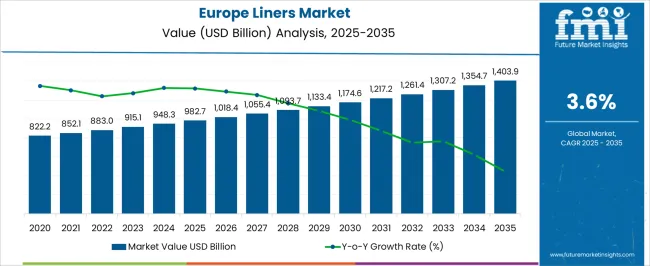

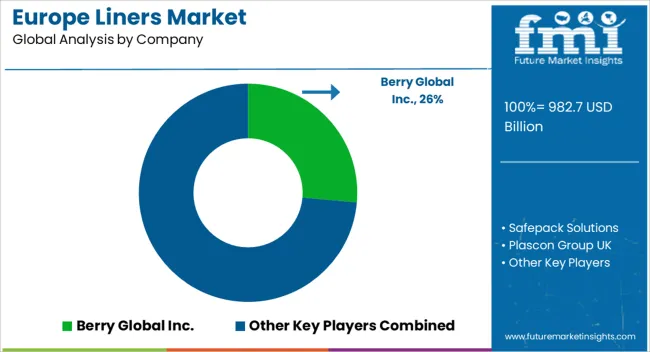

The Europe Liners Market is estimated to be valued at USD 982.7 billion in 2025 and is projected to reach USD 1403.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

| Metric | Value |

|---|---|

| Europe Liners Market Estimated Value in (2025 E) | USD 982.7 billion |

| Europe Liners Market Forecast Value in (2035 F) | USD 1403.9 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The Europe liners market is expanding steadily, supported by rising demand for protective packaging solutions in industrial, commercial, and retail sectors. The need to safeguard goods against contamination, moisture, and external damage is driving the adoption of liners across food, pharmaceutical, and chemical applications.

Regulatory emphasis on hygiene and sustainability has accelerated the shift toward advanced liner materials that are recyclable, lightweight, and compliant with European environmental standards. In addition, the region’s well established manufacturing and logistics sectors have intensified the requirement for reliable protective packaging that ensures product integrity during transportation and storage.

Technological innovations in film extrusion and barrier materials are further shaping the market’s progression. The overall outlook remains positive as industries prioritize operational efficiency, supply chain resilience, and sustainable material adoption across diverse end use applications.

The plastic material segment is anticipated to account for 48.60% of total market revenue by 2025, making it the leading choice in the material category. The growth of this segment is being driven by the durability, flexibility, and cost effectiveness of plastic liners, which provide superior barrier protection against moisture and contamination.

Plastic liners also offer lightweight characteristics that reduce shipping costs and carbon footprint, aligning with industry efforts to optimize packaging efficiency.

Continued advancements in recyclable and biodegradable plastic formulations are also strengthening the acceptance of this material across regulated European markets, reinforcing its dominance within the segment.

The less than 3 millimeter thickness category is projected to represent 44.20% of overall revenue by 2025, reflecting its preference within the thickness segment. This is largely attributed to its adaptability for a wide range of packaging needs, including food, pharmaceutical, and industrial products.

Liners within this thickness range provide sufficient strength and barrier protection while maintaining cost efficiency and ease of handling. Their compatibility with automation and high speed packaging lines has further increased their adoption.

As industries seek balance between performance and material savings, the less than 3 millimeter category continues to maintain its leadership in the market.

The box liners category is expected to command 57.90% of total market revenue by 2025, making it the most dominant product type. This growth is being fueled by the extensive use of box liners in food packaging, pharmaceuticals, and industrial shipments where contamination control and moisture protection are critical.

Their ability to extend product shelf life, ensure regulatory compliance, and improve transportation efficiency has strengthened their presence. Moreover, the rising demand for bulk packaging solutions in Europe’s food and beverage supply chain has further reinforced the dominance of box liners.

Their functional benefits combined with broad applicability continue to secure their position as the leading product type segment.

Europe liners market showcased a CAGR of 2.0% during the historical period. It stood at a valuation of USD 982.7 million in 2025 from USD 822.2 million in 2020.

Liners have been an important packaging material for several decades, with a long history of use in a variety of sectors, including food & beverage, pharmaceutical, and cosmetics. The market has primarily been driven by rising need for environmentally friendly and economically viable packaging solutions across a range of sectors.

Surging demand for high-density polyethylene (HDPE), low-density polyethylene (LDPE), and linear low-density polyethylene (LLDPE) have been principally credited for this growth. These offer enhanced durability and resilience to environmental elements such moisture & temperature changes.

Due to rising demand for packaged food & beverages, as well as increased emphasis on sustainability and eco-friendliness, the food & beverage sector has emerged dominant. Due to tight regulatory requirements and high demand for safe & hygienic packaging solutions, the pharmaceutical and chemical sectors have also made key contributions.

Increasing use of bioplastics in the packaging sector is driven by rising demand for sustainable products by consumers and brands alike. This is anticipated to augment liner demand in Europe.

Trend for Online Shopping and Expansion of E-commerce to Boost Demand

To deliver goods to clients, e-commerce businesses need last-mile delivery services that are effective and affordable. Companies that produce liners are collaborating with logistics providers to offer last-mile delivery services, creating new revenue streams for the liners sector.

Liner enterprises have been pushed to adapt and digitalize their services as a result of the growth of e-commerce. To promote operational effectiveness, transparency, and customer service, numerous shipping businesses have made investments in digital systems. Improved customer satisfaction and service quality as a result have further fueled expansion of the Europe liners market.

E-commerce revenue in 2024 grew by 13 percent to USD 948.3 billion in the region. Growth rate remains stable after a peak in e-commerce in 2024 due to COVID-19.

E-commerce business is taking up a larger share of the retail sector in Europe, as online shopping has become a habit of customers. Astonishing increase in the number of internet shoppers has also contributed to growth.

The e-commerce sector has expanded due to the pandemic back in 2024. E-commerce companies need to meet the massive demand for packaging during the peak shopping period. Liners provide perfect product protection during transportation, keeping the product fresh for a longer duration and making packaging more robust.

Significant rise in modern retail chains such as supermarkets, hypermarkets, and specialty & convenience stores in Europe is generating huge demand for liners.

Rapid penetration of the organized retail sector also necessitates liner packaging. Growing demand for packed foods, digitalization, and changing consumer trends regarding online & offline shopping are expected to accelerate growth in the evaluation period.

Trend for Sustainable Packaging Solutions and Circular Economy to Support Growth

Sustainability and eco-friendly packaging are mega trends in the packaging sector due to rising awareness of environmental impact. The European Commission (EU) adopted a new circular economy action plan (CEAP) in March 2024.

It promotes circular economy processes & sustainable consumption, ensures waste prevention, and reduces pressure on natural resources.

The European Packaging and Packaging Waste Directives (PPWD) reinforced new targets in 2020. It stated that by 2025, at least 65% of the weight of packaging waste must be recycled, with a target of 50% for plastic recycling.

In this context, on 14 June 2025, Versalis set up two projects, namely, ‘Bag to Bag’ and ‘Liner to Liner.’ These aim to create a virtuous circle focused at recovering and recycling industrial polyethylene packaging bags & putting them back into the system.

In the Liner to Liner project, container liners are recycled into new liners, containing 50% of recycled plastic. These two projects will help reduce the consumption of virgin raw materials by 50% along with a consequent reduction in terms of carbon dioxide.

The Liner to Liner project was developed in collaboration with Eceplast. It a leading global company in the production of polyethylene liner bags for containers.

Eceplast is concentrating on designing only sustainable packaging solutions, harmonizing the technical and economic needs of Versalis. Hence, liner-to-liner closing loops on plastic packaging & recycling will lead to a transition toward a circular economy and sustainable use of resources in Europe.

| Country | Germany |

|---|---|

| Market Share (2025) | 20.8% |

| Market Share (2035) | 19.5% |

| BPS Analysis | -130 |

| Country | Spain |

|---|---|

| Market Share (2025) | 12.8% |

| Market Share (2035) | 13.5% |

| BPS Analysis | 80 |

| Country | France |

|---|---|

| Market Share (2025) | 14.9% |

| Market Share (2035) | 15.2% |

| BPS Analysis | 30 |

| Country | Italy |

|---|---|

| Market Share (2025) | 15.4% |

| Market Share (2035) | 14.9% |

| BPS Analysis | 50 |

| Country | United Kingdom |

|---|---|

| Market Share (2025) | 10.9% |

| Market Share (2035) | 10.1% |

| BPS Analysis | -90 |

| Country | Russia |

|---|---|

| Market Share (2025) | 7.3% |

| Market Share (2035) | 7.1% |

| BPS Analysis | -20 |

| Country | Poland |

|---|---|

| Market Share (2025) | 6.2% |

| Market Share (2035) | 6.7% |

| BPS Analysis | 50 |

| Country | BENELUX |

|---|---|

| Market Share (2025) | 5.3% |

| Market Share (2035) | 6.1% |

| BPS Analysis | 80 |

| Country | Nordic |

|---|---|

| Market Share (2025) | 4.0% |

| Market Share (2035) | 4.5% |

| BPS Analysis | 50 |

Custom Plastic Box Liners to Show High Demand in the United Kingdom with Sales from Food Companies

Demand for packaging solutions, especially liners, has increased as the food & beverage sector in the United Kingdom has expanded. More and more liners will be required to transport and store food & beverage products as the business grows.

According to the Food & Drink Federation (FDF), the food & drink sector is the United Kingdom’s most prominent manufacturing sector. In the country, the food & beverage sector is heavily regulated.

Strong standards are in place to guarantee the safety and caliber of food products. As liners are used to safely and hygienically transport & store food items, these are a crucial part of this regulatory framework. The United Kingdom is anticipated to offer an incremental opportunity of USD 30.0 million over the next ten years.

Demand for Protective Packaging Liners to Surge among Pharmaceutical Companies in Germany

According to the International Trade Administration (ITA), between 28% and 30% of German imports consists of medicines. Pharmaceutics, chemicals, and machinery are all produced in Germany's robust industrial sector.

Pharmaceutical products are in high demand both domestically and globally. Germany has one of the largest pharmaceutical sectors in the world.

Liners, which are used in the packaging and delivery of medicinal items, now have a sizable market. Germany liners market stood at a valuation of around USD 982.7 million in 2025. It is expected to raise up to USD 982.7 million in 2025 and expand with a CAGR of 2.4% from 2025 to 2035.

Shipping Container Liners Made of High Density Polyethylene to Showcase Demand

The high density polyethylene (HDPE) sub-segment under the plastic segment is likely to remain at the forefront by 2035. It is a strong and long-lasting material that is impervious to tearing, abrasion, and punctures.

It can tolerate exposure to severe chemicals and UV rays, and has a high tensile strength. As it is the perfect material for liners, it can be used in a variety of industrial and environmental applications.

As a flexible material that can be molded and formed into a variety of shapes, HDPE is suitable for liners that must follow complex geometries and irregular shapes. It can also be tailored to match particular size and thickness specifications.

It is hence set to be flexible and adaptable for a variety of applications. Due these factors, HDPE is likely to create an incremental value of USD 67.4 million during the forecast period.

Sales of Container Liner Bags to Surge amid Exponential Demand for Meat Packaging

Based on end use, the meat packaging segment is likely to dominate the Europe liners market through 2035. The meat sub-segment is predicted to exhibit a CAGR of 2.0% from 2025 to 2035.

Liners play a crucial role in ensuring hygiene and food safety standards are met during the packaging process. They act as a protective barrier, preventing contamination and cross-contamination of meat products.

By providing a barrier against external elements such as moisture, oxygen, and light, liners help to extend the shelf life of meat. This preservation of freshness, flavor, and texture reduces food waste and enables longer distribution & retail shelf lives. Increasing demand for fresh meat and rising awareness of hygiene are set to drive the segment.

Liner manufacturers in Europe are focusing on building strong relationships with their customers. They are providing personalized services, offering technical support, and maintaining regular communication to understand customer needs better.

By developing strong customer relationships, they can secure long-term partnerships, enhance customer loyalty, and increase sales through repeat business.

A few other companies are streamlining their supply chains to improve efficiency and reduce costs. They are implementing lean manufacturing principles, adopting automation & robotics, and optimizing logistics & transportation processes.

By optimizing the supply chain, they can offer competitive pricing, faster delivery, and reliable customer service, which can help them expand their customer base and boost sales.

For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 982.7 billion |

| Projected Market Valuation (2035) | USD 1403.9 billion |

| Value-based CAGR (2025 to 2035) | 3.6% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) |

| Segments Covered | Material, Thickness, Product Type, End-use, Country |

| Key Countries Covered | Germany, Spain, Russia, Italy, United Kingdom, France, BENELUX, Nordic, Poland, Rest of Europe |

| Key Companies Profiled | Berry Global Inc.; Safepack Solutions; Plascon Group UK; Mettcover; Sealed Air Corporation; Coveris Holdings S.A.; Ströbel GmbH; Flexipol; Polymer-Synthese-Werk GmbH; ILC Dover LP; Roundliner GmbH; Nittel Halle GmbH; Protective Packaging Ltd.; Pack Tech A/s; EMPAC Verpackungs GmbH; Chiltern Plastics (UK); Lormac Group; All About Polythene |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global Europe liners market is estimated to be valued at USD 982.7 billion in 2025.

The market size for the Europe liners market is projected to reach USD 1,403.9 billion by 2035.

The Europe liners market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in Europe liners market are plastic, _high density polyethylene, _low density polyethylene, _linear density polyethylene, _polypropylene, paper and aluminum foil.

In terms of thickness, less than 3 millimeter segment to command 44.2% share in the Europe liners market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA