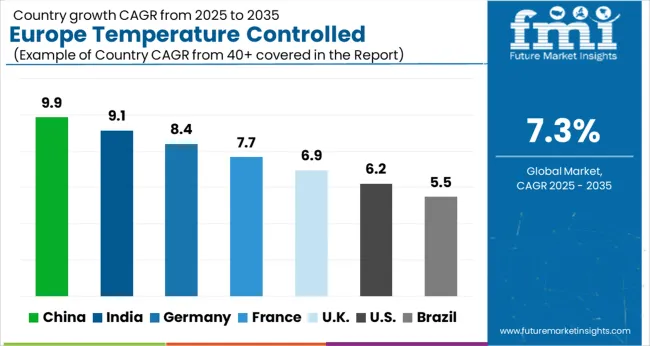

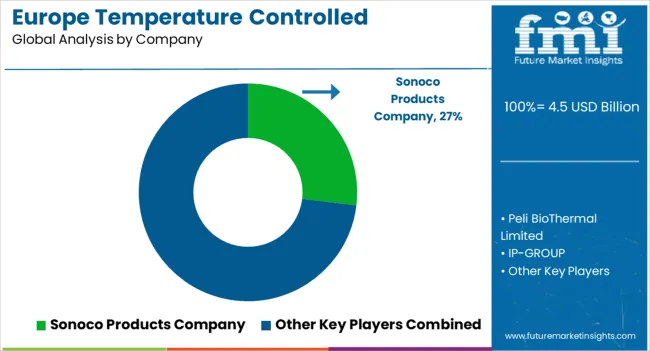

The Europe Temperature Controlled Packaging Solutions Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 9.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

| Metric | Value |

|---|---|

| Europe Temperature Controlled Packaging Solutions Market Estimated Value in (2025 E) | USD 4.5 billion |

| Europe Temperature Controlled Packaging Solutions Market Forecast Value in (2035 F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The Europe temperature controlled packaging solutions market is expanding steadily due to rising demand for safe transportation of pharmaceuticals, biologics, and perishable food products. Growing adoption of biologic drugs, vaccines, and temperature sensitive therapies has intensified the need for reliable cold chain logistics.

Regulatory standards across Europe that mandate strict temperature compliance are further accelerating the use of advanced packaging systems. Continuous innovation in insulation materials, phase change materials, and lightweight yet durable shipper designs has improved performance and cost efficiency.

Additionally, e commerce growth in food and beverage and an increasing focus on reducing spoilage have expanded application areas. The market outlook remains positive as industries continue investing in sustainable, reusable, and technology integrated solutions that ensure product integrity, compliance, and reduced environmental impact across supply chains.

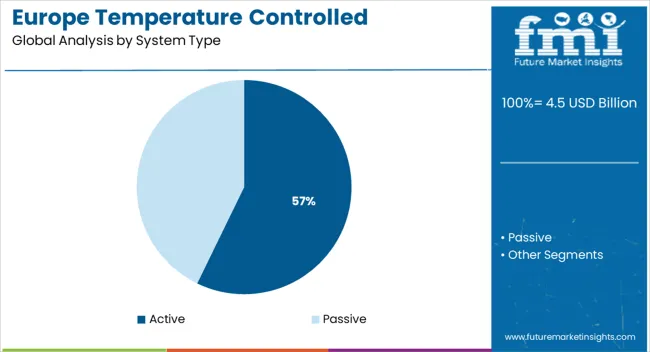

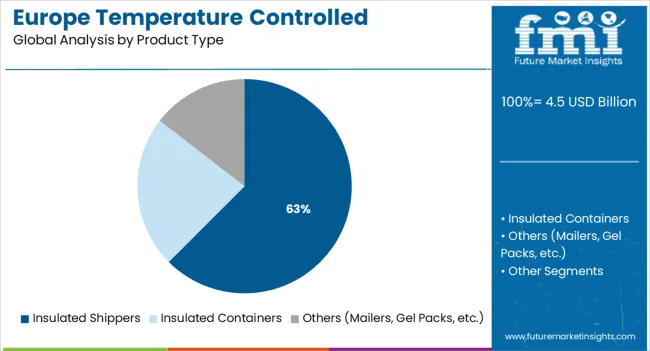

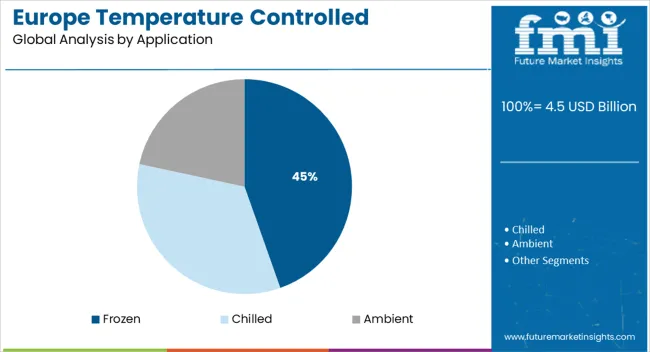

The market is segmented by System Type, Product Type, Application, and End Use and region. By System Type, the market is divided into Active and Passive. In terms of Product Type, the market is classified into Insulated Shippers, Insulated Containers, and Others (Mailers, Gel Packs, etc.). Based on Application, the market is segmented into Frozen, Chilled, and Ambient. By End Use, the market is divided into Food, Beverages, Pharmaceutical, Cosmetics & Personal Care, and Chemicals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The active system type segment is expected to account for 57.20% of total revenue by 2025, making it the leading system category. Growth in this segment is supported by its ability to provide precise temperature control through advanced refrigeration and power based mechanisms.

These systems are highly reliable for long distance and large volume shipments where consistency is critical. The adoption has been reinforced by the rising demand for global pharmaceutical and biologics distribution requiring guaranteed thermal stability.

Furthermore, investments in reusable active systems have contributed to sustainability goals, strengthening their role as the preferred choice within system type.

The insulated shippers segment is projected to represent 62.50% of overall market revenue by 2025, making it the dominant product category. Their widespread adoption is driven by cost efficiency, ease of handling, and compatibility with both short and medium haul distribution.

Insulated shippers are lightweight, customizable, and effective in maintaining desired temperature ranges, making them highly suitable for pharmaceutical, biotech, and food supply chains. Continuous improvements in insulation materials and design have enhanced product performance, while a focus on reusable formats supports sustainability initiatives.

This combination of affordability, reliability, and environmental alignment has secured insulated shippers as the leading product type segment.

The frozen application segment is expected to account for 44.60% of market revenue by 2025, establishing itself as the largest application area. This is due to the growing requirement for maintaining strict sub zero conditions in the transport of vaccines, biologics, and specialty foods.

The rise of advanced therapies and biologic drugs that demand frozen chain logistics has significantly contributed to this share. In the food sector, rising consumer demand for frozen ready meals and seafood products has further supported growth.

Enhanced shipper technology, improved coolant materials, and stricter compliance standards are reinforcing adoption across both healthcare and food supply chains, ensuring that frozen applications remain the leading area of use.

Europe temperature-controlled packaging solutions market witnessed a CAGR of 6.7% during the historic period and attained a valuation of USD 4.5 billion at the end of 2025. However, for the forecast period of 2025 and 2035, Future Market Insights predicts temperature controlled packaging solutions demand to surge at 7.3% CAGR across Europe.

The growing need for protecting temperature-sensitive and perishable products during storage and transportation is a primary factor driving the Europe temperature controlled packaging solutions industry.

It is a known fact that pharmaceutical products such as stem cells and vaccines need a lower temperature for successful shipping. Hence, rising demand for these pharmaceutical products across Europe will continue to generate demand for cold chain solutions such as temperature controlled packaging solutions during the assessment period.

Similarly, innovations in cold storage solutions, rising import and export of food and beverage products across European countries, and growing concerns about food wastage are expected to bolster temperature controlled packaging solutions sales over the next ten years.

Increasing Demand for Biologics to Boost Temperature Controlled Packaging Solution Sales

There have been numerous advancements in the pharmaceutical industry, especially across European countries such as the United Kingdom and Germany over the last few decades. One such advancement was the development of biologics or biological products.

Biologics such as vaccines, blood components, somatic cells, and recombinant therapeutic proteins have gained wider popularity due to their highly effective nature. However, these products often require specific temperature ranges during storage and transportation. Hence, companies are extensively employing temperature controlled packaging solutions.

Growing demand for structurally-complex biotechnology drugs that require constant temperature control is expected to act as a catalyst triggering the development of the temperature controlled packaging solutions market across Europe.

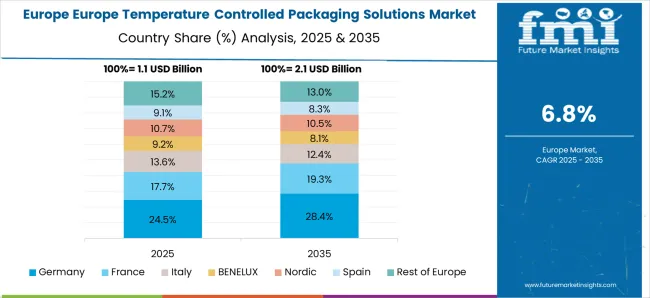

| Country | Germany |

|---|---|

| Market Share (2025) | 22.20% |

| Market Share (2035) | 21.80% |

| Basis Points (BPS) Analysis | -40 |

| Country | France |

|---|---|

| Market Share (2025) | 16.80% |

| Market Share (2035) | 15.70% |

| Basis Points (BPS) Analysis | -110 |

| Country | United Kingdom |

|---|---|

| Market Share (2025) | 18.70% |

| Market Share (2035) | 19.80% |

| Basis Points (BPS) Analysis | 110 |

| Country | Poland |

|---|---|

| Market Share (2025) | 4.40% |

| Market Share (2035) | 4.70% |

| Basis Points (BPS) Analysis | 30 |

| Country | Italy |

|---|---|

| Market Share (2025) | 11.40% |

| Market Share (2035) | 11.50% |

| Basis Points (BPS) Analysis | 10 |

Rising Demand for Frozen Food/Fruits Fueling Adoption of Insulated Containers Across the United Kingdom

As per Future Market Insights, the United Kingdom is expected to hold around 19.8% share of the Europe temperature controlled packaging solutions market by the end of 2035. Growth in the United Kingdom temperature controlled packaging solutions market is driven by rising demand for frozen food products and a growing focus on reducing food wastage.

Over the years, there has been a dramatic increase in frozen food demand with Europe leading at the forefront. Europe, spearheaded by the United Kingdom and Germany, accounted for around 38% of the worldwide frozen vegetable demand in 2024 according to a report by the Centre for the Promotion of Imports from developing countries (CBI). This rising demand for frozen food products will continue to fuel sales of temperature controlled packaging solutions such as insulated containers in the country.

Temperature-controlled shipping containers or reefers are generally used for the import and export of temperature-sensitive and perishable food products such as frozen fruits, vegetables, and meat in large quantities. For local deliveries and smaller quantities, mostly insulated containers are gaining traction in the United Kingdom market as an efficient and cost-effective mode.

Over the years, technological advancements have made it possible for frozen foods to be safe for consumption even after a long period. These innovations are triggered by stringent government regulations.

Insulated containers play a key role in keeping the temperature of food products in check during storage and transit, thereby increasing the longevity of products. Hence, the growing demand for frozen food products will eventually boost sales of insulated containers in the United Kingdom.

Increasing Export of Food and Pharmaceutical Products Making Germany a Lucrative Market

Currently, with a share of around 22.2%, Germany remains the most dominant market for temperature controlled packaging solutions across Europe and the trend is expected to continue during the projection period.

The rapid expansion of the pharmaceutical industry, easy availability of heat-retaining containers and other insulated packaging formats, and increasing export of food and pharmaceutical products are a few of the key factors driving Germany’s market forward.

Food and pharmaceutical items are being increasingly transported or shipped over longer distances by using advanced cold chain solutions as they require optimal temperatures for maintaining integrity. A report by Eurostat states that Germany among the EU Member countries exported USD 4.2 billion worth of medicinal as well as pharmaceutical products in 2024.

In order to protect these temperature-sensitive pharmaceutical products during transportation and shipping, temperature controlled packaging solutions are being increasingly used by industries.

Owing to added specialization and sensitivity of pharma products, consignments are now being shipped globally across variegated climatic regions from European countries such as Germany. Specialized agriculture/aquaculture functions of temperature-controlled packaging solutions enable the transport of temperature-sensitive food and pharmaceutical products to distant markets from Europe.

Clinical trial logistics, which require rigorous temperature-controlled packaging solutions, is witnessing a sheer trend of shifting/outsourcing trials out of the USA to the Asia Pacific region, while most drugs used for the same are manufactured in North America and Western Europe. This is positively influencing Germany’s temperature controlled packaging solutions market.

Growing Popularity of Active Packaging in Pharmaceutical Logistics Driving Demand

Based on system type, Europe’s temperature controlled packaging solutions industry is categorized into active and passive. Among these, demand for passive temperature controlled packaging solutions across Europe is expected to rise at a significant pace during the assessment period. This is attributed to the rising usage of active temperature controlled packaging systems across pharmaceutical logistics due to their inexpensive nature.

Pharmaceuticals need different temperature ranges during storage and transportation for their efficient delivery to the respective pharmacies. For protecting these pharmaceutical products, companies use both active and passive packaging systems.

However, the use of the active systems are not preferred when the order quantity of pharmacies is low in volume, as it is not economical. Hence, distributors use a passive temperature controlled packaging systems due to their more cost-effective features.

Passive packaging systems do not require any additional configurations and settings to adjust temperature requirements. Transportation of temperature-sensitive products by using passive packaging systems offers better flexibility of transportation and ease of handling as well as reduces damage during transportation. Hence, several industries are opting for passive temperature controlled packaging solutions over its counterpart.

Pharmaceutical Industry to Generate Maximum Revenues in the Europe Market

According to Future Market Insights, the pharmaceutical segment currently holds a prominent share of Europe temperature controlled packaging solutions market and it is forecast to register robust growth over the next ten years. This is attributed to the rapidly growing healthcare industry across Europe, the development of a variety of pharmaceutical products, growing adoption of temperature controlled packaging solutions for effectively protecting pharmaceutical compositions during storage and transportation.

The highly reactive nature of temperature sensitive pharmaceutical products makes them prone to thermal damage during storage and transportation. In order to protect these sensitive pharmaceuticals, companies across European countries such as the United Kingdom, Germany, and France increasingly use temperature controlled packaging solutions. This in turn is creating lucrative opportunities for temperature controlled packaging solution manufacturers.

Key temperature controlled packaging solution manufacturers are concentrating on introducing novel thermal packaging solutions including thermal containers, insulated mailers, and other cold-chain solutions to meet end-user demand. Besides this, they are using strategies such as partnerships, mergers, acquisitions, facility expansions, collaborations, and joint ventures to strengthen their presence in Europe and other attractive markets.

Recent Developments:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 4.5 billion |

| Projected Market Size (2035) | USD 9.1 billion |

| Anticipated Growth Rate (2025 to 2035) | 7.3% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Segment Covered | System Type, Product Type, Application, End Use, Region |

| Key Countries Covered | Germany, Italy, France, United Kingdom, Spain, BENELUX, Nordics, Russia, Poland, Rest of Europe |

| Key Companies Profiled | Sonoco Products Company;Peli BioThermal Limited; IP-GROUP; GEBHARDT Logistic Solutions GmbH; INKA Pallets Ltd.; TKT GmbH; OLIVO Cold Logistics; SÆPLAST Iceland ehf; Sofrigam SA Ltd.; va-Q-tec AG; Topa Thermal; Inmark Global Holdings, LLC; Tempack Packaging Solutions S.L.; EcoCool GmbH; Exeltainer SL; KRAUTZ - TEMAX Europe; Softbox Systems Ltd.; DGP Intelsius Ltd.; Snyder Industries, LLC |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

The global europe temperature controlled packaging solutions market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the europe temperature controlled packaging solutions market is projected to reach USD 9.1 billion by 2035.

The europe temperature controlled packaging solutions market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in europe temperature controlled packaging solutions market are active and passive.

In terms of product type, insulated shippers segment to command 62.5% share in the europe temperature controlled packaging solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Europe Winter Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA