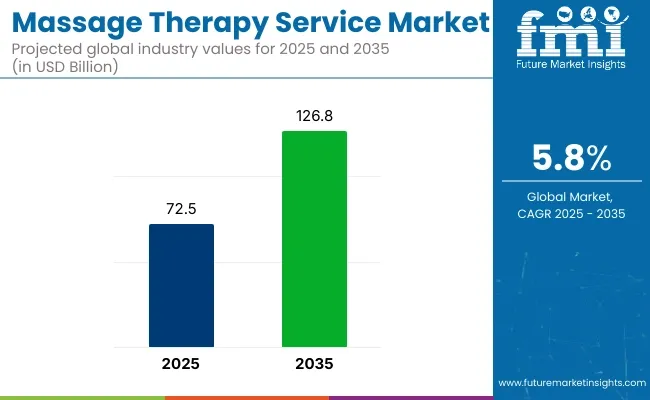

The massage therapy service market size will reach USD 72.5 billion in 2025 and USD 126.8 billion in 2035, growing at a CAGR of 5.8% from the forecast period. This is due to growing consumer health and wellness awareness, rising stress levels, and increasing interest in alternative, holistic healing and relaxation.

That is, the industry needs specialty treatment, novel service models with greater accessibility, and an improved customer experience, which are the next big things. Massage therapy has become a key part of the wellness industry and is well-recognized for its health advantages, both physical and mental.

Its applications vary from pain relief to muscle rehabilitation, to stress reduction, to overall health. With the increasing popularity of massage therapy services in the medical and recreational industries, it is increasingly becoming useful in hospitals, rehabilitation centers, gymnasiums, and spas as well.

In addition, technology innovations like AI-powered massage solutions, web-based booking tools, mobile massages, etc., are transforming consumers' access to these services. The expansion of the massage therapy service industry owes to a range of factors. Universal acceptance of massage as therapy for chronic pain, post-operative recovery and managing stress is widening its consumer base.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 72.5 Billion |

| Industry Value (2035F) | USD 126.8 Billion |

| CAGR (2025 to 2035) | 5.8% |

Further, increased disposable incomes and a preference for preventive care have fueled greater utilization of massage services. There is a growing demand for specialty treatments like deep tissue massage, sports massage, and lymphatic drainage therapy, which serve as differentiating factors for the growth of the industry.

Wellness tourism and corporate wellness programs are also driving the increase in demand. Though the industry has strong growth potential, it faces high charges for services and a shortage of trained massage therapists.

The initial setup cost of opening massage centers, together with, operational expenditure is a hurdle for new entrants. Industry growth may also be slowed by regulatory and licensing policies that differ from location to location. For the service providers, consumer hygiene and safety concerns - particularly in post-pandemic settings - are also an issue.

Emerging trends and recent developments characterize the future of the massage therapy service business. The adoption of technology in the shape of AI (artificial intelligence)-powered massage chairs, robotics-based therapy solutions, and virtual wellness consultations are enriching the environment with regard to convenience and efficiency.

Personalized massage experiences-such as mobile massage services and wellness programs with subscription-based pricing-are sought after.

Green and eco-friendly spa businesses are also on the rise as clients look for holistic wellness solutions supportive of ecological awareness. As this takes hold, along with service model innovation and improvements in technology, the business will continue to intensify, keeping a positive and robust industry for massage therapy services.

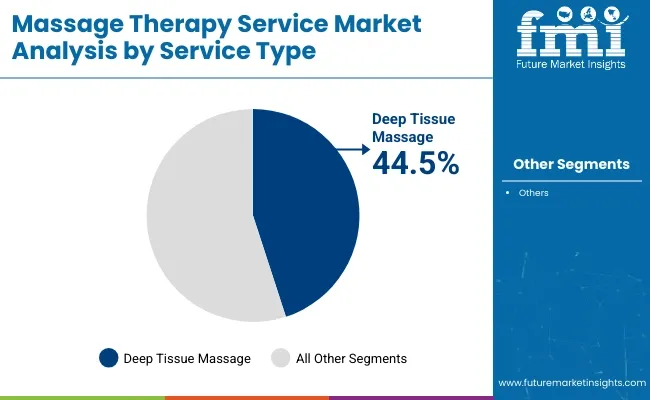

The market is segmented based on service type, service provider, purpose, end user, booking channel, and region. By service type, the market includes deep tissue massage, lymphatic massage, sports massage, oncology massage, Swedish massage, and others (thai massage, shiatsu massage, aromatherapy massage, and prenatal massage).

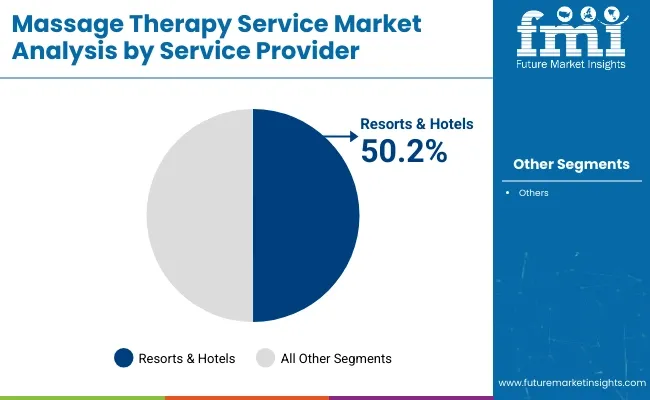

In terms of service provider, it is categorized into massage parlour, hospital/clinics, and resorts/hotels. Based on purpose, the market is segmented into beauty/grooming, relaxation, physical fitness, treatment, and others (rehabilitation, pain management, mental wellness, and posture correction).

By end user, the market includes men and women. In terms of booking channel, it is segmented into online booking, phone booking, and in-person booking. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The deep tissue massage segment is projected to account for the largest market share of 44.5% in 2025. This dominance is driven by growing demand for therapeutic and restorative services among athletes, fitness enthusiasts, and individuals managing chronic conditions like arthritis, fibromyalgia, and lower back pain.

As more people engage in physically intensive lifestyles, the need for muscle recovery therapies continues to climb. Corporate wellness programs and physical therapy centers are also increasingly integrating deep tissue massages into their routines to alleviate muscular stress and improve flexibility. These services are particularly effective at targeting deeper layers of muscle and connective tissue, making them highly suitable for rehabilitation.

High-profile endorsements from professional athletes and clinical studies citing improved range of motion and reduced injury recovery times are further strengthening consumer trust. Cities with dense working populations and sports infrastructures, such as New York, London, and Tokyo, have shown significant adoption. With both clinical and recreational use cases expanding, the deep tissue massage segment is well-positioned to retain its leadership from 2025 to 2035.

| Service Type Segment | Market Share (2025) |

|---|---|

| Deep Tissue Massage | 44.5% |

The resorts and hotels segment is expected to hold the highest market share of 50.2% in 2025 within the massage therapy service market. This growth is fueled by the expansion of luxury wellness tourism, particularly in high-income regions and global travel hubs.

Travelers increasingly seek therapeutic experiences that combine relaxation, cultural immersion, and holistic care all of which are commonly found in hotel spas and wellness retreats. Luxury hotel chains such as Four Seasons, Aman Resorts, and Six Senses are incorporating premium massage services like lymphatic drainage, hot stone therapy, and Ayurvedic techniques into their spa menus.

These services are designed to enhance the guest experience and promote repeat visitation. The post-pandemic surge in self-care awareness has also increased bookings for on-site massages, even among domestic travelers.

Resorts in Southeast Asia, the Mediterranean, and North America are investing heavily in wellness infrastructure, staff training, and sustainable therapy products. As demand rises among affluent tourists and wellness-oriented consumers, this segment is likely to remain dominant.

| Service Provider Segment | Market Share (2025) |

|---|---|

| Resorts & Hotels | 50.2% |

The online booking segment is expected to grow at the highest CAGR of 16.65% from 2025 to 2035, fueled by digitalization and convenience-driven consumer behavior. With the rise of on-demand wellness services and mobile apps, customers now prefer scheduling massages through platforms like Urban Company, Soothe, and Zeel. These digital channels offer features such as real-time availability, therapist ratings, payment gateways, and personalized reminders making the booking process effortless and efficient. he pandemic significantly accelerated this trend as contactless, home-based wellness services gained popularity.

Today, spas and independent therapists are embracing online modules to reduce administrative costs and increase client conversion. Moreover, online discount codes, loyalty programs, and referral incentives drive recurring purchases among tech-savvy users. In developing regions, improved internet penetration and smartphone adoption are enabling small massage parlors and freelancers to join aggregator platforms. This democratization of access is particularly visible in Southeast Asia and Latin America.

The integration of AI for automated scheduling and preference learning further streamlines operations and enhances customer satisfaction. Given evolving digital habits and rising preference for in-home services, the online booking segment is poised to dominate the booking channel landscape by CAGR.

| Booking Channel Segment | CAGR (2025 to 2035) |

|---|---|

| Online Booking | 16.65% |

The physical fitness segment is anticipated to grow at a CAGR of 15.43% in the massage therapy service market from 2025 to 2035. Increasing awareness of recovery-focused self-care, especially among gym-goers and amateur athletes, is creating new demand for fitness-oriented massage therapies.

These include sports massage, trigger point therapy, and muscle-relaxation sessions designed to prevent injuries, enhance mobility, and support post-exercise regeneration. Wellness integration within fitness clubs and athletic training centers is a key growth driver. Facilities like Equinox and Anytime Fitness now offer massage services as part of wellness packages, while personal trainers often refer clients for therapeutic sessions. Additionally, participation in marathons, CrossFit competitions, and dance fitness events is on the rise, increasing demand for recovery services.

Social media influencers and physiotherapists frequently endorse massage therapy for fitness recovery, helping normalize its role in weekly wellness routines. Bundled offerings combining physiotherapy, massage, and chiropractic care are gaining traction across North America, Europe, and Australia. As hybrid fitness and wellness models evolve, massage therapy for physical fitness is emerging as a strategic pillar, ensuring sustained CAGR-driven expansion.

| Purpose Segment | CAGR (2025 to 2035) |

|---|---|

| Physical Fitness | 15.43% |

The men segment is projected to grow at a CAGR of 13.72% from 2025 to 2035 in the massage therapy service market, driven by shifting cultural norms and rising health awareness. Historically underrepresented in wellness consumption, male clients are increasingly seeking massage services for stress relief, physical recovery, and performance enhancement particularly in urban and corporate environments.

As work-related stress and sedentary lifestyles lead to musculoskeletal issues, more men are turning to therapeutic solutions for relaxation and rehabilitation. Gyms, sports centers, and physiotherapy clinics are tailoring services specifically to male clientele by offering sports massage, deep tissue therapy, and pain relief regimens.

Moreover, digital booking platforms and wellness aggregators are using targeted ads and male-oriented wellness content to drive adoption. Brands such as Zeel and Soothe report a year-over-year increase in male users, particularly in the 25-45 age group. Additionally, wellness tourism, especially in Asia and Europe, is promoting male-focused spa experiences that blend massage with fitness and mindfulness. With disposable incomes rising and mental health stigma diminishing, the men segment is expected to witness strong and consistent CAGR-led expansion throughout the forecast period.

| End User Segment | CAGR (2025 to 2035) |

|---|---|

| Men | 13.72% |

The massage therapy service industry is experiencing a remarkable period of expansion primarily because of the growing concern about health issues, the need for stress management, and the rising consideration of alternative solutions for wellness.

Wellness centers and spas feature the high-end offering of services characterized by high customization, which may include aromatherapy, deep tissue, and relaxation techniques. Hospitals and clinics on the other hand, usually, deal with medical-related therapies like physical rehabilitation and pain management which are sometimes directly related to the use of high-tech devices for accurate operation.

Stress massage services have been added to the list by corporate wellness programs as one of the means to improve employees' productivity and decrease stress; therefore, it is vital that they be convenient and low-cost, which are the key elements. The home service providers are also increasing in number due to the need for the on-demand; that is, the personalized therapy along with the fact that people are looking for comfort and flexibility.

The industry is also seeing tech changes like AI-based massage chairs, app booking systems, and smart tools for wellness tracking. Businesses, focusing on affordability, technological enhancement, and expertise should remain competitive because consumer preferences shift from difficult to pertinent, effective, and hybridist wellness.

The industry is at risk from regulatory compliance, which is because the licensing and certification that differ by geographical areas tend to be more stringent. The businesses need to check their therapists to be in accordance with these norms, otherwise, they will face legal concerns. In the same line, the establishment of branches at new locations proves to be difficult, requiring the organizations to adjust to various compliance structures.

Another risk factor is the economic downturns as massage therapy is mainly associated with luxury. During financial hardship, people might reduce their spending on the extra things thus the demand of the services drops. This exposes the sector to economic cycles and makes prudent the companies' action of putting in place clever financial planning.

Again, the competition and the price wars are other risks that the industry must tackle. Since there are many freelancers, spas, and resorts providing the same services, the pressure from the price has a bad effect on profits. To survive, enterprises should set themselves apart through top-notch services, branding, and customer loyalty programs.

Labor shortages on the other hand could be a headache, not to mention that skilled massage therapists are a scarce commodity. The burden of continuous operation and the problem of short staffing considering high turnover ratios as well as the demand for recurrent training can be serious strains on the businesses. Companies must spend on employee retention initiatives for them to have a robust and proficient workforce.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.2% |

| France | 6.8% |

| Germany | 7.4% |

| Italy | 6.5% |

| South Korea | 7.1% |

| Japan | 6.9% |

| China | 8.3% |

| Australia | 7.0% |

| New Zealand | 6.7% |

The 2025 to 2035 CAGR is expected to be 7.5%, driven by growing consumer awareness of wellness and stress relief. Growing franchise-based massage services, demand for treatment, as well as corporate wellness programs support industry growth. Consumers are looking for massage therapies for relaxing purposes as well as pain relief, hence the growing demand for luxury spa franchises as well as independent therapists. Mobile and on-demand massage has gained significant traction, a testament to consumer demand for convenience and customized experiences.

The development of technology-based platforms facilitates booking procedures, providing more ease of access to massage services. Moreover, the aging population and increased focus on holistic well-being create demand for medical and physiotherapy-oriented massage services. The competitive landscape consists of well-established chains and independent operators who use online platforms to expand their operations. Growing insurance coverage for massage therapy also contributes to the industry scenario, making the USA a strong growth driver in the international industry.

2025 to 2035 CAGR is 7.2% due to rising disposable income and rising wellness awareness, which is driving demand. Spa retreats and wellness resorts with premium massage experiences are pulling in customers who are looking for relaxation and stress relief. Growth in fitness and sporting activity drives further demand for sports massage and deep tissue therapy, with specialty treatments being the prime driver of the industry.

Corporate wellness initiatives involve the use of massage therapy as it improves productivity and overall well-being of employees. The demand for mobile massage services makes it possible for customers to receive treatments in workplaces and homes. Better booking websites make the service more convenient, increasing coverage. Demand for alternative therapy, such as aromatherapy massages, remains high, supporting growth across different segments.

CAGR during the period 2025 to 2035 is 6.8% as customers adopt healthier lifestyles and use stress-relieving products. Spa culture in the nation plays a significant role in promoting industry expansion through luxury as well as mid-range items with an appeal to differing customer bases. Therapeutic massage in the form of lymphatic drainage and reflexology is becoming more and more popular as consumers turn towards natural means of remediation to address problem ailments.

The French wellness tourism industry is growing at a strong rate, with both international and domestic tourists embracing massage therapies as an integral part of their wellness. Booking and subscription-based online portals for massages provide consumers with improved ease of access, driven by convenience. Massage therapy continues to be incorporated into corporate wellness initiatives, solidifying its value in ensuring employees' health and productivity.

The CAGR between 2025 and 2035 will be 7.4%, owing to an increasing demand for physiotherapy and rehabilitation-focused massage therapies. Consumers have an enhanced awareness of health and wellness, and this is translating into a higher demand for medical and therapeutic massage therapies. Chain spas and wellness resorts also enhance the menu offerings to incorporate high-class packages for the premium segment seeking high-class services.

Expansion in mobile massage therapy and online portals makes booking simpler, enhancing penetration in the marketplace. Companies also see the value of massage therapy, incorporating it into corporate well-being programs. The industry of stress-relief treatments and therapy based on relaxation is expanding yet further, creating Germany as the prime target country for local as well as global well-being seekers.

2025 to 2035 CAGR is 6.5% as the country's wellness sector grows. The demand for spa therapy and holistic treatments, such as aromatherapy and lymphatic massage, supports industry growth. Rising disposable income allows consumers to spend money on multiple massage sessions, which raises the demand for services.

Tourism is a large contributor to the industry for massage therapy in Italy, as travelers spend money on upscale wellness treatments. Spa services in hotels and upmarket retreats are highly sought after by tourists for relaxation. The growing use of digital platforms for booking appointments gives convenience, as locals and travelers can book with ease. The growth in mobile massage therapy also ensures the industry, servicing busy urban professionals who have no time to spare.

2025 to 2035 CAGR is 7.1% because of increasing demand for beauty and wellness treatment. The massage business in South Korea flourishes on its well-established practice of self-improvement and alternative medicine culture. Korean massages such as acupressure are in greater demand now to reduce stress and achieve a general sense of well-being.

Wellness tourism growth and luxury spa expansion drive industry growth. K-beauty and wellness trends influence the marketing of massage therapies as integral parts of self-care. Online booking platforms and mobile massage services appeal to time-constrained consumers, making them more convenient. Integration of massage therapy into medical and wellness clinics drives adoption further.

2025 to 2035 CAGR stands at 6.9% on the strength of a culture that loves conventional healing practices. Shiatsu and other massage therapies remain fashionable in fulfilling the needs of those looking for stress relief and pain management. Demand is also driven by an aging population for physiotherapy-based massage treatments.

Luxury wellness resorts and spas are a major industry driver, drawing domestic and overseas visitors. Increased availability through mobile massage firms and internet sites increases convenience. The practice of massage therapy is also being incorporated into corporate wellness programs to enhance employee health. Increased understanding of massage therapy as a health amenity further supports its position in Japan's wellness industry.

2025 to 2035 CAGR will stand at 8.3%, which is one of the highest growth markets. Demand is fueled by massage therapies based on TCM, including Tuina and reflexology. Consumers seek holistic healing and wellness, propelling the consumption of massage services in segments.

The growth of wellness resorts and luxury spas reinforces industry growth as consumers with higher incomes pursue premium experiences. Online reservation systems and mobile massage provide more convenience. Support from the government for wellness and preventive care also drives industry growth. Greater utilization of corporate wellness programs also drives the growing utilization of massage therapy.

2025 to 2035 CAGR is 7.0% as growing consciousness of wellness and health tourism is driving growth. People opt for massage therapy in order to de-stress and relax, hence driving demand for high-end as well as mid-end therapies. The incorporation of massage therapy within physiotherapies as well as in rehabilitation programs makes the healthcare sector credible.

Corporate wellness programs that include massage therapy become increasingly popular as firms spend money on workers' health. Mobile massage companies grow, servicing clients who prefer treatment at home. More popular online booking sites make it easier to gain access, allowing working professionals more convenience in obtaining massage therapy. The tourism industry's emphasis on wellness activities creates more momentum for the industry's expansion.

CAGR for 2025 to 2035 is 6.7%, driven by growing interest in overall well-being. Clients increasingly seek massage therapy for physical and emotional health, driving industry growth. The popularity of spa retreats and luxury wellness resorts drives demand for premium services.

Corporate wellness initiatives and mobile massage companies increase in popularity with greater availability. Internet booking is more convenient, with greater consumer access. The wellness tourism industry, especially in picturesque areas, continues to be a primary force in business within the industry. Greater awareness of therapeutic massage services assists in building further opportunities for New Zealand as a developing player in the industry.

The industry for massage therapy services is experiencing consistent growth with greater consumer focus on wellness, stress relief, and pain management. Higher disposable incomes, corporate wellness programs, and the boom in spa and wellness tourism also boost industry demand.

Some prominent companies include Massage Envy, Hand & Stone Massage, Elements Massage, and Massage Heights, which try to distinguish themselves by offering membership programs, advanced forms of massage techniques, and mobile/on-demand services. Start-ups and niche service providers are utilizing AI for booking and therapy experiences while incorporating holistic wellness options in their propositions to render themselves to a larger clientele base.

The industry is making its shift towards other technological service enhancements, such as online appointment scheduling with AI massage customization and health-tracking app integration. In addition, the growing acceptance of therapeutic and medical massages for pain relief and rehabilitation is also widening the industry in the industry beyond just traditional relaxation services.

Strategic factors that guide the competitive position are regulatory licensing, availability of therapists, scalability of operations, and retention strategies. In this highly dynamic marketplace, the companies will have to enhance their competitive capability by focusing on the geographical expansion of service locations, maximizing digital booking experiences, and integrating wellness innovations.

By service type, the industry is segmented into Swedish massage, deep tissue massage, sports massage, reflexology, aromatherapy massage, and others.

By end-user, the industry caters to individuals, athletes, corporate clients, and medical patients.

By service channel, services are offered through spa & wellness centers, massage clinics, home services, hotels & resorts, and others.

By region, the industry spans North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The anticipated revenue for 2025 is estimated to be USD 72.5 billion.

The industry is projected to reach USD 126.8 billion by 2035, growing at a CAGR of 5.8%.

Key players include Massage Envy, Hand & Stone, Elements Massage, Massage Heights, Spavia Day Spa, The NOW Massage, LaVida Massage, Woodhouse Spa, Soothe, and Massage Green Spa.

North America and Europe, driven by increasing consumer focus on wellness, stress relief, and alternative healthcare treatments.

Swedish massage dominates due to its popularity for relaxation, stress reduction, and muscle relief.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 4: Global Market Value (USD Million) Forecast by Purpose, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 6: Global Market Value (USD Million) Forecast by Booking Channel, 2020 to 2035

Table 7: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 8: North America Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 10: North America Market Value (USD Million) Forecast by Purpose, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 12: North America Market Value (USD Million) Forecast by Booking Channel, 2020 to 2035

Table 13: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 14: Latin America Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 15: Latin America Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 16: Latin America Market Value (USD Million) Forecast by Purpose, 2020 to 2035

Table 17: Latin America Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 18: Latin America Market Value (USD Million) Forecast by Booking Channel, 2020 to 2035

Table 19: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 20: Western Europe Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 21: Western Europe Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 22: Western Europe Market Value (USD Million) Forecast by Purpose, 2020 to 2035

Table 23: Western Europe Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 24: Western Europe Market Value (USD Million) Forecast by Booking Channel, 2020 to 2035

Table 25: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 26: Eastern Europe Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 27: Eastern Europe Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 28: Eastern Europe Market Value (USD Million) Forecast by Purpose, 2020 to 2035

Table 29: Eastern Europe Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 30: Eastern Europe Market Value (USD Million) Forecast by Booking Channel, 2020 to 2035

Table 31: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 32: South Asia and Pacific Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 33: South Asia and Pacific Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 34: South Asia and Pacific Market Value (USD Million) Forecast by Purpose, 2020 to 2035

Table 35: South Asia and Pacific Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 36: South Asia and Pacific Market Value (USD Million) Forecast by Booking Channel, 2020 to 2035

Table 37: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 38: East Asia Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 39: East Asia Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 40: East Asia Market Value (USD Million) Forecast by Purpose, 2020 to 2035

Table 41: East Asia Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 42: East Asia Market Value (USD Million) Forecast by Booking Channel, 2020 to 2035

Table 43: Middle East and Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 44: Middle East and Africa Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 45: Middle East and Africa Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 46: Middle East and Africa Market Value (USD Million) Forecast by Purpose, 2020 to 2035

Table 47: Middle East and Africa Market Value (USD Million) Forecast by End User, 2020 to 2035

Table 48: Middle East and Africa Market Value (USD Million) Forecast by Booking Channel, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Service Type, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Purpose, 2025 to 2035

Figure 4: Global Market Value (USD Million) by End User, 2025 to 2035

Figure 5: Global Market Value (USD Million) by Booking Channel, 2025 to 2035

Figure 6: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 7: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 10: Global Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 11: Global Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 12: Global Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 13: Global Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 14: Global Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 15: Global Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 16: Global Market Value (USD Million) Analysis by Purpose, 2020 to 2035

Figure 17: Global Market Value Share (%) and BPS Analysis by Purpose, 2025 to 2035

Figure 18: Global Market Y-o-Y Growth (%) Projections by Purpose, 2025 to 2035

Figure 19: Global Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 20: Global Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 21: Global Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 22: Global Market Value (USD Million) Analysis by Booking Channel, 2020 to 2035

Figure 23: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2025 to 2035

Figure 24: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2025 to 2035

Figure 25: Global Market Attractiveness by Service Type, 2025 to 2035

Figure 26: Global Market Attractiveness by Service Provider, 2025 to 2035

Figure 27: Global Market Attractiveness by Purpose, 2025 to 2035

Figure 28: Global Market Attractiveness by End User, 2025 to 2035

Figure 29: Global Market Attractiveness by Booking Channel, 2025 to 2035

Figure 30: Global Market Attractiveness by Region, 2025 to 2035

Figure 31: North America Market Value (USD Million) by Service Type, 2025 to 2035

Figure 32: North America Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 33: North America Market Value (USD Million) by Purpose, 2025 to 2035

Figure 34: North America Market Value (USD Million) by End User, 2025 to 2035

Figure 35: North America Market Value (USD Million) by Booking Channel, 2025 to 2035

Figure 36: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 37: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 40: North America Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 41: North America Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 42: North America Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 43: North America Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 44: North America Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 45: North America Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 46: North America Market Value (USD Million) Analysis by Purpose, 2020 to 2035

Figure 47: North America Market Value Share (%) and BPS Analysis by Purpose, 2025 to 2035

Figure 48: North America Market Y-o-Y Growth (%) Projections by Purpose, 2025 to 2035

Figure 49: North America Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 50: North America Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 51: North America Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 52: North America Market Value (USD Million) Analysis by Booking Channel, 2020 to 2035

Figure 53: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2025 to 2035

Figure 54: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2025 to 2035

Figure 55: North America Market Attractiveness by Service Type, 2025 to 2035

Figure 56: North America Market Attractiveness by Service Provider, 2025 to 2035

Figure 57: North America Market Attractiveness by Purpose, 2025 to 2035

Figure 58: North America Market Attractiveness by End User, 2025 to 2035

Figure 59: North America Market Attractiveness by Booking Channel, 2025 to 2035

Figure 60: North America Market Attractiveness by Country, 2025 to 2035

Figure 61: Latin America Market Value (USD Million) by Service Type, 2025 to 2035

Figure 62: Latin America Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 63: Latin America Market Value (USD Million) by Purpose, 2025 to 2035

Figure 64: Latin America Market Value (USD Million) by End User, 2025 to 2035

Figure 65: Latin America Market Value (USD Million) by Booking Channel, 2025 to 2035

Figure 66: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 67: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 70: Latin America Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 73: Latin America Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 76: Latin America Market Value (USD Million) Analysis by Purpose, 2020 to 2035

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Purpose, 2025 to 2035

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Purpose, 2025 to 2035

Figure 79: Latin America Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 82: Latin America Market Value (USD Million) Analysis by Booking Channel, 2020 to 2035

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2025 to 2035

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2025 to 2035

Figure 85: Latin America Market Attractiveness by Service Type, 2025 to 2035

Figure 86: Latin America Market Attractiveness by Service Provider, 2025 to 2035

Figure 87: Latin America Market Attractiveness by Purpose, 2025 to 2035

Figure 88: Latin America Market Attractiveness by End User, 2025 to 2035

Figure 89: Latin America Market Attractiveness by Booking Channel, 2025 to 2035

Figure 90: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 91: Western Europe Market Value (USD Million) by Service Type, 2025 to 2035

Figure 92: Western Europe Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 93: Western Europe Market Value (USD Million) by Purpose, 2025 to 2035

Figure 94: Western Europe Market Value (USD Million) by End User, 2025 to 2035

Figure 95: Western Europe Market Value (USD Million) by Booking Channel, 2025 to 2035

Figure 96: Western Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 97: Western Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 100: Western Europe Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 101: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 102: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 103: Western Europe Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 104: Western Europe Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 105: Western Europe Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 106: Western Europe Market Value (USD Million) Analysis by Purpose, 2020 to 2035

Figure 107: Western Europe Market Value Share (%) and BPS Analysis by Purpose, 2025 to 2035

Figure 108: Western Europe Market Y-o-Y Growth (%) Projections by Purpose, 2025 to 2035

Figure 109: Western Europe Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 112: Western Europe Market Value (USD Million) Analysis by Booking Channel, 2020 to 2035

Figure 113: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2025 to 2035

Figure 114: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2025 to 2035

Figure 115: Western Europe Market Attractiveness by Service Type, 2025 to 2035

Figure 116: Western Europe Market Attractiveness by Service Provider, 2025 to 2035

Figure 117: Western Europe Market Attractiveness by Purpose, 2025 to 2035

Figure 118: Western Europe Market Attractiveness by End User, 2025 to 2035

Figure 119: Western Europe Market Attractiveness by Booking Channel, 2025 to 2035

Figure 120: Western Europe Market Attractiveness by Country, 2025 to 2035

Figure 121: Eastern Europe Market Value (USD Million) by Service Type, 2025 to 2035

Figure 122: Eastern Europe Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 123: Eastern Europe Market Value (USD Million) by Purpose, 2025 to 2035

Figure 124: Eastern Europe Market Value (USD Million) by End User, 2025 to 2035

Figure 125: Eastern Europe Market Value (USD Million) by Booking Channel, 2025 to 2035

Figure 126: Eastern Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 127: Eastern Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 130: Eastern Europe Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 131: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 132: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 133: Eastern Europe Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 134: Eastern Europe Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 135: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 136: Eastern Europe Market Value (USD Million) Analysis by Purpose, 2020 to 2035

Figure 137: Eastern Europe Market Value Share (%) and BPS Analysis by Purpose, 2025 to 2035

Figure 138: Eastern Europe Market Y-o-Y Growth (%) Projections by Purpose, 2025 to 2035

Figure 139: Eastern Europe Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 142: Eastern Europe Market Value (USD Million) Analysis by Booking Channel, 2020 to 2035

Figure 143: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2025 to 2035

Figure 144: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2025 to 2035

Figure 145: Eastern Europe Market Attractiveness by Service Type, 2025 to 2035

Figure 146: Eastern Europe Market Attractiveness by Service Provider, 2025 to 2035

Figure 147: Eastern Europe Market Attractiveness by Purpose, 2025 to 2035

Figure 148: Eastern Europe Market Attractiveness by End User, 2025 to 2035

Figure 149: Eastern Europe Market Attractiveness by Booking Channel, 2025 to 2035

Figure 150: Eastern Europe Market Attractiveness by Country, 2025 to 2035

Figure 151: South Asia and Pacific Market Value (USD Million) by Service Type, 2025 to 2035

Figure 152: South Asia and Pacific Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 153: South Asia and Pacific Market Value (USD Million) by Purpose, 2025 to 2035

Figure 154: South Asia and Pacific Market Value (USD Million) by End User, 2025 to 2035

Figure 155: South Asia and Pacific Market Value (USD Million) by Booking Channel, 2025 to 2035

Figure 156: South Asia and Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 157: South Asia and Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 160: South Asia and Pacific Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 161: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 162: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 163: South Asia and Pacific Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 164: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 165: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 166: South Asia and Pacific Market Value (USD Million) Analysis by Purpose, 2020 to 2035

Figure 167: South Asia and Pacific Market Value Share (%) and BPS Analysis by Purpose, 2025 to 2035

Figure 168: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Purpose, 2025 to 2035

Figure 169: South Asia and Pacific Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 172: South Asia and Pacific Market Value (USD Million) Analysis by Booking Channel, 2020 to 2035

Figure 173: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2025 to 2035

Figure 174: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2025 to 2035

Figure 175: South Asia and Pacific Market Attractiveness by Service Type, 2025 to 2035

Figure 176: South Asia and Pacific Market Attractiveness by Service Provider, 2025 to 2035

Figure 177: South Asia and Pacific Market Attractiveness by Purpose, 2025 to 2035

Figure 178: South Asia and Pacific Market Attractiveness by End User, 2025 to 2035

Figure 179: South Asia and Pacific Market Attractiveness by Booking Channel, 2025 to 2035

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2025 to 2035

Figure 181: East Asia Market Value (USD Million) by Service Type, 2025 to 2035

Figure 182: East Asia Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 183: East Asia Market Value (USD Million) by Purpose, 2025 to 2035

Figure 184: East Asia Market Value (USD Million) by End User, 2025 to 2035

Figure 185: East Asia Market Value (USD Million) by Booking Channel, 2025 to 2035

Figure 186: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 187: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 190: East Asia Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 191: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 192: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 193: East Asia Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 194: East Asia Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 195: East Asia Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 196: East Asia Market Value (USD Million) Analysis by Purpose, 2020 to 2035

Figure 197: East Asia Market Value Share (%) and BPS Analysis by Purpose, 2025 to 2035

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by Purpose, 2025 to 2035

Figure 199: East Asia Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 202: East Asia Market Value (USD Million) Analysis by Booking Channel, 2020 to 2035

Figure 203: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2025 to 2035

Figure 204: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2025 to 2035

Figure 205: East Asia Market Attractiveness by Service Type, 2025 to 2035

Figure 206: East Asia Market Attractiveness by Service Provider, 2025 to 2035

Figure 207: East Asia Market Attractiveness by Purpose, 2025 to 2035

Figure 208: East Asia Market Attractiveness by End User, 2025 to 2035

Figure 209: East Asia Market Attractiveness by Booking Channel, 2025 to 2035

Figure 210: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 211: Middle East and Africa Market Value (USD Million) by Service Type, 2025 to 2035

Figure 212: Middle East and Africa Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 213: Middle East and Africa Market Value (USD Million) by Purpose, 2025 to 2035

Figure 214: Middle East and Africa Market Value (USD Million) by End User, 2025 to 2035

Figure 215: Middle East and Africa Market Value (USD Million) by Booking Channel, 2025 to 2035

Figure 216: Middle East and Africa Market Value (USD Million) by Country, 2025 to 2035

Figure 217: Middle East and Africa Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 220: Middle East and Africa Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 223: Middle East and Africa Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 226: Middle East and Africa Market Value (USD Million) Analysis by Purpose, 2020 to 2035

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Purpose, 2025 to 2035

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Purpose, 2025 to 2035

Figure 229: Middle East and Africa Market Value (USD Million) Analysis by End User, 2020 to 2035

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2025 to 2035

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2025 to 2035

Figure 232: Middle East and Africa Market Value (USD Million) Analysis by Booking Channel, 2020 to 2035

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2025 to 2035

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2025 to 2035

Figure 235: Middle East and Africa Market Attractiveness by Service Type, 2025 to 2035

Figure 236: Middle East and Africa Market Attractiveness by Service Provider, 2025 to 2035

Figure 237: Middle East and Africa Market Attractiveness by Purpose, 2025 to 2035

Figure 238: Middle East and Africa Market Attractiveness by End User, 2025 to 2035

Figure 239: Middle East and Africa Market Attractiveness by Booking Channel, 2025 to 2035

Figure 240: Middle East and Africa Market Attractiveness by Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share Analysis for Massage Therapy Service Providers

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Massage Guns Market Analysis – Demand, Growth & Forecast 2025–2035

Massage Equipment Market

Hand Massager Market Size and Share Forecast Outlook 2025 to 2035

Electric Massagers Market Analysis - Size, Share, and Forecast 2025 to 2035

Women Personal Massager Market Size and Share Forecast Outlook 2025 to 2035

USA Percussion Massage Gun Market Growth - Trends & Forecast, 2025 to 2035

Intelligent Cervical Massager Market Size and Share Forecast Outlook 2025 to 2035

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

Mesotherapy Market Size and Share Forecast Outlook 2025 to 2035

Cryotherapy Market Growth - Demand, Trends & Emerging Applications 2025 to 2035

Radiotherapy Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy-Induced Nausea And Vomiting Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Lamps And Units For Aesthetic Medicine Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Equipment Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Heat Therapy Units Market Analysis - Size, Share, and Forecast 2025 to 2035

Chemotherapy Induced Anemia Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA