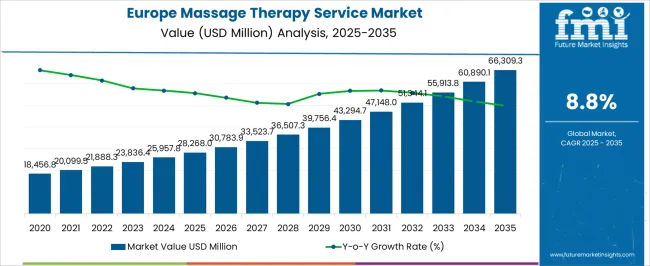

The Europe Massage Therapy Service Market is estimated to be valued at USD 28268.0 million in 2025 and is projected to reach USD 66309.3 million by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

| Metric | Value |

|---|---|

| Europe Massage Therapy Service Market Estimated Value in (2025 E) | USD 28268.0 million |

| Europe Massage Therapy Service Market Forecast Value in (2035 F) | USD 66309.3 million |

| Forecast CAGR (2025 to 2035) | 8.8% |

The Europe massage therapy service market is expanding steadily, driven by increasing consumer awareness of wellness, stress management, and alternative health therapies. The growing integration of massage services within mainstream healthcare systems and insurance coverage in select regions has further supported demand.

Rising disposable income and lifestyle-related health concerns such as musculoskeletal pain and stress-induced disorders are reinforcing the adoption of massage therapies as both preventive and therapeutic solutions. The market benefits from strong cultural acceptance of professional wellness services, complemented by the expansion of wellness centers and spa chains.

Technological integration, including online booking platforms and digital wellness programs, is also enhancing accessibility and service personalization. Looking forward, growth is expected to be reinforced by the rising popularity of holistic health practices, government initiatives promoting mental health, and increasing recognition of massage therapy’s role in rehabilitation and pain management.

The Swedish massage segment leads the service type category with approximately 27.9% share, attributed to its wide acceptance as a foundational massage technique across Europe. Its therapeutic benefits, including improved circulation, relaxation, and stress relief, have made it a preferred choice among clients seeking both wellness and medical-oriented services.

The accessibility of trained practitioners, coupled with its suitability for diverse age groups and health conditions, has reinforced its strong position. The segment has also benefited from its integration into rehabilitation and physiotherapy programs, where Swedish massage is utilized for recovery and mobility enhancement.

With growing demand for stress management therapies and the increasing adoption of wellness routines, the Swedish massage segment is projected to retain its leadership within the service type category.

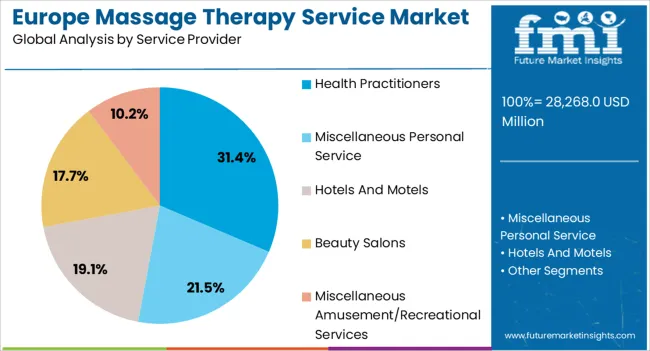

The health practitioners segment dominates the service provider category with approximately 31.4% share, reflecting the growing preference for clinically supervised massage therapy services. Health practitioners, including physiotherapists and licensed therapists, are increasingly offering massage as part of integrated healthcare solutions for pain management, rehabilitation, and preventive care.

This segment’s leadership is reinforced by rising trust in regulated, professionalized service delivery that ensures safety and efficacy. Collaboration with healthcare institutions and insurance coverage in certain regions have further expanded service accessibility.

As massage therapy continues to gain medical validation, the health practitioners segment is expected to sustain its prominence in the European market, aligning with the broader trend of wellness-medical convergence.

Europe's massage therapy service industry witnessed steady growth from 2020 to 2025. This was attributed to increasing awareness of the health benefits of massage, rising stress levels, and a growing aging population.

In Europe, people are becoming conscious of holistic health and wellness. As a component of a comprehensive approach to health and well-being, this tendency has helped to fuel the demand for massage therapy services.

There has been a movement in several countries in Europe to incorporate massage treatment into standard medical procedures. Since massage has been shown to offer therapeutic effects, several medical professionals have included it in their treatment strategies for specific medical disorders.

Travelers seeking spa and wellness experiences frequently travel to Europe. Several individuals worldwide travel to Europe for spa holidays, which often involve massage therapy. This has fueled industry expansion, particularly in countries recognized for providing wellness travel.

The forecast predicts a substantial surge in the industry due to the profound integration of massage therapy services into mainstream healthcare practices and advancements in massage technology.

Evolving consumer preferences toward holistic well-being and preventive healthcare, coupled with the expansion of spa and wellness tourism, are expected to significantly boost the demand for massage therapy services. As a result, Europe’s massage therapy service industry is estimated to expand at an 8.9% CAGR during the forecast period.

Massage Therapy Services to be a Part of Corporate Wellness Initiatives

The integration of massage therapy services within corporate wellness initiatives is propelling the massage therapy service industry in Europe. Massage therapy services are becoming a cornerstone in several companies for reducing stress, improving productivity, and enhancing employee morale.

Recognizing tangible benefits such as stress reduction, alleviating musculoskeletal issues, and overall relaxation is making corporations to invest in on-site or off-site massage services as a proactive measure to enhance employee health. This strategic alignment fosters a healthy workforce, boosts employee retention, and cultivates a positive work environment.

Adoption of Advanced Massage Therapy Service Equipment and Tools

Adopting advanced massage therapy service equipment and tools is a pivotal catalyst propelling the growth of Europe’s massage therapy service industry.

Innovations in massage technology, including sophisticated handheld devices, specialized tables & chairs, and electronic massagers with several intensity settings, are propelling the industry. These tools offer practitioners enhanced precision, efficiency, and versatility in addressing diverse client needs, from targeted muscle relief to holistic wellness therapies.

The integration of technology is elevating the quality of massage treatments and augmenting the overall customer experience. This is further attracting a wider client base seeking personalized and technologically aided therapies. The surging demand for cutting-edge equipment signifies a key driver fueling expansion, reinforcing the industry's evolution toward more effective massage therapy services.

Expansion into the Healthcare Sector

Expanding into the healthcare sector within Europe’s massage therapy service industry presents multifaceted opportunities. Integrating massage therapy services into healthcare settings offers a pathway for collaboration with hospitals, rehabilitation centers, and clinics.

It is set to help in positioning services as complementary to conventional medical treatments. Partnering with healthcare providers allows for the inclusion of massage therapy services in patient care plans, catering to individuals seeking non-invasive pain management and stress reduction.

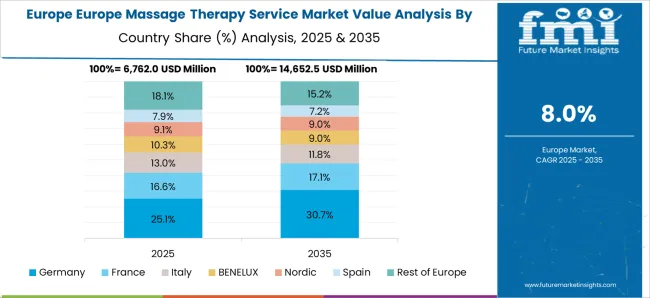

The table below shows the estimated growth rates of the top five countries. Spain, Italy, and France are set to record high CAGRs of 10.2%, 9.6%, and 8.5% respectively, through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.0% |

| Germany | 6.9% |

| France | 8.5% |

| Spain | 10.2% |

| Italy | 9.6% |

Germany is expected to surge at a CAGR of 6.9% through 2035. Several factors propelling the massage therapy service industry in Germany are as follows:

The massage therapy service industry in France is projected to rise at a CAGR of 8.5% by 2035. The factors responsible for this growth are as follows:

The demand for massage therapy services is increasing in Spain, with a projected CAGR of 10.2% through 2035. Emerging patterns in Spain’s industry are as follows:

The below section shows the Thai massage segment leading in terms of service type. It is estimated to thrive at a 10.6% CAGR between 2025 and 2035. Based on service providers, the hotels and motels segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 10.8% during the forecast period.

| Service Type | Thai Massage |

|---|---|

| Value CAGR | 10.6% |

Thai massage is gaining prominence within the service types offered in Europe’s massage therapy service industry due to its unique and holistic approach to healing & relaxation. This traditional form of massage from Thailand involves a blend of acupressure, yoga-like stretching, and deep-tissue massage techniques. Its popularity in Europe stems from its ability to provide physical, mental, and spiritual benefits.

Consumers often seek Thai massage for its therapeutic effects, which include stress relief, improved flexibility, and relief from muscle tension. The distinctiveness and effectiveness of Thai massage is driving its prominence through Europe. This segment is projected to expand at a CAGR of 10.6% over the forecast period.

| Service Provider | Hotels and Motels |

|---|---|

| Value CAGR | 10.8% |

Hotels and motels are emerging as leading service providers in Europe’s massage therapy industry. These establishments cater to a diverse clientele, including business travelers, tourists, and local visitors, providing an ideal platform to offer massage services to a wide range of individuals.

The convenience of accessing massage facilities within these accommodations enhances the overall guest experience, contributing to customer satisfaction and loyalty. Hotels and motels often prioritize wellness and relaxation amenities as part of their service offerings, aligning with the growing trend of travelers seeking holistic experiences.

By integrating massage therapy services into their packages, these establishments attract guests looking for rejuvenation during their stay, making them the leading service providers sought by patrons seeking comfort and convenience. The hotels and motels segment is predicted to increase at a CAGR of 10.8% over the assessment period.

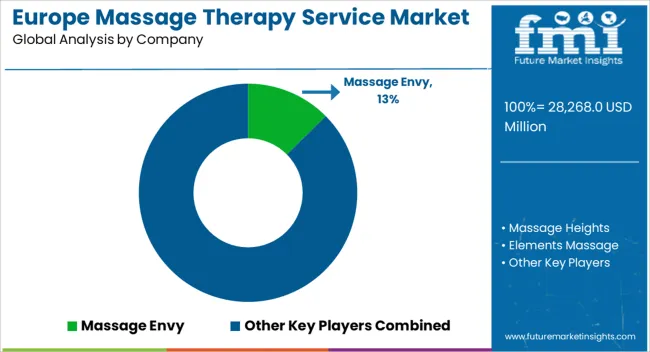

In Europe’s massage therapy service industry, a competitive landscape emerges with diverse players offering unique services and approaches. Established brands are maintaining a significant presence through their expansive network of clinics, diverse massage offerings, and emphasis on customer experience.

Europe-based brands such as Soma Body, Lush Spa, and Bliss Spa bring innovation by combining traditional techniques with modern wellness approaches, targeting niche industries with specialized services and organic products. The competitive landscape thrives on a blend of traditional practices, technological advancements, and evolving consumer demands for holistic wellness, creating a dynamic environment.

For instance,

The global Europe massage therapy service market is estimated to be valued at USD 28,268.0 million in 2025.

The market size for the Europe massage therapy service market is projected to reach USD 66,309.3 million by 2035.

The Europe massage therapy service market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in Europe massage therapy service market are swedish massage, deep tissue massage, sports massage, hot stone massage, shiatsu massage, thai massage, reflexology and pregnancy massage.

In terms of service provider, health practitioners segment to command 31.4% share in the Europe massage therapy service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA