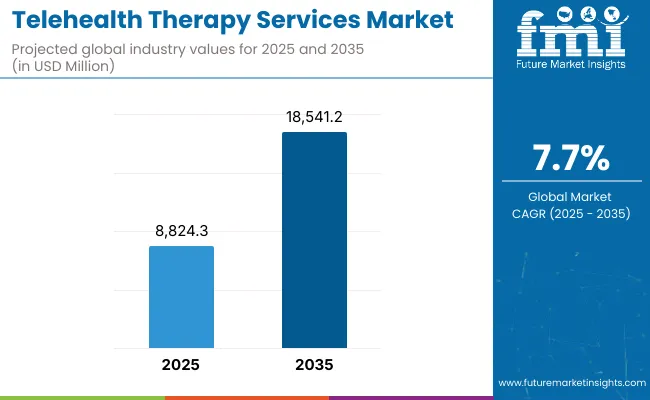

The Global Telehealth Therapy Services Market is expected to record a valuation of USD 8,824.3 million in 2025 and USD 18,541.2 million in 2035, with an increase of USD 9,716.9 million, which equals a growth of 2.1X over the decade. The overall expansion represents a CAGR of 7.7% and a doubling of market size.

Global Telehealth Therapy Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 8,824.3 million |

| Market Forecast Value in (2035F) | USD 18,541.2 million |

| Forecast CAGR (2025 to 2035) | 7.7 % |

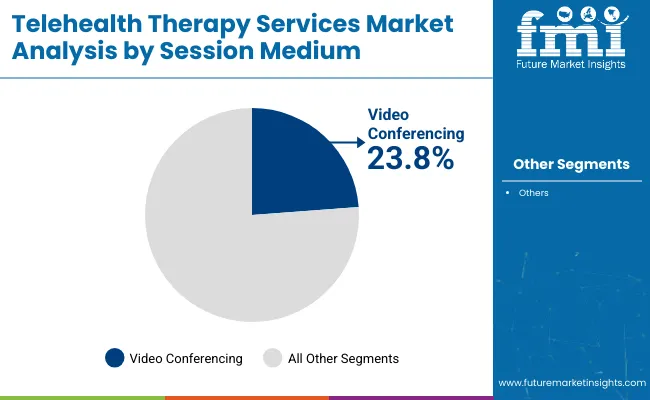

During the first five-year period from 2025 to 2030, the market increases from USD 8,824.3 million to USD 12,791.1 million, adding USD 3,966.8 million, which accounts for 40.8% of the total decade growth. This phase records steady adoption in cognitive behavioral therapy, video conferencing-based sessions, and residential end use, driven by rising mental health awareness and digital accessibility. Video conferencing dominates this period as it caters to over 23.8% of users requiring real-time therapist interaction.

The second half from 2030 to 2035 contributes USD 5,750.1 million, equal to 59.2% of total growth, as the market jumps from USD 12,791.1 million to USD 18,541.2 million. This acceleration is powered by widespread deployment of AI-driven teletherapy, multilingual counseling platforms, and hybrid commercial adoption across workplaces, schools, and healthcare institutions. Residential continues to hold majority share, but commercial adoption rises to reshape the demand mix by 2035.

From 2020 to 2024, the Global Telehealth Therapy Services Market grew from under USD 5,000 million to over USD 8,500 million, driven by pandemic-led adoption and digital transformation in mental health delivery. During this period, the competitive landscape was dominated by BetterHelp, Talkspace, and Amwell, which controlled a large share of digital therapy sessions. Competitive differentiation relied on network size, affordability, and therapist accessibility, while instant messaging and AI triage remained secondary features. Service-based subscription models began to gain momentum but represented less than 15% of total value.

Demand for telehealth therapy services will expand to USD 8,824.3 million in 2025, and the revenue mix will shift as commercial deployments gain traction alongside residential dominance. Traditional leaders face rising competition from AI-powered platforms and niche providers offering targeted services such as LGBTQ+ counseling, family therapy, and multilingual digital platforms. Market leaders are pivoting to hybrid models that combine video conferencing, instant messaging, and telephone-based sessions, while startups build competitive advantage around ecosystem integration, scalability, and recurring subscription revenues.

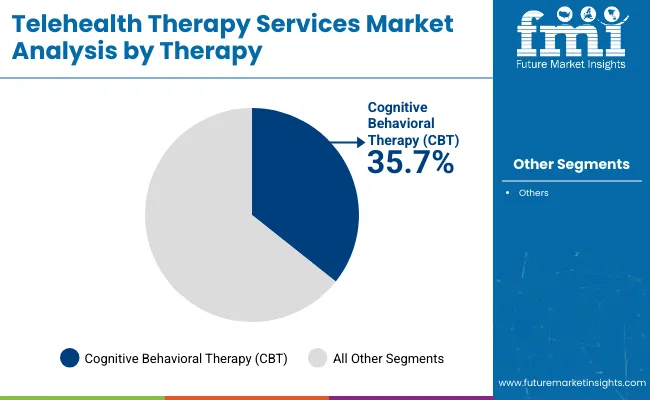

Advances in digital therapy platforms have improved accessibility, allowing for more efficient delivery of services across diverse demographics. Video conferencing sessions, valued at USD 2,100.2 million in 2025, gained popularity due to their ability to replicate in-person therapy experiences and provide real-time engagement. The expansion of cognitive behavioral therapy (CBT) as a structured, evidence-based modality, with 35.7% share in 2025, strengthens its role as the dominant therapy type.

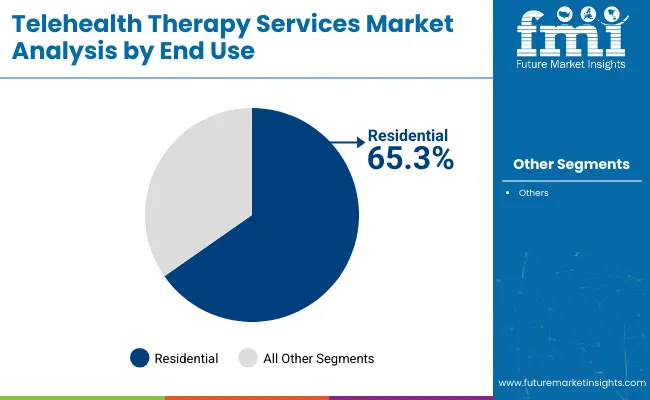

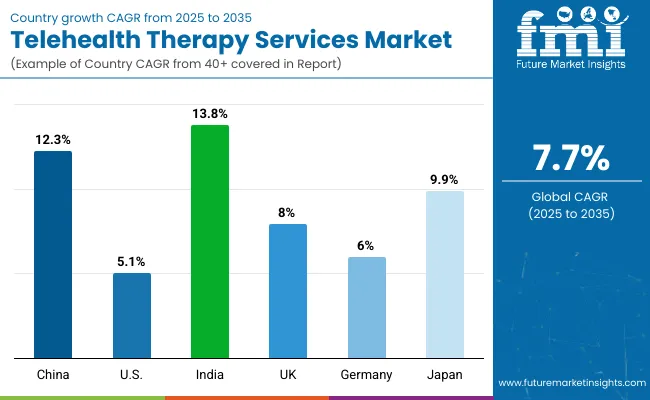

Expansion of residential end use, representing 65.3% share in 2025, continues to fuel growth as patients prefer flexible, at-home therapy options. Rapid adoption in India (13.8% CAGR), China (12.3% CAGR), and Japan (9.9% CAGR) underscores the rising demand in emerging and technologically advancing regions. Innovations in AI-driven therapy matching, multilingual session delivery, and integration with corporate wellness programs are expected to open new commercial adoption pathways. Segment growth is expected to be led by cognitive behavioral therapy, video conferencing as a medium, and residential end use, due to their adaptability and scalability.

The market is segmented by therapy type, session medium, end use, and region. Therapy types include Cognitive Behavioral Therapy (CBT), Psychodynamic Therapy, and Person-Centered Therapy, representing the core categories of psychological treatment delivered through telehealth platforms. Session mediums cover video conferencing, instant messaging or chat, and telephone (audio-based therapy), highlighting the different modes of remote therapist-patient interaction.

Based on end use, the segmentation includes residential and commercial applications. Residential use reflects individual and family-based therapy sessions conducted at home, which dominate the market due to affordability and accessibility. Commercial adoption spans corporate wellness programs, schools, clinics, and institutional healthcare environments, where structured mental health programs are increasingly integrated into organizational frameworks.

Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with key country-level contributions from the USA, China, India, Japan, Germany, and the UK Emerging markets in Asia are expected to grow fastest, driven by increasing digital adoption, supportive government initiatives, and high unmet mental health needs.

| Therapy Type Segment | Market Value Share, 2025 |

|---|---|

| Cognitive Behavioral Therapy (CBT) | 35.7% |

| Others | 64.3% |

The Cognitive Behavioral Therapy (CBT) segment is projected to contribute 35.7% of the Global Telehealth Therapy Services Market revenue in 2025, making it the leading therapy type. This dominance is driven by CBT’s structured, evidence-based approach and its effectiveness in treating depression, anxiety, and behavioral conditions. The adaptability of CBT to digital platforms enhances its accessibility, supporting strong adoption among patients seeking measurable outcomes.Growth in the CBT segment is also supported by the integration of AI-driven therapy modules and digital tools that allow guided self-help sessions under therapist supervision. As awareness of mental health expands globally, CBT is expected to remain the backbone of telehealth therapy services, providing consistent value across both residential and commercial users.

| Session Medium Segment | Market Value Share, 2025 |

|---|---|

| Video Conferencing | 23.8% |

| Others | 76.2% |

The video conferencing segment is forecasted to hold 23.8% of the market share in 2025, emerging as the dominant session medium for telehealth therapy. This format is preferred due to its ability to replicate in-person counseling experiences, creating a higher level of trust and engagement between patients and therapists. Real-time interactions make it suitable for complex therapy sessions where visual and non-verbal cues are critical. The segment’s growth is further strengthened by the availability of secure, HIPAA-compliant platforms and high-speed internet penetration that enables seamless connectivity. As personalization and visual engagement become central to mental health treatment, video conferencing is expected to maintain its role as the most effective and widely adopted teletherapy medium.

| End Use Segment | Market Value Share, 2025 |

|---|---|

| Residential | 65.3% |

| Others | 34.7% |

The residential segment is projected to account for 65.3% of the Global Telehealth Therapy Services Market revenue in 2025, establishing itself as the leading end use category. The dominance of residential usage is driven by increasing patient preference for at-home, flexible therapy sessions that eliminate travel barriers and reduce costs. The rise of subscription-based platforms like BetterHelp and Talkspace has accelerated adoption in this category.

The segment’s growth is also fueled by rising mental health awareness campaigns, post-pandemic digital health habits, and the convenience of on-demand therapy services. While residential remains dominant, the commercial segment covering corporate wellness programs, educational institutions, and healthcare facilitiesis expected to grow faster over the forecast period, driven by organizational investments in structured mental health support for employees and students.

Drivers

Rising Demand for Accessible and Affordable Mental Health Care

The demand for accessible and affordable mental health care is one of the strongest growth drivers for the global telehealth therapy services market. Rising incidences of depression, anxiety, post-traumatic stress disorder, and burnout are pushing patients toward solutions that are flexible and more cost-effective than traditional in-person counseling. According to WHO, one in every eight people globally suffers from a mental health disorder, yet access to therapy remains limited due to cost, stigma, and geographical barriers. Telehealth therapy bridges this gap by eliminating the need for physical infrastructure and enabling therapy delivery across remote and underserved populations.

In 2025, the residential end use already accounts for 65.3% of the market (USD 5,762.3 million), reflecting how patients are increasingly engaging in therapy sessions from the comfort of their homes. The cost-efficiency of subscription-based services, such as BetterHelp, Talkspace, and Cerebral, has further strengthened adoption among younger demographics who may not otherwise afford in-person sessions. Additionally, the convenience of scheduling, reduced waiting times, and the ability to switch therapists seamlessly all contribute to wider acceptance.

This accessibility-driven growth is particularly pronounced in emerging economies. Countries like India (13.8% CAGR) and China (12.3% CAGR) are seeing a surge in demand as smartphone penetration and digital payments open access to millions of first-time therapy seekers. Governments and NGOs are also supporting mental health awareness campaigns, reducing stigma, and creating favorable conditions for teletherapy platforms to grow. Over the decade, affordability and accessibility will remain central to expanding patient bases, positioning telehealth therapy services as a critical part of global mental healthcare ecosystems.

Integration of AI, Multilingual Platforms, and Personalized Digital Therapies

The second major driver is the integration of advanced technologies such as artificial intelligence (AI), natural language processing (NLP), and machine learning into therapy platforms. AI-driven therapy matching systems now analyze patient needs, demographics, and preferences to connect them with the most suitable therapist, reducing drop-out rates and improving outcomes. Additionally, AI chatbots and guided therapy modules provide immediate mental health support, acting as a supplement between live sessions and lowering overall therapy costs.

The market already reflects this technology-driven growth: in 2025, video conferencing accounts for 23.8% (USD 2,100.2 million) of revenues, showing the importance of digital-first interaction. Platforms like Amwell and Teladoc Health are embedding AI for personalized therapy programs, while niche players such as Pride Counseling focus on specialized user groups (e.g., LGBTQ+ therapy) supported by targeted digital experiences.

Multilingual and multicultural platforms are also opening new avenues. In Asia-Pacific, for instance, therapy platforms are providing content and live sessions in local languages, addressing previously underserved populations. This localization makes teletherapy more inclusive and culturally sensitive, a critical factor in patient trust and engagement. The personalization wave is also tied to analytics.

By tracking patient progress through digital dashboards, therapists can adjust treatment plans in real-time, ensuring higher success rates. The integration of wearable devices and mobile mental health apps with therapy platforms is also creating feedback loops, where daily mood or stress data can inform therapy. Over the next decade, these innovations will transform teletherapy from being just a replacement for in-person care into a personalized, data-driven mental health management system.

Restraints

Regulatory and Licensing Barriers Across Countries

Despite strong growth potential, one of the most significant restraints on the global telehealth therapy services market is the patchwork of regulatory frameworks across regions. Mental health therapy is governed by strict licensing, privacy, and professional accreditation laws that vary significantly between countries and even within countries like the USA, where state-level licensing restricts therapists from treating patients across state lines. This lack of harmonization creates barriers for platforms that want to scale globally.

Teletherapy services also face challenges around compliance with HIPAA (Health Insurance Portability and Accountability Act) in the USA and GDPR (General Data Protection Regulation) in Europe. These regulations ensure patient confidentiality but add operational complexity and costs for therapy providers. Smaller teletherapy startups often struggle to meet compliance requirements, limiting their ability to expand internationally.

In emerging markets, the regulatory frameworks are less developed, but this creates uncertainty rather than opportunity. Lack of clear telehealth standards makes it difficult for investors and providers to scale confidently. Moreover, governments often hesitate to authorize cross-border mental health services, citing risks around malpractice liability and patient safety. Without harmonized global or regional policies, teletherapy providers must navigate fragmented and restrictive legal systems, which slows innovation and limits patient access. Although regulatory reform is gradually underway in some regions, this restraint will remain a key challenge through the forecast period.

Digital Divide and Technology Limitations

The digital divide represents another major restraint on the adoption of telehealth therapy services. While urban and developed regions have access to high-speed internet and affordable smartphones, rural and low-income populations in emerging economies face challenges in accessing reliable digital infrastructure.

Even in high-growth markets such as India and China, large sections of the population remain offline or have unstable internet connectivity, limiting the scalability of video-based sessions. This limitation directly impacts the session medium segment. Although video conferencing leads with 23.8% share in 2025, instant messaging and audio-based therapy dominate the remainder of the market (76.2%) because they require less bandwidth. While these modes increase accessibility, they may compromise on therapy quality due to limited visual cues.

Furthermore, older age groups and digitally unskilled users often find it difficult to navigate therapy apps or platforms, creating an adoption barrier. The digital literacy gap, coupled with lack of access to devices in lower-income groups, could exclude vulnerable populations who need therapy the most. Unless governments and private providers invest in digital infrastructure, affordable internet access, and digital literacy programs, this divide will continue to hinder universal access to telehealth therapy services. While growth in urban centers remains strong, bridging the gap in rural and underserved areas is essential for the market to achieve its full potential.

Key Trends

Commercial Adoption of Teletherapy in Corporate Wellness and Institutions

A key trend shaping the telehealth therapy services market is the expansion from residential to commercial adoption. While residential usage dominates in 2025 with a 65.3% share, companies, schools, and universities are increasingly integrating teletherapy services into their wellness programs. Employers are recognizing the link between employee productivity, retention, and mental health, driving demand for large-scale subscription contracts with platforms such as Teladoc Health and Amwell. In educational institutions, digital therapy platforms are being introduced to address rising levels of anxiety and stress among students.

Schools and universities are offering counseling services through online platforms, making mental health support more accessible to younger populations. This trend is particularly visible in the 2030-2035 growth phase, where commercial adoption contributes a significant share of incremental revenues. By embedding teletherapy into workplace wellness packages and institutional support systems, providers gain steady, recurring revenue streams while broadening their user base. The commercialization of teletherapy is expected to rebalance the market’s revenue mix, creating a dual ecosystem of residential flexibility and institutional scale.

Shift Toward Hybrid and Niche Service Models

Another defining trend is the move away from one-size-fits-all therapy toward hybrid and niche-focused teletherapy models. Platforms are increasingly combining video conferencing, instant messaging, and audio sessions to offer flexibility for diverse user preferences. This hybrid delivery ensures that patients can switch between modes depending on their needs, improving satisfaction and retention. At the same time, niche teletherapy platforms are gaining traction. For instance, Pride Counseling specializes in LGBTQ+ therapy, while ReGain focuses on relationship and couples counseling. These platforms differentiate themselves by offering targeted expertise, curated therapist networks, and tailored user experiences.

The rise of specialized services also reflects the market’s maturity. As mainstream platforms like BetterHelp and Talkspace compete on scale, niche providers build loyalty through personalization. Hybrid service models, combined with AI-driven personalization and cultural adaptation, are expected to dominate by 2035.This trend signals a shift in competitive advantage from sheer network size to ecosystem strength, inclusivity, and service differentiation, reshaping the global telehealth therapy landscape.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.3% |

| USA | 5.1% |

| India | 13.8% |

| UK | 8.0% |

| Germany | 6.0% |

| Japan | 9.9% |

The global Telehealth Therapy Services Market shows a pronounced regional disparity in adoption speed, strongly influenced by digital infrastructure, smartphone penetration, healthcare spending, and regulatory frameworks. Asia-Pacific emerges as the fastest-growing region, anchored by India at 13.8% CAGR and China at 12.3% CAGR. India’s trajectory reflects sharp growth in residential therapy adoption, with rising awareness, government-backed mental health initiatives, and affordability driving uptake in both urban and semi-urban regions. China benefits from a strong digital ecosystem, smartphone integration, and city-level programs promoting mental wellness through online platforms. Both countries are leveraging AI-powered and multilingual therapy platforms, boosting accessibility across diverse demographics.

Europe maintains a steady growth profile, led by Germany (6.0% CAGR) and the UK (8.0% CAGR). The region’s expansion is supported by high government investment in mental health, digital health policies, and corporate adoption of employee well-being programs. UK’s faster growth is tied to early adoption of digital platforms in schools and workplaces, while Germany shows moderate but consistent expansion due to regulatory complexity.

Japan (9.9% CAGR) stands out with strong adoption of video conferencing-based therapy and integration of teletherapy services into corporate wellness structures. Cultural openness toward mental health interventions is gradually rising, supporting steady growth. North America shows mature expansion, with the USA growing at 5.1% CAGR. The market reflects high baseline adoption levels but slower growth compared to Asia, as digital therapy is already well-established. Expansion in the USA is more service-driven, with platforms adding value through AI integration, therapist network expansion, and hybrid delivery models rather than new user penetration.

| Year | USA Telehealth Therapy Services Market |

|---|---|

| 2025 | 2046.2 |

| 2026 | 2182.5 |

| 2027 | 2327.9 |

| 2028 | 2482.9 |

| 2029 | 2648.3 |

| 2030 | 2824.7 |

| 2031 | 3012.9 |

| 2032 | 3213.5 |

| 2033 | 3427.6 |

| 2034 | 3655.8 |

| 2035 | 3899.3 |

The Telehealth Therapy Services Market in the United States is projected to grow at a CAGR of 5.1%, led by strong demand for residential therapy sessions and growing employer investments in corporate wellness programs. Platforms like BetterHelp, Talkspace, and Amwell dominate, focusing on affordability, network size, and personalized matching algorithms. While adoption growth is slower than in emerging markets, the USA remains the largest single-country market by value, driven by established digital infrastructure and insurance integration.

The Telehealth Therapy Services Market in the United Kingdom is expected to grow at a CAGR of 8.0%, supported by robust adoption across both residential and institutional segments. Post-pandemic normalization of teletherapy, combined with NHS-backed mental health initiatives and employer-driven adoption, is creating a strong market foundation. Corporate wellness adoption is rising, with employers subsidizing therapy sessions for workforce productivity. Universities and schools are embedding digital therapy into student support systems. Increased mental health awareness campaigns are driving uptake across younger demographics.

India is witnessing rapid growth in the Telehealth Therapy Services Market, forecast to expand at a CAGR of 13.8%, the highest among all leading economies. Adoption is driven by cost-effective digital platforms, widespread smartphone penetration, and increased awareness in tier-2 and tier-3 cities. Subscription platforms are gaining traction due to low-cost entry models. Government initiatives to integrate telehealth into public mental health systems are accelerating growth. Educational institutions are partnering with teletherapy providers for student wellness programs.

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.2% |

| China | 11.9% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.0% |

| India | 4.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.0% |

| China | 13.0% |

| Japan | 8.5% |

| Germany | 13.6% |

| UK | 7.4% |

| India | 6.0% |

The Telehealth Therapy Services Market in China is expected to grow at a CAGR of 12.3%, supported by the country’s digital-first approach and rapid platform adoption. Affordable, domestically developed teletherapy apps are enabling mass-market penetration, while government-led awareness campaigns encourage mental wellness adoption. Video conferencing dominates with 24.8% share (USD 259.4 million) in 2025. Localized platforms offering multilingual support fuel adoption across regions. Corporate and institutional teletherapy programs are expanding as employers prioritize workforce wellness.

The data highlights the shifting market shares of key countries between 2025 and 2035. The USA is projected to retain its leading position with a significant share of 23.2% in 2025, although this will slightly decline to 21.0% by 2035, reflecting a gradual redistribution of global market power. Germany also experiences a decline, moving from 15.3% in 2025 to 13.6% by 2035, signaling the impact of market saturation and stronger competition from emerging economies. Similarly, the UK shows a marginal decline from 8.0% to 7.4%, pointing to slower growth compared to peers.

On the other hand, emerging markets demonstrate steady upward momentum. China grows from 11.9% in 2025 to 13.0% in 2035, driven by rising industrial capacity and domestic consumption. Japan also strengthens its share from 6.9% to 8.5%, benefiting from innovation-driven demand expansion. India shows the most notable growth trajectory, increasing from 4.8% in 2025 to 6.0% in 2035, reflecting its growing role as a demand-driven and cost-competitive market. Together, these shifts illustrate a gradual rebalancing of market power, where developed markets remain dominant but growth momentum increasingly favors Asia.

| Therapy Type Segment | Market Value Share, 2025 |

|---|---|

| Cognitive Behavioral Therapy (CBT) | 3% |

| Others | 34.7% |

The United States Telehealth Therapy Services Market is valued at USD 2,046.24 million in 2025. CBT leads the therapy mix with 37.4% share (USD 765.29 million), reflecting strong clinical evidence, structured, outcome‑oriented protocols, and easy digitization into guided modules and therapist‑led video sessions. Widespread insurance coverage for virtual visits, mature platform ecosystems (BetterHelp, Talkspace, Amwell, Teladoc), and large therapist networks sustain high residential uptake and drive recurring subscription revenue. Commercial demand is expanding as employers embed teletherapy into benefits to address burnout and retention. While the USA remains the single largest market by value, growth is steadier than in Asia due to relative maturity. Product differentiation centers on therapist availability, AI‑assisted matching, care navigation, and tri‑modal delivery (video, chat, audio). Integration with EHRs and outcomes tracking supports payor partnerships and longer‑term contracts.

| Session Medium Segment | Market Value Share, 2025 |

|---|---|

| Video Conferencing | 24.8% |

| Others | 75.2% |

The China Telehealth Therapy Services Market is valued at ≈ USD 1,050.1 million in 2025 (11.9% of global value). Video conferencing commands 24.8% share (USD 259.37 million), supported by high‑speed mobile internet and user preference for real‑time counselor interaction. “Others” (chat and telephone) account for 75.2% (USD 786.48 million), enabling reach across bandwidth‑constrained areas and first‑time therapy users.

Rapid localization multilingual interfaces, culturally adapted CBT content and city‑level wellness initiatives are expanding access beyond Tier‑1 cities. Domestic platforms’ competitive pricing and super‑app integrations (payments, scheduling, messaging) lower friction and accelerate adoption. As mental‑health awareness programs scale and employers introduce wellbeing benefits, China’s growth outpaces mature markets, with rising conversion from text‑based support to scheduled video sessions over the forecast period.

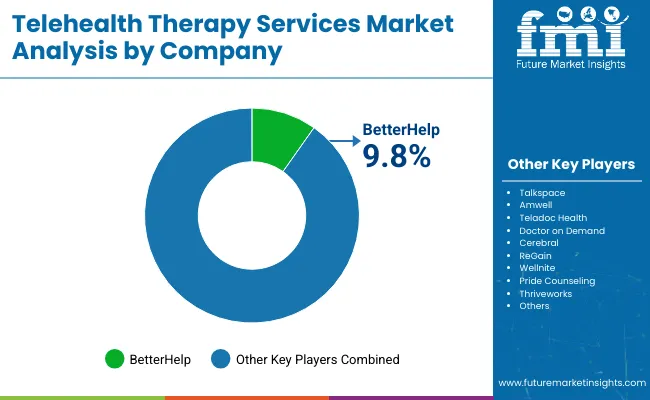

The Global Telehealth Therapy Services Market is moderately fragmented, with global leaders, mid-sized innovators, and niche specialists competing across diverse therapy delivery formats. BetterHelp holds a notable 9.8% share in 2025, emerging as the market leader through its extensive therapist base, affordable subscription models, and widespread digital reach. Other major players such as Talkspace, Amwell, Teladoc Health, Doctor on Demand, Cerebral, ReGain, Wellnite, Pride Counseling, and Thrive works hold strong positions, leveraging differentiated service models spanning individual, couples, group, and LGBTQ+ counseling. Their strategies increasingly emphasize AI-driven therapist matching, integration with employer wellness benefits, and partnerships with insurers and healthcare systems.

Growth is also supported by hybrid delivery models that combine live therapy sessions with asynchronous support via messaging, guided CBT programs, and wellness tracking apps. Mid-sized providers are gaining traction by focusing on personalization, niche demographics, and user-friendly mobile platforms, making them particularly relevant for younger and first-time therapy users. Competitive differentiation is shifting away from simple session delivery toward ecosystem-driven value propositions.

Leading companies are building integrated platforms that include clinical outcome tracking, digital triage tools, and subscription-based therapy packages, positioning themselves not only as therapy providers but as holistic mental-health ecosystems. This shift is expected to intensify competition, with players differentiating through scalability, therapist network quality, regional localization, and recurring revenue models.

Key Developments in Global Telehealth Therapy Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 8,824.3 Million |

| Therapy Type | Cognitive Behavioral Therapy (CBT), Psychodynamic Therapy, Person-Centered Therapy |

| Session Medium | Video Conferencing, Instant Messaging / Chat, Telephone (Audio) |

| End-use | Residential, Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BetterHelp, Talkspace, Amwell, Teladoc Health, Doctor on Demand, Cerebral, ReGain, Wellnite, Pride Counseling, Thriveworks |

| Additional Attributes | Dollar sales by therapy type and session medium, adoption trends across residential and commercial end-use, and expanding insurance and employer-wellness partnerships are shaping the telehealth therapy services market. Rising demand for video-based and chat-based therapy sessions is fueling platform adoption, while AI-driven personalization and multilingual access are making services more inclusive and scalable. |

The global market is estimated at USD 8,824.3 million in 2025.

The market is projected to reach USD 18,541.2 million by 2035.

The market is expected to grow at a 7.7% CAGR between 2025 and 2035.

Key service categories include Therapy Type (CBT, Psychodynamic, Person-Centered), Session Medium (Video Conferencing, Instant Messaging/Chat, Telephone), and End Use (Residential, Commercial).

By session medium, Video Conferencing is set to command 23.8% share in 2025 (≈ USD 2,100.2 million). By therapy type, CBT leads with 35.7% (≈ USD 3,150.3 million); by end use, Residential holds 65.3% (≈ USD 5,762.3 million).

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Dose Radiotherapy Services Market – Growth & Forecast 2025 to 2035

Telehealth Kiosk Market Size and Share Forecast Outlook 2025 to 2035

Telehealth and Telemedicine Market Growth - Trends & Forecast 2025 to 2035

Telehealth Software Market Analysis by Competent, Deployment, End-user, and Region Through 2035

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Mesotherapy Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Cryotherapy Market Growth - Demand, Trends & Emerging Applications 2025 to 2035

Aromatherapy Market Size and Share Forecast Outlook 2025 to 2035

Radiotherapy Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy-Induced Nausea And Vomiting Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Lamps And Units For Aesthetic Medicine Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Equipment Market Size and Share Forecast Outlook 2025 to 2035

Phototherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Heat Therapy Units Market Analysis - Size, Share, and Forecast 2025 to 2035

Chemotherapy Induced Anemia Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA