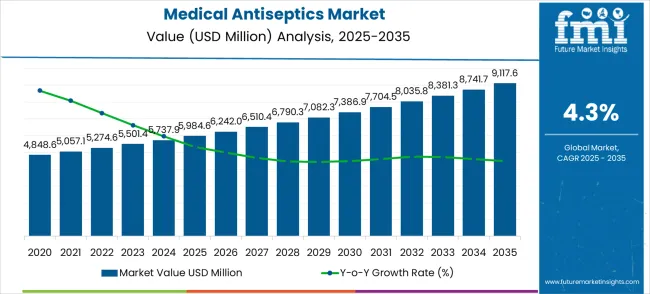

The global medical antiseptics market is expected to grow from USD 5,984.6 million in 2025 to approximately USD 9,117.6 million by 2035, recording an absolute increase of USD 3,133.0 million over the forecast period. This translates into a total growth of 52.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.3% between 2025 and 2035. The overall market size is expected to grow by approximately 1.52X during the same period, supported by the increasing emphasis on infection prevention and growing demand for advanced antimicrobial solutions in healthcare, household, and institutional applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 5,984.6 million |

| Market Forecast Value (2035) | USD 9,117.6 million |

| Market Forecast CAGR | 4.3% |

Between 2025 and 2030, the medical antiseptics market is projected to expand from USD 5,984.6 million to USD 7,386.9 million, resulting in a value increase of USD 1,402.3 million, which represents 44.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising awareness of hygiene importance in healthcare settings, increasing demand for consumer antiseptic products, and growing adoption of professional-grade disinfection solutions. Antiseptic manufacturers are expanding their product portfolios to address the growing complexity of modern healthcare infection control and consumer hygiene requirements.

From 2030 to 2035, the market is forecast to grow from USD 7,386.9 million to USD 9,117.6 million, adding another USD 1,730.7 million, which constitutes 55.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of advanced antimicrobial formulations, development of enhanced spectrum antiseptic solutions, and advancement of smart packaging and delivery systems. The growing focus on antimicrobial resistance prevention and personalized hygiene solutions will drive demand for more sophisticated medical antiseptic products and specialized application methods.

Market expansion is being supported by the sustained increase in infection prevention awareness worldwide and the corresponding need for effective antimicrobial solutions that provide superior pathogen elimination capabilities and skin compatibility for critical healthcare and consumer applications. Modern healthcare facilities and households rely on consistent antimicrobial performance and skin safety to ensure optimal infection control including surgical preparations, wound care, and daily hygiene routines. Even minor antiseptic ineffectiveness can require comprehensive infection control adjustments to maintain optimal safety standards and regulatory compliance.

The growing complexity of antimicrobial resistance challenges and increasing demand for broad-spectrum antiseptic solutions are driving demand for medical antiseptics from certified manufacturers with appropriate efficacy capabilities and safety profiles. Healthcare providers are increasingly requiring documented antimicrobial effectiveness and skin compatibility standards to maintain infection prevention quality and patient safety. Regulatory guidelines and clinical standards are establishing standardized antiseptic procedures that require proven antimicrobial technologies and trained healthcare personnel.

The Medical Antiseptics market is entering a sustained growth phase, driven by demand for infection prevention, hygiene maintenance, and evolving health awareness and safety standards. By 2035, these pathways together can unlock USD 800-1,000 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Formulation Leadership (Alcohol-Based Solutions) The alcohol-based segment already holds the largest share due to its rapid action and broad spectrum. Expanding skin compatibility, sustained activity, and application convenience can consolidate leadership. Opportunity pool: USD 200-250 million.

Pathway B -- Consumer Market Expansion (Household Applications) Household use accounts for the largest demand. Growing health consciousness and preventive hygiene practices, especially in emerging economies, will drive higher adoption of medical antiseptics for home protection. Opportunity pool: USD 180-220 million.

Pathway C -- Healthcare Facility Integration (Surgical & Clinical Use) Healthcare applications represent significant growth potential with increasing infection control requirements. Products optimized for clinical environments can capture substantial growth. Opportunity pool: USD 150-190 million.

Pathway D -- Emerging Market Expansion Asia-Pacific and Latin America present growing demand due to rising healthcare standards. Targeting affordable solutions and local distribution will accelerate adoption. Opportunity pool: USD 120-150 million.

Pathway E -- Specialized Applications Integration With increasing awareness in dental and veterinary care, there is an opportunity to promote antiseptics optimized for specialized healthcare applications. Opportunity pool: USD 80-100 million.

Pathway F -- Professional & Institutional Markets Products optimized for workplace hygiene, food service, and institutional applications offer premium positioning for high-traffic environments. Opportunity pool: USD 40-50 million.

Pathway G -- Value-Added Services & Education Revenue from hygiene training programs, compliance consulting, and infection prevention services creates long-term engagement streams. Opportunity pool: USD 20-25 million.

Pathway H -- Smart Packaging & IoT Integration Intelligent dispensing systems, usage monitoring, and connected hygiene management can elevate antiseptics into comprehensive infection prevention solutions. Opportunity pool: USD 10-15 million.

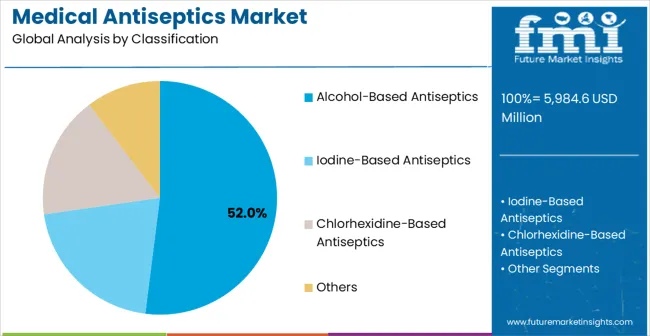

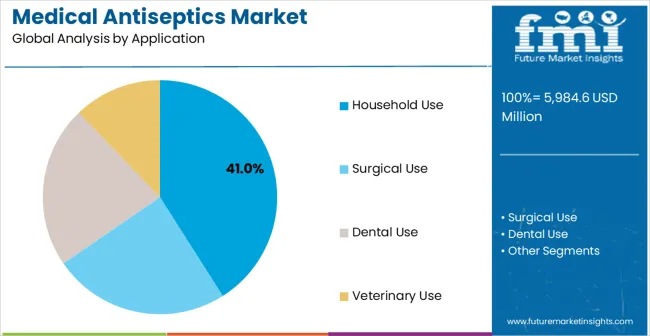

The market is segmented by formulation type, application, and region. By formulation type, the market is divided into alcohol-based antiseptics, iodine-based antiseptics, chlorhexidine-based antiseptics, and other antimicrobial formulations. Based on application, the market is categorized into household use, surgical use, dental use, veterinary use, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

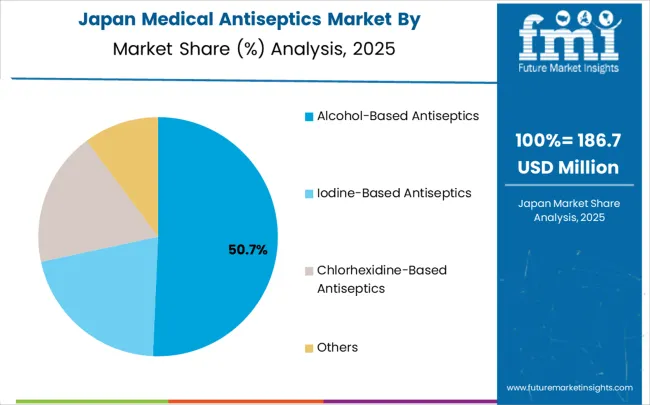

In 2025, the alcohol-based antiseptics segment is projected to capture around 52% of the total market share, making it the leading formulation type category. This dominance is largely driven by the widespread adoption of ethanol and isopropanol-based solutions that provide optimal balance between rapid antimicrobial action and broad-spectrum effectiveness, catering to a wide variety of healthcare and consumer applications. Alcohol-based antiseptics are particularly favored for their ability to deliver superior pathogen kill rates and quick-drying properties in both clinical and household environments, ensuring immediate microbial reduction and user convenience. Healthcare institutions, consumer households, workplace facilities, and food service applications increasingly prefer this formulation, as it meets demanding antimicrobial requirements without imposing excessive contact time or residue concerns.

The availability of well-established manufacturing processes, along with comprehensive regulatory approvals and standardized concentration guidelines from health authorities, further reinforces the segment's market position. Additionally, this formulation type category benefits from consistent demand across regions, as it is considered a proven and versatile solution for situations requiring rapid antimicrobial action and broad pathogen coverage. The combination of effectiveness speed, spectrum coverage, and application convenience makes alcohol-based antiseptics a reliable choice, ensuring their continued dominance in the healthcare and consumer hygiene markets.

The household use segment is expected to represent 41% of medical antiseptics demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the sustained consumer awareness of hygiene importance and the integration of antiseptic products into daily household routines, where hand sanitization and surface disinfection are essential to family health and infection prevention. Household environments often feature multiple touchpoints and shared spaces that demand reliable antiseptic solutions throughout daily activities, requiring convenient and effective antimicrobial products. Medical antiseptics are particularly well-suited to these applications due to their ability to provide consistent pathogen elimination and skin-safe formulations, even during frequent use and varying household conditions. As health consciousness remains elevated globally and emphasizes preventive hygiene practices, the demand for household antiseptic products continues to grow.

The segment also benefits from increased health awareness within consumer markets, where families are increasingly prioritizing antimicrobial effectiveness and skin safety as essential household necessities. With consumers investing in comprehensive home hygiene solutions and preventive health measures, medical antiseptics provide an essential component to maintain high-performance infection prevention standards. The growth of e-commerce distribution and value-sized packaging options, coupled with increased focus on family health protection, ensures that household use will remain the largest and most stable demand driver for medical antiseptics in the forecast period.

The Medical Antiseptics market is advancing steadily due to sustained hygiene awareness and growing recognition of antiseptic advantages over basic soap and water cleaning in infection prevention applications. However, the market faces challenges including potential skin sensitivity concerns with frequent use, need for proper application technique education and antimicrobial stewardship, and complex regulatory requirements with efficacy testing standards across different healthcare environments. Product innovation efforts and advanced formulation technology programs continue to influence antiseptic development and market adoption patterns.

The growing development of moisturizing and conditioning ingredients in antiseptic formulations is enabling superior skin tolerance with maintained antimicrobial effectiveness and reduced irritation potential. Advanced emollient technologies and pH-balanced formulations provide superior pathogen elimination while maintaining skin health requirements. These technologies are particularly valuable for healthcare workers who require frequent antiseptic use that can support extensive hand hygiene protocols with consistent skin comfort results.

Modern medical antiseptic manufacturers are incorporating advanced polymer technologies and extended-release systems that enhance antimicrobial duration and operational effectiveness. Integration of film-forming agents and optimized active ingredient delivery systems enables superior residual protection and comprehensive coverage capabilities. Advanced sustained-release features support operation in high-contact environments while meeting various antimicrobial duration requirements and safety specifications.

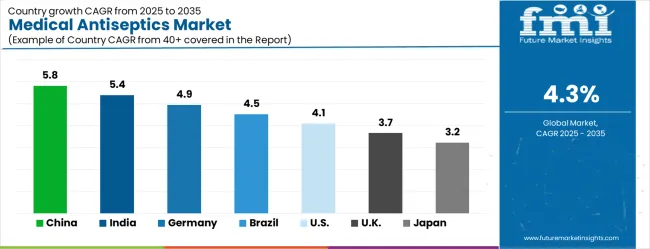

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| United States | 4.1% |

| United Kingdom | 3.7% |

| Japan | 3.2% |

The medical antiseptics market is growing consistently, with China leading at a 5.8% CAGR through 2035, driven by expanding healthcare infrastructure and increasing adoption of infection prevention solutions. India follows at 5.4%, supported by rising health awareness and growing implementation of hygiene technologies. Germany grows strongly at 4.9%, integrating advanced antiseptic technology into its established healthcare system. Brazil records 4.5%, emphasizing healthcare infrastructure development and infection control modernization initiatives. The United States shows solid growth at 4.1%, focusing on healthcare quality enhancement and antimicrobial innovation. The United Kingdom demonstrates steady progress at 3.7%, maintaining established healthcare hygiene applications. Japan records 3.2% growth, concentrating on technology advancement and infection prevention optimization.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Medical antiseptics in China is projected to exhibit the highest growth rate with a CAGR of 5.8% through 2035, driven by unprecedented expansion of healthcare infrastructure and increasing demand for infection prevention solutions. The country's massive healthcare sector and expanding hospital construction are creating enormous demand for advanced medical antiseptic solutions. Major healthcare providers are establishing comprehensive infection control protocols to support the increasing requirements of medical facilities and healthcare service companies across metropolitan regions.

Government healthcare development initiatives are supporting establishment of modern medical facilities and advanced infection prevention complexes, driving demand for high-performance medical antiseptics throughout major healthcare zones. Healthcare sector modernization programs are facilitating adoption of antiseptic technologies that enhance infection control efficiency and patient safety standards across medical infrastructure networks.

Medical antiseptics in India is expanding at a CAGR of 5.4%, supported by increasing health awareness and growing implementation of infection prevention technologies. The country's expanding healthcare access and rising hygiene standards are driving demand for advanced medical antiseptic solutions. Healthcare facilities and consumer markets are gradually implementing high-performance antimicrobial products to maintain safety standards and health protection.

Healthcare sector growth and hygiene infrastructure development are creating opportunities for suppliers that can support diverse antimicrobial requirements and affordability specifications. Public health programs and education initiatives are building awareness among healthcare workers and consumers, enabling effective utilization of medical antiseptic technology that meets safety standards and infection prevention requirements.

Demand for medical antiseptics in Germany is projected to grow at a CAGR of 4.9%, supported by the country's emphasis on healthcare quality standards and advanced infection prevention adoption. German healthcare facilities and medical institutions are implementing sophisticated antiseptic systems that meet stringent performance requirements and regulatory specifications. The market is characterized by focus on antimicrobial effectiveness, patient safety excellence, and compliance with comprehensive healthcare standards.

Healthcare industry investments are prioritizing cutting-edge antiseptic technology that demonstrates superior performance and safety while meeting German quality and regulatory standards. Professional training programs are ensuring comprehensive technical expertise among healthcare personnel, enabling specialized infection prevention capabilities that support diverse medical applications and patient care requirements.

Revenue from medical antiseptics in Brazil is growing at a CAGR of 4.5%, driven by increasing healthcare infrastructure development and growing recognition of infection prevention advantages. The country's expanding healthcare system is gradually integrating advanced antiseptic solutions to enhance patient safety and infection control. Healthcare facilities and consumer markets are investing in medical antiseptic technology to address evolving hygiene requirements and safety standards.

Healthcare infrastructure modernization is facilitating adoption of advanced antiseptic technologies that support comprehensive infection prevention capabilities across healthcare regions. Professional development programs are enhancing technical capabilities among healthcare personnel, enabling effective medical antiseptic utilization that meets evolving healthcare standards and performance requirements.

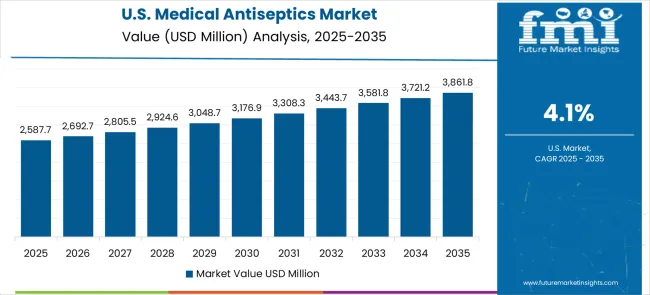

Medical antiseptics in the USA is expanding at a CAGR of 4.1%, driven by established healthcare industries and growing emphasis on infection prevention enhancement. Large healthcare systems and consumer product companies are implementing comprehensive medical antiseptic capabilities to serve diverse antimicrobial requirements. The market benefits from established healthcare distribution systems and professional development programs that support various healthcare and consumer applications.

Healthcare industry leadership is enabling standardized antiseptic utilization across multiple facility types, providing consistent performance standards and comprehensive infection prevention coverage throughout regional markets. Professional development and certification programs are building specialized technical expertise among healthcare personnel, enabling effective medical antiseptic utilization that supports evolving healthcare facility requirements.

Demand for medical antiseptics in the UK is projected to grow at a CAGR of 3.7%, supported by established healthcare sectors and growing emphasis on infection control capabilities. British healthcare facilities and medical service providers are implementing medical antiseptic systems that meet industry performance standards and regulatory requirements. The market benefits from established healthcare infrastructure and comprehensive training programs for medical professionals.

Healthcare facility investments are prioritizing advanced antiseptic solutions that support diverse infection prevention applications while maintaining established performance and safety standards. Professional development programs are building technical expertise among healthcare personnel, enabling specialized medical antiseptic operation capabilities that meet evolving facility requirements and performance standards.

Medical antiseptics in Japan is growing at a CAGR of 3.2%, driven by the country's focus on healthcare technology innovation and infection prevention applications. Japanese healthcare facilities and pharmaceutical companies are implementing advanced medical antiseptic systems that demonstrate superior performance reliability and operational consistency. The market is characterized by emphasis on technological excellence, quality assurance, and integration with established healthcare workflows.

Healthcare technology investments are prioritizing innovative antiseptic solutions that combine advanced antimicrobial technology with precision formulation while maintaining Japanese quality and safety standards. Professional development programs are ensuring comprehensive technical expertise among healthcare personnel, enabling specialized infection prevention capabilities that support diverse healthcare applications and patient care requirements.

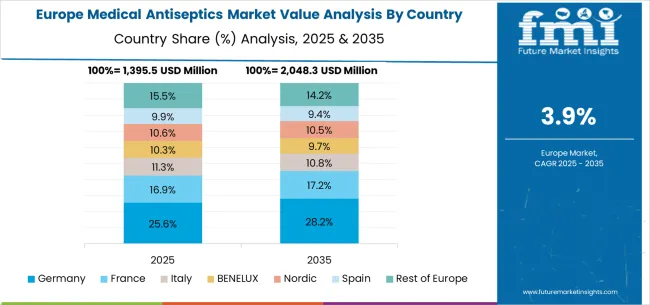

The medical antiseptics market in Europe is forecast to expand from USD 1,567.9 million in 2025 to USD 2,385.2 million by 2035, registering a CAGR of 4.3%. Germany will remain the largest market, holding 31.2% share in 2025, easing to 30.7% by 2035, supported by strong healthcare infrastructure and advanced infection prevention standards. The United Kingdom follows, rising from 23.4% in 2025 to 23.8% by 2035, driven by healthcare facility modernization and infection control enhancement initiatives. France is expected to maintain stability from 18.1% to 17.9%, reflecting consistent healthcare industry investments and antimicrobial requirements. Italy holds around 12.9% throughout the forecast period, supported by healthcare facility upgrades and infection prevention modernization programs. Spain grows from 8.7% to 9.0% with expanding healthcare infrastructure and increased focus on medical antiseptic solutions. BENELUX markets maintain 3.9% to 3.8%, while the remainder of Europe hovers near 1.8%--1.8%, balancing emerging Eastern European healthcare development against mature Nordic markets with established antiseptic technology adoption patterns.

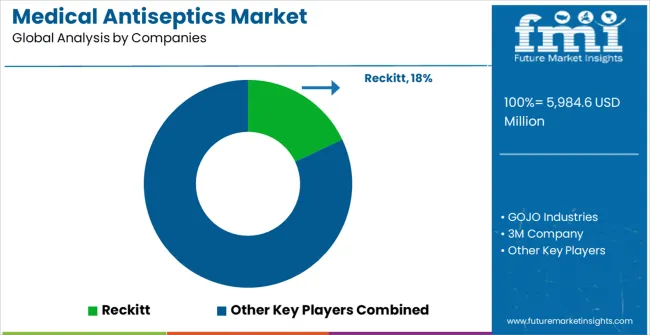

The Medical Antiseptics market is defined by competition among specialized healthcare product manufacturers, consumer goods companies, and pharmaceutical solution providers. Companies are investing in advanced formulation technology development, skin compatibility innovation, antimicrobial effectiveness optimization, and comprehensive healthcare service capabilities to deliver safe, effective, and convenient antiseptic solutions. Strategic partnerships, regulatory compliance, and market expansion are central to strengthening product portfolios and market presence.

Reckitt offers comprehensive consumer antiseptic solutions with established brand expertise and professional-grade antimicrobial capabilities. GOJO Industries provides specialized hand hygiene systems with focus on healthcare effectiveness and operational convenience. 3M Company delivers advanced antiseptic products with emphasis on clinical performance and healthcare-friendly application. Procter & Gamble specializes in consumer antiseptic technology with advanced formulation integration.

Unilever offers consumer-grade antiseptic products with comprehensive market reach capabilities. Henkel delivers established personal care solutions with advanced antiseptic technologies. Hartmann provides specialized healthcare equipment with focus on infection prevention optimization. Ecolab, Kimberly-Clark, Colgate-Palmolive, Johnson & Johnson, BD, Pfizer, GSK, Novartis, Sanofi, B. Braun, Merck, Abbott, and ACI Limited offer specialized manufacturing expertise, regulatory compliance, and comprehensive development across global and regional healthcare market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 5,984.6 million |

| Formulation Type | Alcohol-Based Antiseptics, Iodine-Based Antiseptics, Chlorhexidine-Based Antiseptics, Others |

| Application | Household Use, Surgical Use, Dental Use, and Veterinary Use |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Reckitt, GOJO Industries, 3M Company, Procter & Gamble, Unilever, Henkel, Hartmann, Ecolab, Kimberly-Clark, Colgate-Palmolive, Johnson & Johnson, BD, Pfizer, GSK, Novartis, Sanofi, B. Braun, Merck, Abbott, ACI Limited |

| Additional Attributes | Dollar sales by formulation type and application segment, regional demand trends across major markets, competitive landscape with established healthcare manufacturers and emerging antiseptic providers, customer preferences for different antiseptic configurations and safety options, integration with infection prevention systems and healthcare protocols, innovations in antimicrobial technology and application efficiency, and adoption of advanced formulation features with enhanced skin compatibility capabilities for improved hygiene workflows. |

The global medical antiseptics market is estimated to be valued at USD 5,984.6 million in 2025.

The market size for the medical antiseptics market is projected to reach USD 9,117.6 million by 2035.

The medical antiseptics market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in medical antiseptics market are alcohol-based antiseptics, iodine-based antiseptics, chlorhexidine-based antiseptics and others.

In terms of application, household use segment to command 41.0% share in the medical antiseptics market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA