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Source, 2023 to 2033

Figure 27: Global Market Attractiveness by Flavors, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Flavors, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Flavors, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Flavors, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Flavors, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Flavors, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Source, 2023 to 2033

Figure 57: North America Market Attractiveness by Flavors, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Flavors, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Flavors, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Flavors, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Flavors, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Flavors, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Flavors, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Flavors, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Flavors, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by Flavors, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Flavors, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Flavors, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Flavors, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Flavors, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Flavors, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Flavors, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Flavors, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Flavors, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Flavors, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Flavors, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Flavors, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by Flavors, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Flavors, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Flavors, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Flavors, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Flavors, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Flavors, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by Flavors, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Flavors, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Flavors, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Flavors, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Flavors, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Flavors, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by Flavors, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Flavors, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Flavors, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Flavors, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Vegan Flavor Market – Trends & Forecast 2025 to 2035

Vegan Sauces Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA