The Europe Chitin market is set to grow from an estimated USD 601.8 million in 2025 to USD 1,681.80 million by 2035, with a compound annual growth rate (CAGR) of 10.8% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 601.8 million |

| Projected Europe Value (2035F) | USD 1,681.80 million |

| Value-based CAGR (2025 to 2035) | 10.8 % |

The chitin market in Europe has been seeing significant demand because of the many applications that exist across industries like biomedical and pharmaceutical, food and beverages, agriculture, and cosmetics. Chitin as a biopolymer is gaining popularity naturally since it is derived from crustacean exoskeletons and has seen recognition for its versatility, especially with the increasing adoption of sustainable and natural ingredients in various sectors.

Four main forms of chitin are sold in Europe. These include chitin powder, flakes, pellets, and films. These vary in their different uses across widely different industries. For instance, the biomedical and pharmaceutical industries widely apply chitin for drug delivery systems, wound healing, and as constituent elements in medical devices due to its biocompatibility and non-toxic nature. Chitin also has been extensively used in foods and beverages since it acts naturally as a preservative, an emulsifier, and even as a thickening agent.

Key industry players in the European market are businesses such as KitoZyme S.A., which specializes in the production of chitin-based ingredients, which can be used across various applications. Another is Primex, which specializes in natural chitin products applied in foods and agriculture as well as healthcare applications. Such companies focus on product portfolio expansion, where innovations are highlighted, such as enhanced chitin extracts with improved bioavailability for clinical applications and their incorporation into food preservatives.

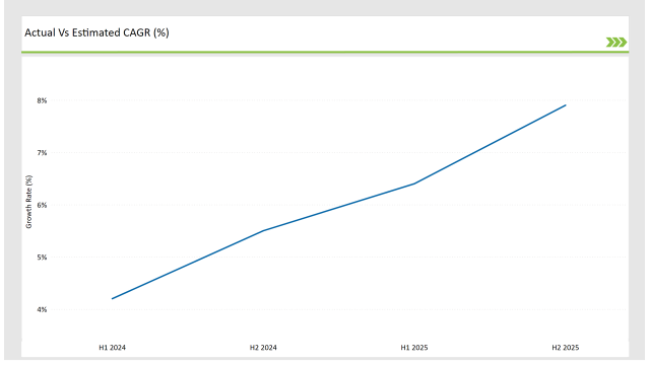

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Chitin market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.2% |

| H2 (2024 to 2034) | 5.5% |

| H1 (2025 to 2035) | 6.4% |

| H2 (2025 to 2035) | 7.9% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Chitin market, the sector is predicted to grow at a CAGR of 4.2% during the first half of 2023, with an increase to 5.5% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 6.4% in H1 but is expected to rise to 7.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | New Biomedical Applications - Chitin-based wound dressings launched by Primex in collaboration with European medical institutes, aimed at enhancing healing and reducing infection. |

| March-2024 | Chitin-enriched Food Products - KitoZyme expanded its portfolio to include chitin-based food preservatives for extending shelf life, responding to the growing demand for natural preservatives. |

| January-2024 | Chitin Film Innovations - A new biodegradable chitin film developed by a European startup , used in packaging to reduce plastic waste in the food industry. |

Growing demand for chitin in wound care and drug delivery

In recent times, it has been a fast-growing material for biomedical products as it displays superior biocompatibility and nontoxicity. Chitin finds its usage in wound dressing or bandage forms to support quick healing since maintaining moisture equilibrium is an indispensable feature for recovery. Chitin's application for targeted therapy through drug delivery for chronic diseases is gaining momentum due to its vast study.

Recent studies show that chitin derivatives, including chitosan, improve the absorption of drugs, which in turn is more effective and less invasive. Several pharmaceutical companies in Europe are incorporating chitin into their formulations, especially for controlled drug release in patients with long-term conditions such as diabetes. This demand is expected to grow as further research continues to demonstrate the efficacy of chitin in delivering both therapeutic and cosmetic benefits, making it an essential material for the European healthcare market.

Role of Chitin in Eco-friendly Packaging Solutions

The concern for sustainability has become a significant focus for several industries, especially food and beverages. In reaction to the increased awareness of plastic waste, companies in Europe are looking for alternatives to packaging materials. Chitin-based films and coatings are one of the new alternatives that are biodegradable and environmentally friendly. These films are not only sustainable but also functional, providing resistance to moisture and extending the shelf life of food products.

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share(%) |

|---|---|

| Germany | 30% |

| Italy | 15% |

| UK | 20% |

| France | 25% |

| Other Countries | 10% |

Germany was found as one of the leading European countries for chitin market growth, due to its focus on innovation and sustainable solutions. Today, Germany has a strong industrial base and is ranked at the top position of R&D leadership, where the country's marketplace is showing a rapidly growing trend for chitin applications across different industries. The pharmaceutical and biotechnological sectors are significant figures in the country's market, which use chitin derivatives by their ability to enhance the delivery system of drugs and treatments related to wound healing.

Demand for chitin-based products in France has been continually increasing, most especially in the agriculture and cosmetic sectors. Chitin used in agriculture is a biopesticide or soil enhancer because of its supporting role in the organic farming industry slowly gaining momentum within the country.

French farmers have increasingly recognized chitin's importance in pest control through its inherent chitinase properties. Chitin derivatives are being used in the formulation of skin-care products in the cosmetics sector due to their moisture retention and anti-aging properties. French cosmetic giants are now adding chitin-based ingredients to their products as more and more consumers are looking for sustainable and natural beauty products.

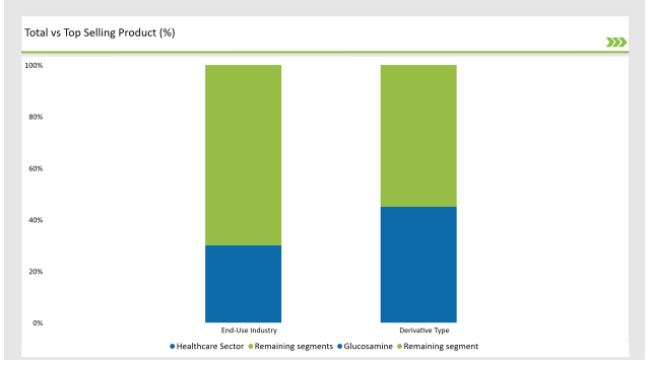

% share of Individual Categories End-Use Industry and Derivative Type in 2025

| Main Segment | Market Share(%) |

|---|---|

| End-Use Industry ( Healthcare Sector ) | 30% |

| Remaining segments | 70% |

Healthcare is the largest growing segment in the European chitin market. The demand for natural and biocompatible materials in various medical applications is rapidly increasing. Chitin is a derivative of crustacean shells. It is highly biocompatible, biodegradable, and nontoxic; hence it has applications in the pharmaceutical and biomedical industries.

Chitin rapidly becomes a primary ingredient in drug delivery systems in the pharmaceutical industry, wound dressings, and tissue engineering in the pharmaceutical world, with an ability to advance cell adhesion and proliferation and make it much more effective for regenerative medicine. Chitin's antimicrobial properties are currently being researched and used in several healthcare products for topical treatments and surgical materials. The rising demand for natural and sustainable ingredients in healthcare is again driving the demand for chitin.

| Main Segment | Market Share(%) |

|---|---|

| Derivative Type ( Glucosamine ) | 45% |

| Remaining segments | 55% |

Glucosamine is the most rapidly growing category in the European chitin market, primarily driven by its vast application in dietary supplements and functional foods. Being a naturally occurring amino sugar, glucosamine is famous for its ability to promote joint health and reduce osteoarthritis symptoms, hence being popularly used by health-conscious consumers. The market for the product is rising with the increasing aged population in the entire European region.

Consumers are opting for more natural alternatives in the management of joint pain and for improving mobility, which has caused an escalation in the production as well as consumption of glucosamine-based products. Additionally, an awareness level regarding the benefits of glucosamine for overall health and the associated functioning of joints is further boosting market growth. Glucosamine also has potential applications in food and beverages wherein it is embedded in functional food to promote the health and wellbeing of consumers.

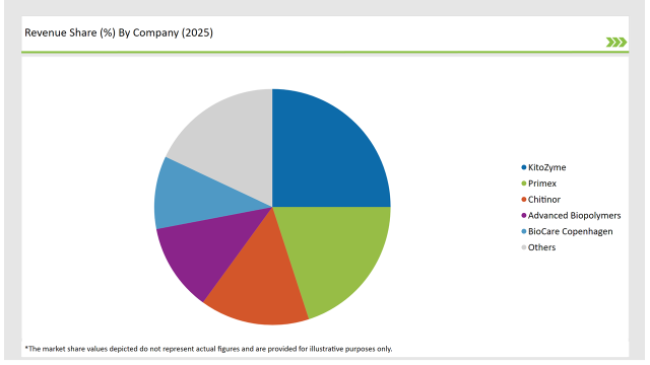

2025 Market share of Europe Chitin manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| KitoZyme | 25% |

| Primex | 20% |

| Chitinor | 15% |

| Advanced Biopolymers | 12% |

| BioCare Copenhagen | 10% |

| Others | 18% |

Note: The above chart is indicative in nature

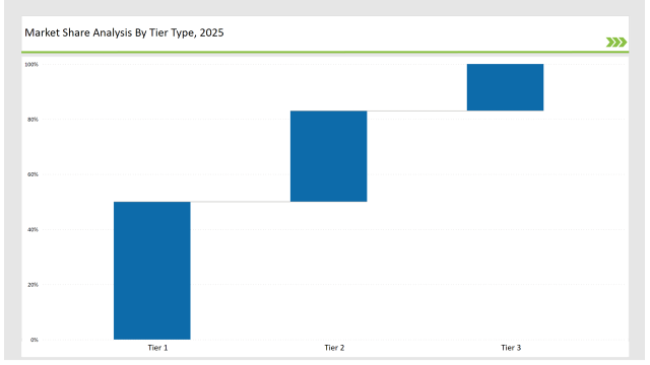

The European chitin market consists of both big players like multinationals and some regional companies playing in their segments, hence augmenting the markets differently. As the research potential is much high with major participants such as KitoZyme S.A., Primex has led to well-established production base and diversified portfolio, these also contribute a considerable market share among them. These companies represent the forefront leaders in innovation involving chitin derivatives and applications that emphasize sustainability as well as environment-friendly solutions.

Epsilon Technologies and Inscopix, regional players, are taking advantage of their deep understanding of chitin properties and their usage in niche industries. These companies mainly operate in niches such as pharmaceuticals or agriculture, offering customized solutions for the unique requirements of their customers. Tier 3 companies are smaller in scale but still add to the market by providing customized chitin products to local markets and meeting regional demands.

As per Derivative Type, the industry has been categorized into Glucosamine, Chitosan, and Others.

As per End-Use Industry, the industry has been categorized into Food and Beverages, Agrochemical, Healthcare, Cosmetics and Toiletries, Waste and Water Treatment, and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Chitin market is projected to grow at a CAGR of 10.8 % from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,681.80 million.

Key factors driving the European chitin market include the increasing demand for natural and biodegradable materials in various applications, such as food, pharmaceuticals, and agriculture. Additionally, the growing awareness of the health benefits associated with chitin, including its use as a dietary supplement and in wound healing, is further propelling market growth.

Germany, France, and UK are the key countries with high consumption rates in the European Chitin market.

Leading manufacturers include KitoZyme, Primex, Chitinor, Advanced Biopolymers, and BioCare Copenhagen known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA