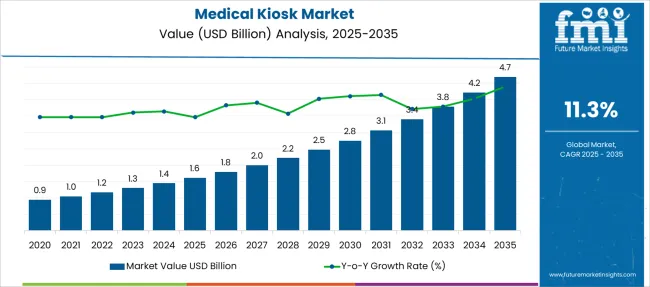

The Medical Kiosk Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 11.3% over the forecast period.

| Metric | Value |

|---|---|

| Medical Kiosk Market Estimated Value in (2025 E) | USD 1.6 billion |

| Medical Kiosk Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 11.3% |

The Medical Kiosk market is experiencing notable growth, driven by increasing digital transformation across healthcare environments and the need to streamline patient engagement. The demand for contactless, efficient, and patient-centric services has significantly accelerated the deployment of self-service kiosks, especially in high-volume settings. Rising patient expectations for faster registration, reduced wait times, and improved service accessibility have further supported the market’s expansion.

Technological advancements in biometric verification, real-time insurance validation, and electronic health record integration have enhanced the functionality and reliability of medical kiosks. Healthcare providers are focusing on reducing administrative burdens and optimizing human resource utilization, which is reinforcing the strategic adoption of kiosk-based solutions.

The integration of AI-driven interfaces, touchless technology, and multilingual support is making these systems more adaptable across diverse demographics. As patient throughput continues to grow and regulatory frameworks emphasize patient safety and data compliance, the Medical Kiosk market is expected to witness sustained investment and innovation across both public and private healthcare sectors..

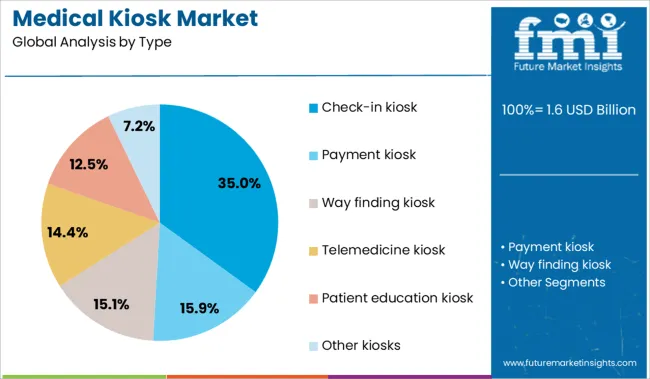

The market is segmented by Type, End-use, and region. By Type, the market is divided into Check-in kiosk, Payment kiosk, Way finding kiosk, Telemedicine kiosk, Patient education kiosk, and Other kiosks. In terms of End-use, the market is classified into Hospitals, Clinics, Pharma stores, and Other end-users.

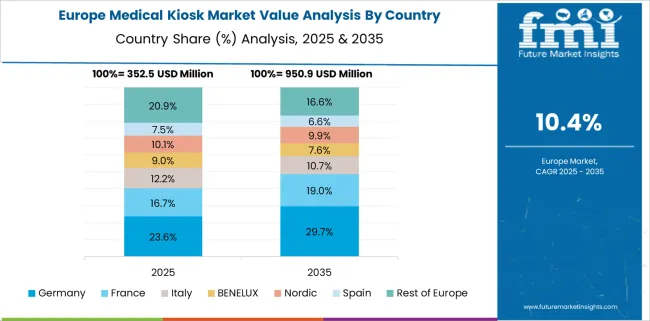

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The check-in kiosk segment is projected to hold 35% of the Medical Kiosk market revenue share in 2025, making it the leading type category. This segment has gained dominance due to its direct impact on enhancing patient intake efficiency and administrative workflow optimization. Check-in kiosks have been widely adopted by healthcare facilities to automate the patient registration process, reducing reliance on front-desk staff and minimizing operational bottlenecks.

Their ability to handle insurance verification, demographic updates, and consent form processing in a secure and user-friendly manner has further expanded their utility. The growing preference for digital interactions over manual procedures has also strengthened the segment’s adoption, particularly in outpatient and diagnostic centers.

Additionally, the rising demand for infection control and contactless check-ins has accelerated investments in advanced kiosk models equipped with touchless sensors and voice navigation. As healthcare systems prioritize throughput and experience, the check-in kiosk type is expected to maintain its leading position within the medical kiosk landscape..

The hospitals segment is expected to account for 42% of the Medical Kiosk market revenue share in 2025, establishing it as the dominant end-use category. This growth has been driven by the rising need for workflow automation, enhanced patient intake processes, and optimized service delivery across high-traffic hospital environments. Hospitals have increasingly adopted medical kiosks to manage patient registration, queue management, billing inquiries, and navigation assistance.

These kiosks have supported healthcare facilities in meeting stringent regulatory standards for patient information accuracy and electronic documentation. The deployment of kiosks has also contributed to workforce efficiency by reallocating administrative duties to automated platforms, thereby allowing staff to focus on clinical care.

Furthermore, hospitals have leveraged kiosks to improve patient satisfaction through shorter wait times and personalized digital interfaces. With a growing emphasis on data interoperability, population health management, and system-wide digitization, hospitals are projected to remain the primary adopters of medical kiosk solutions, ensuring this segment's sustained leadership..

The elevation in patient volumes and outpatient services has been identified as a core catalyst for medical kiosk deployment.

In 2023, check-in kiosks began being used to alleviate front-desk congestion and expedite patient registration processes. By 2024, payment and wayfinding kiosks were being installed in clinics to streamline billing and navigation, reducing administrative workload and wait times. In 2025, these systems were being expanded into pharmacy and telemedicine kiosks, which have been integrated into healthcare facilities to extend access points and enhance service flow. These developments suggest that pressure on administrative efficiency is shaping kiosk market expansion.

Retail pharmacy chains were identified in 2023 as strategic partners for medical kiosk adoption, when self-service diagnostic and teleconsultation kiosks began appearing in high-traffic locations. In 2024, these deployments were further integrated with pharmacy loyalty programs and prescription processing systems, enabling streamlined care delivery within retail environments. By 2025, kiosks capable of dispensing over-the-counter medications and scheduling follow-up consultations were being piloted. These initiatives have shown that kiosks can shift from standalone units to embedded retail care hubs, offering accessible, convenient screening and consultation services. Providers aligning with pharmacy networks are thus positioned to capture growing foot traffic and enhance patient touchpoints without traditional clinical infrastructure.

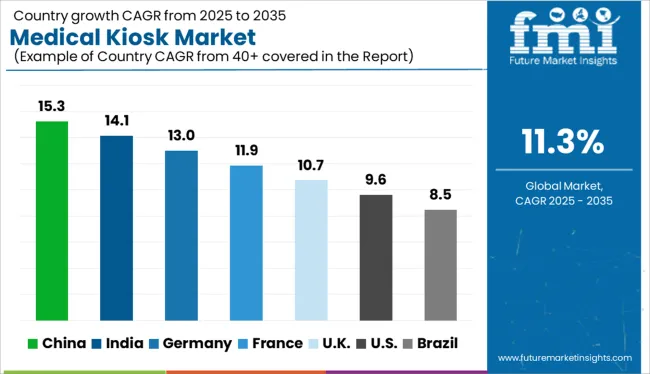

| Country | CAGR |

|---|---|

| China | 15.3% |

| India | 14.1% |

| Germany | 13.0% |

| France | 11.9% |

| UK | 10.7% |

| USA | 9.6% |

| Brazil | 8.5% |

The global medical kiosk market is projected to grow at a CAGR of 11% from 2025 to 2035. China leads with a 15.3% CAGR, followed by India at 14.1% and Germany at 13.0%. France aligns closely with the global average at 11.9%, while the United Kingdom records slightly lower growth at 10.7%. Growth in China and India is driven by public health digitalization, telemedicine expansion, and underserved rural demand. Germany advances through hospital automation and insurance integration. France leverages eHealth funding for preventive screening kiosks, while the UK focuses on pharmacy-based deployment with remote GP access features.

China is projected to lead the medical kiosk market with a 15.3% CAGR, driven by digital health adoption across hospitals, public health clinics, and smart city projects. Touchscreen kiosks equipped with diagnostic sensors, facial recognition, and e-prescription printing have been deployed at community health centers. These systems are integrated with China’s centralized digital health infrastructure and electronic medical record networks. Regional OEMs supply fully autonomous units supporting vitals tracking and specialist referrals.

India is forecast to grow its medical kiosk market at a 14.1% CAGR, supported by digital healthcare schemes, Ayushman Bharat infrastructure, and telemedicine penetration in rural regions. State-run primary care centers and private diagnostic chains are deploying kiosks for basic vitals, registration, and e-consultation linkages. Indian startups are creating modular kiosks equipped with BP, glucose, and ECG sensors to cater to chronic disease management.

Germany is expected to grow at a 13.0% CAGR in the medical kiosk sector, supported by demand for patient automation, e-check-in systems, and hospital workflow optimization. Kiosks are being placed in both private and public hospitals to reduce manual registration and support GDPR-compliant health data exchange. Insurance companies also use kiosks for claims submissions and policyholder onboarding. Use in pharmacies for minor diagnostics is gaining visibility.

France is projected to expand its medical kiosk market at an 11.9% CAGR, with adoption centered around preventive health screening and eHealth automation. Kiosks are being introduced in community pharmacies, government health centers, and workplace wellness programs. France’s health ministry co-funds pilot projects for kiosks offering cholesterol, glucose, and BP assessments. Regulatory push for decentralized diagnostics favors kiosk deployment in suburban zones.

The United Kingdom is forecast to grow at a 10.7% CAGR in the medical kiosk market, driven by controlled deployment in GP clinics, hospitals, and large retail pharmacies. NHS partnerships with digital health firms have launched pilot kiosks for patient intake, e-consults, and flu vaccination bookings. Kiosks are increasingly used in urban pharmacies for blood pressure and weight management programs. Despite strong potential, growth remains tempered by IT infrastructure lag and compliance regulations.

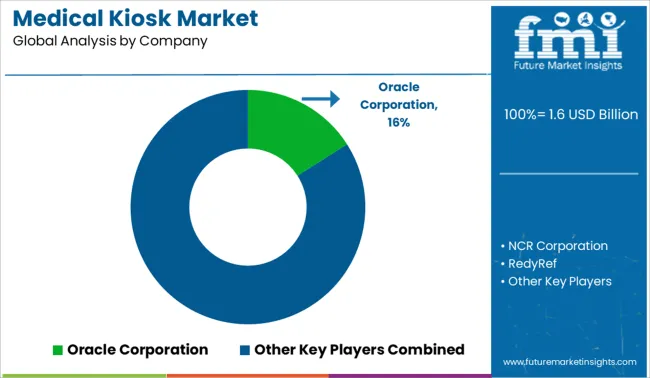

The medical kiosk market is moderately consolidated, led by Oracle Corporation with a significant market share. The company holds a dominant position through its cloud-based health IT integration, patient engagement platforms, and scalable kiosk-enabled EHR solutions. Dominant player status is held exclusively by Oracle Corporation. Key players include NCR Corporation, RedyRef, Fabcon, Vecna, and OLEA Kiosks Inc. - each offering self-service kiosk systems tailored for check-in, teleconsultation, and health data management across hospitals, pharmacies, and clinics. Emerging player Advantech Co., Ltd. focuses on industrial-grade hardware, modular configurations, and localized healthcare deployments requiring durable and interoperable systems. Market demand is driven by rising preference for contactless medical services, operational efficiency in clinical workflows, and digital transformation in outpatient and primary care settings.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Type | Check-in kiosk, Payment kiosk, Way finding kiosk, Telemedicine kiosk, Patient education kiosk, and Other kiosks |

| End-use | Hospitals, Clinics, Pharma stores, and Other end-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Oracle Corporation, NCR Corporation, RedyRef, Fabcon, Vecna, OLEA Kiosks Inc., and Advantech Co., Ltd. |

| Additional Attributes | Dollar sales by kiosk type (check-in, telemedicine, diagnostic, payment & wayfinding), Dollar sales by component (hardware, software, services), Trends in AI/IoT‑enabled and touchless systems, Use of telehealth connectivity and biometric/self‑diagnostics modules, Growth in hospital deployments and retail health access points, Regional adoption led by North America, fastest CAGR in Asia‑Pacific by 2030 |

The global medical kiosk market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the medical kiosk market is projected to reach USD 4.7 billion by 2035.

The medical kiosk market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in medical kiosk market are check-in kiosk, payment kiosk, way finding kiosk, telemedicine kiosk, patient education kiosk and other kiosks.

In terms of end-use, hospitals segment to command 42.0% share in the medical kiosk market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA