The global massage therapy service market is experiencing a great change as wellness tops the priority list of every consumer. A swelling tide of consciousness in terms of stress management, mental well-being, and physical health is driving demand for massage therapy services, accelerating growth in the market. Consumers are no longer looking for relaxation alone but rather therapeutic and restorative benefits to enhance their overall quality of life.

This has compelled service providers to be much more innovative, providing very tailored treatments, AI-based service offerings, and even digitalized booking systems that reduce the hassle on the consumer experience.

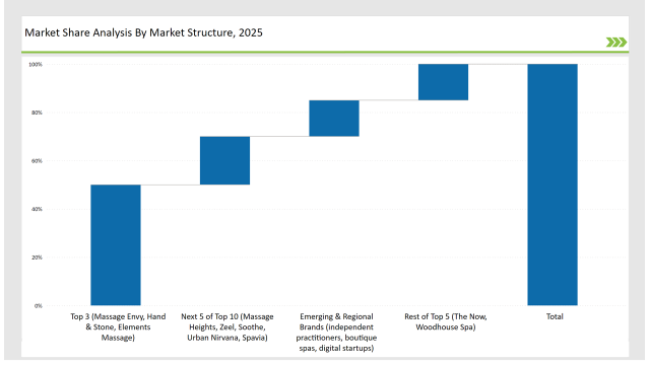

At the same time, industry players are also increasingly looking at holistically healthy wellbeing through added services like assisted stretch, aromatherapy, alternative healing, among others. Leading players in this market are: Massage Envy, Hand & Stone, and Elements Massage, with market share of approximately 50%. Smaller boutique spas, wellness centers, and independent therapists account for 35%, while new digital-first wellness brands account for 15% of the market, hence showing a diversified competitive landscape.

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Massage Envy, Hand & Stone, Elements Massage) | 50% |

| Rest of Top 5 (The Now, Woodhouse Spa) | 15% |

| Next 5 of Top 10 (Massage Heights, Zeel, Soothe, Urban Nirvana, Spavia) | 20% |

| Emerging & Regional Brands (independent practitioners, boutique spas, digital startups) | 15% |

The massage therapy services market in 2025 is highly fragmented, with the top players accounting for 30% to 50% of the total market share. Leading chains such as Massage Envy, Hand & Stone, and Elements Massage dominate the segment, while independent therapists and wellness-focused clinics add competitive diversity. This market structure reflects strong brand influence while allowing space for specialized massage techniques and digital wellness integrations.

The massage therapy market uses several channels of sales. The first are online and direct booking platform leaders. Altogether, online and app-based booking platforms make up 45% because they are convenient, available on the spot, and open to reviews of therapists. A segment of 30% is taken up by a franchise and chain spa sector, since members experience standardized experiences and loyalty customer programs. Boutique wellness centers take 15% of the market share, targeting niche consumers for unique, high-end experiences. The remaining 10% would be corporate and workplace wellness programs, which are becoming more and more part of business's employee wellness programs to boost productivity and minimize stress.

Massage therapy services are very broad in terms of reaching various needs, touching on many fronts for a person's physical and mental well-being. The most often sought service is relaxation and Swedish massage, with 35% of the market targeting its customers with this therapy. The closest service is therapeutic and deep tissue massage at 30%, with many applying it for muscle recovery, tension relief, and in the field of sports therapy. Prenatal and medical massage holds 20% of the market share, giving unique and special treatments to expectant women or those with chronic pain cases. Lastly, 15% falls into luxury and specialty treatments like hot stone therapy, aromatherapy, and reflexology massages for customers who would love to enjoy the premium, holistic experience.

As customer preference evolved, market leaders as well as new comers in the business made strategic choices that transformed the massage therapy business:

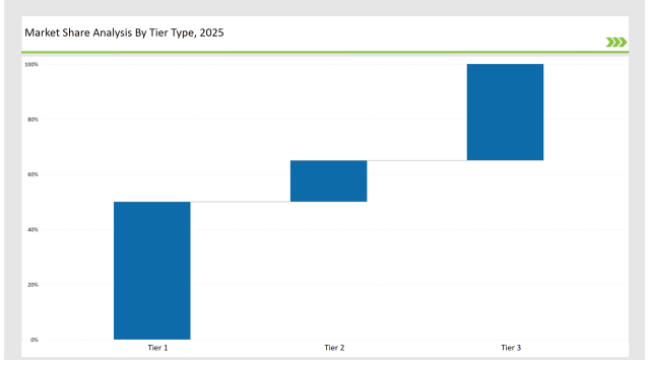

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Massage Envy, Hand & Stone, Elements Massage |

| Market Share (%) | 50% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | The Now, Woodhouse Spa |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Massage Heights, Zeel, Soothe, Urban Nirvana, Spavia, Independent therapists, boutique spas, digital startups |

| Market Share (%) | 35% |

| Brand | Key Focus Areas |

|---|---|

| Massage Envy | Integrated wellness services & assisted stretching |

| Hand & Stone | Luxury spa experiences & relaxation therapy |

| Elements Massage | Flexible membership models & deep tissue specialization |

| Zeel & Soothe | On-demand, mobile massage & subscription wellness |

| The Now | Premium boutique massage with holistic therapy |

| Emerging Brands | AI-driven, personalized wellness & corporate programs |

Massage therapy service is likely to continue experiencing steady growth from wellness trends, digital innovation, and increased self-care focus among consumers. In the future, more people are likely to have more AI-driven solutions, health monitoring devices from wearables, and at-home wellness solutions.

Business success in the changing landscape of technology, sustainability, and customer-centric business approaches will dictate business success. The next wave of massage therapy services will be hyper-personalized, technology-driven, and wellness-focused, offering consumers unparalleled access to relaxation and healing.

Leading players such as Massage Envy, Hand & Stone, and Elements Massage collectively hold around 50% of the market.

Regional brands and independent massage therapists contribute approximately 35% of the market by offering personalized and boutique wellness experiences.

Startups specializing in AI-driven massage booking and on-demand wellness services hold about 15% of the market.

Private labels from wellness centers, fitness studios, and corporate wellness programs hold around 5% of the market.

High for companies controlling 50%+, medium for 35-50%, and low for those under 35%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Massage Therapy Service Market - Growth & Forecast 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Leading Salon Service Providers

Global Telehealth Therapy Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Market Share Distribution Among Food Service Equipment Companies

Examining Food Testing Services Market Share & Industry Outlook

Single Dose Radiotherapy Services Market – Growth & Forecast 2025 to 2035

Market Share Breakdown of Allergy Immunotherapy Providers

Market Share Distribution Among Travel Agency Services Providers

Key Players & Market Share in Packaging Testing Services Industry

Market Share Insights of Compostable Foodservice Packaging Providers

Competitive Overview of Business Analytics BPO Services Companies

Assessing Wireless Telecommunication Services Market Share & Industry Trends

Industry Share & Competitive Positioning in Electronic Equipment Repair Service

Evaluating Market Share in Restaurants & Mobile Food Services

Understanding Market Share Trends in Travelers Identity Protection

Market Leaders & Share in the Preclinical Medical Device Testing Services Industry

A Detailed Industry Analysis of Laundry Facilities and Dry Cleaning Services in the United States

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA