The Europe Bubble Tea market is set to grow from an estimated USD 1,054.1 million in 2025 to USD 2,391.3 million by 2035, with a compound annual growth rate (CAGR) of 8.5% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 1,054.1 million |

| Projected Europe Value (2035F) | USD 2,391.3 million |

| Value-based CAGR (2025 to 2035) | 8.5% |

The European bubble tea market is experiencing tremendous development in this period owing to the continued increase in the demand for new drinks and Asian-inspired drinks. This beverage, which was born in Taiwan, is a mixture of tea, chewy tapioca pearls, and other ingredients, providing a unique experience to the consumer.

Consumers tend to shift their preference from sugary drinks to novelty and healthier substitutes, thus example adding bubble tea. Bubble tea has manifested itself in a whole range of flavours and types, from the classical version.

Leading brands like Chatime, Gong Cha, and local start-ups have set apart by offering innovative flavours, and organic products, and creating a connection with customers. Packaging has been another aspect where the companies have made the most innovations, that is single-serve cups, takeaway cups, and DIY kits, to fulfil diverse consumption patterns. Moreover, it has also spurred the development of truly innovative products, for example, easy-haul and take-home packs.

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Bubble Tea market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 3.2% (2024 to 2034) |

| H2 | 4.7% (2024 to 2034) |

| H1 | 6.1% (2025 to 2035) |

| H2 | 37.0% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December.

For the European Bubble Tea market, the sector is predicted to grow at a CAGR of 3.2% during the first half of 2024, with an increase to 4.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 6.1% in H1 but is expected to rise to 7.0% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | New Product Launches: Companies in Europe, such as Bubbleology, launched a new line of fruit-infused bubble teas, introducing exotic flavors like lychee and mango, designed to attract health-conscious consumers. |

| March-2024 | Market Expansion: Bubble Tea European franchises expand into new regions, notably in smaller European cities, creating a more widespread presence beyond major urban centers like London and Paris. |

| February-2024 | Packaging Innovation: Leading brands like Chatime unveiled eco-friendly takeaway cups, incorporating biodegradable materials to cater to sustainability-conscious customers. |

Flavour Evolution Leading to the Rise of Dessert Inspirations and Tea Infusions

Recently, the European bubble tea market has been experiencing dessert-inspired bubble tea varieties that have been gaining the most popularity. Among these rich and indulgent flavours are tiramisu, caramel pudding, and matcha cheesecake that a customer can mix with a drink or have in shake format, which is especially appealing to younger people interested in something new and different.

On a parallel note, the tea-infused bubble teas, also popular now, are fusing traditional brews like Earl Grey, jasmine, and oolong with chewy pearls that make them an upscale option instead of a fruit-based or milk tea choice. The fact that these products are tea-based and are served with chewy pearls makes them the perfect solution for an emerging customer segment that seeks a classy but still fun and customizable bubble tea drink.

Livelier Packaging Choices Giving Rise to a Combination of Customer Convenience and Sustainability

The modern lifestyle that is characterized by being busy and on the go has prompted the sales of single-serve cups and takeaway cups that have now become inextricably linked with convenience, yet not at the expense of quality. The ascent of single-serve cups and takeaway cups as the main lidding formats to non-flexible food packaging was particularly evident in high-traffic cities like London and Berlin, whose visitors yearn for a fast grab during the day.

Moreover, the emergence of DIY kits has changed the scene totally, as it has made it possible for people to have their drinks made at their homes. Apart from these packaging innovations, eco-friendly customers have persuaded brands to incorporate sustainable practices.

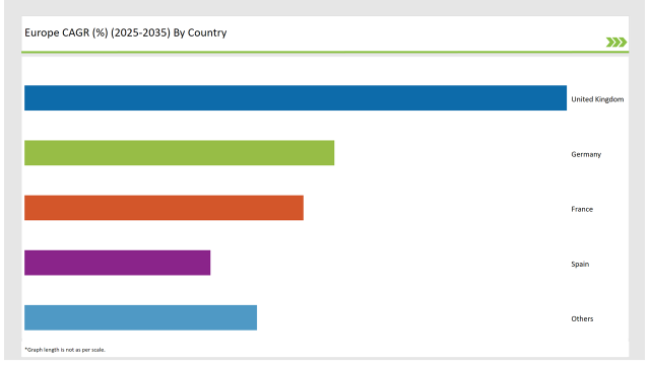

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| United Kingdom | 35% |

| Germany | 20% |

| France | 18% |

| Spain | 12% |

| Others | 15% |

The German market for bubble tea is growing impressively, with the primary drivers of demand coming from the need for healthier beverages and more sophisticated drink options. Fruit-infused bubble teas are most common in the country, where consumers prefer green apple, pomegranate, and citrus flavours. These drinks also align well with Germany's growing health focus since consumers are interested in drinks carrying lower sugar content and no artificial additives.

For this reason, most of the bubble tea brands have now started to provide sugar-free or low-sugar offerings for this growing market segment. The demand for dairy-free milk tea options has also grown because of the current trend in Germany toward plant-based diets. Milk tea is now obtained from oat, almond, and soy milk. Such market adaptation mirrors dietary trends in Germany, where veganism and living by the plant-based principle are becoming more mainstream.

In recent times, there has been the rise of this trendy beverage across the United Kingdom, especially for the younger active social media consumer who is mainly found on platforms such as Instagram. The attraction of bubble tea lies in the colourful ingredients it comes with, which can easily be customized for the perfect image that a social media influencer can share with his or her audience.

This trend has significantly helped with the increase in popularity of this beverage among youngsters, especially teenagers and young adults, in the UK.

When it comes to flavour, fruit-based bubble teas dominate the list, while passion fruit and strawberry are at the top, followed by dessert-flavoured ones like caramel and red bean. The UK market enjoys a lively culture of street foods, with quite several pop-up outlets and mobile vendors selling bubble teas to locals as well as foreign visitors.

Its mobile outlets tend to meet increasing demand for prompt, convenient, and customized beverages contributing to the surging popularity of bubble tea everywhere in the nation.

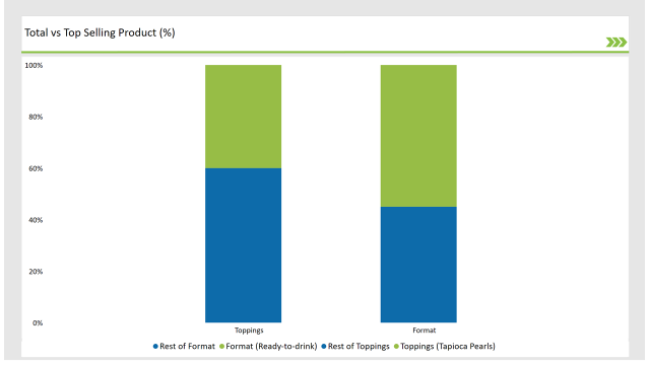

| Main Segment | Market Share (%) |

|---|---|

| Toppings (Tapioca Pearls) | 40% |

| Remaining segments | 60% |

The European market for bubble tea is experiencing tremendous growth, especially in the toppings category. Tapioca pearls, popping boba, and taro balls are among the products leading the way in this area. Tapioca pearls hold a large share of the market as the classic favourite for consumers because of their chewy texture and ability to absorb a wide variety of flavours.

The classic topping has created its fan base and will see growth with innovative shops popping new flavours and flavour combinations, leading to higher demand for tapioca pearls.

Meanwhile, popping boba is this newer product that continues to catch the attention of young customers who crave a new and different mouth-popping sensation. Besides boosting sensory perception and appreciation in terms of enjoying a frothy mug, such flavoured bubble spheres entice exploratory gourmets interested in innovation.

| Main Segment | Market Share (%) |

|---|---|

| Format (Ready-to-drink) | 55% |

| Remaining segments | 45% |

Quick and convenient bottles and ready-to-drink bubble tea are easily available options for consumers who want to consume their favourite beverage without any quality compromise. This trend goes well with the busy lifestyle of urban dwellers, who look for solutions that can be easily consumed on the go and that fit into their schedules. With more brands launching innovative ready-to-drink products, this segment is likely to grow significantly.

The ready-to-mix format is gaining traction as consumers try to recreate their favourite flavours at home. To allow experimentation and customization by the increasing tendency of home food and beverage consumption, this is a DIY. As brands introduce diverse flavour kits and easy mixes, the segment of ready-to-mix, which will certainly expand with new consumers who want to create something on their own, is really promising.

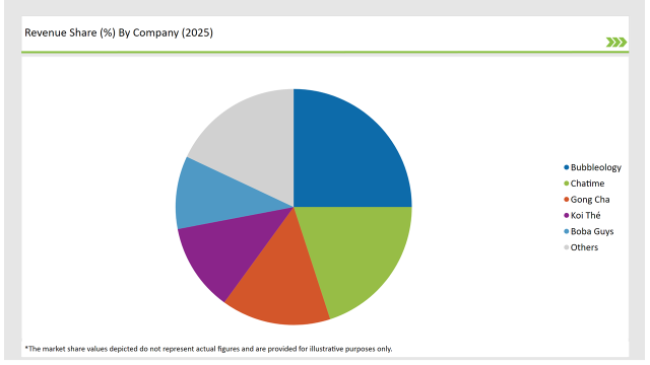

2025 Market share of Europe Bubble Teamanufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Bubbleology | 25% |

| Chatime | 20% |

| Gong Cha | 15% |

| Koi Thé | 12% |

| Boba Guys | 10% |

| Others | 18% |

Note: The above chart is indicative in nature

The European bubble tea market is moderately concentrated, reflecting both multinational players and regional players. Tier 1 companies such as Chatime, Gong Cha, and CoCo Fresh Tea & Juice have the strength to command the most significant market share because of their established global presence and intense supply chains.

The strategic innovations undertaken in the branding department and the franchise network growth in Europe's major cities have been the most crucial instruments used by these companies to win market leadership.

Tier 2 companies, like Bubbleology and Bubblicious, have a critical role in serving regional markets by providing niche products catering to specific consumer segments. These companies usually concentrate on localized flavor options, for example, those that include regional flavors and have marked their presence with options such as vegan, low-sugar, or gluten-free bubble teas.

Tier 3 players, even if small in number, have more localized offerings and are usually consistent customers in smaller European towns. Their strength can be seen as unique flavor lines, green and sustainable initiatives, or even serving local preferences in a much more personalized way.

As per Format, the industry has been categorized into Ready-To-Drink, and Ready-To-Mix.

As per Flavour, the industry has been categorized into Flavoured, and Unflavoured.

As per Toppings, the industry has been categorized into Tapioca Pearls, Popping Bob Bursting Bubbles, Taro Balls, and Coconut Jelly.

As per Distribution Channel, the industry has been categorized intoIndirect Sales, and Direct Sales.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Bubble Tea market is projected to grow at a CAGR of 8.5% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,391.3 million.

Key factors driving the bubble tea market in Europe include the rising popularity of unique and customizable beverage options among younger consumers, as well as the growing trend of social media influence that promotes bubble tea as a trendy lifestyle choice. Additionally, increasing health consciousness is leading to the demand for innovative flavors and healthier ingredient options in bubble tea offerings.

Germany, France, and UK are the key countries with high consumption rates in the European Bubble Tea market.

Leading manufacturers include Bubbleology, Chatime, Gong Cha, Koi Thé, and Boba Guys known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA