The Europe Fish Protein market is set to grow from an estimated USD 238.1 million in 2025 to USD 446.1 million by 2035, with a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025 E) | USD 238.1 million |

| Projected Europe Value (2035 F) | USD 446.1 million |

| Value-based CAGR (2025 to 2035) | 6.5% |

The European fish protein sector has seen the utmost growth rate because of the increasing customer awareness of the advantages of fish protein as a part of the diet. Fish protein is known for its particular bioavailability and the presence of essential amino acids, which explains its more frequent usage in different food products.

This market consists of many types of fish protein such as whole fish, fish meal, fish hydrolysates, and fish collagen, and these are found in food & beverages, animal feed, and nutraceuticals/health supplements products.

The surge in the need of fish protein in Europe is mainly due to the running consumer’s choice of taking the enriched food products and natural sourced dietary supplements. Moreover, the shift to plant-based foods and the knowledge of environmental consequences of meat production make more and more people turn to fish as an alternative source of protein.

The market consists of players like Marvesa, Omega Protein Corporation, and Lysi which are widening their fish protein portfolio with the addition of new products. Moreover, the European regulations on food safety, sustainability, and traceability are also the driving force behind the market developing; thus, the companies can prosper while staying true to the side of the law.

The promotion is mainly noticed in the health supplements and nutraceuticals sector where fish hydrolysates are applied in the formulations for their digestive and anti-inflammatory properties.

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Fish Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.5% |

| H2 (2024 to 2034) | 3.3% |

| H1 (2025 to 2035) | 4.5% |

| H2 (2025 to 2035) | 5.8% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Fish Protein market, the sector is predicted to grow at a CAGR of 2.5% during the first half of 2024, with an increase to 3.3% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.5% in H1 but is expected to rise to 5.8% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | New Fish Collagen Launches: Leading company Marvesa launched a new line of fish collagen peptides targeting the European skincare and cosmetics market, with high bioavailability for better skin health. |

| March-2024 | Innovative Fish Hydrolysate Integration: Omega Protein Corporation introduced a new line of hydrolyzed fish proteins for use in vegan and vegetarian-friendly supplements, expanding its consumer base. |

| January-2024 | Enhanced Fish Meal Protein: Lysi introduced a high-quality fish meal protein for the European pet food industry, enriched with essential fatty acids and micronutrients for improved pet health. |

An Increase in Fish Hydrolysates in Nutraceuticals

These bioactive peptides produce hydrolysates by transforming the proteins within the fish into shorter peptides. It has thus emerged to be one of the main technological innovations in the European fish protein market. It provides elevated digestibility and health-promoting properties including anti-inflammatory effects and also health of joints.

Their inevitable migration to the nutraceutical and health supplements sectors arises from the increased knowledge among European consumers regarding the role of functional foods in preventing diseases and fostering good health.

Fish hydrolysates, which are commonly identified in the formulation of protein supplements, sports nutrition drinks, and joint health capsules, are also the subject of these products. One of the benefits of hydrolysed fish proteins is the improvement in amino acids and peptide bioavailability, which is one reason why their integration into health supplements is increasing. Such supplements are aimed at immune system boosting, digestive health improvement, and skin and joint enhancement.

Increasing Use of Fish Protein in Animal Feed

Fish meal and fish protein concentrate, while still being strongly correlated with European poultry by-product meal and poultry protein sources, are becoming more thriving animal-feed sectors. This justifies any comment regarding fish products being no longer separate entities except in industrial fish waste treatment.

The organic matter for animal feed production with fish meal and fish protein concentrates being the main ingredients would seem to make a complete picture of this done product. The rising animal welfare concern and the increasing requirement for high-quality food produced by fish have led to a corresponding increase in the inclusion of fish protein in animal feeds.

Companies such as Lysi have further expanded their range of products by adding fish-based proteins to the formulations, thus, catering to the growing sector of nutritious pet foods. Fish protein-based feeds are the richest in omega-3 fatty acids found in aquaculture, which has consequently raised the demand for healthy fish production.

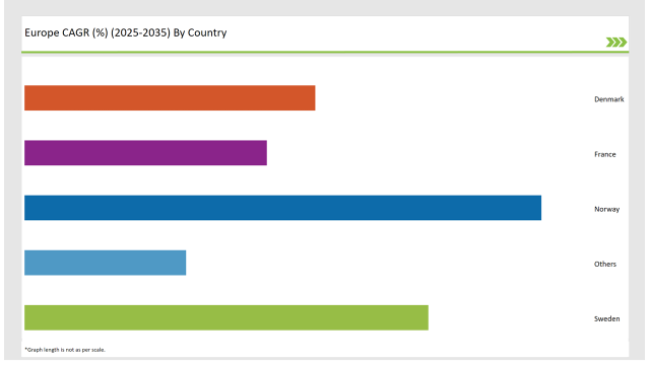

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Norway | 32% |

| Sweden | 25% |

| Denmark | 18% |

| France | 15% |

| Others | 10% |

With its population becoming increasingly health conscious, along with a turn of preference toward natural and plant-based proteins, the UK has turned into one of Europe's prime marketplaces for the fish protein specifically in the nutraceutical as well as the health supplement category. In recent years, fish protein hydrolysates have found their way into numerous dietary supplements focused on boosting immunity, aiding digestion, or enhancing joint health.

UK companies are exploiting this current trend with fish-based proteins to innovate in the field of nutraceuticals, developing highly bioavailable products that resonate well with a clean, effective maintenance solution for the consumer. Further, the boom in the pet food market in the UK has been one of the most important drivers for fish-based proteins.

The fish protein market of Europe has developed Germany into one of the main powerhouses for the country's demand in both animal feed and nutraceuticals. Notorious for environmental regulations, strict and concentration on sustainable processes, Germany takes the lead position in incorporating fish protein into feed formulations and dietary supplements.

The strong aquaculture and animal farming industries in the country ensure a strong German market for fish protein, where the application of fish protein in enhancing animal health is increasingly known. Companies in Germany are maximizing this increased demand for sustainable, high-quality feed in livestock such as poultry, cattle, and fish farming while using fish protein in specialized feed formulations.

These feed products are meant to enhance animal growth, immune response, and even general health conditions to meet Germany's increasingly healthy, high-quality animal products need.

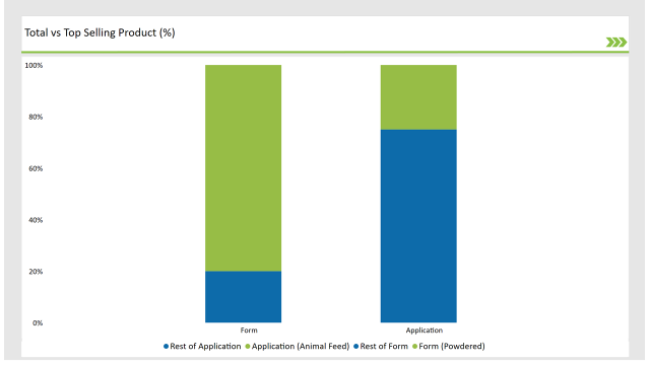

% share of Individual Categories Form and Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Powdered) | 80% |

| Remaining segments | 20% |

Powdered fish protein, in the most recent times, has become a popular format across the European nutraceutical sector. It happens to be mostly because of versatility and easy implementation in numerous items, including high-protein milkshakes, bars, supplements, among many others. These consumers want very high-quality easily digestible supplements to enhance fitness and well-being.

Due to its better amino acid profile and digestibility, fish protein powder is also fast gaining popularity among consumers who still prefer animal-based protein over plant-based options. The ease of mixing powdered fish protein into beverages or incorporating it into various functional food products has led to the widespread use of this product in sports nutrition and weight management solutions.

| Main Segment | Market Share (%) |

|---|---|

| Application (Animal Feed) | 25% |

| Remaining segments | 75% |

Fish meal protein remains a very essential component of the European animal feed industry, especially in aquaculture. Fish meal, which is ground dried fish into a protein-rich powder, contains excellent sources of essential amino acids and omega-3 fatty acids, both critical for animal growth, development, and immune health.

With the rising demand for quality animal products, fish meal is a critical input in animal feed formulations that enhance optimal health in livestock and pets. Its high nutritional value is very important for use in aquaculture where fish protein contributes significantly to maintaining the health and growth of farmed fish.

Rising demand for sustainable fish meal from certified fisheries is driving growth in this segment; European regulations ensure that fish meal production reaches high standards of environmental sustainability.

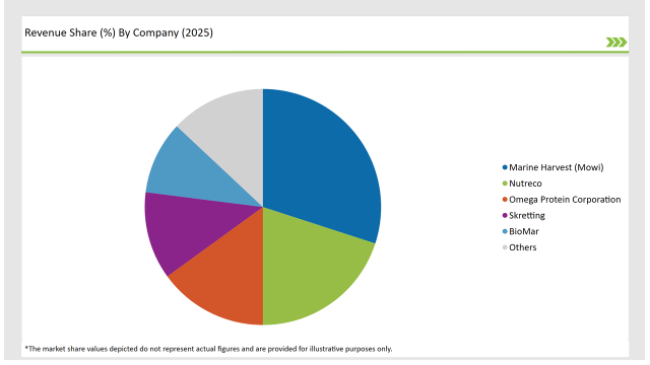

2025 Market share of Europe Fish Protein manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Marine Harvest (Mowi) | 30% |

| Nutreco | 20% |

| Omega Protein Corporation | 15% |

| Skretting | 12% |

| BioMar | 10% |

| Others | 13% |

Note: The above chart is indicative in nature

European fish protein market has a high competition level wherein large players in the industry drive it. Companies of Tier 1, for instance, such as Omega Protein Corporation, Marvesa, and Lysi dominate the industry due to an excellent research and development process, efficient distribution channel, and big business operations.

Due to all these factors, the companies are very strong at this point with diversified products ranging from fish meal to fish hydrolysates to collagen peptides, in the market of fish proteins.

Tier 2 companies, like Cargill and Biomega AS, operate on a regional level and focus on niches in the market. They are mostly innovators and manufacturers of specialized products for different industries, for example, animal feed and nutraceuticals. Their market share is rising since they can offer customized solutions for either large-scale producers or smaller, more specialized clients.

The Tier 3 companies comprise less than the part of the economy and are mainly the local companies that serve the specific regional areas. Even though their business share is not as big as the Tier 1 and Tier 2 companies, they still play an essential role in fulfilling local requirements and capitalist markets with specific products which may be unsustainable or limit the environmental impact involved in the use of fish protein.

As per Product Type, the industry has been categorized into Fish Protein Hydrolysate, Fish Protein Isolate, Fish Protein Concentrate.

As per Form, the industry has been categorized into Powder, Liquid.

As per Application, the industry has been categorized into Food & Beverages, Dietary Supplements, Pharmaceuticals, Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Fish Protein market is projected to grow at a CAGR of 6.5% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 446.1 million.

Key factors driving the fish protein market in Europe include the increasing consumer demand for high-quality protein sources that are sustainable and environmentally friendly, as awareness of health and nutrition continues to rise. Additionally, the growing popularity of fish-based diets, including the Mediterranean diet, is contributing to the demand for fish protein products.

Germany, France, and Norwayare the key countries with high consumption rates in the European Fish Protein market.

Leading manufacturers include Marine Harvest (Mowi), Nutreco, Omega Protein Corporation, Skretting, BioMarknown for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Fish Protein Manufacturers

Fish Protein Isolate Market Trends – Growth & Industry Forecast 2025-2035

Fish Protein Market Insights - Trends & Forecast 2024 to 2034

Europe Fish Oil Market Report – Trends, Demand & Industry Forecast 2025–2035

Europe Fish Meal Market Insights – Size, Demand & Industry Growth 2025–2035

UK Fish Protein Market Outlook – Share, Growth & Forecast 2025–2035

Fish Muscle Protein Market Analysis by Species, Type, Form and Application Through 2035

United States Fish Protein Market Report – Demand, Size & Forecast 2025–2035

Europe Fungal Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Chickpea Protein Market Outlook – Size, Share & Forecast 2025–2035

Europe Duckweed Protein Market Trends – Size, Demand & Forecast 2025–2035

ASEAN Fish Protein Market Trends – Size, Share & Growth 2025–2035

Australia Fish Protein Market Report – Trends, Demand & Outlook 2025-2035

Western Europe Pea Protein Market Analysis - Size, Share & Trends 2025 to 2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

Europe Animal Feed Alternative Protein Market Insights – Demand, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA