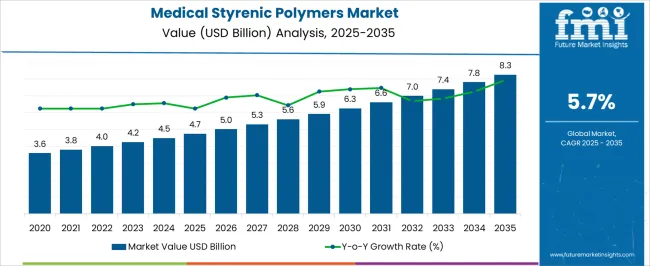

The medical styrenic polymers market is projected to grow from USD 4.7 billion in 2025 to USD 8.3 billion by 2035, reflecting a CAGR of 5.7%. This growth represents an absolute dollar opportunity of USD 3.6 billion over the decade. Starting at USD 3.6 billion in the early years, the market experiences steady expansion, reaching USD 6.3 billion by 2030. For companies in medical devices and polymer manufacturing, this growth indicates substantial revenue potential.

The absolute dollar opportunity from 2025 to 2035 highlights annual gains that grow from USD 5.0 billion in 2026 to USD 7.8 billion in 2034, culminating at USD 8.3 billion in 2035. This predictable expansion allows companies to plan capacity, supply chain, and marketing strategies effectively. Capturing market share during this period ensures meaningful revenue gains while reducing investment risk. Companies entering or scaling operations in alignment with these trends can maximize returns and establish a strong foothold in the evolving medical styrenic polymers market.

| Metric | Value |

|---|---|

| Medical Styrenic Polymers Market Estimated Value in (2025 E) | USD 4.7 billion |

| Medical Styrenic Polymers Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

A breakpoint analysis of the medical styrenic polymers market highlights periods of gradual and accelerated growth. From 2025 to 2028, the market grows from USD 4.7 billion to USD 5.3 billion, with annual increments of around USD 0.2 billion. This early-stage period represents a stable phase where companies can establish operations, optimize supply chains, and evaluate demand patterns. Recognizing this initial breakpoint allows businesses to allocate resources efficiently, test product and marketing strategies, and build a foundation in the market.

Early engagement during this period sets the stage for capturing higher-value opportunities as growth accelerates in subsequent years. The next breakpoint occurs between 2030 and 2035, as the market expands from USD 6.3 billion to USD 8.3 billion, reflecting larger annual increments of USD 0.4–0.5 billion. This stage represents accelerated growth and significant absolute dollar opportunity, making strategic positioning essential.

The medical styrenic polymers market is progressing steadily, supported by increasing demand for high-performance, cost-effective materials in healthcare applications. Industry developments and polymer technology reports have emphasized the suitability of styrenic polymers for medical uses due to their durability, ease of processing, and compliance with regulatory standards for biocompatibility.

Growth has been further driven by the expansion of single-use medical devices and packaging solutions, fueled by stringent hygiene requirements and the shift toward disposable products to minimize contamination risks. Advances in polymer formulation have enabled enhanced properties such as improved impact resistance, chemical stability, and sterilization compatibility, expanding their application scope.

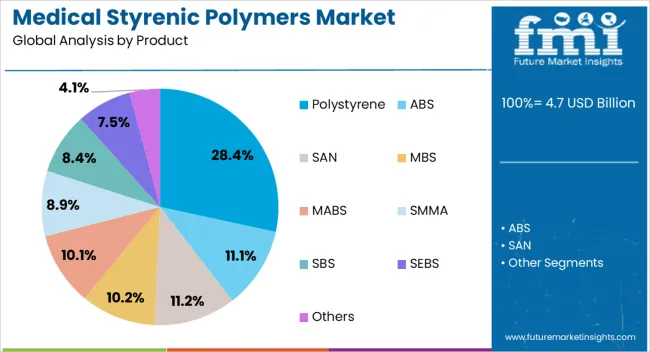

Additionally, the rise in global healthcare infrastructure investment, coupled with demand for lightweight and cost-efficient alternatives to traditional materials, has created sustained opportunities for styrenic polymers. Looking forward, innovations in recyclable and bio-based styrenic materials are expected to align with sustainability targets, while product and application demand will continue to be led by polystyrene and medical packaging segments due to their established utility and market penetration.

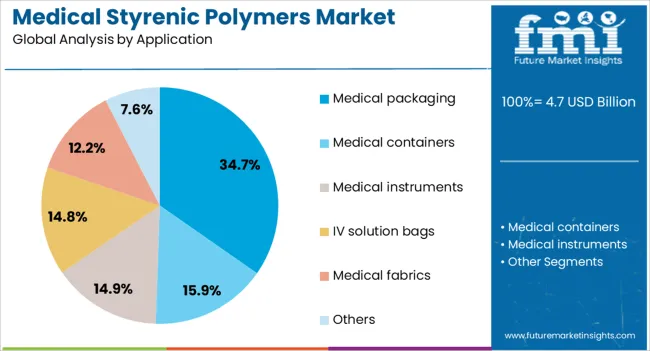

The medical styrenic polymers market is segmented by product, application, and geographic regions. By product, medical styrenic polymers market is divided into Polystyrene, ABS, SAN, MBS, MABS, SMMA, SBS, SEBS, and Others. In terms of application, medical styrenic polymers market is classified into Medical packaging, Medical containers, Medical instruments, IV solution bags, Medical fabrics, and Others. Regionally, the medical styrenic polymers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polystyrene segment is projected to hold 28.4% of the medical styrenic polymers market revenue in 2025, maintaining its position as the leading product category. Its dominance has been supported by its versatility, cost-effectiveness, and adaptability to various medical manufacturing processes, including injection molding and extrusion.

Polystyrene’s clarity, rigidity, and ease of sterilization have made it suitable for diagnostic components, labware, and protective enclosures. Additionally, its favorable price-to-performance ratio has encouraged its selection over alternative materials for high-volume production, especially in disposable applications.

Industry production data indicates that polystyrene’s established manufacturing base ensures consistent supply, while ongoing material enhancements—such as improved chemical resistance—are broadening its potential uses. The combination of affordability, reliability, and process efficiency positions polystyrene as a preferred choice within the medical styrenic polymers portfolio.

The medical packaging segment is projected to account for 34.7% of the medical styrenic polymers market revenue in 2025, reflecting its crucial role in ensuring product safety, sterility, and compliance with healthcare standards. Styrenic polymers, particularly polystyrene, have been favored in medical packaging due to their durability, lightweight nature, and ability to be formed into protective yet transparent enclosures.

Growth in this segment has been accelerated by the rising demand for sterile, tamper-evident packaging across pharmaceuticals, surgical instruments, and diagnostic kits. Reports from healthcare packaging associations have highlighted that these materials can withstand multiple sterilization methods, including gamma irradiation and ethylene oxide treatment, without significant degradation.

Furthermore, the global increase in healthcare logistics and e-commerce for medical supplies has reinforced the need for packaging that offers both mechanical strength and regulatory compliance. With ongoing innovations in barrier properties and sustainable packaging solutions, the medical packaging segment is set to retain its leadership within the application spectrum.

The medical styrenic polymers market is expanding due to increasing use in medical devices, diagnostic kits, and laboratory consumables. North America and Europe lead in adoption of high-purity, biocompatible polymers for critical medical applications, while Asia-Pacific shows rapid growth driven by medical device manufacturing and hospital expansion. Key manufacturers differentiate through polymer grade, processability, and regulatory compliance. Market growth is supported by rising demand for disposable medical devices, stringent hygiene standards, and technological advancements in diagnostic and laboratory equipment.

Medical styrenic polymers vary in purity, molecular weight, and biocompatibility. Europe and North America prioritize ultra-pure, sterilizable polymers suitable for syringes, diagnostic cartridges, and labware. In contrast, Asia-Pacific often adopts cost-efficient grades for non-critical devices or bulk disposables. Differences in polymer quality affect device safety, sterilization capability, and regulatory approval. Leading global suppliers maintain consistent high-purity standards, whereas smaller regional manufacturers may produce polymers with broader quality ranges. These contrasts shape adoption across professional medical applications, influence regulatory compliance, and impact pricing and supplier credibility in high-value versus cost-sensitive markets.

Medical styrenic polymer manufacturers face stringent regulations from FDA, EMA, and ISO standards. North American and European suppliers must ensure biocompatibility, sterilization compatibility, and traceability, whereas emerging Asia-Pacific markets are gradually adopting international standards. Differences in regulatory adherence influence market entry, product acceptance, and adoption speed. Companies with certified polymers gain trust among OEMs and healthcare institutions, while suppliers without full compliance face limited access to regulated applications. Regulatory contrasts affect product formulation, testing requirements, and global market competitiveness. Suppliers that align with regional and international standards can capture high-value markets and secure long-term contracts with medical device manufacturers.

Medical device, laboratory, and diagnostic industries drive demand for styrenic polymers. North America and Europe prioritize advanced applications requiring high clarity, mechanical strength, and chemical resistance. Asia-Pacific growth is driven by hospital expansion, diagnostic kit production, and cost-sensitive disposable device manufacturing. Differences in end-use applications influence polymer grade selection, production planning, and marketing strategies. Global manufacturers provide tailored solutions for high-value, performance-sensitive applications, while regional producers focus on bulk, standard-grade polymers. Understanding these contrasts enables suppliers to optimize product offerings and inventory, targeting premium versus high-volume segments effectively.

Polymer manufacturing scale and raw material sourcing impact supply consistency and quality. Europe and North America rely on established facilities with controlled production and strict quality systems. Asia-Pacific relies on high-volume production with variable process control, affecting consistency in polymer characteristics. Availability of styrene monomer, energy costs, and production efficiency influence pricing and delivery timelines. Companies with integrated operations and diversified sourcing maintain a steady supply for medical device manufacturers, whereas smaller regional producers may experience shortages during peak demand. Production and supply differences shape regional adoption, contract fulfillment, and competitive positioning across the medical polymer market.

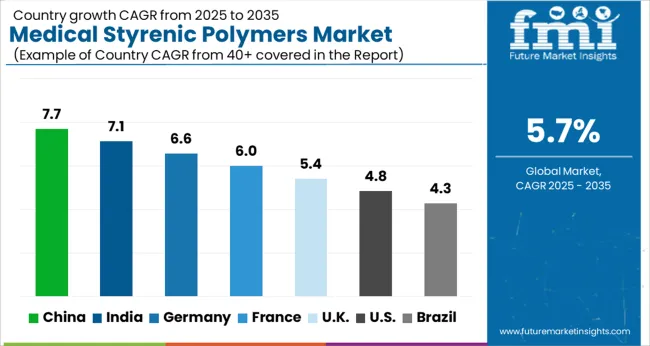

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

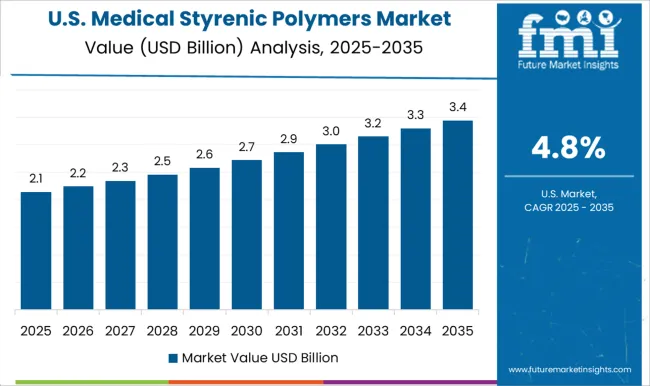

| USA | 4.8% |

| Brazil | 4.3% |

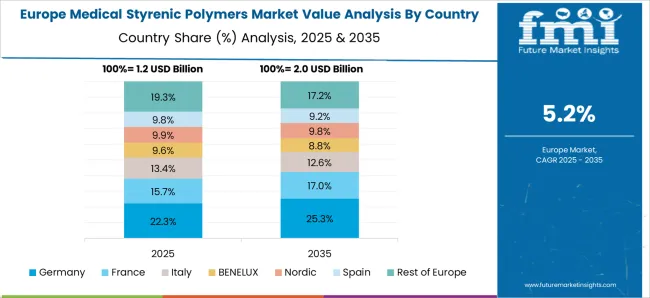

The global medical styrenic polymers market was projected to grow at a 5.7% CAGR through 2035, driven by demand in medical devices, packaging, and healthcare applications. Among BRICS nations, China recorded 7.7% growth as large-scale production facilities were commissioned and compliance with chemical and medical safety standards was enforced, while India at 7.1% growth saw expansion of manufacturing units to meet rising regional consumption in healthcare and medical device applications. In the OECD region, Germany at 6.6% maintained substantial output under strict industrial and healthcare regulations, while the United Kingdom at 5.4% relied on moderate-scale operations for medical and laboratory applications. The USA, expanding at 4.8%, remained a mature market with steady demand across healthcare, diagnostics, and packaging segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Medical styrenic polymers market in China is growing at a CAGR of 7.7%. Between 2020 and 2024, growth was driven by rising demand in medical devices, packaging, and disposable healthcare products. Domestic manufacturers focused on producing high purity, biocompatible, and cost effective polymers for surgical instruments, diagnostic kits, and drug delivery systems. In the forecast period 2025 to 2035, growth is expected to accelerate with increasing adoption in advanced medical devices, implantable components, and innovative healthcare applications. Government support for healthcare manufacturing, rising medical infrastructure, and growing hospital and diagnostic networks will further drive market expansion. China remains a leading market due to industrial scale, polymer production capacity, and growing healthcare sector.

Medical styrenic polymers market in India is growing at a CAGR of 7.1%. Historical period 2020 to 2024 saw growth supported by rising demand for medical devices, diagnostics, and hospital consumables. Manufacturers focused on high quality, biocompatible, and cost efficient polymers. Expansion of healthcare infrastructure, hospitals, and diagnostic centers created steady demand. In the forecast period 2025 to 2035, market growth is expected to continue with adoption in implantable devices, surgical instruments, and innovative medical applications. Government initiatives promoting healthcare manufacturing and increased hospital investments will further drive growth. India is projected to maintain strong growth due to growing healthcare demand and industrial polymer capabilities.

Medical styrenic polymers market in Germany is growing at a CAGR of 6.6%. Between 2020 and 2024, growth was supported by demand in medical devices, laboratory equipment, and hospital consumables. Manufacturers focused on high purity, biocompatible, and EU compliant polymers. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption in implantable devices, surgical kits, and advanced healthcare applications. Strong regulatory standards, innovation in medical polymers, and rising demand for disposable and high performance products will further support adoption. Germany remains a key European market due to advanced healthcare infrastructure and technological expertise.

Medical styrenic polymers market in the United Kingdom is growing at a CAGR of 5.4%. During 2020 to 2024, adoption was driven by medical devices, hospital consumables, and diagnostics applications. Manufacturers focused on reliable, biocompatible, and high-performance polymers. In the forecast period 2025 to 2035, market growth is expected to continue moderately with increasing adoption in surgical instruments, implantable devices, and innovative healthcare applications. Government healthcare programs, hospital expansions, and regulatory compliance will further support market expansion. The United Kingdom market reflects stable growth with emphasis on quality, performance, and biocompatibility.

Medical styrenic polymers market in the United States is growing at a CAGR of 4.8%. Historical period 2020 to 2024 saw growth driven by adoption in medical devices, diagnostics, and disposable healthcare products. Manufacturers focused on high purity, biocompatible, and reliable polymers. In the forecast period 2025 to 2035, growth is expected to continue steadily with increasing adoption in implantable devices, surgical instruments, and advanced medical applications. Technological innovation, regulatory compliance, and rising healthcare infrastructure will further support market expansion. The United States market demonstrates stable growth with emphasis on quality, performance, and advanced healthcare applications.

The market is characterized by the presence of major chemical companies, polymer manufacturers, and niche medical-grade material suppliers. Leading players such as INEOS Styrolution, Trinseo, and LG Chem dominate the market through extensive product portfolios that include styrene block copolymers, acrylonitrile butadiene styrene (ABS), and styrene acrylonitrile (SAN) formulations tailored for medical applications. These companies focus on producing high-purity, biocompatible, and sterilizable grades suitable for devices like syringes, IV components, diagnostic housings, and surgical instruments.

Regional manufacturers and specialty suppliers compete by offering customized compounds, faster delivery cycles, and cost-effective alternatives. Strategic collaborations with medical device OEMs and contract manufacturers are common to ensure compliance with regulatory standards such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) guidelines. Material performance, regulatory certifications, consistent quality, and technical support services drive competitive advantages. As demand for lightweight, durable, and transparent medical components rises, companies investing in R&D, expanding cleanroom production, and strengthening global distribution networks are positioned to maintain a strong foothold in the medical styrenic polymers market.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Product | Polystyrene, ABS, SAN, MBS, MABS, SMMA, SBS, SEBS, and Others |

| Application | Medical packaging, Medical containers, Medical instruments, IV solution bags, Medical fabrics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Styrolution group GmbH, BASF, Trinseo, SABIC, Chi Mei, Kraton, Chevron Phillips Chemical, Bayer MaterialScience, Nova Chemical, LG Chem, ELIX Polymers, Mitsubishi Chemical Holding, Ovation Polymers, Grupo Dynasol, and Formosa Chemical & Fibre Corporation |

| Additional Attributes | Dollar sales vary by polymer type, including high-impact polystyrene (HIPS), acrylonitrile-butadiene-styrene (ABS), and styrene-acrylonitrile (SAN); by application, such as medical devices, diagnostic equipment, laboratory disposables, and packaging; by end-use industry, spanning healthcare, diagnostics, and pharmaceuticals; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising healthcare infrastructure, demand for lightweight and durable polymers, and adoption in medical applications. |

The global medical styrenic polymers market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the medical styrenic polymers market is projected to reach USD 8.3 billion by 2035.

The medical styrenic polymers market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in medical styrenic polymers market are polystyrene, abs, san, mbs, mabs, smma, sbs, sebs and others.

In terms of application, medical packaging segment to command 34.7% share in the medical styrenic polymers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Anti-Decubitus Air Mattress Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Medical Holography Market Size and Share Forecast Outlook 2025 to 2035

Medical Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA