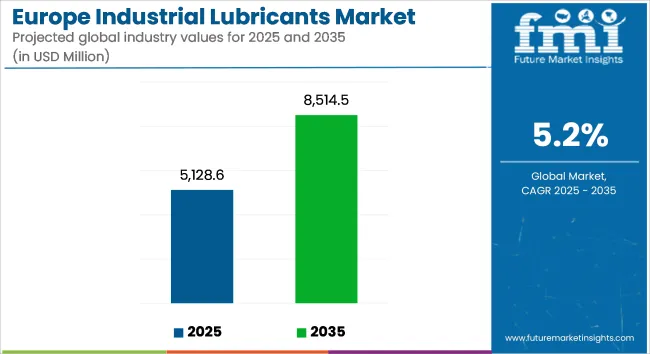

The European industrial lubricants market is estimated to be valued at USD 5,128.6 million in 2025 and is forecast to reach USD 8,514.5 million by 2035, reflecting a CAGR of 5.2% during the forecast period. Industrial lubricants are being utilized in sectors such as automotive, manufacturing, construction, and energy to reduce friction, protect equipment, and ensure operational continuity.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 5,128.6 million |

| Industry Value (2035F) | USD 8,514.5 million |

| CAGR | 5.2% |

In 2024, an increase in lubricant demand was observed in Germany, supported by higher vehicle production and machinery exports. According to the German Association of the Automotive Industry (VDA), 3.96 million passenger vehicles were produced in 2023, representing an increase of 18% compared to the previous year. This output supported the consumption of engine oils, gear lubricants, and metalworking fluids.

In France and the United Kingdom, lubricant volumes were driven by public infrastructure projects. Eurostat reported that construction output rose by 3.5% across the EU in 2023. Heavy equipment maintenance cycles led to increased procurement of greases and hydraulic fluids.

Sustainability requirements continued to influence lubricant selection across Scandinavia. As reported by the Swedish Forest Industries Federation, biodegradable hydraulic fluids have been increasingly used in forestry and construction to meet national environmental standards. Bio-based alternatives were supplied by firms such as FUCHS and Klüber Lubrication, which expanded their VGP-compliant (Vessel General Permit) lubricant lines.

The adoption of condition monitoring systems and predictive maintenance tools has driven the use of sensor-compatible lubricants. According to UEIL, the Union of the European Lubricants Industry, industrial users are shifting to synthetic lubricants that allow longer drain intervals and support real-time diagnostics.

Lubricant consumption is expected to be influenced by the rollout of Industry 4.0 technologies and the rise in automation across factories. Import reliance for specialty grades has increased in Central and Eastern Europe, with demand being served by OEM-backed supply agreements and distributor networks.

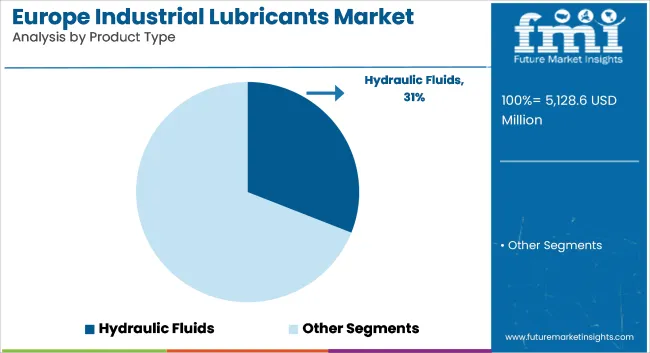

Hydraulic fluids are estimated to account for approximately 31% of the Europe industrial lubricant market share in 2025 and are projected to grow at a CAGR of 5.3% through 2035. These fluids play a critical role in power transmission, equipment actuation, and heat dissipation in industries such as construction, manufacturing, marine, and material handling.

With Europe’s strong focus on energy-efficient machinery and preventive maintenance protocols, the demand for advanced hydraulic fluids-formulated with anti-wear additives, thermal stability, and extended drain intervals-continues to rise. OEM specifications and regulatory pressure to minimize environmental impact are further accelerating the use of low-toxicity and fire-resistant hydraulic formulations across Germany, Italy, and France.

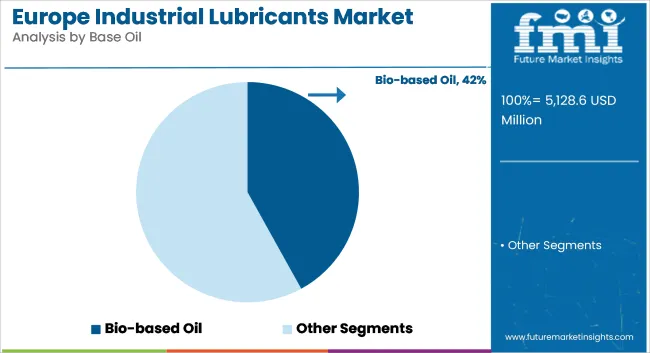

Synthetic oils are projected to hold approximately 42% of the Europe industrial lubricant market share in 2025 and are forecast to grow at a CAGR of 5.5% through 2035. Their superior oxidative stability, low-temperature fluidity, and extended service life make them ideal for gearboxes, turbines, compressors, and precision equipment operating under demanding conditions.

Industrial facilities in Western and Northern Europe increasingly favor synthetic formulations to reduce downtime, enhance energy efficiency, and comply with circular economy mandates. Lubricant manufacturers are expanding portfolios to include Group III+ base stocks and synthetic esters tailored for food-grade, low-emission, and biodegradable applications. As European industries continue to transition toward high-performance and environmentally aligned lubrication strategies, synthetic oils are expected to see sustained demand growth across all major verticals.

A new market study conducted by Future Market Insights reveals that the European industrial lubricants market is expected to see significant growth and reach USD 7,710.3 million by 2032. This growth is mostly fueled by the strong manufacturing industry in the region, including the automotive, aerospace, and machinery sectors, which are all greatly dependent on superior quality lubricants to achieve optimal performance and extend equipment lifespan.

The survey also points to a major trend towards sustainable and green lubricants in Europe. The strict environmental policies and high priority on minimizing carbon footprints have driven the market for bio-based and biodegradable lubricants. Firms are investing more in research and development to create products that conform to these environmental norms without any compromise on performance.

In addition, new synthetic lubricant technologies are picking up momentum. These lubricants possess better properties, including improved thermal stability and longer service life, which make them suitable for heavy-duty industrial use. The survey observes that industries in Europe are increasingly using these advanced lubricants to maximize machinery performance and lower maintenance expenses.

| Regulation/Standard | Description and Impact |

|---|---|

| ISO 21469:2006 | This international standard specifies hygiene requirements for the formulation, manufacture, and use of lubricants that may come into incidental contact with products during processing, such as in the food industry. While not legally mandated across Europe, ISO 21469 certification is recognized as a mark of quality and safety, enhancing a lubricant manufacturer's credibility and marketability. |

| EU Ecolabel for Lubricants | Established under Regulation (EC) No 66/2010, the EU Ecolabel is awarded to lubricants that meet stringent environmental criteria throughout their life cycle, from production to disposal. This voluntary label promotes products with reduced environmental impact, encouraging manufacturers to develop more sustainable lubricants. |

| Seveso-III Directive (Directive 2012/18/EU) | Aimed at preventing major chemical accidents, this directive requires establishments handling significant quantities of dangerous substances, including certain lubricants, to implement safety measures and emergency response plans. Compliance is mandatory for facilities exceeding specified thresholds of hazardous materials. |

| Eco-design for Sustainable Products Regulation (ESPR) | As part of the European Green Deal, the ESPR introduces new sustainability standards for products, including industrial lubricants. It emphasizes aspects like recyclability and the use of bio-based oils, influencing manufacturers to innovate towards more sustainable lubricant solutions. |

The German Industrial Lubricants Market is anticipated to grow at a CAGR of around 5.4% during the forecast period. The strong industrial base of the country, especially the automotive and manufacturing sectors, which are the key consumers of industrial lubrication, is influencing this growth. This article discusses the advances in watch lubricants, the German way of doing it, and the future of sustainable greases that are based on state-of-the-art technology.

Stringent environmental regulations in the country are also driving demand for high-performance lubricants that reduce emissions and improve energy efficiency. Germany's emphasis on Industry 4.0 and automation is increasing the demand for specialty lubricants that keep computerized machinery running smoothly.

FMI opines that Germany industrial lubricants sales will grow at nearly 5.4% CAGR through 2025 to 2035.

The industrial lubricants market in Italy is anticipated to expand at a CAGR of approximately 5.0% through 2023. Major industrial sectors in the country, such as machinery, automotive, and manufacturing, are the prominent driving forces of lubricant consumption.

It is for this reason that Italy is focused on the integrity of its industrial output, ultimately investing in high-performance lubricants that will allow machinery to run more efficiently and ultimately last longer. Bio-based and synthetic lubricants are increasingly being adopted, a reflection of worldwide societal trends and regulatory focus aimed at reducing the environmental footprint.

FMI opines that Italy's industrial lubricants sales will grow at nearly 5.0% CAGR through 2025 to 2035.

Between 2025 and 2035, the French market is expected to grow with a CAGR of 5.1%. The demand for industrial lubricants is propelled by the country's varied industrial landscape, notably the aerospace, automotive, and energy sectors.

France's focus on sustainability and energy efficiency is driving demand for high-performance lubricants that comply with local regulations regarding health and environmental sustainability. The shift to renewable energy sources and the expansion of the electric vehicle market are also impacting lubricant formulations and applications.

FMI opines that France's industrial lubricants sales will grow at nearly 5.1% CAGR through 2025 to 2035.

The industrial lubricants market in the UK is expected to grow at a CAGR of around 4.8% during the forecast period. Lubricant’s demand is driven by industrial activity in the country, especially in sectors such as manufacturing, automotive, and aerospace.

Examples include lubricants that not only boost energy efficiency but also meet environmental regulations in line with the UK's focus on innovation and sustainability. The rapidly growing adoption of electric vehicles and renewable energy technologies is one of the other key attributes disrupting the lubricant market's dynamism.

FMI opines that the United Kingdom industrial lubricants sales will grow at nearly 4.8% CAGR through 2025 to 2035.

The Spanish market is projected to witness a CAGR of around 5.2% in the forecasted period of 2025 to 2035. Automotive, manufacturing, and energy are the main consumers of industrial lubricants in the country. The demand for high-performance lubricants is driven by Spain's industrial modernization and energy efficiency efforts.

Alongside global sustainability trends and regulatory demands, the drivers for the adoption of sustainable or environmentally friendly lubricants are another area of growth.

FMI opines that Spain's industrial lubricants sales will grow at nearly 5.2% CAGR through 2025 to 2035.

The BENELUX region is expected to grow at a CAGR of approx. 5.3% during the forecast period. The demand for industrial lubricants is supported by the region's strong industrial sectors, such as chemicals, manufacturing, and logistics. With a strong emphasis on sustainability and innovation, the BENELUX region is adopting advanced lubricants that meet stringent performance and environmental requirements. Additionally, the lubricant market is also aided by the region's strategic location and strong infrastructure.

FMI opines that BENELUX industrial lubricants sales will grow at nearly 5.3% CAGR through 2025 to 2035.

For the rest of Europe, the CAGR is expected to be approximately 5.5% from 2025 to 2035. These countries have a diverse range of industrial activities, such as manufacturing, automotive, and energy, which lead to the demand for industrial lubricants. This necessitates the use of high-quality lubricants to improve machinery operation while complying with environmental rules due to industrialization and modernization initiatives.

Europe is expected to be a steadily growing market for Industrial Lubricants in the given timeframe, largely due to industrial activities, technological advancements, and a strong emphasis on sustainability and environmental compliance.

FMI opines that industrial lubricants sales in the rest of Europe will grow at nearly 5.5% CAGR through 2025 to 2035.

The European industrial lubricants industry is a key segment in the industrial chemicals and manufacturing industry, acting as a pillar for many industries, such as automotive, construction, power generation, food processing, and marine usage. Industrial lubricants are vital for the prevention of friction, enhanced efficiency, and increased lifespan of machinery and equipment in manufacturing and heavy industry sectors. The market is driven by technologies, strict environmental standards, and increasing demand for eco-friendly solutions.

In the future, the macroeconomic environment will define the European industrial lubricants market considerably. The sustainability and carbon neutrality push of the region will likely boost the use of bio-based and synthetic lubricants. The European Green Deal and EU regulations on tighter carbon emissions will compel businesses toward green lubrication solutions, including minimizing waste, maximizing energy efficiency, and creating biodegradable products.

Geopolitics and economics, including crude oil price volatility, energy transition strategies, and supply chain disturbances, will also influence market growth. Also, the use of Industry 4.0 and digitalization in production will lead to increased demand for sophisticated lubricants that can enable automation, predictive maintenance, and process efficiency.

Industrial lubricant manufacturers will have to find a balance between sustainability objectives, performance efficacy and affordability in the next few years, which will create huge innovation in formulation technologies.

The European market for industrial lubricants is geared up for continued growth, driven by growing automation, strict environmental regulations, and a growing focus on sustainability. Perhaps the most significant of these growth prospects is the move to bio-based and synthetic lubricants, underpinned by regulation such as the European Green Deal and the EU's pledge to reach carbon neutrality by 2050. With strict emissions regulations and increasing demand for eco-friendly options, the demand for bio-based and biodegradable lubricants should accelerate.

Moreover, the industrial and manufacturing boom in Central and Eastern Europe, especially in Poland, Hungary, and the Czech Republic, will propel demand for industrial lubricants in metalworking and machinery applications. The transformation of the automotive sector toward electric vehicles (EVs) and hybrid technology will also provide opportunities for niche lubricants that maximize efficiency in high-performance electric drivetrains and cooling systems.

Energy-efficient, low-viscosity synthetic lubricants will experience robust growth, especially in Western Europe in some applications such as hydraulic fluids and turbine oils, with governments implementing strict emissions regulations. In Scandinavian countries, where eco-friendliness is the key area of focus, bio-based and biodegradable lubricants will witness a significant shift. The industry will change drastically by 2035, with digitalization and IoT-based predictive maintenance solutions being key drivers in improving efficiency and maximizing lubricant use.

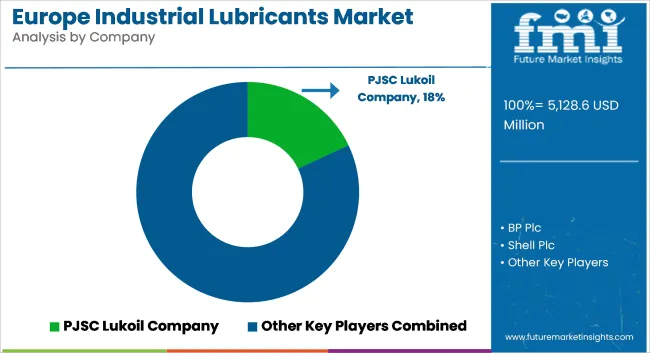

The European industrial lubricant market is becoming increasingly competitive as companies focus on developing high-performance, eco-friendly products. Key players are investing in advanced formulations to meet stricter environmental regulations and demand for sustainable solutions.

Strategic partnerships are accelerating the development of biodegradable lubricants, while vertical integration is being adopted to improve supply chain efficiency and reduce costs. Manufacturing capacities are being expanded to meet rising demand from automotive, manufacturing, and energy sectors. Market growth is driven by the push for greener alternatives and adherence to evolving environmental standards.

Hydraulic fluids, Metalworking fluids, Gear Oils, Compressor Oil, Grease, Turbine Oil, Transformer Oil, Refrigeration Oil, Textile Machinery Lubricants, and Others

Mineral Oil, Synthetic Oil, and Bio-based Oil

Construction, Metal and Mining, Cement Production, Power Generation, Automotive, Chemical Production, Oil and Gas, Textile Manufacturing, Food Processing, Agriculture, Pulp and Paper, Marine Application, and others

Germany. Italy, France, United Kingdom, Spain, BENEFLUX, and the Rest of Europe.

Growing automation, strict environmental laws, and expanding industries like automotive and construction.

Companies are shifting to biodegradable and low-emission products to meet sustainability targets.

Automotive, power generation, construction, and manufacturing lead consumption.

IoT and AI optimize lubricant performance and predictive maintenance.

Through innovation, partnerships, regional expansion, and eco-friendly products.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA