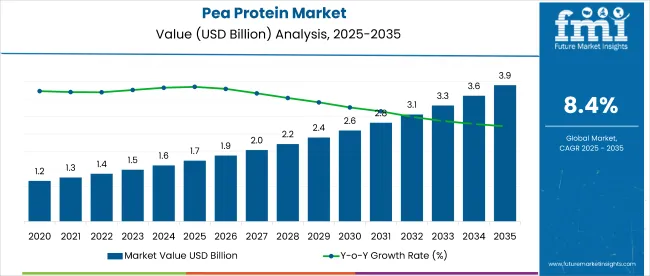

The global pea protein market is valued at USD 1.74 billion in 2025 and is poised to reach USD 3.9 billion by 2035. This growth corresponds to a CAGR of 8.4% over the coming years. The market's expansion reflects a rising consumer interest in plant-based protein sources, driven by increasing awareness about health, nutrition, and sustainability. Pea protein, as a versatile and nutrient-rich ingredient, has found widespread acceptance in various food and beverage applications worldwide.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.74 billion |

| Industry Value (2035F) | USD 3.9 billion |

| CAGR (2025 to 2035) | 8.4% |

Pea protein is gaining traction primarily due to its status as a complete protein, containing all nine essential amino acids needed by the human body. Its hypoallergenic nature and ease of digestion make it an attractive alternative to other plant-based proteins that may cause allergies or digestive issues.

Consumers are increasingly adopting protein-rich diets to improve their overall health and well-being. This dietary shift is further supported by a growing number of people seeking convenient, nutrient-dense options amid busy lifestyles. Packaged food items fortified with pea protein cater perfectly to these evolving consumer preferences, expanding the market’s reach.

The surge in demand is also fueled by the global shift towards sustainable and environmentally friendly food production. Pea protein, derived from legumes, has a lower environmental footprint compared to animal-based proteins, appealing to eco-conscious consumers.

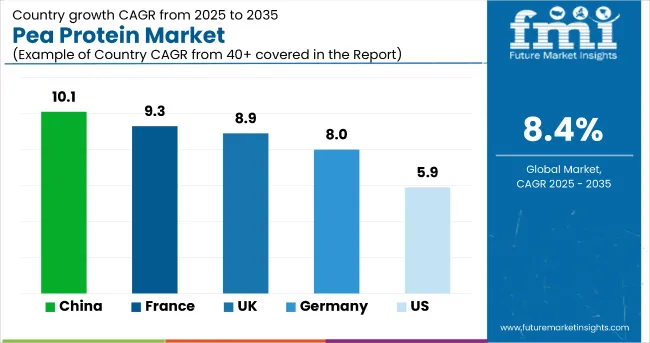

This trend is particularly prominent in regions such as China, which leads the market with a 10.1% CAGR, followed by Germany and the USA. The increasing adoption of plant-based diets, combined with technological advancements in protein extraction and formulation, continues to drive innovation and market penetration. As a result, the pea protein market is expected to witness robust growth throughout the next few years, reflecting broader changes in consumer behavior and industry dynamics.

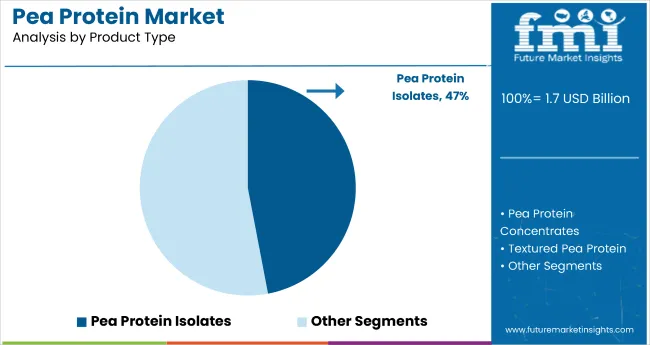

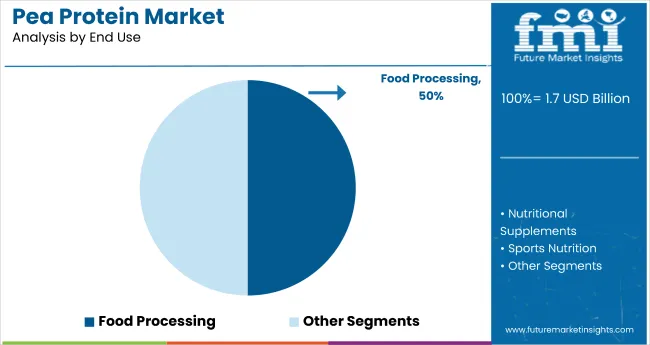

China is expected to be the fastest-growing market for pea protein, with a projected CAGR of 10.1%. Pea protein isolates hold a 47% share by product type, while food processing accounts for 50% of end-use in 2025. The USA and Germany are also expected to experience notable growth, with projected CAGRs of 5.9% and 8.0%, respectively.

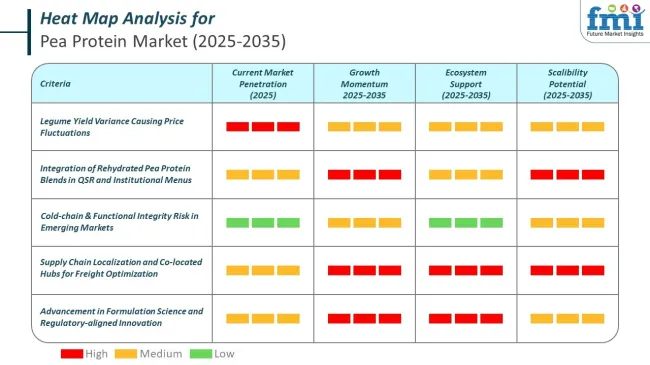

Pea protein prices in 2025 have shown moderate volatility. Futures contracts tracked on CME-linked ingredient boards indicate contract stabilization at USD 2.10 to USD 2.30 per kg for high-purity isolates.

Per-capita consumption shows wide divergence. USDA data reflects average annual intake in the USA nearing 0.7 kg, driven by ready-to-mix beverage formats and sports nutrition. In Germany, consumption is marginally lower at 0.5 kg but rising sharply, supported by new government labeling regulations around sustainable proteins. In China, per capita pea protein intake crossed 0.4 kg, with dairy analogs and meat extenders fueling steady demand growth in the east and southeast provinces.

Distribution networks are maturing across modern retail and institutional foodservice. Foodservice uptake remains uneven in the pea protein market.

Cold-chain infrastructure remains under strain in the pea protein market. Reports from the International Institute of Refrigeration (IIR) highlight logistical choke points at inland depots in India and Vietnam. Pea protein concentrates require stable temperatures under 25°C to maintain functional solubility.

In several regions, particularly Africa and South Asia, storage degradation is a risk. Bulk-handling infrastructure in North America remains robust. Investment in ISO-certified dry-powder silos and nitrogen-flushed shipping containers has kept loss rates below 2.5%.

Leading players in the pea protein market are advancing on three strategic fronts, formulation science, supply chain localization, and regulatory alignment.

Axiom Foods has entered USA school foodservice with allergen-free offerings and is developing hospital-ready concentrates in the industry. The Scoular Company is piloting co-located hubs near pulse farms to reduce freight emissions and speed up delivery. These companies are not only meeting rising demand but shaping future competitiveness through IP-driven innovation, retail partnerships, and logistics redesign.

Their moves collectively enhance durability and differentiation in a climate-sensitive, protein-hungry market, raising barriers to entry for newer players in the pea protein market while reinforcing trust in plant-based protein as a mainstream dietary solution. This factor is augmenting product sales.

Pea protein isolates hold a leading position with 47% of the market share within the product type category in the pea protein market. Their dominance stems from a high protein content, exceptional purity, and superior functional properties including solubility and neutral taste.

Pea protein isolates are favored by manufacturers of sports nutrition, protein supplements, and dairy alternatives for their ability to deliver concentrated nutrition, support clean-label claims, and meet rising consumer demand for plant-based ingredients.

Ongoing innovation in extraction and purification technologies further enhances isolate quality, making them the preferred choice for applications requiring high-protein content and reduced anti-nutritional factors. As consumer preference for natural, allergen-free, and sustainable protein sources strengthens, the market share of pea protein isolates is expected to remain robust.

Food processing is the dominant end-use segment with 50% of the market share in the pea protein industry. This segment’s leadership is driven by the expanding integration of pea protein into processed food products such as meat analogues, bakery items, snacks, and beverages.

Food processors value pea protein for its excellent emulsification, binding, and texture-enhancement capabilities, enabling formulation of nutritionally enriched products that appeal to health-conscious consumers.

Growing demand for plant-based and fortified foods coupled with the versatility of pea protein in addressing various dietary needs supports the segment’s position. Major food brands are investing in product development and reformulation strategies to include pea protein as a core ingredient in their portfolios, ensuring the continued growth of this segment in global markets.

Increase in Vegan Consumers is Driving the Market Growth

Global sales of plant-based foods are expected to rise significantly as people’s concerns about the welfare of animals and the environmental effects of different food products grow. This will help the market for pea protein grow until 2035. A study conducted by Oxford Martin School researchers suggests that by 2050, a global shift toward diets higher in fruits and vegetables and lower in meat could save approximately 8 million lives.

It will also cut greenhouse gas emissions by two-thirds and prevent damages from climate change worth USD 1.5 trillion. It has been demonstrated that eating a plant-based diet improves health, lowering the risk of coronary heart disease, diabetes, and high blood pressure. Sales of pea protein will be triggered during the assessment period by the increasing popularity of plant-based foods.

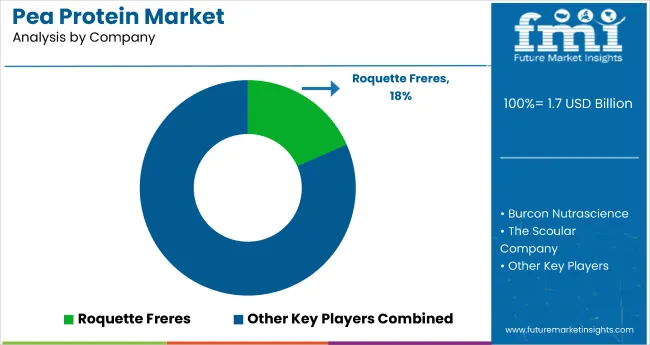

Tier 1 companies comprise industry leaders acquiring a 70% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing solutions utilizing the latest technology, while adhering to legal requirements to ensure the best quality.

Tier 2 companies comprise mid-sized players with a presence in some regions and a significant influence on local commerce, holding a market share of 20%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprise mostly small-scale businesses serving niche economies and having a local presence, with a market share of 10%. Due to their notable focus on meeting local needs, these businesses are categorized as belonging to the tier 3 share segment; they are minor players with a constrained geographic scope. As an unorganized ecosystem, Tier 3 in this context refers to a sector that, unlike its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. The USA, Germany, and China are among the countries exhibiting high consumption, recording CAGRs of 5.9%, 8.0%, and 10.1%, respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| United States | 5.9% |

| Germany | 8.0% |

| China | 10.1% |

The rise in pea protein sales in the USA is partly due to the development of whole egg substitutes. Pea protein stands out as a useful and protein-rich ingredient that can mimic the texture and nutritional value of eggs in a variety of applications as consumers look for meat substitutes.

It is anticipated that the adaptability of pea protein in plant-based formulations will support the expansion of the pea protein market in the USA. As the country moves toward more sustainable and healthful food options, pea protein is portrayed as a crucial component, and sales are predicted to rise as these trends develop.

Pea protein is widely supplied by businesses such as Foodchem International Corporation in China. Among their products is pea protein, which meets a variety of dietary requirements and quality standards, as it is certified HALAL, HACCP, and KOSHER. Particularly in the dairy substitutes sector, there is a notable rise in the demand for pea protein with a protein content exceeding 75%.

The growing interest in plant-based and vegan food companies has led to the increasing popularity of this high-protein ingredient in products such as cheeses and yogurt. Pea protein has a high nutritional content, is free of allergens, and is suitable for people with dietary restrictions or lactose intolerance. As the trend shifts toward healthier and more sustainable eating options, plant-based proteins are gaining increasing importance.

Businesses are capitalizing on this demand by offering premium, certified pea protein that meets the requirements of various end-use industries, while ensuring adherence to global standards and consumer preferences.

Pea protein sales in Germany are rising sharply, especially in the sports nutrition sector. Due to the high-quality amino acid profile of pea protein, which aids in muscle growth and recovery, athletes and fitness enthusiasts are increasingly selecting plant-based proteins.

This shift is being fueled by growing awareness of the health benefits of plant-based proteins, such as their hypoallergenicity and ease of digestion, which make them a good choice for consumers with lactose intolerance or allergies to other protein sources like whey or soy.

Given its lower carbon footprint compared to animal-based proteins pea protein is environmentally sustainable and aligns with consumers increasing emphasis on choosing eco-friendly foods.ds, particularly those that are plant-based. Likewise, the target market will probably benefit from the increasing use of pea protein in the food processing industry as a thickener, emulsifier, texturizer and anti-foaming agent.

The pea protein market is moderately consolidated, with leading players such as Burcon Nutrascience, The Scoular Company, Roquette Freres, Cosucra Groupe Warcoing SA, and Shandong Jianyuan Group driving significant growth. These companies are key innovators and suppliers in the industry, offering a range of high-quality pea protein products catering to the growing demand for plant-based proteins.

For example, Burcon Nutrascience is renowned for its advanced protein extraction technologies, while Roquette Freres focuses on sustainable ingredient solutions for food and nutrition markets. The Scoular Company and Cosucra Groupe Warcoing SA play essential roles in global pea protein sourcing and processing. Other notable companies like Nutri-Pea Ltd., Sotexpro SA, Axiom Foods, Inc., Ingredion, Inc., and Martin & Pleasance contribute with specialized formulations and supply chain expertise, strengthening their market positions across various regions.

| Report Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.74 Billion |

| Projected Market Size (2035) | USD 3.9 Billion |

| CAGR (2025 to 2035) | 8.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/Volume in Kilo Tons |

| Product Types Analyzed | Pea Protein Isolates, Pea Protein Concentrates, Textured Pea Protein, Hydrolyzed Pea Protein |

| End Use Applications | Food Processing, Nutritional Supplements, Sports Nutrition, Meat Substitutes, Beverages, Bakery Products, Dairy Alternatives |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Top Segments Covered | By Product Type, By End Use |

| Top Growth Markets | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia |

| Key Players | Roquette Freres, The Scoular Company, Burcon Nutrascience, Nutri-Pea Ltd., Axiom Foods, Cosucra Groupe Warcoing SA, Ingredion, Fenchem Inc. |

| Additional Attributes | Country-wise insights, CAGR variation by region, Innovation trends, Market concentration, Regulatory outlook |

| Customization & Pricing | Available upon request |

By product type, methods industry has been categorized into Protein Concentrates, Protein Isolates, Textured Protein and Hydrolyzed Protein

By end use, industry has been categorized into Food Processing, Animal Feed, Nutraceuticals, Sports Nutrition, Infant Nutrition and Cosmetic and Personal Care

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 8.4% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 3.9 Billion.

Demand for vegan food is increasing demand for Pea Protein Market.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Nutri-Pea Ltd., Sotexpro SA, Axiom Foods, Inc. and more.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pea Protein Ingredients Market Insights - Plant-Based Nutrition Growth 2025 to 2035

Chickpea Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Chickpea Protein Companies

Japan Pea Protein Market Analysis - Size, Share & Trends 2025 to 2035

Yellow Pea Protein Market Outlook - Growth, Demand & Forecast 2025 to 2035

UK Chickpea Protein Market Insights – Demand, Size & Industry Trends 2025–2035

USA Chickpea Protein Market Report – Trends, Demand & Industry Forecast 2025–2035

Pea Protein in Plant-Based Meat Analysis - Size Share and Forecast outlook 2025 to 2035

Pea Protein Demand in Dairy Alternatives Analysis - Size Share and Forecast outlook 2025 to 2035

Demand for Pea Protein RTM Dispersibility for Shaker Formats Size and Share Forecast Outlook 2025 to 2035

Demand for Pea Protein Bakery Fortification in CIS Size and Share Forecast Outlook 2025 to 2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

Europe Chickpea Protein Market Outlook – Size, Share & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Western Europe Pea Protein Market Analysis - Size, Share & Trends 2025 to 2035

Latin America Chickpea Protein Market Analysis – Demand, Share & Forecast 2025–2035

Demand for Textured Pea for High Protein Savory in EU Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Pea Protein in South Korea Size and Share Forecast Outlook 2025 to 2035

Pea Grits Market Size and Share Forecast Outlook 2025 to 2035

Pearl Liquid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA