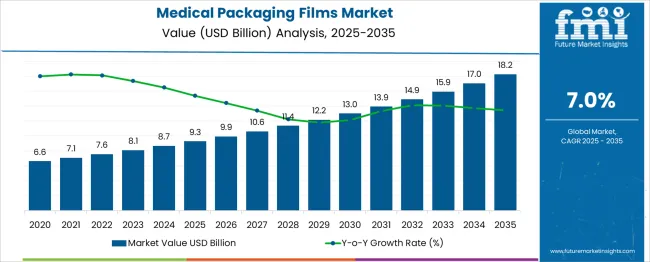

The Medical Packaging Films Market is estimated to be valued at USD 9.3 billion in 2025 and is projected to reach USD 18.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. Between 2020 and 2025, the market grows from USD 6.6 billion to USD 9.3 billion, creating an absolute dollar opportunity of USD 2.7 billion. This expansion is driven by the rising demand for sterile and durable packaging solutions, increased pharmaceutical production, and heightened regulatory standards for medical product safety.

The early growth phase is steady, supported by advancements in material technology and increasing healthcare investments globally. From 2025 to 2035, the market is set to add USD 8.9 billion in absolute dollar opportunity, reaching USD 18.2 billion by the end of the forecast period. Growth during this phase is propelled by expanding hospital infrastructure, the rise of home healthcare, and the growing adoption of flexible packaging formats for medical devices and pharmaceuticals. By 2030, midway through this period, the market value is projected to hit USD 13.0 billion, signaling a strong upward momentum. Over 2020–2035, the total cumulative absolute dollar opportunity is USD 11.6 billion, presenting significant prospects for manufacturers to innovate in barrier properties, recyclability, and sustainability in medical-grade packaging films.

| Metric | Value |

|---|---|

| Medical Packaging Films Market Estimated Value in (2025 E) | USD 9.3 billion |

| Medical Packaging Films Market Forecast Value in (2035 F) | USD 18.2 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The medical packaging films market is gaining strong traction owing to increasing demand for sterile and secure packaging solutions that ensure product integrity throughout the healthcare supply chain. Growth has been significantly influenced by advancements in material sciences and film processing technologies that meet stringent global healthcare regulations. A shift toward minimally invasive procedures and high-value pharmaceuticals has underscored the need for durable, puncture-resistant films with superior barrier properties.

The expanding base of diagnostic labs, surgical centers, and pharmaceutical manufacturers has also driven the need for extended shelf life, tamper-evident formats, and patient safety assurance. Global focus on sustainability has further pushed manufacturers to innovate recyclable or biodegradable film solutions, especially for single-use medical products.

Continued investments in cleanroom manufacturing and automation in packaging processes are enhancing scalability and hygiene standards. Over the coming years, growth is expected to accelerate through integrated smart packaging systems and material upgrades that align with quality assurance protocols and eco-compliance standards in both developed and emerging markets.

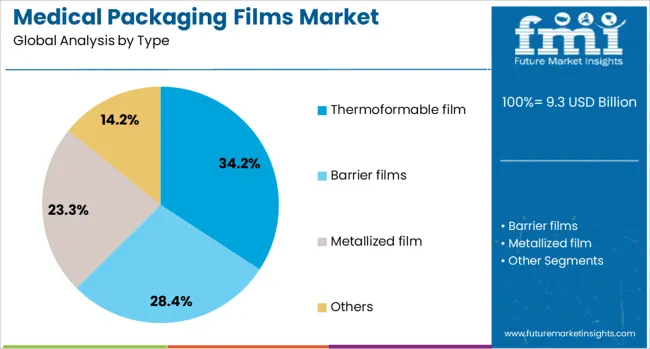

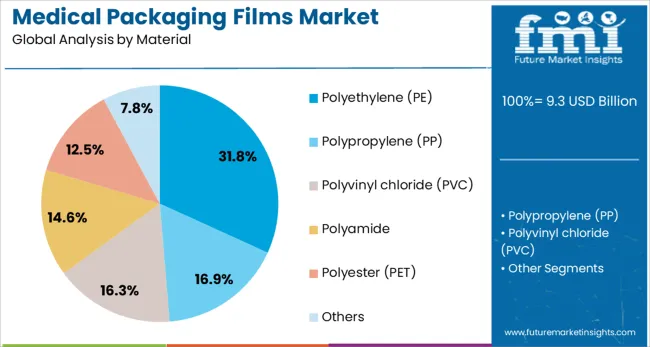

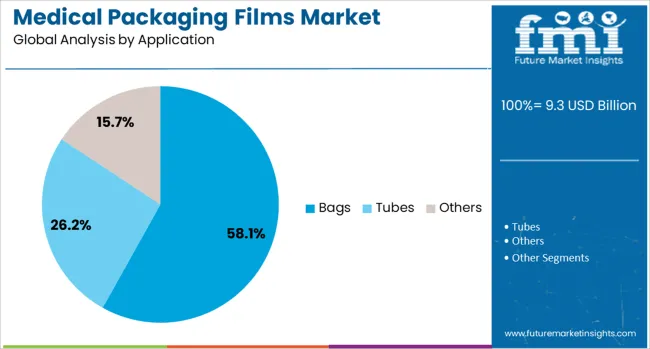

The medical packaging films market is segmented by type, material, application, and geographic regions. The medical packaging films market is divided into Thermoformable film, Barrier films, metallized film, and others. In terms of material, the medical packaging films market is classified into Polyethylene (PE), Polypropylene (PP), Polyvinyl chloride (PVC), Polyamide, Polyester (PET), and Others. Based on the application, the medical packaging films market is segmented into Bags, Tubes, and Others. Regionally, the medical packaging films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Thermoformable film is expected to hold 34.2% of the medical packaging films market revenue share in 2025, making it the leading type segment. This prominence is driven by its superior formability, seal integrity, and compatibility with a wide range of medical devices and pharmaceutical products. The segment has gained preference due to its adaptability in vacuum and pressure forming processes, which support the packaging of devices with complex geometries.

Enhanced protection against oxygen, moisture, and microbial ingress has made thermoformable films a suitable choice for applications requiring sterile barrier systems. Manufacturers have focused on incorporating multilayer structures with customizable mechanical properties that support both transparency and strength.

Demand has further increased with the expansion of disposable medical kits and pre-filled drug containers that require uniform sealing and dimensional stability. The capability to support high-speed forming and sealing processes, along with ease of integration with automated packaging lines, has solidified the role of thermoformable films in enhancing operational efficiency across healthcare packaging facilities.

Polyethylene is anticipated to account for 31.8% of the revenue share in the medical packaging films market in 2025, emerging as the leading material type. Its dominance is attributed to high flexibility, chemical resistance, and low moisture permeability, which are critical for maintaining product safety in medical applications. The widespread use of polyethylene has been supported by its availability in both high-density and low-density variants, each suited to specific packaging needs such as rigid trays or soft pouches.

The material’s ability to meet regulatory requirements while offering cost efficiency has further contributed to its preference among medical packaging manufacturers. Its sealability and compatibility with sterilization techniques including gamma irradiation and ethylene oxide have enhanced its utility in sterile medical packaging.

Additionally, the recyclability of polyethylene aligns with global sustainability targets, making it a favored choice for eco-conscious procurement policies in healthcare institutions. Innovations in multilayer extrusion using polyethylene blends have also expanded its scope across complex medical product packaging formats.

The bags application segment is projected to represent 58.1% of the total medical packaging films market revenue in 2025, maintaining a dominant position due to its versatility and broad usage across various healthcare environments. Bags have been widely adopted for packaging intravenous fluids, blood products, dialysis solutions, and surgical disposables, supported by their lightweight nature and ease of storage. The ability to provide contamination resistance and tamper-evident protection has reinforced their utility in sterile and high-risk environments.

Advances in co-extruded film structures have enabled the production of high-barrier medical bags that ensure extended shelf life without compromising flexibility or transparency. Growing demand from hospitals, clinics, and home healthcare settings has led to a surge in the production of single-use medical bags with enhanced portability and user safety features.

Additionally, the compatibility of medical bags with heat-sealing and sterilization processes has further improved their adoption across automated filling and packaging systems. Their adaptability and cost-efficiency continue to support their strong market positioning.

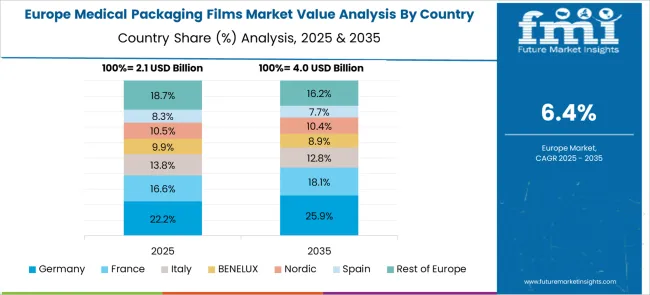

The medical packaging films market is experiencing strong growth as demand rises for safe, sterile, and durable packaging in healthcare applications. These films are widely used in packaging surgical instruments, diagnostic kits, pharmaceutical products, and medical devices. The growing global healthcare infrastructure, expansion of pharmaceutical manufacturing, and emphasis on patient safety fuel market expansion. High-barrier properties, chemical resistance, and sterilization compatibility make these films essential in maintaining product integrity. North America, Europe, and Asia-Pacific lead consumption due to rising medical device exports and stricter healthcare packaging standards.

Medical packaging films are manufactured from materials such as polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and multilayer laminates. Selection depends on the required barrier performance, sterilization method, and application. High-barrier films protect against moisture, oxygen, and microbial contamination, while breathable films allow sterilization gases to pass through. Material innovations focus on improved strength, clarity, and chemical compatibility. Custom film solutions are developed to meet specific device and pharmaceutical packaging needs.

These films play a vital role in preserving sterility and extending the shelf life of packaged medical products. By preventing contamination and degradation, they ensure product safety from manufacturing to end use. Compatibility with sterilization methods such as gamma irradiation, ethylene oxide, and steam autoclaving is critical. Enhanced sealing performance and puncture resistance reduce the risk of package failure during transportation and handling. High-quality films contribute to reduced recalls and improved brand trust among healthcare providers.

The market is competitive, with global packaging film producers and specialized healthcare material suppliers competing on quality, innovation, and service. Consistent raw material supply, particularly medical-grade polymers, is essential to meet production timelines. Price volatility in petrochemical feedstocks and global supply chain disruptions can affect cost and delivery schedules. Companies investing in vertical integration, advanced extrusion technologies, and regional manufacturing capabilities enhance reliability. Technical support and collaborative development with medical device manufacturers strengthen market positioning.

Medical packaging films must comply with stringent international standards, including ISO 11607 for sterile barrier systems. Regulations mandate biocompatibility, material safety, and traceability of packaging materials. Manufacturers must validate performance through rigorous testing, including barrier integrity, seal strength, and sterilization compatibility. Evolving environmental packaging regulations also encourage the development of recyclable and reduced-plastic solutions. Adherence to global and regional compliance requirements is critical for market access and customer confidence.

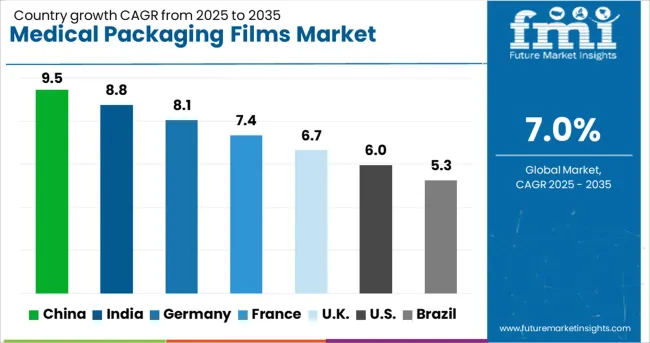

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

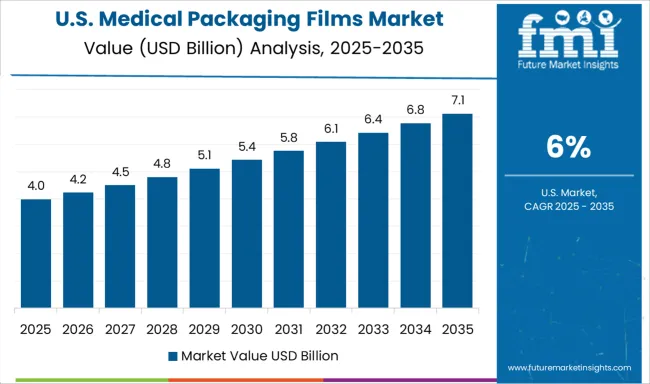

| USA | 6.0% |

| Brazil | 5.3% |

The global medical packaging films market is expanding at a 7.0% CAGR, driven by the need for sterile, durable, and compliant materials in healthcare applications. Within BRICS economies, China leads at 9.5% growth, benefiting from its large-scale pharmaceutical manufacturing and export capabilities. India follows at 8.8%, supported by its strong generic drug production and increasing domestic healthcare demand. In the OECD region, Germany records 8.1% growth, leveraging advanced material engineering and strict quality regulations. The UK grows at 6.7%, aided by medical device production and pharmaceutical exports. The USA, with 6.0% growth, continues to innovate in high-barrier films and compliance-driven packaging. This report covers 40+ countries, with top performers highlighted here.

China shows strong performance in the medical packaging films market with a 9.5% growth rate. Rising healthcare infrastructure investments increase demand for high-quality packaging materials. Compared to India, China benefits from a larger manufacturing base for medical supplies, ensuring steady film production. The rapid expansion of pharmaceutical manufacturing facilities further boosts market prospects. Adoption of advanced film materials improves product protection and storage life. Strict regulations for medical product safety encourage the use of certified packaging films. Export opportunities in Asia-Pacific also strengthen China’s position in this industry.

India records an 8.8% growth rate in the medical packaging films market. Rising demand for affordable healthcare products drives increased use of cost-effective packaging materials. Compared to Germany, India focuses on scaling local production capacities for both domestic and export purposes. Growth in hospitals, clinics, and pharmaceutical companies fuels steady film consumption. Manufacturers explore durable yet lightweight packaging films to meet storage and transportation needs. Government health initiatives improve accessibility of packaged medical supplies across regions. The expansion of online pharmacy services also adds to the market’s momentum.

Germany sees an 8.1% growth rate in the medical packaging films market. Compared to the United Kingdom, Germany has a well-established medical supply chain, ensuring consistent film demand. Manufacturers focus on producing high-barrier films that protect sensitive medical products from contamination. Growing exports of medical devices and pharmaceuticals support the industry. Hospitals and clinics demand packaging films with advanced sealing properties for sterile supplies. Sustainability trends lead to development of recyclable medical films, balancing safety with environmental responsibility. Partnerships between film producers and healthcare providers enhance market innovation.

The United Kingdom records a 6.7% growth rate in the medical packaging films market. The country emphasizes quality compliance and traceability in medical packaging processes. Compared to the United States, the UK market prioritizes compact and efficient film designs for space-saving storage. Pharmaceutical and medical device companies seek films with long shelf-life capabilities. The rise in home healthcare services increases the need for easy-to-use medical packaging. Manufacturers invest in product innovations that balance durability, flexibility, and cost-effectiveness. Strong import and export activities keep the supply chain competitive.

The United States achieves a 6.0% growth rate in the medical packaging films market. The market benefits from the expansion of biotechnology and pharmaceutical companies. Compared to China, the US places greater focus on innovative packaging designs for patient convenience. The growing need for secure, tamper-proof films supports industry growth. Hospitals and healthcare providers require packaging with strong barrier protection for sensitive materials. Cold chain logistics further drive demand for specialized films capable of preserving product integrity. Collaboration between medical packaging companies and research institutions supports technological development.

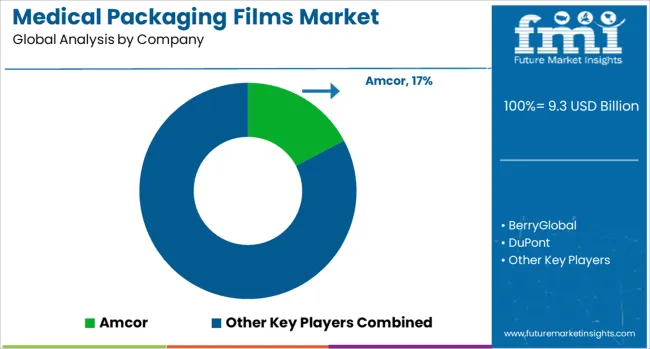

The medical packaging films market is driven by a select group of global leaders specializing in high-performance materials that meet stringent regulatory, sterility, and barrier requirements. Amcor commands a strong position with an extensive portfolio of multi-layer and high-barrier films, serving both pharmaceutical and medical device sectors. Berry Global focuses on customizable film solutions, leveraging advanced extrusion technology to deliver precision-engineered materials for sterile packaging. DuPont is recognized for its Tyvek® brand, offering lightweight, breathable, and puncture-resistant films ideal for sterilizable medical packaging.

Sealed Air provides innovative protective films that ensure product integrity throughout the supply chain, emphasizing solutions with extended shelf life and consistent sealing performance. Klockner Pentaplast specializes in rigid and flexible films with high clarity and robust mechanical properties, supporting both form-fill-seal and thermoforming processes. Mitsubishi Chemical contributes through its advanced polymer technologies, delivering films with superior chemical resistance and stability for sensitive medical applications. Toppan differentiates itself through precision-engineered barrier films incorporating proprietary coating technologies, enabling extended sterility assurance and reduced contamination risk. Competitive strategies in this market focus on innovation in sterilization-compatible materials, sustainable film production, and high-barrier laminations, responding to the increasing global demand for safe, compliant, and eco-conscious medical packaging solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 Billion |

| Type | Thermoformable film, Barrier films, Metallized film, and Others |

| Material | Polyethylene (PE), Polypropylene (PP), Polyvinyl chloride (PVC), Polyamide, Polyester (PET), and Others |

| Application | Bags, Tubes, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, BerryGlobal, DuPont, SealedAir, KlocknerPentaplast, MitsubishiChemical, and Toppan |

| Additional Attributes | Dollar sales in the Medical Packaging Films Market vary by material type including polyethylene, polypropylene, and polyvinyl chloride, application across bags, pouches, and blister packs, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for sterile packaging, increasing healthcare expenditure, and advancements in medical packaging technology. |

The global medical packaging films market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the medical packaging films market is projected to reach USD 18.2 billion by 2035.

The medical packaging films market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in medical packaging films market are thermoformable film, barrier films, metallized film and others.

In terms of material, polyethylene (pe) segment to command 31.8% share in the medical packaging films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Packaging Market from 2025 to 2035

Medical Packaging Paper Market

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Packaging Films Suppliers

Medical Device Packaging Market Size, Share & Forecast 2025 to 2035

Understanding Market Share Trends in Medical Device Packaging

Bio-Medical Packaging Market from 2023 to 2033

Medical Flexible Packaging Market

Medical Diagnostic Packaging Market

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

MOPP Packaging Films Market Insights - Growth & Forecast 2025 to 2035

Meat Packaging Films Market

BOPET Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Sterile Medical Packaging Market

Hygiene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Antifog Packaging Films Market Trends – Growth & Forecast 2025-2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Compostable Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Static-Free Packaging Films Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA