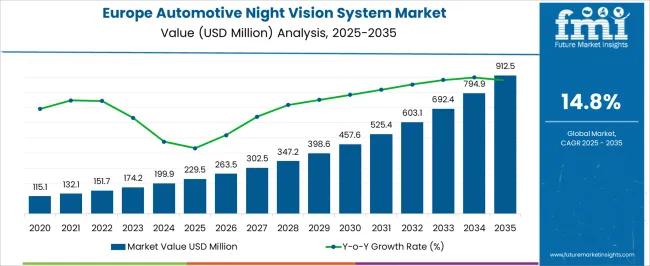

The Europe Automotive Night Vision System Market is estimated to be valued at USD 229.5 million in 2025 and is projected to reach USD 912.5 million by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period.

| Metric | Value |

|---|---|

| Europe Automotive Night Vision System Market Estimated Value in (2025 E) | USD 229.5 million |

| Europe Automotive Night Vision System Market Forecast Value in (2035 F) | USD 912.5 million |

| Forecast CAGR (2025 to 2035) | 14.8% |

The Europe automotive night vision system market is witnessing accelerating adoption, driven by increasing consumer demand for advanced safety technologies and regulatory emphasis on reducing nighttime road fatalities. Growing vehicle electrification and premiumization trends have further fueled integration of night vision systems as part of broader ADAS packages.

Automakers are embedding thermal and infrared imaging systems to enhance visibility in low-light and adverse weather conditions, aiming to prevent pedestrian and animal collisions. The shift toward intelligent mobility and rising demand for luxury vehicles across European markets have positioned night vision systems as a differentiating safety feature.

Governments and regulatory bodies within the EU are encouraging deployment of such technologies through safety mandates and Euro NCAP ratings. As OEMs ramp up investments in sensor fusion and smart imaging platforms, the market is expected to see strong growth through 2030, supported by continued innovation in sensor accuracy, software intelligence, and cost-efficient integration.

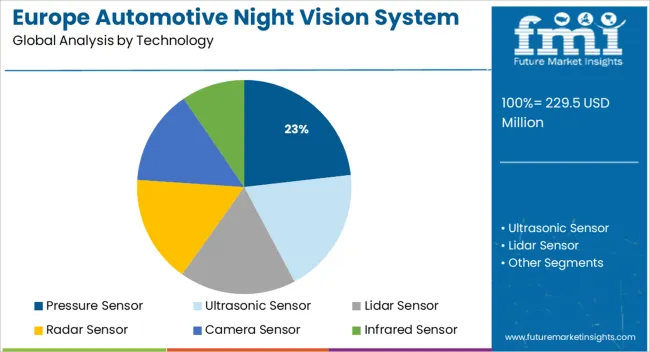

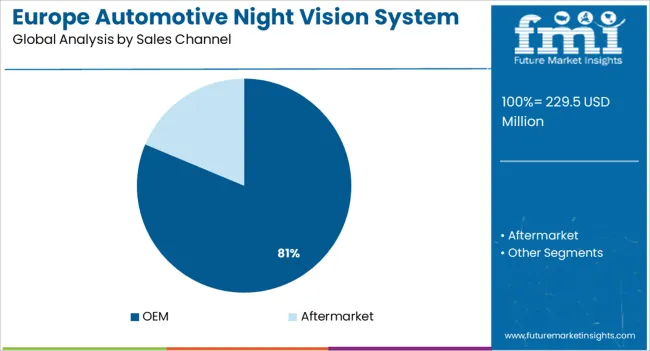

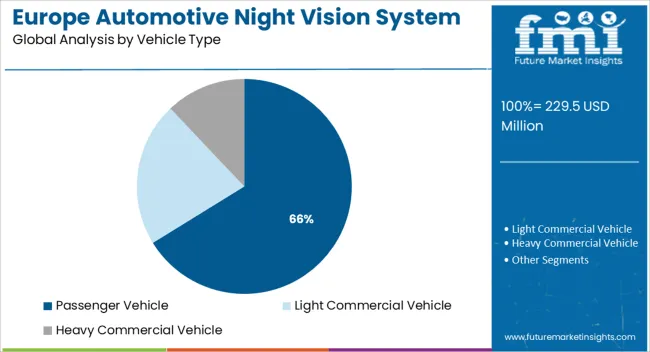

The market is segmented by Technology, Sales Channel, and Vehicle Type and region. By Technology, the market is divided into Pressure Sensor, Ultrasonic Sensor, Lidar Sensor, Radar Sensor, Camera Sensor, and Infrared Sensor. In terms of Sales Channel, the market is classified into OEM and Aftermarket. Based on Vehicle Type, the market is segmented into Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pressure sensor technology segment is projected to hold a 23.2% share of revenue in 2025 within the technology category. Its prominence is attributed to its role in enhancing detection sensitivity and image stability in automotive night vision systems. Pressure sensors contribute to real-time calibration of imaging hardware, ensuring accurate detection despite environmental or thermal fluctuations.

Their integration supports improved performance of infrared-based systems and contributes to faster system response times. The widespread use of pressure sensors across various automotive subsystems has facilitated their cost-effective inclusion in night vision modules.

Furthermore, advancements in miniaturization and sensor accuracy have supported their application in compact designs, aligning with OEM integration requirements. As automotive platforms continue to demand high-resolution, adaptive vision capabilities, pressure sensor technology is expected to retain a strong foothold in the market.

Original equipment manufacturers are expected to contribute 81.3% of revenue in 2025 under the sales channel category, affirming their dominant position in the European automotive night vision system market. This leadership is driven by the direct integration of night vision technology into premium and high-end vehicle models at the production level.

OEMs are increasingly embedding such systems into broader ADAS architectures, enhancing value propositions and competitive differentiation. The alignment with Euro NCAP safety requirements and customer preference for factory-installed safety features has further accelerated OEM channel growth.

Additionally, streamlined supply chains, in-house software calibration, and integrated user interface development have made OEMs the preferred distribution route for automotive night vision technologies. As regulatory frameworks evolve and OEMs expand ADAS offerings across vehicle segments, this channel is set to maintain its substantial share of the market.

The passenger vehicle segment is forecast to account for 66.2% of total revenue in 2025 within the vehicle type category, positioning it as the market’s leading segment. This dominance is being driven by rising consumer demand for enhanced driver assistance features and growing penetration of luxury and high-end vehicles equipped with night vision capabilities.

Passenger vehicle manufacturers have increasingly adopted thermal imaging and infrared sensors to bolster nighttime safety, particularly in densely populated and rural areas where visibility challenges persist. Integration of night vision systems has become a key differentiator in the premium passenger car segment, reinforcing brand value and safety ratings.

Additionally, advancements in user interfaces, including digital dashboards and HUD displays, have enabled seamless integration of night vision outputs for improved driver awareness. These trends, along with increasing alignment with safety regulations and consumer expectations, are expected to ensure continued dominance of the passenger vehicle segment in the foreseeable future.

The analysis of automotive Night Vision System demand from 2020 to 2024 showed a historical growth rate of less than 7.5% CAGR, automotive night vision system is essential in vehicle for security purpose. Rapid growth has been observed of installation of this system in automotive vehicle with increasing worldwide road safety awareness.

Auto manufacturing and the economy as a whole were significantly affected by the coronavirus. In principle, manufacturers suffered greatly from the lack of raw materials necessary to manufacture automotive components, which resulted in the shutdown of the automotive manufacturing industry.

Driving frictional barriers on the production chains, a lack of raw materials out of the factories, and distrust in demanding customers led to a reduction in manufacturing thus hampering growth expectations of the Automotive Night Vision System.

The night activity, fueled by the development of logistics and delivery and shipping worldwide, is increasing with the rapid expansion of logistics and transportation businesses. The vast majority of the shipments and driving a courier are only delivered during the night time in logistics companies.

Consequently, an increase in deaths and car crashes during nighttime hours is a challenge for the international community. In light of that, night-driving technology and cameras are becoming increasingly popular in the logistics industry. This factor is responsible for growth in Automotive Night Vision System used in various end use vehicle type.

The developing trend of advance driver assistance system (ADAS) installation in the vehicle also propelling the growth of automotive night vision system Market. The main focus of auto manufacturers is the enhancement of security in their cars.

One pioneering development on this topic is integrating the driver assistance system with night vision capabilities in the vehicle. Automobile producers are working towards improving the security level of vehicles by introducing vehicles that have the advance driver assistance system.

Like automobiles and trucks, military ground transport vehicles like tanks or Humvees typically feature night vision systems. Hence, the sale of actual systems is increasing. Individuals today usually prefer to purchase luxury vehicles in which such systems are present. That, the heightened need for luxury vehicles, also causes a surge in sales for night vision systems.

The rapid technological growth in the auto sector has enabled the rise of the market for Automotive Night Vision System (ANVS). The automobile-producing corporations are investing heavily in technology for the development of catalyst support systems for driver assistance.

Night vision cameras, controllers, and sensors are some of the main influencer developments of this innovation. New and improved varieties of sensor sensors are being included in automotive steerage systems like the near and far infrared method.

The near-infrared strategy takes advantage of the radiations bounced of the object and illuminates it by extending the revolving solid infra-red array. As a result, the resulting information appears like what is produced through the infra-red spectrum.

Night vision systems that make use of far infrared detection have the advantage that they show objects to keep track of them naturally. Though far-right infrared systems signify the objects detected with heat, these systems have competitive prices and offer soothing imagery to the driver.

Similarly, the development of 3D-supported vehicle night vision systems presents a significant opportunity for market participants. Using laser pulses, night vision systems that are based on light detection and ranging (LiDAR) produce a 3D representation of the surrounding area.

Currently, this technology is being developed by automakers for greater integration in vehicles. Automotive night vision system manufacturers can use this technology to grow their client base and market share.

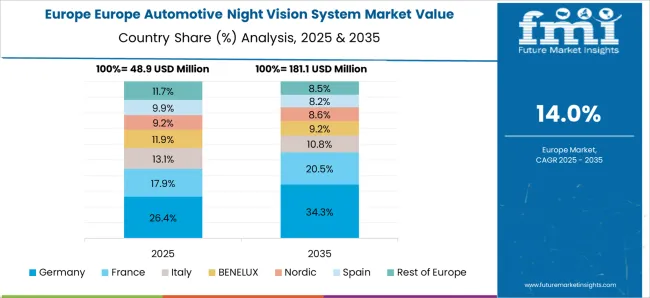

Geographically, the market is sub-segmented into five countries as Germany, France, Spain, Italy, UK, and countries in Eastern Europe. Among all of these region, Germany and U.K are among the top countries in terms of end use sectors, collectively accounting as a prominent contributor to the total Automotive Night Vision System in 2024.

Germany is expected to exhibit significant CAGR and lead the market for Automotive Night Vision System market. According to ‘Germany trade and Invest’ data, Germany's core business is the automotive sector, and the German auto industry is one of the prominent in the world.

Additionally, when it comes to high-tech automotive items, including autonomous driving technology, Germany is among the strongest nations in the world.

German automobile manufacturers produced over 199.9 million vehicles in 2024 which making Germany Europe’s leading automotive production site. German cars embody highly cherished values of innovation, reliability, safety, and design into it, which also includes night vision system in it.

Similarly, UK is also lucrative market for night vision system creating opportunity for market growth in forecasted period through its developing automotive sector having a lengthy history of invention and advanced engineering.

According to ‘Automotive council of UK’ country’s Automotive sector has the second largest manufacturers sector with expenditure of research and development, which fuel the growth of night vision system market.

Key players operating in the Europe Automotive Night Vision System Market include Robert Bosch GmbH, Autoliv Inc., TRW Automotive, Omron Corporation, L-3 Communications Holdings, DENSO Corporation, OmniVision Technologies, Inc., and Continental AG.

The players in this market concentrate on releasing cutting-edge products. The main techniques used by major key players is to increase their geographic footprint, market share, and client base by acquisitions and mergers.

The government's push for safety and security, the economic recovery, and the rise in general technological awareness are all contributing to the predicted growth of the Europe automotive night vision system market in the future.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 15.80% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Tons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Technology, Sales Channel, Vehicle Type, Region |

| Region Covered |

Europe |

| Key Countries Covered |

Germany, France, Spain, Italy, UK, Eastern Europe |

| Key Companies Profiled |

Robert Bosch GmbH; Autoliv Inc.; TRW Automotive; Omron Corporation; L-3 Communications Holdings; DENSO Corporation; OMillioniVision Technologies, Inc.; Continental AG. |

| Customization & Pricing | Available upon Request |

The global europe automotive night vision system market is estimated to be valued at USD 229.5 million in 2025.

The market size for the europe automotive night vision system market is projected to reach USD 912.5 million by 2035.

The europe automotive night vision system market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in europe automotive night vision system market are pressure sensor, ultrasonic sensor, lidar sensor, radar sensor, camera sensor and infrared sensor.

In terms of sales channel, oem segment to command 81.3% share in the europe automotive night vision system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Night Vision System Market Growth - Trends & Forecast 2024 to 2034

Automotive Night Vision Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision Market

Night Vision Surveillance Cameras Market Size and Share Forecast Outlook 2025 to 2035

Night Vision Device Market

Material, Thickness, Capacity, and Type of Europe Automotive Tire Market Forecast Economic Projections to 2035

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Piston System Market Growth - Trends & Forecast 2025 to 2035

Automotive Washer System Market Trends - Growth & Forecast 2025 to 2035

Automotive Seating Systems Market Analysis - Size, Share & Forecast 2025 to 2035

Automotive Exhaust Systems Market Trends - Growth & Forecast 2025 to 2035

Automotive Starting System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Ignition Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Steering System Market Growth - Trends & Forecast 2025 to 2035

Automotive Embedded System Market Growth - Trends & Forecast 2024 to 2034

Automotive Defogger System Market

Automotive Platooning System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Gear Shift System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA