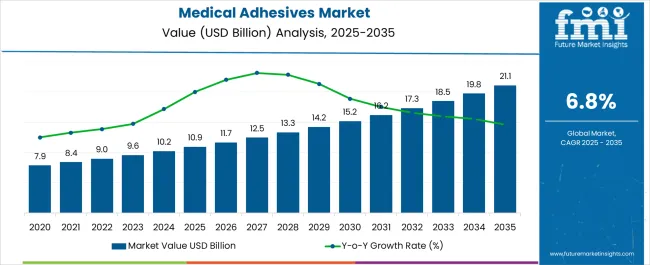

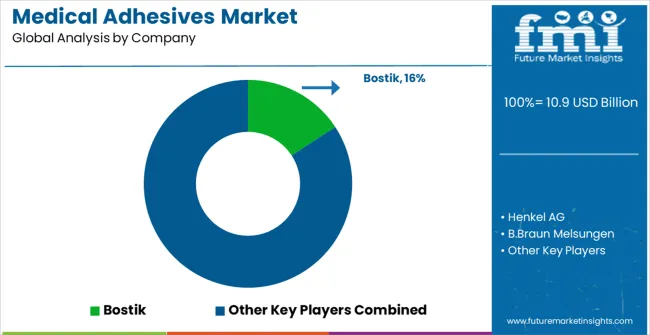

The Medical Adhesives Market is estimated to be valued at USD 10.9 billion in 2025 and is projected to reach USD 21.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Medical Adhesives Market Estimated Value in (2025 E) | USD 10.9 billion |

| Medical Adhesives Market Forecast Value in (2035 F) | USD 21.1 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The Medical Adhesives market is expanding steadily, driven by the increasing adoption of advanced wound care solutions, surgical procedures, and medical device assembly that rely on effective adhesive technologies. Growing demand for minimally invasive surgeries, coupled with the rising prevalence of chronic diseases and trauma cases, is contributing to the widespread application of medical adhesives across healthcare settings. The industry is witnessing technological advancements such as bio-compatible formulations, faster curing times, and enhanced bonding strength, which are improving patient outcomes and operational efficiency.

Increasing investments in healthcare infrastructure, particularly in emerging economies, are creating new opportunities for market penetration. Additionally, regulatory approvals for innovative adhesive products are accelerating adoption across both developed and developing markets.

Sustainability trends, including the development of eco-friendly and natural adhesive formulations, are also reshaping industry dynamics As global healthcare systems continue to prioritize infection control, improved healing, and reduced surgical risks, the role of medical adhesives is becoming increasingly critical, ensuring their long-term market growth across multiple applications.

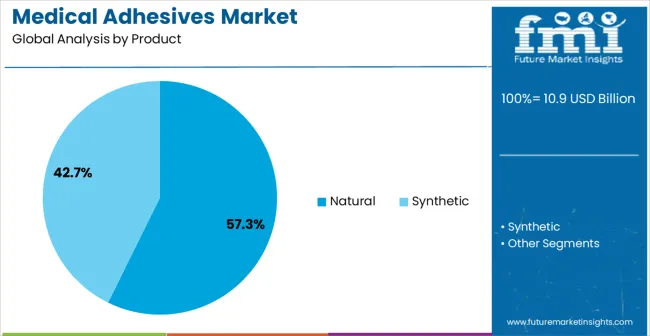

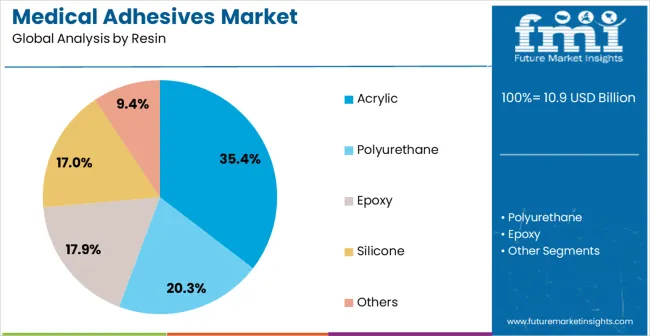

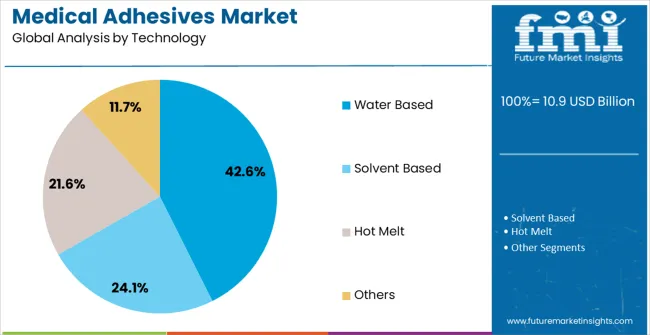

The medical adhesives market is segmented by product, resin, technology, application, end user, and geographic regions. By product, medical adhesives market is divided into Natural and Synthetic. In terms of resin, medical adhesives market is classified into Acrylic, Polyurethane, Epoxy, Silicone, and Others. Based on technology, medical adhesives market is segmented into Water Based, Solvent Based, Hot Melt, and Others. By application, medical adhesives market is segmented into Dental, Medical Device & Equipment, Internal Medical Application, and External Medical Application. By end user, medical adhesives market is segmented into Hospitals, Specialty Clinics, and Others. Regionally, the medical adhesives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural product segment is projected to account for 57.3% of the market revenue in 2025, making it the leading product type. Its dominance is being driven by the increasing demand for biocompatible, safe, and eco-friendly adhesives that can support a wide range of medical applications. Natural adhesives, derived from biological sources, are widely adopted due to their lower toxicity, reduced side effects, and compatibility with sensitive tissues.

They are particularly suited for wound closure, dressing applications, and surgical interventions where patient safety is prioritized. Growing awareness among healthcare providers about the benefits of natural materials is accelerating their adoption. In addition, regulatory approvals and patient preference for environmentally sustainable products are reinforcing growth.

As healthcare systems worldwide focus on enhancing patient outcomes while adhering to stringent safety and compliance standards, the natural product segment is expected to maintain its leadership position Its ability to align with sustainability initiatives and provide effective performance is ensuring strong long-term market presence.

The acrylic resin segment is anticipated to capture 35.4% of the market revenue in 2025, establishing itself as the leading resin type. This growth is being fueled by the superior adhesive strength, durability, and versatility of acrylic-based formulations, which make them highly effective for medical applications. Acrylic adhesives are widely used in medical device assembly, wound care, and surgical applications, where long-lasting bonding is required.

Their resistance to moisture and environmental conditions ensures stability and reliability across diverse medical settings. Additionally, the compatibility of acrylic adhesives with different substrates enhances their adoption across a broad range of medical products. The increasing use of single-use medical devices and disposable equipment is further driving demand for acrylic adhesives.

Technological advancements have led to the development of low-irritant and fast-curing acrylic formulations, which are improving patient comfort and treatment efficiency As healthcare providers continue to prioritize high-performance adhesives that support critical medical functions, the acrylic resin segment is expected to remain a market leader.

The water based technology segment is expected to hold 42.6% of the market revenue in 2025, making it the dominant technology type. Its leadership is supported by the growing preference for safer, eco-friendly adhesive technologies that minimize harmful chemical exposure and support sustainability objectives. Water based adhesives are widely adopted due to their low volatile organic compound emissions, non-toxic formulations, and ease of handling in medical environments.

They are extensively used in wound care products, medical tapes, and surgical applications where patient safety and environmental considerations are paramount. The increasing adoption of water based adhesives in emerging economies is also driving growth, as healthcare providers seek cost-effective yet high-performance solutions.

Advancements in polymer science are further enhancing the bonding strength and curing efficiency of water based adhesives, expanding their applicability across complex medical procedures As global healthcare systems emphasize both environmental responsibility and patient safety, the water based technology segment is expected to strengthen its leadership, supported by sustainable innovation and clinical effectiveness.

“The aspects setting the tone for the global market include the expanding adoption of minimally invasive procedures as well as the rising number of medical implantation or transplanting procedures carried out globally.”

Medical adhesives are used across a variety of surgical operations, such as orthopedic surgery, organ implants, and cardiovascular surgery, to lessen blood loss. Medical adhesives help with wound healing naturally and stop air and liquid leaks during and after surgery. New kinds of adhesives and sealants are used in place of surgical sutures and staples.

These adhesives are used in orthopedic treatments, cardiac surgery, thoracic surgery, aesthetic surgery, neurosurgery, and ophthalmologic procedures in addition to dental extraction and oral surgery with the advantage of quicker hemostasis and more efficacy than conventional procedures.

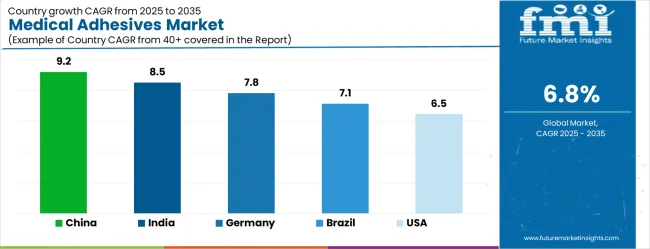

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

| UK | 5.8% |

| Japan | 5.1% |

The Medical Adhesives Market is expected to register a CAGR of 6.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.2%, followed by India at 8.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.1%, yet still underscores a broadly positive trajectory for the global Medical Adhesives Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.8%. The USA Medical Adhesives Market is estimated to be valued at USD 3.8 billion in 2025 and is anticipated to reach a valuation of USD 3.8 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 523.4 million and USD 350.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.9 Billion |

| Product | Natural and Synthetic |

| Resin | Acrylic, Polyurethane, Epoxy, Silicone, and Others |

| Technology | Water Based, Solvent Based, Hot Melt, and Others |

| Application | Dental, Medical Device & Equipment, Internal Medical Application, and External Medical Application |

| End User | Hospitals, Specialty Clinics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bostik, Henkel AG, B.Braun Melsungen, 3M, CryoLife, C R Bard, Cyberbond, Chemence Medical Inc., Ethicon, Covidien, GlaxoSmithKline plc., Adhezion Biomedical, and Cohera Medical |

The global medical adhesives market is estimated to be valued at USD 10.9 billion in 2025.

The market size for the medical adhesives market is projected to reach USD 21.1 billion by 2035.

The medical adhesives market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in medical adhesives market are natural and synthetic.

In terms of resin, acrylic segment to command 35.4% share in the medical adhesives market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA