The Europe Chickpea Protein market is set to grow from an estimated USD 52.6 million in 2025 to USD 104.8 million by 2035, with a compound annual growth rate (CAGR) of 7.1% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 52.6 million |

| Projected Europe Value (2035F) | USD 104.8 million |

| Value-based CAGR (2025 to 2035) | 7.1% |

The European chickpea protein market is anticipated to experience impressive growth attributed to major factors such as the introduction of plant-based protein alternatives, the launch of functional and fortified food products, and the growing popularity of chickpeas in sports nutrition, pharmaceuticals, and personal care.

Chickpea protein, which is a by-product obtained from processing chickpeas, is vegan and this protein is often consumed during the training season. It is a source of the amino acid tryptophan and is gluten-free. Because of these properties, it is mostly added to clean-label and sustainable food products.

Chickpea protein is increasingly being used largely due to the preference for non-soy, gluten-free, and less processed plant-based proteins. These plant proteins are included in major food and beverage products, dietary supplements, and infant nutrition formulations.

The leading companies build on protein extraction technology developments to improve the bioavailability, solubility, and textural properties of chickpea protein in different applications. Furthermore, the newly found high-performance plant proteins in sports and health formulations create opportunities for chickpea protein in the market.

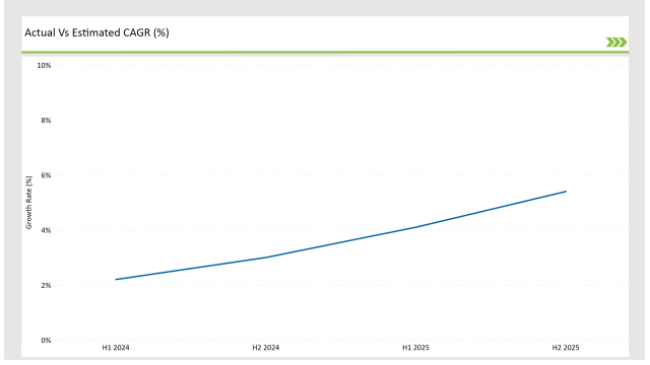

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Chickpea Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.2% |

| H2 (2024 to 2034) | 3.0% |

| H1 (2025 to 2035) | 4.1% |

| H2 (2025 to 2035) | 5.4% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Chickpea Protein market, the sector is predicted to grow at a CAGR of 2.2% during the first half of 2023, with an increase to 3.0% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.1% in H1 but is expected to rise to 5.4% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Innovation - Ingredion launched a hydrolysed chickpea protein isolate with enhanced solubility for infant and medical nutrition applications. |

| March-24 | Strategic Partnerships- Roquette partnered with European food manufacturers to develop textured chickpea protein for meat alternatives. |

| February-24 | Processing Expansion - Bühler Group introduced advanced chickpea protein processing technology , improving extraction efficiency and functional properties. |

| January-24 | Sustainability Initiatives- Emsland Group invested in eco-friendly chickpea protein production , reducing water and energy consumption in processing plants. |

Improvements through Creative Processing Methods

The rapidly advancing technological processes in chickpea protein extraction and modification are making significant contributions to protein function and bioavailability in a wide range of applications. The leading manufacturers in Europe are actively employing processes like enzymatic hydrolysis, high-moisture extrusion, and cold-pressed protein isolation to make chickpea protein that is highly digestible, soluble, and stable under heat.

New inventions include methods of precision fermentation used by Bühler Group and Roquette to improve the amino acid profile of chickpeas and produce a higher yield of protein. This is very useful for sports nutrition, dairy-free beverages, and infant formula, and it is essential to extend the usability of chickpea protein.

Additionally, the use of Nano-encapsulation and lipid-based delivery systems is also enabling the formulation of a slow-digesting chickpea protein that can provide energy over longer durations, particularly for athletes and endurance performance products. These processing breakthroughs are likely to be the reason behind the increase in chickpea protein in European functional food categories.

Chickpea Protein Gaining Favour in Premium and Specialized Nutrition

European consumers' preferences for more personalized and premium nutritional options are the main characteristics driving the demand for specialized chickpea protein in medical nutrition, pharmaceutical-grade supplements, and anti-aging formulations. Schemes are deployed to create chickpea protein isolates that are full of bioactive peptides that have properties such as muscle recovery, cognitive enhancement, and immune support.

The latest research findings concerning chickpea isolates of saponins and flavonoids point to the potential of these substances as anti-inflammatory and gut-health constituents, thus making them very valuable products for clinical nutrition and dietary supplements. In this light, companies like Nestlé Health Science have come up with nutritional therapies for the elderly and immune-compromised people that include bioactive chickpea protein complexes.

The emergence of neuro-nutrition and gut microbiome-cantered formulations is also growing the intersection of chickpea protein with brain health beverages and probiotic-enhanced meal replacements.

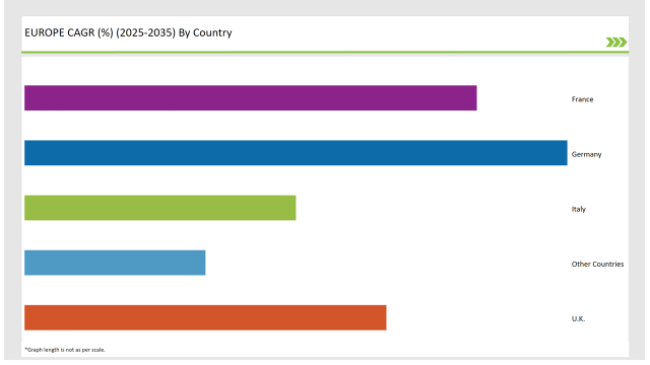

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 15% |

| UK | 20% |

| France | 25% |

| Other Countries | 10% |

Germany is undeniably one of the most rapidly developing markets for chickpea protein across Europe, owing to the surge in functional food, plant-based diet, and high-protein equivalent demands. The trend is seen where German consumers for cleaner-label products and protein sources that are formulated by scientific methods are pushing the manufacturers to produce chickpea protein-based alternatives to dairy, soy, and wheat proteins.

The Emsland Group, a food company in Germany, is also contributing to this trend by investing in high-protein chickpea processing and extrusion technologies to make the production of textured chickpea protein for plant-based meat and dairy alternatives possible. The sports and medical nutrition sectors are also flourishing, with more German pharmaceutical companies incorporating hydrolysed chickpea protein in muscle recovery and metabolic health supplements.

France is experiencing an incredible rate regarding the areas, such as chickpea protein usage, which has indeed been popularized the most extensively in plant-based applications for dairy, bakery, and beauty nutrition. Due to a rising number of consumers replacing lactose with a high-protein plant-based alternative, chickpea protein has become a must-have in the formulations of dairy-free yogurt, cheese substitutes, and fortified baking mixes.

Brands in the French market like Roquette have also shown interest in fermented chickpea protein formulations, which on the one side would make people eat easily and on the other side would make people's gut' health better. Further, cosmetics and personal care brands in France are applying chickpea-derived bioactive peptides to beauty and anti-aging products, thus, concretely showing that chickpea protein is not just limited to food and beverage processing.

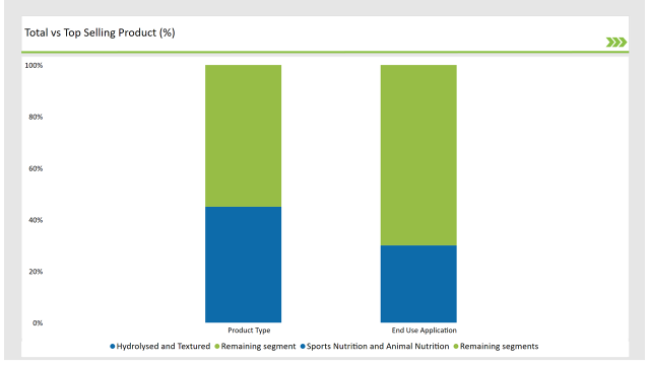

% share of Individual CategoriesProduct Type and End-Use Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type ( Hydrolysed and Textured ) | 45% |

| Remaining segments | 55% |

Chickpea protein isolate and hydrolysed chickpea protein account for more than half of the total consumption, while hydrolysed chickpea protein is becoming more popular due to its higher solubility, better digestibility, and more bioactive properties.

Recently, hydrolysed chickpea protein has been added to a wide variety of infant nutrition products, pharmaceutical-grade protein supplements, and personal care formulations for its fast absorption and prebiotic benefits. Furthermore, it is being microencapsulated for better stability and controlled release in clinical nutrition applications.

Textured chickpea protein, is being presented as a fibrous protein-rich sub of meat and abundant high-protein snacks. European food companies are being backed by extensive investments in the latest extrusion technologies, including high moisture and enzymatic processing, to bring improvements to chickpea protein's chewiness, water retention, and emulsion qualities. As consumers look for more genuine meat-feel category products, the textured chickpea protein is asserting itself as the primary non-soy choice for the development of plant-related protein.

| Main Segment | Market Share (%) |

|---|---|

| End Use Application ( Sports Nutrition and Animal Nutrition ) | 30% |

| Remaining segments | 70% |

The expansion of high-performance nutrition and animal-free dairy alternatives follows the trend of being a central player in the market, which is food & beverage processing. The segment comprises more chickpea protein being added to dairy-free yogurts, cheese substitutes, and protein-fortified baked goods primarily. The flavour and texture of functional beverages, where chickpea protein is often used, remain unaffected while they are enriched with nutritional components. Furthermore, chickpea protein has stimulated the birth of new protein-rich donut types in the handmade high-protein bakery and craft bread sector.

The sports nutrition sector is witnessing tremendous growth, with chickpea protein being included in products such as vegan protein powders, endurance recovery drinks, and high-protein meal replacements. Chickpea differs from traditional plant proteins in that it provides a more complete amino acid profile; consequently, it is a product that has gained significant attention from athletes, bodybuilders, and endurance sports professionals.

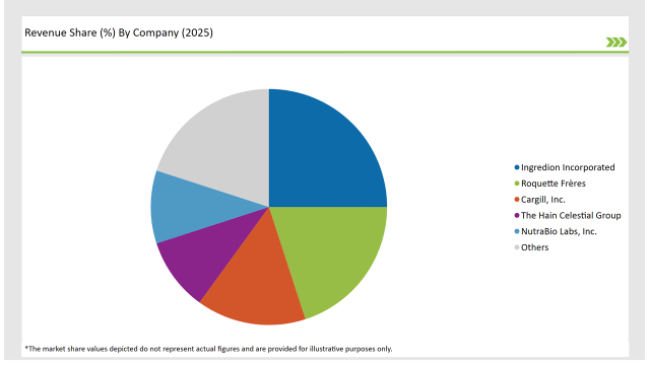

2025 Market share of Europe Chickpea Proteinmanufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Ingredion Incorporated | 25% |

| R oquette Frères | 20% |

| Cargill, Inc. | 15% |

| The Hain Celestial Group | 10% |

| NutraBio Labs, Inc. | 10% |

| Others | 20% |

Note: The above chart is indicative in nature

The chickpea protein market in Europe is subject to a moderate degree of consolidation having the major companies being Ingredion, Roquette, Bühler Group, and Emsland Group. These corporations are firmly standing in their positions by increasing the number of protein processing plants, investing in newly developed extraction methods, and forming strategic partnerships, such as in food, sports nutrition, pharmaceuticals, and personal care sectors.

Along with these, there are also new entrants and mid-tier companies that are creating their foothold in the market by providing special chickpea protein blends that mainly focus on performance nutrition and are used in medical applications. The companies that are adopting the idea of the customized protein and the patented bioactive chickpea protein are the ones expected to lead in their competitiveness.

As per Product Type, the industry has been categorized into Isolate, Concentrate, Textured, and Hydrolysed.

As per End Use Application, the industry has been categorized intoFood & Beverage Processing, Sports Nutrition, Infant Nutrition, Pharmaceutical Products, Personal Care Products and Animal Nutrition.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Chickpea Protein market is projected to grow at a CAGR of 7.1 % from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 104.8 million.

Key factors driving the chickpea protein market include the increasing demand for plant-based protein sources due to rising health consciousness and dietary preferences, as well as the growing trend of veganism and vegetarianism among consumers. Additionally, the nutritional benefits of chickpea protein, such as its high fibre content and essential amino acids, further enhance its appeal in the food and beverage industry.

Germany, France, and UK are the key countries with high consumption rates in the European Chickpea Protein market.

Leading manufacturers include Ingredion Incorporated, Roquette Frères, Cargill, Inc., The Hain Celestial Group, and NutraBio Labs, Inc. known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chickpea Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Chickpea Protein Companies

Europe Fish Protein Market Analysis – Growth, Demand & Forecast 2025–2035

Europe Fungal Protein Market Insights – Demand, Size & Industry Trends 2025–2035

UK Chickpea Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Duckweed Protein Market Trends – Size, Demand & Forecast 2025–2035

USA Chickpea Protein Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

Western Europe Pea Protein Market Analysis - Size, Share & Trends 2025 to 2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Europe Animal Feed Alternative Protein Market Insights – Demand, Trends & Forecast 2025–2035

Western Europe Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Country Through 2035

Latin America Chickpea Protein Market Analysis – Demand, Share & Forecast 2025–2035

Western Europe Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA