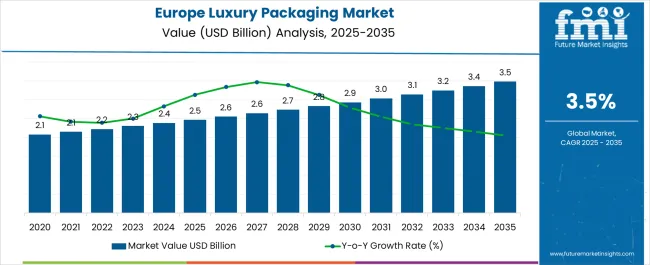

The Europe Luxury Packaging Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Europe Luxury Packaging Market Estimated Value in (2025 E) | USD 2.5 billion |

| Europe Luxury Packaging Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The Europe luxury packaging market is experiencing steady growth driven by rising consumer preference for premium goods, strong brand positioning strategies, and the emphasis on sustainability in packaging materials. High spending capacity and demand for luxury products across fashion, cosmetics, jewelry, and premium food are reinforcing the adoption of sophisticated and eco friendly packaging solutions.

Paper and paperboard materials are gaining traction as brands shift from plastics toward recyclable and renewable substrates, aligning with European regulatory mandates and sustainability goals. Innovation in design, tactile finishes, and smart printing technologies are further shaping market dynamics, offering brands an opportunity to differentiate and elevate consumer experiences.

The market outlook remains optimistic as premium retailers and manufacturers continue to invest in sustainable luxury packaging formats that combine aesthetics, durability, and brand storytelling, thus meeting both environmental expectations and consumer aspirations.

The paper and paperboard segment is projected to account for 47.60% of the overall market revenue in 2025 within the material category, making it the dominant choice. Growth has been driven by increasing consumer and regulatory pressure to replace plastic based packaging with recyclable and biodegradable alternatives.

Brands in luxury categories value the versatility of paperboard in delivering premium finishes, embossing, and intricate designs that enhance shelf appeal. The material also supports sustainability narratives, which resonate strongly with European consumers who prioritize environmental responsibility.

As a result, paper and paperboard continue to reinforce their role as the leading material segment.

The bags segment is estimated to capture 53.20% of total revenue in 2025 within the packaging format category, establishing it as the leading format. The segment’s strength is underpinned by its wide use in luxury retail, fashion, and jewelry where premium carry bags enhance brand perception and consumer experience.

Customization options in design, texture, and finishes have elevated their value as brand extension tools. Additionally, the emphasis on recyclable and reusable bags has aligned with both sustainability requirements and consumer expectations in Europe.

These factors have positioned bags as the most impactful and widely adopted format in the luxury packaging sector.

The premium food segment is expected to contribute 44.90% of overall revenue in 2025 under the end use category, positioning it as the largest segment. Growth in this category is driven by the expanding premium food and beverage industry across Europe, where presentation, safety, and sustainability are key.

Luxury packaging in this sector has been increasingly adopted to reflect quality, freshness, and exclusivity while meeting evolving consumer demand for recyclable solutions. Premium confectionery, spirits, and gourmet food brands are leveraging innovative packaging to differentiate products and create memorable consumer experiences.

These factors continue to strengthen premium food as the dominant end use segment in Europe’s luxury packaging market.

Between 2020 and 2025, the market for luxury packaging in Europe could only accelerate at an extremely sluggish 1.8% CAGR. This sluggishness in market expansion was predominantly a result of the COVID-19 pandemic, which brought the overall European economy to a standstill. Despite the sluggish acceleration, the market still reached a USD 2.5 billion in 2025.

However, it was not all doom and gloom for the market as several trends came to the fore. For instance, in December 2020, Easyfairs announced the launch of Packaging of Premium & Luxury Drinks (PLD), an exhibition. Its aim was to encourage collaborations between suppliers, innovators, and designers working across the international luxury beverage packaging sector.

Prominent acquisitions took place as well. For example, in November 2024, GPA Global announced the acquisition of a packaging manufacturing site on the outskirts of Warsaw, the capital of Poland. The site, with an 8,000 square meters area, was owned previously by ASG Spark.

Sustainable security solutions relevant to luxury packaging also made their presence felt. For instance, in August 2024, Austrian company Securikett announced the launch of a security seal for making packaging tamper-proof. The paper-based seal is an eco-friendly solution for today’s security needs in the packaging sector.

According to FMI, these trends are set to gain more traction from 2025 to 2035. As a result, they are likely to facilitate Europe luxury packaging market expansion. FMI’s estimates suggest these trends could be telling as the market makes its way towards a USD 3.2 billion.

Drivers

Restraints

Opportunities

Threats

Convenience of Online Retail and Return of Travel Retail to Spur Luxury Packaging Industry Expansion in Europe

The burgeoning popularity of online retail is presenting opportunities for luxury goods players to ship products to customers anywhere in the world. Compared to physical retail stores, the costs associated with online channels are significantly lower.

As a result, players can offer premium products to customers via online channels at discounted rates. This is generating substantial demand for luxury products created by premium brands across several industries.

FMI anticipates the penetration of online sales channels to increase in the years ahead. With the escalating penetration of online retailing, it’s safe to say that luxury packaging demand is bound to experience a boost.

Tourism restrictions enforced during the COVID-19 pandemic affected travel retailing. However, over the last 2 years, tourism in Europe has bounced back. This should provide incentives to players operating in the travel retail sector as they aim to woo international tourists with their sophisticated packaging solutions.

Plastic Waste Problems in Europe to Fuel Adoption of Sustainable Luxury Packaging Materials

Governments across Europe are increasingly taking notice of the plastic waste’s toll on the region. As a result, they are engaging in initiatives with the intention to reduce plastic waste drastically. They are also taking proactive steps in managing the plastic waste the region generates.

For instance, in December 2025, the Environment Committee of the European Parliament voted to ban the region’s plastic waste exports. In the recent past, the region’s plastic waste has been predominantly exported to Türkiye for recycling.

Research carried out by global watchdog Human Rights Watch has revealed that the lives of workers across the country’s recycling plants have suffered as a result.

Such efforts to reduce plastic waste should spur demand for eco-friendly materials in the region’s luxury packaging market like paper and paperboard. Luxury brands operating in Europe are also willing to lend a helping hand in eradicating the menace of plastic waste.

Specialty Packaging Demand in Europe to Surge Owing to Increasing Adoption of Paper & Paperboard

FMI’s research reflects the immense potential that the paper & paperboard segment holds on the basis of material. The segment’s sales are set to increase significantly in the coming years owing to the substantial sustainability that paper and paperboard packaging products offer. Between 2025 and 2035, the segment’s hold on the Europe market should account for a 40% share.

The paper & paperboard segment is also likely to thrive owing to its excellent recyclability. Packaging materials made from paper and paperboard can be recycled multiple times. In the long run, this aspect can facilitate increasing adoption of the segment, which should help Europe meet its plastic waste reduction goals as well.

Based on Packaging Format, Boxes & Cartons to Dominate Specialty Packaging Demand

On the basis of packaging format, FMI expects the boxes & cartons to lead the market from 2025 to 2035. Both boxes and cartons offer excellent rigidity, which is important in preventing damage to products.

Their use is likely to skyrocket as consumers purchase more and more luxury products across online channels, which may involve long-distance shipping. The bottles segment is also set to register exponential acceleration as luxury alcohol brands are focusing on achieving product differentiation through unique packaging.

Key players in the luxury alcohol sector are increasingly collaborating with design agencies to sophisticate their product packaging efforts. All in all, the two segments should combine to offer a whopping USD 2.5 million absolute dollar opportunity between 2025 and 2035.

Burgeoning Fashion & Textile Sales in the United Kingdom to Make it Leading Destination for Luxury Packaging Companies in Europe

The United Kingdom market for luxury packaging is likely to register a slow 4.5% CAGR from 2025 to 2035. The expanding fashion & textile industry in the United Kingdom is estimated to fuel the sales of luxury packaging. According to the United Kingdom Fashion & Textile Association (UKFT), the industry contributes around USD 128 billion to the country’s economy.

Spending on fashion & textile is on the rise in the United Kingdom. Consumers are spending around a mammoth USD 2.4 billion on fashion & textile annually. In 2024, around 34,000 businesses operated in the United Kingdom’s fashion & textile sector. As a result, it is fair to assume that the United Kingdom is likely to dominate luxury packaging sales in Europe due to its thriving fashion & textile industry.

Acquisitions, partnerships, and collaborations are all likely in the Europe market for luxury packaging between 2025 and 2035. FMI also expects players’ approaches to be dynamic as regulations issues by government agencies keep changing.

For instance

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.5 billion |

| Projected Market Size (2035) | USD 3.5 billion |

| Growth Rate | 3.5% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Segments Covered | Material Type, Packaging Format, End Use, and Country Packaging Format |

| Key Countries Profiled | The United Kingdom, Germany, Italy, France, Spain, Russia, Poland, BENELUX, Nordic, and Rest of Europe |

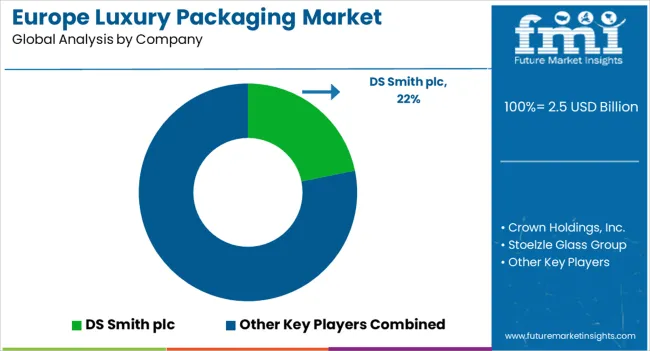

| Key Companies Profiled | DS Smith plc; Crown Holdings, Inc.; Stoelzle Glass Group; Aptar Group, Inc.; International Paper Company; WestRock Company; Ardagh Group S.A.; Owens-Illinois, Inc.; Robinson plc; Swiss Packaging LLC; Npack Ltd.; Alya Packaging; GZ Media, a.s.; Neenah, Inc.; Cantobox; BLONDEBOX; Via Aquaria UAB; GPA Global; Fleet Luxury Packaging; Max Luxury Packaging; IPL Packaging; Rudholm Group; Knoll Prestige Packaging; Centurybox; Billerud AB; Milo Group; MARBER S.R.L.; The Sherwood Group; Parcome Paris; Swedbrand Group |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities, and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global europe luxury packaging market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the europe luxury packaging market is projected to reach USD 3.5 billion by 2035.

The europe luxury packaging market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in europe luxury packaging market are paper & paperboard, plastic, wood, glass, metal and fabric.

In terms of packaging format, bags segment to command 53.2% share in the europe luxury packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Luxury Packaging Providers

Europe Flexible Plastic Packaging Market Analysis by Material, Product Type, End Use, Packaging Type, and Region Forecast Through 2035

Competitive Breakdown of Europe Flexible Plastic Packaging Providers

Breaking Down Market Share in Europe Molded Fiber Pulp Packaging

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Premade Pouch Packaging Market Analysis by Closure Type, Material Type, End-Use Industry, and Country through 2035

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Western Europe Heavy-Duty Corrugated Packaging Market Trends - Growth & Forecast 2025 to 2035

Europe Cement Packaging Market Analysis – Trends & Forecast 2024-2034

Europe Barrier Packaging Market Growth – Demand & Forecast 2024-2034

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Western Europe Bubble Wrap Packaging Market Analysis – Growth & Forecast 2023-2033

Europe Molded Fiber Pulp Packaging Market Analysis – Demand, Growth & Future Outlook 2024-2034

Western Europe Molded Fiber Pulp Packaging Market Insights – Growth & Forecast 2023-2033

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Europe Healthcare Rigid Plastic Packaging Market Trends – 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA