The telehealth kiosk market is gaining strong traction due to the growing integration of digital health infrastructure, rising demand for remote healthcare access, and ongoing advancements in telecommunication technologies. Increasing patient inclination toward contactless consultations, supported by regulatory acceptance of telemedicine practices, is accelerating deployment across hospitals, clinics, and corporate environments.

Current dynamics are characterized by healthcare providers expanding digital care models to improve service accessibility and operational efficiency. The future outlook remains positive as health systems increasingly adopt hybrid care frameworks, combining in-person and virtual consultations through smart kiosks.

Market growth is being reinforced by advancements in AI-enabled diagnostics, enhanced connectivity, and secure data management solutions The growth rationale is founded on the expanding healthcare digitization trend, the demand for patient-centered care delivery, and the capacity of telehealth kiosks to reduce waiting times, optimize clinician resources, and provide consistent monitoring, thereby positioning the market for robust and sustained expansion in the coming years.

| Metric | Value |

|---|---|

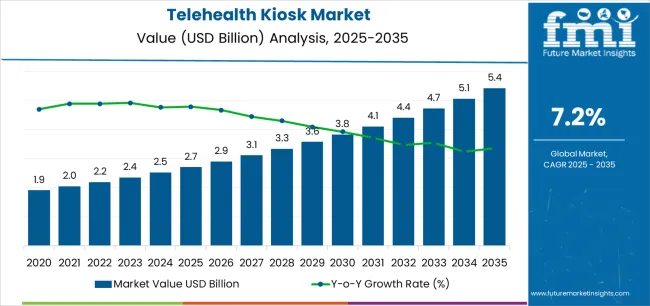

| Telehealth Kiosk Market Estimated Value in (2025 E) | USD 2.7 billion |

| Telehealth Kiosk Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The market is segmented by Product Type, Application, Modality, and End User and region. By Product Type, the market is divided into System, Software, and Accessories. In terms of Application, the market is classified into Teleconsultation, Remote Patient Monitoring, Store And Data Transfer, Medication Management, Health Education & Awareness, Behavioural Telecare, and Other Applications. Based on Modality, the market is segmented into Fixed and Portable. By End User, the market is divided into Hospital Settings, Clinic Settings, Office Premises, Retail Outlets, Supermarkets/Hypermarkets, Community Centres, and Other End Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

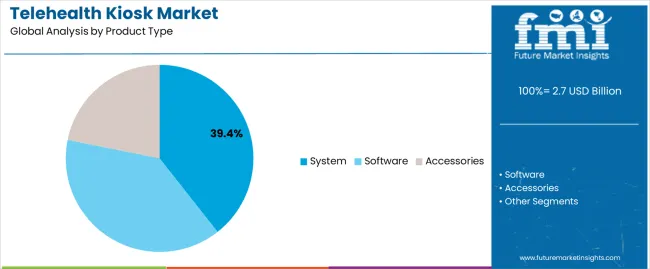

The system segment, accounting for 39.4% of the product type category, has maintained leadership due to its comprehensive configuration, integrating diagnostic peripherals, connectivity modules, and interactive interfaces within a single unit. Its adoption has been driven by hospitals and corporate wellness centers seeking end-to-end teleconsultation solutions with minimal setup complexity.

Reliability, data security, and user-friendly design have enhanced product acceptance. The segment’s growth has been supported by advancements in medical device interoperability and seamless integration with electronic health records.

Market players are focusing on system customization to address varied clinical and non-clinical requirements, which has strengthened its dominance Future growth is expected to be driven by innovations in biometric sensors, portable configurations, and AI-assisted functionalities that enhance real-time diagnostics and improve patient engagement outcomes.

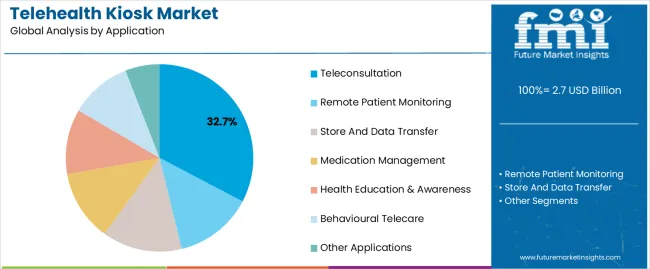

The teleconsultation segment, representing 32.7% of the application category, has emerged as the leading application area due to its pivotal role in enabling remote medical access. The segment’s growth has been accelerated by increasing adoption of virtual care platforms and the necessity for continuous patient monitoring in both urban and rural settings.

Healthcare systems have leveraged teleconsultation kiosks to address specialist shortages, reduce appointment delays, and manage chronic diseases more efficiently. Strong regulatory backing for telemedicine reimbursement has further bolstered adoption.

The segment benefits from improved user experience, lower operational costs, and real-time communication capabilities that support effective diagnosis and treatment With growing emphasis on accessibility, convenience, and preventive healthcare, teleconsultation through kiosks is expected to remain the most prominent application over the forecast period.

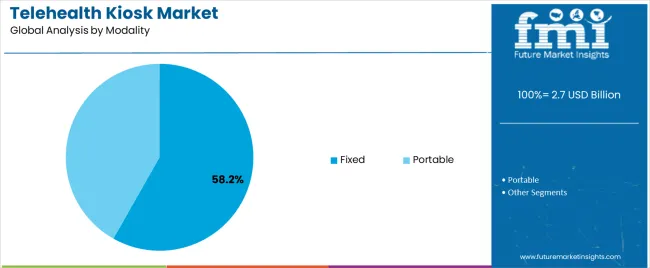

The fixed segment, holding 58.2% of the modality category, has been leading due to its stability, higher throughput capacity, and suitability for deployment in healthcare facilities and corporate environments. Its market share is being reinforced by consistent use in high-traffic locations such as hospitals, airports, and public institutions, where durable and permanently installed kiosks ensure continuous service availability.

The segment’s success is supported by robust hardware design, secure network connections, and minimal maintenance requirements. Health systems prefer fixed installations for their reliability and integration with centralized data systems.

Ongoing advancements in connectivity and display technologies are enhancing operational performance Future adoption will be supported by large-scale digital health initiatives and government programs promoting smart infrastructure, ensuring that the fixed modality continues to hold its dominant position in the telehealth kiosk market.

Integration with Cloud-based Services

Telehealth kiosks connected to cloud-based services that provide essential patient storage are on the rise within the healthcare industry. This usefulness is coordinated with pharmacies that respond quickly, in compliance with legitimate prescriptions, and with suitable payment options for the necessary pharmaceuticals. The knowledge acquired from such sophisticated functionality has enhanced patient-doctor engagement, improved hospital administration, and offered emerging market enterprises a quick and cost-effective option in the telehealth kiosk sector.

Digital Transformation in Healthcare

The increase in digitalization across healthcare businesses significantly impacts the market growth rate. Also, the adoption of 5G in hospital kiosks that will benefit from faster speed and payment efficiency. This is contributing to the increase in the demand for telehealth kiosks in addition to the increasing number of payment kiosks in healthcare industry. Moreover, it is expected that a rising biometrics and face recognition technologies integrated hospital kiosk are likely to support market expansion.

This section provides detailed insights into specific segments in the telehealth kiosk industry.

| By Product Type | System |

|---|---|

| Market Share in 2025 | 67.50% |

In 2025, telehealth kiosk systems are likely to hold 67.50% of the market share.

| Leading Application Segment | Teleconsultation |

|---|---|

| Market Share in 2025 | 29.80% |

In 2025, teleconsultation leads among application segments in the telehealth kiosk industry with a significant share of 29.80%.

The section analyzes the telehealth kiosk market across key countries, including the United States, United Kingdom, China, Japan, and South Korea. The analysis delves into the specific factors driving the demand for telehealth kiosks in these countries.

| Countries | CAGR |

|---|---|

| United States | 3.40% |

| United Kingdom | 4.50% |

| China | 4.80% |

| Japan | 2.20% |

| South Korea | 4.50% |

The United States market is anticipated to grow at a rate of 3.40% by 2035. Due to the large population in the United States, there is a high demand for healthcare services. In some places, there are not enough healthcare workers; therefore, another way is necessary. Telehealth kiosks come fully packed with technology that enables easy access by all types of patients through secure means of communication thus popularizing them among patients worldwide. Increased insurance coverage has lead to growth in the use of telehealth kiosks.

The telehealth kiosk market in the UK has been projected to grow at a CAGR of 4.50% through 2035. The United Kingdom faces problems with regard to access to doctors in some areas, similar to the United States health system.

Telehealth kiosks represent an enticing answer by providing remote consultations. It is worth noting that the UK government actively advocates for programs developed to improve accessibility and other stages of adoption of telehealth technologies, including telehealth kiosks.

China’s telehealth kiosk market has seen stable expansion, and it is expected to continue this trend with a CAGR of 4.8% towards 2035. There are growing medical needs since China has a huge population which continues to grow at a steady pace. The government supports offering these kinds of services via technology because it knows it can solve such problems. As a result, telehealth kiosks can be introduced as an intervention that bridges all gaps present in accessing healthcare especially in remote areas of China.

In Japan, the growth of the telehealth kiosk market is projected to be at a 2.20% CAGR through 2035, showing a mature healthcare system with an established health infrastructure. Still, there is a potential for growth as they merge with existing services.

Telehealth kiosks could provide remote monitoring that can be very useful in managing chronic conditions in Japan, which has a rapidly aging population. The healthcare sector of Japan is open to new technologies and innovations; hence, it can widely accept telehealth kiosks.

South Korea's telehealth kiosk market is projected to expand by a CAGR of 4.50% through 2035. This growth has LED the South Korean government to consider telehealth initiatives that would enhance telehealth kiosk performance.

South Korea, just like Japan, has an aging population that requires remote healthcare monitoring and consultations provided by these centers. As technology advances, South Korea leads in innovation, and this sets a good stage for deploying the use of telehealth kiosks as technology matures and user experience improves.

A conflict is building up between traditional healthcare providers and telehealth firms that concentrate on that service. Telehealth kiosks may be viewed by established hospitals and clinics as potentially dangerous in the sense of losing patients. On the other hand, some might consider this by coming up with their own telehealth kiosk solutions or teaming up with already existing telehealth companies.

In contrast, this is seen as an opportunity for exclusive telehealth firms to extend their services beyond conventional medical centers and provide convenient healthcare. This rivalry is consequently positive for patients since it brings about new ideas in terms of innovation that could also lower service costs due to market pressure.

Established players and telehealth-focused companies are looking into fostering partnerships and acknowledging the significance of a holistic healthcare journey. Case in point, these alliances can come about through brand sharing so that one partner can benefit from another’s reputation, thus attracting more clients. Moreover, ensuring technology integration facilitates smooth data transfer between hospital or clinic IT systems and telehealth kiosks.

Recent Developments in the Telehealth Kiosk Industry

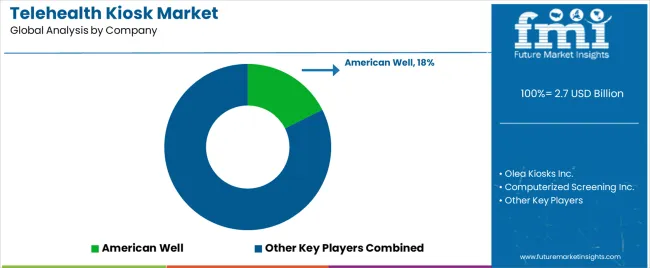

The global telehealth kiosk market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the telehealth kiosk market is projected to reach USD 5.4 billion by 2035.

The telehealth kiosk market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in telehealth kiosk market are system, outdoor kiosks, indoor kiosks, software and accessories.

In terms of application, teleconsultation segment to command 32.7% share in the telehealth kiosk market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Telehealth Therapy Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Telehealth and Telemedicine Market Growth - Trends & Forecast 2025 to 2035

Telehealth Software Market Analysis by Competent, Deployment, End-user, and Region Through 2035

Medical Kiosk Market Size and Share Forecast Outlook 2025 to 2035

Digital Kiosk Display Market

Smart City Kiosk Deployment Market – Digital Urbanization 2034

Global Veterinary Telehealth Market Analysis – Size, Share & Forecast 2024-2034

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Decentralized Packaging Kiosks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA