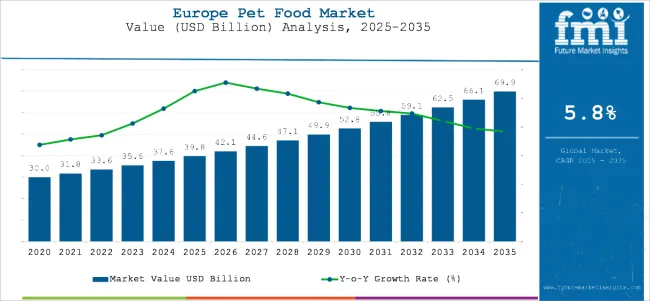

The Europe pet food market is estimated to be worth USD 39.8 billion in 2025. It is projected to reach a value of USD 69.9 billion by 2035, expanding at a CAGR of 5.8% over the assessment period from 2025 to 2035.

The industry shows consistent growth with increasing pet ownership and the growing trend of pet humanization. With pet owners looking for quality, nutritious, and specialized pet diets, the demand for high-quality pet food products such as organic, grain-free, and functional foods continue to grow in the region.

Among the key drivers accelerating this growth are heightened consumer perceptions of pet well-being and health. More and more, consumers tend to opt for pet foods fortified with extra vitamins, probiotics, and a high protein component to fuel pet nutrition. Enhanced disposable incomes, as well as the expenditure on expensive pet care products, are also catalyzing growth.

Even with its expansion, there are some challenges. Among the key restraints is premium and organic pet food being relatively expensive, and this could deter accessibility in price-sensitive markets. Another manufacturing challenge is rigorous European regulations concerning pet food ingredients and labeling requirements, which create compliance and entry issues.

Yet, there are huge opportunities. Rising demand for sustainable and environmentally friendly pet food packaging is compelling manufacturers to utilize biodegradable and recyclable packaging materials. Furthermore, online retailing of pet food and the popularity of direct-to-consumer brands offer convenience and variety, thereby driving the growth further.

There is an increasing popularity of plant-based and insect-based pet food as sustainable options to conventional protein sources. Furthermore, the growth of customized and breed-specific pet food formulations is on the rise. With further innovation, the industry is likely to transform with healthier, more sustainable, and personalized pet nutrition solutions.

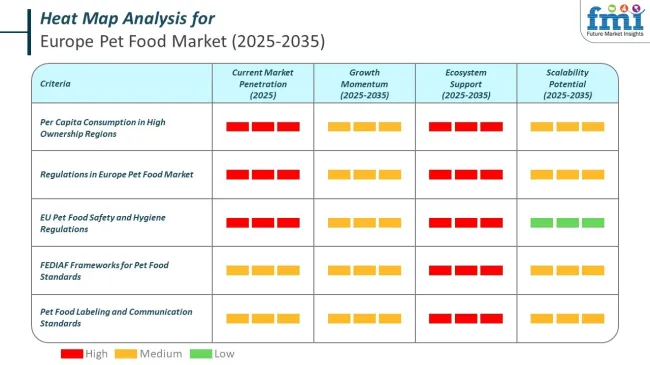

The Europe pet food market is anchored by strong per capita consumption in smaller, high-ownership countries such as Ireland, Portugal, and Hungary. These markets lead with up to 44 kg per person annually, indicating elevated pet density and premium feeding habits within relatively compact populations.

The Europe pet food market is structured around robust regulatory foundations, including multiple EU directives that govern feed safety, hygiene, labeling, and organic compliance. These regulations are enforced at both national and EU levels, ensuring traceability, animal welfare, and consumer protection across all product categories.

Beyond legislation, the Europe pet food market is guided by FEDIAF’s industry-specific codes that shape production, labeling, and nutrition standards. These voluntary frameworks offer manufacturers clear implementation tools aligned with EU regulatory expectations.

The industry is fueled by increasing pet ownership and a shift towards high-quality nutrition. The manufacturers focus more on product quality and nutritional content and incorporate natural ingredients, grain-free options, and personalized formulas for different pet needs. Compliance with regulations is key to ensuring safety and EU food standards.

Distributors are concerned with supply dependability and cost control. With the increased demand for specialized pet food, they engage manufacturers closely to facilitate a smooth stream of products and optimize logistics and pricing structures. Distributors are also critical to increasing the reach, especially for organic and sustainable pet food products.

Retailers accommodate various customer tastes with combinations of economy, premium, and specialized pet foods. Online business expansion further deepened retail products with the trend toward personalized subscription offerings.

End consumers value nutrition, ingredient clarity, and value. Pet owners look for high-protein, additive-free, and breed-specific products to maintain pet health. As there is a growing trend toward human-grade and sustainable pet food, there is a transformation to address the ever-increasing demand for ethically sourced and functional pet nutrition products.

Pet food sales in Europe experienced a revolution from 2020 to 2024 as a result of rising pet ownership, human interest in pets' well-being, and the quest for good-quality nutrition. Royal Canin, Purina, and Hill's Science Diet are among the brands whose product lines they expanded with breed-specific, grain-free, and functional food promoting digestive health, joints, and weight.

The demand for organically produced, ethically grown ingredients rose as a result, and Yora and Entoma's insect protein foods led them. Online pet shops such as Zooplus and Fressnapf witnessed a sharp rise, with doorstep delivery and subscription schemes being all the rage. Sustainability, too, became a space that gained importance, with companies greenifying by carbon emission reductions via recyclable packs and plant-based food.

During 2025 to 2035, the sector will further transform with a hyper-personalized diet, intelligent feeding solutions, and alternative protein platforms. Pet health diagnostics will be designed, which will result in personalized pet diets through DNA tests and microbiome studies. Pet nutrition apps powered by artificial intelligence will be funded by companies that will track the health of pets and suggest food modification in real time.

Lab-grown meat and algae-based proteins will also become sustainable alternatives. Functional pet food supplemented with probiotics, antioxidants, and immunostimulant additives will be mainstream, indicating a rising focus on preventive health. Markets for veterinary prescription diets, vegetarian pet food, and holistic health products will set the trend.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Pet adoption and premiumization . Organic, grain-free, and high-protein diet requirements. | Personalized nutrition and smart feeding systems development. |

| Increased AI-based pet health monitoring. | Introduction of breed life-stage and life-stage diets. Use of insect protein as an alternative. |

| Consumption of lab-grown meat and algal-based proteins. Incorporation of DNA-based customized pet diets. | Use of natural, premium, and raw pet food. Greater use of e-commerce and subscription services. |

| Increased demand for holistic, veterinarian-formulated therapeutic pet food. Increased adoption of gut-health and immunity-focused pet food. | Creation of recyclable and biodegradable packaging. Focus on local sourcing of ingredients. |

| Carbon-neutral pet food manufacturing is growing. Increased use of plant-based and sustainable protein sources. | Online digital retail websites like Zooplus and Pets at Home m ake online shopping convenient. |

| AI-powered smart pet bowls and real-time nutrition monitoring apps. | Tighter pet food labeling and ingredient disclosure regulations. Laws promoting natural preservatives. |

| Increased enforcement of sustainable sourcing and a nimal welfare regulations. | Firms investing in digestive health formulas and veterinary diets. Plant-based pet food alternatives expansion. |

The pet food market in Europe is also challenged by different risks, such as changing consumer demands, supply chain issues, regulatory demands, pricing instability, and sustainability issues. Businesses need to strategically address these risks to stay competitive and maintain stability.

Changing consumer interests are the foremost risk, and pet owners call for organic, grain-free, functional, and customized nutritional sources. If they do not address these changing requirements, the failing brands could risk losing consumers. To offset such a threat, firms can place investments in product diversification as well as in research to fit various nutritional diets and health considerations of pets.

Raw material price fluctuations for meat, fish, and grains can affect production costs and profitability. Inflation, trade tariffs, and unstable currency exchange rates as economic drivers make it even more challenging for pricing strategies. To cope with it, companies must implement dynamic pricing models, strategic buying contracts with suppliers, and cost-effective manufacturing processes.

Sustainability concerns are increasingly driving consumer choices, with consumers demanding green packaging, plant-based ingredients, and carbon-neutral manufacturing. The companies that fail to address these concerns do face a decline. Investment in sustainable ingredient procurement, biodegradable packaging, and carbon footprint reduction initiatives will be essential to long-term success.

European pet food companies must turn to product innovation, supply chain strength, regulatory adherence, price resilience, and sustainability efforts alongside strong brand positioning in a competitive industry in order to survive.

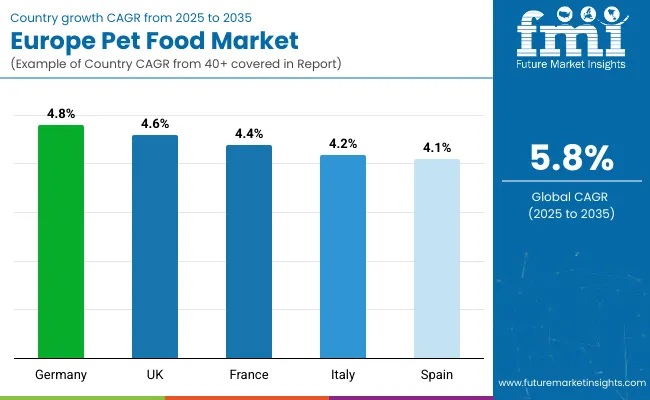

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.8% |

| UK | 4.6% |

| France | 4.4% |

| Italy | 4.2% |

| Spain | 4.1% |

Germany has the largest pet food market in Europe, and there is high demand due to a gigantic population of pets and a desire for high-quality, specialty pet foods. The growth of the pet food sector in the country will be higher than the regional rate, at 4.8% between 2025 and 2035.

The industry is also experiencing a trend towards a premium trend for dry and wet pet foods, as there is increasing demand for health-focused formulations like grain-free, organic, and fortified. Recipe reformulation, functional ingredients, and packaging remain key drivers of growth; since Germany is a trendsetter in Europe, its pet food industry will likely have a high growth rate toward pets' health and wellness.

The UK is experiencing an unprecedented surge in premium foodstuffs, spearheaded by the pet humanization trend, where pets are being regarded more and more as part of the family. The UK will have a CAGR of 4.6% from 2025 to 2035. Natural ingredients and high-protein pet foods, particularly in the cat food category, are top-selling items, led by increasing demand for functional nutrition.

Product extension to incorporate gourmet and specialist products is in line with the UK's growing emphasis on high-quality, health-oriented pet food. Pet shops, both online and online, offer wide accessibility, driving successive growth of the premium sector and driving consumer commitment.

France will develop at a 4.4% CAGR from 2025 to 2035. Demand for specific products addressing distinctive pet needs remains robust, and there is consistent momentum toward therapeutically driven, breed-niche, or organic/hypoallergenic diets. Wet food is especially overbearing because its perceived nutritional quality and taste are well-known by pet owners.

Pet health education for consumers increases every year, creating a call for functional foods that address complications like allergies, aging, and weight control. This demand is fulfilled by companies that possess knowledge about the incorporation of new ingredients and formulations catering to the special needs of pets, which helps the industry evolve and improve in France.

Italy will grow at a CAGR of 4.2% between 2025 and 2035. There is a steady demand for both regular and high-end pet foods. Italians are also more concerned with natural, organic, and functional products as part of a larger trend towards healthier lifestyles.

Expansion is fueled by increasing pet health awareness and product innovation centered on nutritional value and taste. Retail distribution, particularly online, continues to grow, and premium pet food products reach a broad consumer base, driving steady growth.

Spain is expected to register a CAGR of 4.1% and show modest growth in the pet food market during the forecast period of 2025 to 2035. Though the pet food industry is increasingly growing, Spain falls behind Germany and the UK in terms of premium pet food product demand. Nonetheless, there is an emerging trend for products related to health, particularly organic foods and natural foods.

Spain is witnessing an emerging demand for convenient pack sizes, e.g., single-serve pouches. Physical outlets and online outlets are the distribution channels, fueling additional industry growth since pet owners increasingly want to offer their pets proper nutrition.

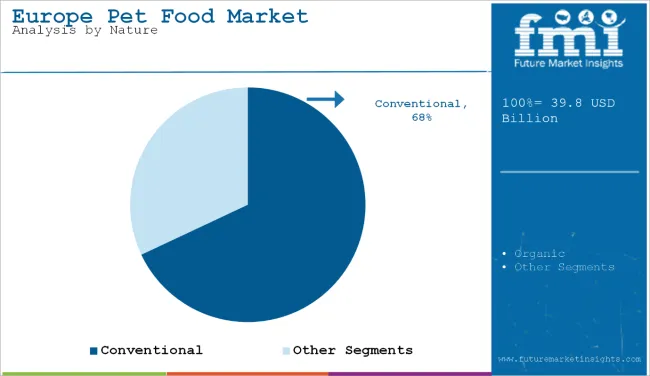

| Segment | Value Share (2025) |

|---|---|

| Conventional | 68% |

The conventional segment accounts for 68% share. Conventional pet food continues to dominate the European market due to its affordability, convenience, and wide availability. It meets the needs of the majority of pet owners who prioritize balanced nutrition, safety, and cost-effectiveness. Most conventional brands are well-established, trusted, and regulated under strict EU food safety standards, which ensures consistent quality.

European consumers often prefer purchasing from known brands with proven track records. Conventional pet food is formulated to meet the nutritional standards set by authorities like FEDIAF (European Pet Food Industry Federation), giving pet owners confidence in its adequacy for daily feeding.

Additionally, the strong presence of multinational pet food companies in Europe has reinforced the dominance of conventional pet food. These companies invest heavily in marketing, distribution networks, and product development, making their products highly visible and accessible across the continent. They also offer a wide range of options tailored to different breeds, life stages, and dietary needs, appealing to a broad consumer base. Combined with strong veterinary endorsements and loyalty programs, these strategies further encourage pet owners to choose conventional options over emerging alternatives like raw, organic, or plant-based diets.

| Segment | Value Share (2025) |

|---|---|

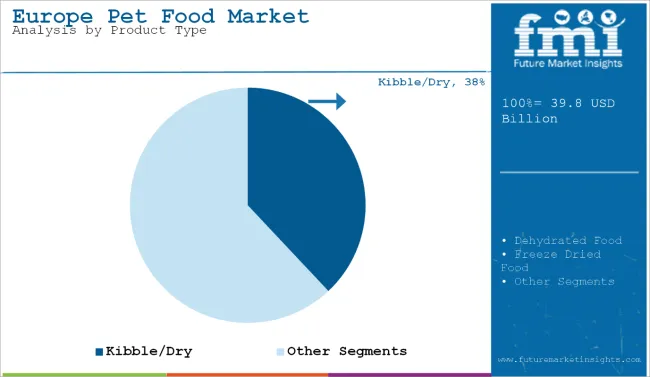

| Dry pet food (Product) | 38% |

The pet food industry in Europe will see strong demand in 2025, with a dominant share of kibble/dry food occupying 38%, followed by wet foods at a 15% share. Kibble/dry foods are mostly preferred in the marketplace due to cost-effectiveness, long shelf-life, and user-friendliness for pet owners. Such foods are very popular among dog and cat owners since they supply the required nutrients, assist in dental care, and are easy to store.

Lead brands like Royal Canin, Hill's Pet Nutrition, and Purina produce functional dry pet food that addresses health problems such as digestibility, weight-loss management, or breed-specific formulae. Acana, Orijen, and Farmina largely produce high-protein, grain-free kibbles that have helped increase the sales of natural and high-meat-content formulas.

In contrast, wet food's share of 15% is mainly attributable to those properties that make it great for the hydration-based needs of pets and aged animals with dental issues: its high moisture and palatability. The wet food segment is dominated by companies like Mars Petcare (Pedigree, Whiskas), Nestlé Purina (Felix, Gourmet), and Animonda, which provide canned and pouch wet food products in a wide array of flavors and nutrition profiles.

The premiumization trend has also pushed higher demand for human-grade, organic, and fresh wet food; brands such as Lily's Kitchen, Butcher's, and Edgard and Cooper are paving the way for natural and quality nutrition for your pet.

| Segment | Value Share (2025) |

|---|---|

| Organic (Nature) | 46.6% |

By nature, organic pet food dominates with a share of 46.6% in 2025, while that made conventionally will capture 35.4%. Organic pet foods show good sales because of the current market trend of consumer's preference for natural, chemical-free, and ethically sourced ingredients. Brands like Lily's Kitchen, Yarrah, and Edgard & Cooper have fed into this demand by providing certified organic pet food from grass-fed meats and non-GMO ingredients.

At the same time, other pet owners looking for healthier diets without preservatives are turning towards organic formulations that minimize allergy and digestive risks. Again, EU regulations on organic certification, along with thepremiumization trend in pet nutrition, are enhancing the stronghold of this segment.

Conventional pet foods, with a 35.4% share, still have their fair share of strength, principally due to the same reasons, like low price, long shelf life, and balanced nutrition. Leading brands like Pedigree (Mars Petcare), Purina (Nestlé), and Royal Canin continue to produce affordable and easily available formulations responding to the different dietary needs of pets.

Traditional pet food is being supplemented with necessary nutrients. Still, some people shift from conventional pet food to natural or organic alternatives since they are concerned about artificial additives and inferior ingredients. Despite this, affordability and availability will always guarantee the relevance of traditional pet feeds.

The European pet food market has been growing fast due to factors such as an increase in pet ownership and an enhanced focus on pet health and nutrition. Leading companies have expanded their portfolio with premium, functional, and clean-label products in response to the changing preferences of pet owners. Sustainability has become a major focus, with companies investing in biodegradable and recyclable packaging and responsibly sourced ingredients, answering to the consumer demand for eco-consciousness.

Innovation is the next key competitive strategy, with big companies working towards special diets for specific health needs, life stages, and breed requirements. Digital technologies, including e-commerce as well as personalized online services, have helped augment customer engagement and streamline distribution channels to provide more convenient options for consumers.

Strategic mergers and acquisitions have also contributed to the shaping of the competitive landscape, thereby enabling companies to consolidate their industry positions as well as expand their offerings. Collaborations with veterinary professionals and pet nutritionists have played a key role in developing science-based offerings that attract health-conscious consumers.Though big brands dominate, niche players are coming up with raw, natural, and alternate protein sources.

| Company Name | Estimated Market Share (%) |

|---|---|

| Mars Incorporated | 24% |

| Nestlé Purina PetCare | 21% |

| Colgate-Palmolive (Hill's) | 16% |

| Affinity Petcare SA | 11% |

| Canagan Group | 9% |

| Other Companies | 19% |

| Company Name | Key Offerings/Activities |

|---|---|

| Mars Incorporated | It offers brands like Pedigree and Whiskas and focuses on sustainability and innovation in pet nutrition. |

| Nestlé Purina PetCare | Provides Purina brands emphasize research-driven nutrition and pet welfare initiatives. |

| Colgate-Palmolive (Hill's) | Specializes in Hill's Science Diet and invests in veterinary partners hips and clinical nutrition research. |

| Affinity Petcare SA | Develops premium pet food that integrates sustainable practices as well as community engagement programs. |

| Canagan Group | It focuses on grain-free recipes and sources high-quality ingredients for na tural pet nutrition. |

Mars Incorporated, which includes Pedigree and Whiskas in a varied array of products, is Europe's leading pet food company. The company is also gravely concerned about sustainability and aims to do so by making responsible sourcing choices and providing eco-friendly packaging.

Nestlé Purina PetCare is another major player with Purina brand names. The company prides itself on science-based nutrition, working with veterinarians and pet experts to create products geared toward the health as well as longevity of pets.

Hill's Pet Nutrition from Colgate-Palmolive caters to prescription diets and well-being products under Hill's Science Diet. The company conducts clinical studies on its diet formulations that target specific health issues and works closely with veterinary professionals to ensure both efficacy and safety.

Affinity Petcare SA focuses on the high-end of the pet food market, marketing products that highlight natural ingredients and customized nutrition. It is committed to sustainability, promoting eco-friendly production and packaging practices, and is actively engaged in community programs that encourage responsible pet ownership.

Canagan Group offers grain-free pet food formulas, sourcing premium ingredients to give natural and balanced nutrition. Its commitment to biologically appropriate nutrition is successful with customers who want premium alternatives to traditional pet food.

The industry is segmented into Organic, Mono Protein, and Conventional, catering to different consumer preferences and dietary requirements for pets.

The industry is segmented into Kibble/Dry (Extruded, Baked, Cooked), Dehydrated Food, Freeze-Dried Food, Freeze-Dried Raw, Wet Food, Frozen, Raw Food, Powder, and Treats & Chews (Dog and Cat), offering diverse options for pet nutrition.

The industry is segmented into Animal-derived (Fish, Chicken, Duck, Beef, Pork, Venison/Game, Lamb, Turkey), Plant-derived, and Insect-derived (Crickets, Mealworms, Black Soldier Flies), reflecting the growing demand for sustainable and alternative protein sources.

The industry is segmented into Cat (Kitten, Senior), Dog (Puppy, Adult, Senior), Birds, and Others (Rabbits, Hamsters, etc.), ensuring specialized nutrition for different pet species and life stages.

The segmentation is into Pouches, Bags, Folding Cartons, Tubs & Cups, and Cans, emphasizing convenience and preservation.

This industry is segmented into store-based retailing and online retailers. Store-based retailing includes hypermarkets/supermarkets, convenience stores, mom-and-pop stores, pet stores, discounters, independent grocery retailers, drugstores, and other retail formats, offering consumers the advantage of in-person shopping and immediate product availability. Meanwhile, online retailers represent the rapidly growing digital commerce landscape, providing convenience, a wider product selection, and home delivery options for pet owners.

The report covers Germany, the United Kingdom, France, Italy, Spain, Russia, and Poland, reflecting key regional demand and market growth.

The industry is expected to reach USD 39.8 billion in 2025.

The market is projected to grow to USD 69.4 billion by 2035.

Germany is expected to experience significant growth with a 4.8% CAGR during the forecast period.

Dry pet food is one of the most popular categories.

Leading companies include Mars Incorporated, Nestlé Purina PetCare, Colgate-Palmolive (Hill's Pet Nutrition), Affinity Petcare SA, Canagan Group, Evanger’s Dog & Cat Food Company, Roll Over Pet Food Ltd., The Pet Food Market, Wagg Foods Ltd., McAdams Pet Foods Limited, Sabre Pet Food, Mera Pet Food Family, and Symrise.

Table 1: Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 7: Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 8: Market Volume (MT) Forecast by Source, 2018 to 2033

Table 9: Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 10: Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 11: Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 12: Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 13: Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 14: Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 15: Germany Pet Food Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Germany Pet Food Market Volume (MT) Forecast by Country, 2018 to 2033

Table 17: Germany Pet Food Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 18: Germany Pet Food Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 19: Germany Pet Food Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Germany Pet Food Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Germany Pet Food Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Germany Pet Food Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Germany Pet Food Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 24: Germany Pet Food Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 25: Germany Pet Food Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 26: Germany Pet Food Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 27: Germany Pet Food Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 28: Germany Pet Food Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 29: United Kingdom Pet Food Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: United Kingdom Pet Food Market Volume (MT) Forecast by Country, 2018 to 2033

Table 31: United Kingdom Pet Food Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 32: United Kingdom Pet Food Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 33: United Kingdom Pet Food Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: United Kingdom Pet Food Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: United Kingdom Pet Food Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: United Kingdom Pet Food Market Volume (MT) Forecast by Source, 2018 to 2033

Table 37: United Kingdom Pet Food Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 38: United Kingdom Pet Food Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 39: United Kingdom Pet Food Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 40: United Kingdom Pet Food Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 41: United Kingdom Pet Food Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: United Kingdom Pet Food Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 43: France Pet Food Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: France Pet Food Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: France Pet Food Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 46: France Pet Food Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 47: France Pet Food Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: France Pet Food Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 49: France Pet Food Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 50: France Pet Food Market Volume (MT) Forecast by Source, 2018 to 2033

Table 51: France Pet Food Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 52: France Pet Food Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 53: France Pet Food Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 54: France Pet Food Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 55: France Pet Food Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: France Pet Food Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 57: Italy Pet Food Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Italy Pet Food Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Italy Pet Food Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 60: Italy Pet Food Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 61: Italy Pet Food Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 62: Italy Pet Food Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 63: Italy Pet Food Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 64: Italy Pet Food Market Volume (MT) Forecast by Source, 2018 to 2033

Table 65: Italy Pet Food Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 66: Italy Pet Food Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 67: Italy Pet Food Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 68: Italy Pet Food Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 69: Italy Pet Food Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: Italy Pet Food Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 71: Spain Pet Food Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Spain Pet Food Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Spain Pet Food Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 74: Spain Pet Food Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 75: Spain Pet Food Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Spain Pet Food Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 77: Spain Pet Food Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 78: Spain Pet Food Market Volume (MT) Forecast by Source, 2018 to 2033

Table 79: Spain Pet Food Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 80: Spain Pet Food Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 81: Spain Pet Food Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 82: Spain Pet Food Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 83: Spain Pet Food Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 84: Spain Pet Food Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 85: Russia Pet Food Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Russia Pet Food Market Volume (MT) Forecast by Country, 2018 to 2033

Table 87: Russia Pet Food Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 88: Russia Pet Food Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 89: Russia Pet Food Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 90: Russia Pet Food Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 91: Russia Pet Food Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 92: Russia Pet Food Market Volume (MT) Forecast by Source, 2018 to 2033

Table 93: Russia Pet Food Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 94: Russia Pet Food Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 95: Russia Pet Food Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 96: Russia Pet Food Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 97: Russia Pet Food Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 98: Russia Pet Food Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 99: Poland Pet Food Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 100: Poland Pet Food Market Volume (MT) Forecast by Country, 2018 to 2033

Table 101: Poland Pet Food Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 102: Poland Pet Food Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 103: Poland Pet Food Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 104: Poland Pet Food Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 105: Poland Pet Food Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 106: Poland Pet Food Market Volume (MT) Forecast by Source, 2018 to 2033

Table 107: Poland Pet Food Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 108: Poland Pet Food Market Volume (MT) Forecast by Pet Type, 2018 to 2033

Table 109: Poland Pet Food Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 110: Poland Pet Food Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 111: Poland Pet Food Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 112: Poland Pet Food Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Market Value (US$ Million) by Source, 2023 to 2033

Figure 4: Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 5: Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 6: Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 7: Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 10: Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 11: Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 12: Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 13: Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 14: Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 15: Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 16: Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 17: Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 18: Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 19: Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 20: Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 21: Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 22: Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 23: Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 24: Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 25: Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 26: Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 27: Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 28: Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 29: Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 30: Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 31: Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 32: Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 33: Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 34: Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 35: Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 36: Market Attractiveness by Nature, 2023 to 2033

Figure 37: Market Attractiveness by Product Type, 2023 to 2033

Figure 38: Market Attractiveness by Source, 2023 to 2033

Figure 39: Market Attractiveness by Pet Type, 2023 to 2033

Figure 40: Market Attractiveness by Packaging, 2023 to 2033

Figure 41: Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 42: Market Attractiveness by Region, 2023 to 2033

Figure 43: Germany Pet Food Market Value (US$ Million) by Nature, 2023 to 2033

Figure 44: Germany Pet Food Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 45: Germany Pet Food Market Value (US$ Million) by Source, 2023 to 2033

Figure 46: Germany Pet Food Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 47: Germany Pet Food Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 48: Germany Pet Food Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 49: Germany Pet Food Market Value (US$ Million) by Country, 2023 to 2033

Figure 50: Germany Pet Food Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 51: Germany Pet Food Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 52: Germany Pet Food Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 53: Germany Pet Food Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 54: Germany Pet Food Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 55: Germany Pet Food Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 56: Germany Pet Food Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 57: Germany Pet Food Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 58: Germany Pet Food Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 59: Germany Pet Food Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 60: Germany Pet Food Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 61: Germany Pet Food Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 62: Germany Pet Food Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 63: Germany Pet Food Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 64: Germany Pet Food Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 65: Germany Pet Food Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 66: Germany Pet Food Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 67: Germany Pet Food Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 68: Germany Pet Food Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 69: Germany Pet Food Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 70: Germany Pet Food Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 71: Germany Pet Food Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 72: Germany Pet Food Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 73: Germany Pet Food Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 74: Germany Pet Food Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Germany Pet Food Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 76: Germany Pet Food Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 77: Germany Pet Food Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 78: Germany Pet Food Market Attractiveness by Nature, 2023 to 2033

Figure 79: Germany Pet Food Market Attractiveness by Product Type, 2023 to 2033

Figure 80: Germany Pet Food Market Attractiveness by Source, 2023 to 2033

Figure 81: Germany Pet Food Market Attractiveness by Pet Type, 2023 to 2033

Figure 82: Germany Pet Food Market Attractiveness by Packaging, 2023 to 2033

Figure 83: Germany Pet Food Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 84: Germany Pet Food Market Attractiveness by Country, 2023 to 2033

Figure 85: United Kingdom Pet Food Market Value (US$ Million) by Nature, 2023 to 2033

Figure 86: United Kingdom Pet Food Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 87: United Kingdom Pet Food Market Value (US$ Million) by Source, 2023 to 2033

Figure 88: United Kingdom Pet Food Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 89: United Kingdom Pet Food Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 90: United Kingdom Pet Food Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 91: United Kingdom Pet Food Market Value (US$ Million) by Country, 2023 to 2033

Figure 92: United Kingdom Pet Food Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 93: United Kingdom Pet Food Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 94: United Kingdom Pet Food Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 95: United Kingdom Pet Food Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 96: United Kingdom Pet Food Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 97: United Kingdom Pet Food Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 98: United Kingdom Pet Food Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 99: United Kingdom Pet Food Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 100: United Kingdom Pet Food Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: United Kingdom Pet Food Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 102: United Kingdom Pet Food Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: United Kingdom Pet Food Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: United Kingdom Pet Food Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 105: United Kingdom Pet Food Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 106: United Kingdom Pet Food Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 107: United Kingdom Pet Food Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 108: United Kingdom Pet Food Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 109: United Kingdom Pet Food Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 110: United Kingdom Pet Food Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 111: United Kingdom Pet Food Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 112: United Kingdom Pet Food Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 113: United Kingdom Pet Food Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 114: United Kingdom Pet Food Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 115: United Kingdom Pet Food Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 116: United Kingdom Pet Food Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 117: United Kingdom Pet Food Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 118: United Kingdom Pet Food Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 119: United Kingdom Pet Food Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 120: United Kingdom Pet Food Market Attractiveness by Nature, 2023 to 2033

Figure 121: United Kingdom Pet Food Market Attractiveness by Product Type, 2023 to 2033

Figure 122: United Kingdom Pet Food Market Attractiveness by Source, 2023 to 2033

Figure 123: United Kingdom Pet Food Market Attractiveness by Pet Type, 2023 to 2033

Figure 124: United Kingdom Pet Food Market Attractiveness by Packaging, 2023 to 2033

Figure 125: United Kingdom Pet Food Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 126: United Kingdom Pet Food Market Attractiveness by Country, 2023 to 2033

Figure 127: France Pet Food Market Value (US$ Million) by Nature, 2023 to 2033

Figure 128: France Pet Food Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 129: France Pet Food Market Value (US$ Million) by Source, 2023 to 2033

Figure 130: France Pet Food Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 131: France Pet Food Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 132: France Pet Food Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 133: France Pet Food Market Value (US$ Million) by Country, 2023 to 2033

Figure 134: France Pet Food Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 135: France Pet Food Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 136: France Pet Food Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 137: France Pet Food Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 138: France Pet Food Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 139: France Pet Food Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 140: France Pet Food Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 141: France Pet Food Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 142: France Pet Food Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 143: France Pet Food Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 144: France Pet Food Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 145: France Pet Food Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 146: France Pet Food Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 147: France Pet Food Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 148: France Pet Food Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 149: France Pet Food Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 150: France Pet Food Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 151: France Pet Food Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 152: France Pet Food Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 153: France Pet Food Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 154: France Pet Food Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 155: France Pet Food Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 156: France Pet Food Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 157: France Pet Food Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 158: France Pet Food Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 159: France Pet Food Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 160: France Pet Food Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 161: France Pet Food Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 162: France Pet Food Market Attractiveness by Nature, 2023 to 2033

Figure 163: France Pet Food Market Attractiveness by Product Type, 2023 to 2033

Figure 164: France Pet Food Market Attractiveness by Source, 2023 to 2033

Figure 165: France Pet Food Market Attractiveness by Pet Type, 2023 to 2033

Figure 166: France Pet Food Market Attractiveness by Packaging, 2023 to 2033

Figure 167: France Pet Food Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: France Pet Food Market Attractiveness by Country, 2023 to 2033

Figure 169: Italy Pet Food Market Value (US$ Million) by Nature, 2023 to 2033

Figure 170: Italy Pet Food Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 171: Italy Pet Food Market Value (US$ Million) by Source, 2023 to 2033

Figure 172: Italy Pet Food Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 173: Italy Pet Food Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 174: Italy Pet Food Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 175: Italy Pet Food Market Value (US$ Million) by Country, 2023 to 2033

Figure 176: Italy Pet Food Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 177: Italy Pet Food Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 178: Italy Pet Food Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 179: Italy Pet Food Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 180: Italy Pet Food Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 181: Italy Pet Food Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 182: Italy Pet Food Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 183: Italy Pet Food Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 184: Italy Pet Food Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 185: Italy Pet Food Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 186: Italy Pet Food Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 187: Italy Pet Food Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 188: Italy Pet Food Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 189: Italy Pet Food Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 190: Italy Pet Food Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 191: Italy Pet Food Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 192: Italy Pet Food Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 193: Italy Pet Food Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 194: Italy Pet Food Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 195: Italy Pet Food Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 196: Italy Pet Food Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 197: Italy Pet Food Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 198: Italy Pet Food Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 199: Italy Pet Food Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 200: Italy Pet Food Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 201: Italy Pet Food Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 202: Italy Pet Food Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 203: Italy Pet Food Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 204: Italy Pet Food Market Attractiveness by Nature, 2023 to 2033

Figure 205: Italy Pet Food Market Attractiveness by Product Type, 2023 to 2033

Figure 206: Italy Pet Food Market Attractiveness by Source, 2023 to 2033

Figure 207: Italy Pet Food Market Attractiveness by Pet Type, 2023 to 2033

Figure 208: Italy Pet Food Market Attractiveness by Packaging, 2023 to 2033

Figure 209: Italy Pet Food Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: Italy Pet Food Market Attractiveness by Country, 2023 to 2033

Figure 211: Spain Pet Food Market Value (US$ Million) by Nature, 2023 to 2033

Figure 212: Spain Pet Food Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Spain Pet Food Market Value (US$ Million) by Source, 2023 to 2033

Figure 214: Spain Pet Food Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 215: Spain Pet Food Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 216: Spain Pet Food Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 217: Spain Pet Food Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: Spain Pet Food Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: Spain Pet Food Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 220: Spain Pet Food Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 221: Spain Pet Food Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 222: Spain Pet Food Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 223: Spain Pet Food Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 224: Spain Pet Food Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 225: Spain Pet Food Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 226: Spain Pet Food Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 227: Spain Pet Food Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 228: Spain Pet Food Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 229: Spain Pet Food Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 230: Spain Pet Food Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 231: Spain Pet Food Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 232: Spain Pet Food Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 233: Spain Pet Food Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 234: Spain Pet Food Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 235: Spain Pet Food Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 236: Spain Pet Food Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 237: Spain Pet Food Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 238: Spain Pet Food Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 239: Spain Pet Food Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 240: Spain Pet Food Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 241: Spain Pet Food Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 242: Spain Pet Food Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 243: Spain Pet Food Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 244: Spain Pet Food Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 245: Spain Pet Food Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 246: Spain Pet Food Market Attractiveness by Nature, 2023 to 2033

Figure 247: Spain Pet Food Market Attractiveness by Product Type, 2023 to 2033

Figure 248: Spain Pet Food Market Attractiveness by Source, 2023 to 2033

Figure 249: Spain Pet Food Market Attractiveness by Pet Type, 2023 to 2033

Figure 250: Spain Pet Food Market Attractiveness by Packaging, 2023 to 2033

Figure 251: Spain Pet Food Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 252: Spain Pet Food Market Attractiveness by Country, 2023 to 2033

Figure 253: Russia Pet Food Market Value (US$ Million) by Nature, 2023 to 2033

Figure 254: Russia Pet Food Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 255: Russia Pet Food Market Value (US$ Million) by Source, 2023 to 2033

Figure 256: Russia Pet Food Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 257: Russia Pet Food Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 258: Russia Pet Food Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 259: Russia Pet Food Market Value (US$ Million) by Country, 2023 to 2033

Figure 260: Russia Pet Food Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 261: Russia Pet Food Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 262: Russia Pet Food Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 263: Russia Pet Food Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 264: Russia Pet Food Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 265: Russia Pet Food Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 266: Russia Pet Food Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 267: Russia Pet Food Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 268: Russia Pet Food Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 269: Russia Pet Food Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 270: Russia Pet Food Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 271: Russia Pet Food Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 272: Russia Pet Food Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 273: Russia Pet Food Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 274: Russia Pet Food Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 275: Russia Pet Food Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 276: Russia Pet Food Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 277: Russia Pet Food Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 278: Russia Pet Food Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 279: Russia Pet Food Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 280: Russia Pet Food Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 281: Russia Pet Food Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 282: Russia Pet Food Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 283: Russia Pet Food Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 284: Russia Pet Food Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 285: Russia Pet Food Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 286: Russia Pet Food Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 287: Russia Pet Food Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 288: Russia Pet Food Market Attractiveness by Nature, 2023 to 2033

Figure 289: Russia Pet Food Market Attractiveness by Product Type, 2023 to 2033

Figure 290: Russia Pet Food Market Attractiveness by Source, 2023 to 2033

Figure 291: Russia Pet Food Market Attractiveness by Pet Type, 2023 to 2033

Figure 292: Russia Pet Food Market Attractiveness by Packaging, 2023 to 2033

Figure 293: Russia Pet Food Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 294: Russia Pet Food Market Attractiveness by Country, 2023 to 2033

Figure 295: Poland Pet Food Market Value (US$ Million) by Nature, 2023 to 2033

Figure 296: Poland Pet Food Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 297: Poland Pet Food Market Value (US$ Million) by Source, 2023 to 2033

Figure 298: Poland Pet Food Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 299: Poland Pet Food Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 300: Poland Pet Food Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 301: Poland Pet Food Market Value (US$ Million) by Country, 2023 to 2033

Figure 302: Poland Pet Food Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 303: Poland Pet Food Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 304: Poland Pet Food Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 305: Poland Pet Food Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 306: Poland Pet Food Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 307: Poland Pet Food Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 308: Poland Pet Food Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 309: Poland Pet Food Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 310: Poland Pet Food Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 311: Poland Pet Food Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 312: Poland Pet Food Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 313: Poland Pet Food Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 314: Poland Pet Food Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 315: Poland Pet Food Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 316: Poland Pet Food Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 317: Poland Pet Food Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 318: Poland Pet Food Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 319: Poland Pet Food Market Volume (MT) Analysis by Pet Type, 2018 to 2033

Figure 320: Poland Pet Food Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 321: Poland Pet Food Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 322: Poland Pet Food Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 323: Poland Pet Food Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 324: Poland Pet Food Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 325: Poland Pet Food Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 326: Poland Pet Food Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 327: Poland Pet Food Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 328: Poland Pet Food Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 329: Poland Pet Food Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 330: Poland Pet Food Market Attractiveness by Nature, 2023 to 2033

Figure 331: Poland Pet Food Market Attractiveness by Product Type, 2023 to 2033

Figure 332: Poland Pet Food Market Attractiveness by Source, 2023 to 2033

Figure 333: Poland Pet Food Market Attractiveness by Pet Type, 2023 to 2033

Figure 334: Poland Pet Food Market Attractiveness by Packaging, 2023 to 2033

Figure 335: Poland Pet Food Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 336: Poland Pet Food Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Europe Postbiotic Pet Food Market Insights – Growth, Innovations & Forecast 2025-2035

Europe Plant-Based Pet Food Market Analysis – Growth, Applications & Outlook 2025-2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA