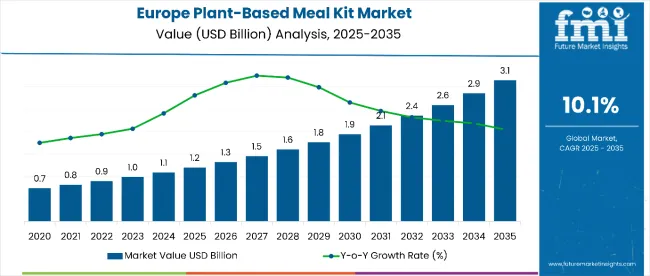

Sales of plant-based meal kits in Europe are estimated at USD 1.2 billion in 2025 and are projected to reach USD 3.1 billion by 2035, reflecting a CAGR of 10.1% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 1.2 billion |

| Forecast Value in 2035 (F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

Growth is being driven by rising consumer demand for convenient, healthy, and sustainable meal solutions, alongside greater awareness of plant-based diets and environmental benefits.

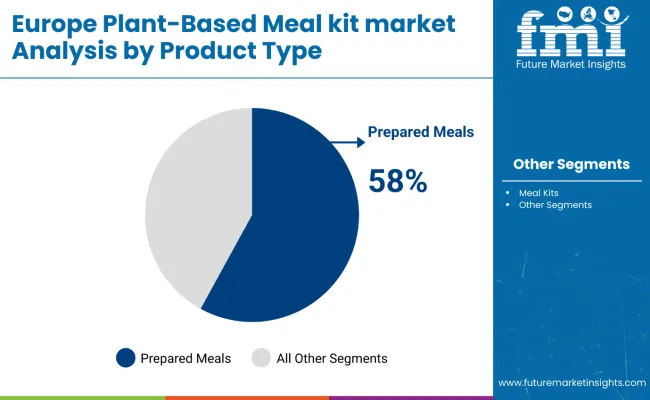

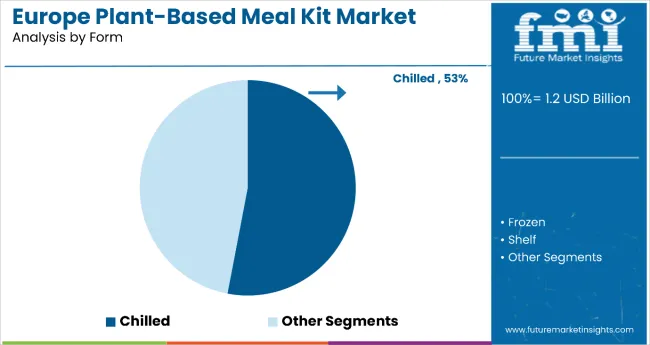

By 2030, the market is forecast to reach approximately USD 1.9 billion, underscoring steady expansion across the first half of the period. The absolute market value increase between 2025 and 2035 is projected at USD 1.9 billion, with prepared meals emerging as the leading product type at 58.0% share in 2025. Chilled product formats account for 53.0% of demand, supported by consumer preference for freshness and quality.

Store-based retail dominates the distribution landscape, commanding 61.0% of the market in 2025, owing to strong accessibility and established networks across European countries. Online channels are gaining traction, with collaborations between meal kit providers, retailers, and digital platforms expanding consumer reach.

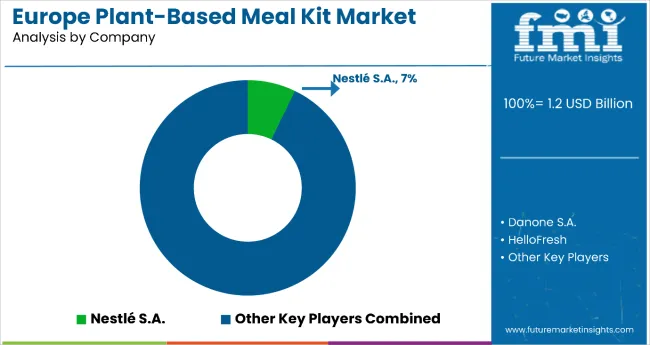

Leading companies such as Nestlé, Danone, and HelloFresh are driving competitive intensity through innovation, broader product offerings, and sustainable sourcing initiatives. Their focus on ready-to-eat, nutritious, and eco-friendly meal kits reflects shifting consumer behaviors, while regulatory frameworks and regional dietary preferences continue to shape market performance.

The Europe plant-based meal kit market is evolving with innovations in ingredients, packaging, and product variety. Its rising share across prepared meals and chilled segments highlights the category’s role in modern dietary habits, increasingly competing with traditional convenience food options in the region.

The plant-based meal kit market in Europe is classified product type, form, sales channel, and country. By product type, it is bifurcated into meal kits and prepared meal. Based on form, it includes chilled, frozen, and shelf stable. In terms of sales channel, it includes, Store-based retailing (convenience stores, discounters, forecourt retailers, hypermarkets/supermarkets, food specialists, independent small grocers, and other grocery retailers) and online retailing. By country, the analysis covers Germany, France, Italy, Spain, United Kingdom, Russia, and Poland.

Prepared meals are projected to dominate sales in 2025, due to their convenience, time-saving appeal, and alignment with health-conscious eating trends. This segment outperforms meal kits by offering ready-to-eat, nutritiously balanced options that cater to busy urban lifestyles.

Chilled products are projected to dominate sales in 2025, owing to rising demand for fresh, high-quality meals with minimal processing and preservatives. Consumers favor chilled offerings for their authentic taste, nutritional value, and alignment with clean-label eating trends.

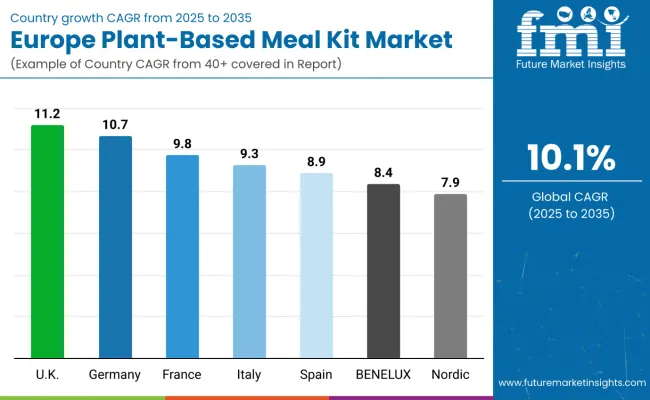

| Countries | CAGR (%) |

|---|---|

| United Kingdom | 11.2 |

| Germany | 10.7 |

| France | 9.8 |

| Italy | 9.3 |

| Spain | 8.9 |

| BENELUX | 8.4 |

| Nordic Countries | 7.9 |

Plant-based meal kit sales will not expand uniformly across Europe, as growth varies depending on consumer behavior, market maturity, and government support. The United Kingdom leads expansion, followed by Germany and France, while southern and smaller northern regions grow at a steadier pace. The table below shows projected CAGRs across leading European countries between 2025 and 2035.

Between 2025 and 2035, demand for plant-based meal kits is projected to expand across Europe, but the pace of growth will vary depending on consumer preferences, culinary traditions, and sustainability initiatives. The United Kingdom is expected to grow at a CAGR of 11.2%, outpacing the projected 10.7% in Germany. This acceleration is underpinned by several factors such as a mature online grocery and meal subscription ecosystem, strong consumer awareness of sustainability and health, and significant retailer investment in chilled plant-based offerings.

The country’s emphasis on convenience, fresh ingredients, and clean-label meals creates a favorable environment for meal kit adoption, particularly among urban populations and younger demographics seeking healthier alternatives to traditional ready meals. Per capita consumption in Germany is projected to rise from 0.42 kits in 2025 to 0.91 kits by 2035, reflecting the mainstreaming of plant-based meals in household diets and the country’s growing flexitarian population.

Both countries exhibit advanced food retail networks with steady growth driven by health-conscious consumer behavior and expanding plant-based innovation rather than rapid demographic shifts. The United Kingdom maintains its leadership position through innovative subscription models, premium product launches, and strong digital penetration, while Germany sustains momentum through its large vegan population, strong regulatory support for sustainability, and robust cold-chain infrastructure.

Collectively, these two countries represent the core of European plant-based meal kit demand. Still, their growth trajectories highlight the importance of country-specific approaches in product development, distribution strategies, and consumer education initiatives.

The competitive environment is characterized by a mix of global food conglomerates, specialized meal kit providers, and regional players. Operational scale, product innovation, and supply chain efficiency remain decisive success factors: the leading companies collectively serve millions of households across Europe through both retail and direct-to-consumer channels while maintaining strong digital and physical distribution networks.

Nestlé maintains a strong positioning as a comprehensive provider of plant-based meal solutions. The company leverages its large-scale production capabilities, extensive ingredient sourcing, and strong brand portfolio to penetrate both retail and subscription-based channels. Its focus on sustainable packaging and premium-quality recipes reinforces its role as a trusted leader in the European market.

Danone, leveraging its expertise in plant-based nutrition and dairy alternatives, positions its meal kit offerings within a broader health and wellness strategy. The company emphasizes personalization, clean-label formulations, and functional nutrition, appealing strongly to health-conscious consumers seeking convenient yet nutritious plant-based options.

HelloFresh benefits from its established leadership in the meal kit subscription space, supported by advanced digital platforms and robust cold-chain infrastructure. Its emphasis on recipe diversity, localized menu development, and customer experience innovation secures strong engagement across major European markets, particularly among younger, urban consumers.

Regional players such as Gousto, Marley Spoon, and Green Chef focus on cost-effective production and tailored recipe customization. Their strategies include collaborations with local suppliers, innovative recipe development reflecting regional tastes, and expansion through hybrid online and offline distribution channels.

Private-label initiatives at major European retailers are expanding assortment at competitive price points, creating margin pressure on specialized providers while driving wider consumer access to plant-based meal kits. Consolidation is expected to continue as operational scale, sustainability credentials, and digital distribution capabilities become increasingly critical for maintaining competitive positioning in this evolving category.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.2 Billion |

| Product | Prepared Meals, Meal Kits |

| Form | Chilled, Frozen, Shelf Stable |

| Sales Channel | Store-Based Retailing (Convenience Store, Discounters, Forecourt Retailers, Hypermarkets/Supermarkets, Food Specialists, Independent Small Grocers, Others such as warehouse clubs), Online Retailing (E-commerce, Direct-to-Consumer) |

| Regions Covered | United Kingdom, Germany, France, Italy, Spain, BENELUX, Nordic Countries |

| Countries Covered | United Kingdom, Germany, France, Italy, Spain, Belgium, Netherlands, Luxembourg, Denmark, Sweden, Norway, Finland |

| Key Companies Profiled | Nestlé S.A., Danone S.A., HelloFresh, Amy’s Kitchen, Beyond Meat Inc. |

| Additional Attributes | Dollar sales by product type and form, growing demand for convenience and sustainable packaging, expansion in retail and online channels, innovations in plant-based meal variety and preparation, increasing focus on personalized nutrition and eco-friendly sourcing |

The global europe plant-based meal kit market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the europe plant-based meal kit market is projected to reach USD 3.4 billion by 2035.

The europe plant-based meal kit market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in europe plant-based meal kit market are meal kit and prepared meal kit.

In terms of form, chilled segment to command 52.6% share in the europe plant-based meal kit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA