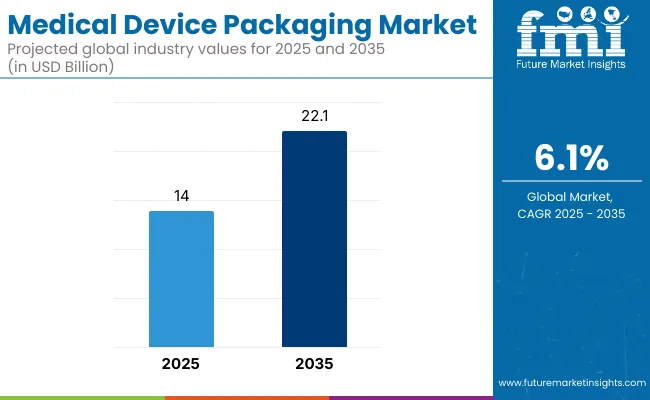

The medical device packaging market is anticipated to expand from USD 14.0 billion in 2025 to USD 22.1 billion by 2035, registering a CAGR of 6.1%. This growth is driven by the rise in surgical procedures, home healthcare usage, and stringent global sterility regulations. The demand for tamper-evident, durable, and easily sterilizable packaging is surging. The estimated sales value in 2024 stands at approximately USD 13.2 billion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14 billion |

| Industry Value (2035F) | USD 22.1 billion |

| CAGR (2025 to 2035) | 6.1% |

Advances in medical device packaging now include RFID-enabled smart labels for tracking, anti-microbial coatings, and multi-layer film laminates for barrier protection. Developments in thermoform-fill-seal and pouching technologies are enabling greater automation and precision. Recyclable polymers and peelable, breathable lidding films are being adopted for safety and sustainability. Sterile barrier packaging remains a top innovation focus due to infection control priorities.

Regulatory alignment with ISO 11607 and regional sterilization norms is shaping product design and material selection. Growth in Asia-Pacific and Latin America is creating demand for cost-effective, transport-durable solutions. Companies will focus on predictive compliance tools, anti-counterfeit features, and extended shelf-life capabilities. Consolidation and R&D investments will remain key to gaining competitive advantage in the evolving medical device ecosystem.

The below table presents the expected CAGR for the global medical device packaging market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.8% |

| H2 (2024 to 2034) | 6.0% |

| H1 (2025 to 2035) | 6.0% |

| H2 (2025 to 2035) | 6.2% |

In the first half (H1) of the decade from 2024 to 2035, the business is predicted to surge at a CAGR of 5.8%, followed by a slightly higher growth rate of 6.0% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2024 to H2 2035, the CAGR is projected to decrease slightly to 6.0% in the first half and remain relatively moderate at 6.2% in the second half. In the first half (H1), the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed an increase of 120 BPS.

The market has been segmented based on material, packaging format, end use or equipment type, and region. Materials such as plastic and paper & paperboard have been utilized to provide sterility assurance, mechanical protection, and compliance with medical-grade standards.

Packaging formats including boxes, folding cartons, bags & pouches, trays, inserts & dividers, and wrapping films have been incorporated to support handling efficiency, contamination control, and labeling clarity. End-use equipment categories have been segmented into surgical, therapeutic, and diagnostic devices, where tailored packaging has been adopted to preserve device integrity and simplify clinical use.

Regional segmentation has been structured across North America, Latin America, Europe, East Asia, South Asia, the Middle East & Africa (MEA), and Oceania to reflect supply chain diversity, healthcare infrastructure, and regulatory conditions.

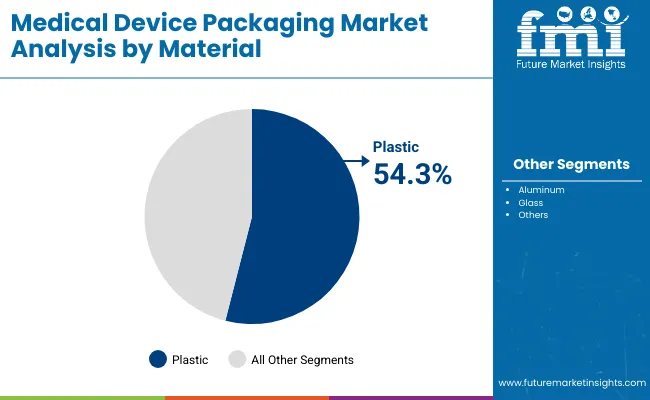

Plastic material is expected to hold the largest share of 54.3% in the medical device packaging market in 2025, owing to its sterility assurance and moisture barrier performance. Polyethylene, polypropylene, and PET have been preferred for their ability to withstand sterilization methods like ethylene oxide and gamma irradiation. Enhanced puncture resistance and seal integrity have made plastic suitable for trays, pouches, and thermoformed packages. Lightweight, flexibility, and compatibility with tamper-evident designs have further reinforced its adoption.

Manufacturers have adopted multi-layer films and co-extruded laminates to enhance microbial protection for Class II and III devices. Customizable dimensions and clear viewing windows have enabled functional designs for better handling and inspection. Automation-friendly properties have supported high-speed filling and sealing lines. These advantages have collectively positioned plastic as a reliable and dominant choice across regulated packaging environments.

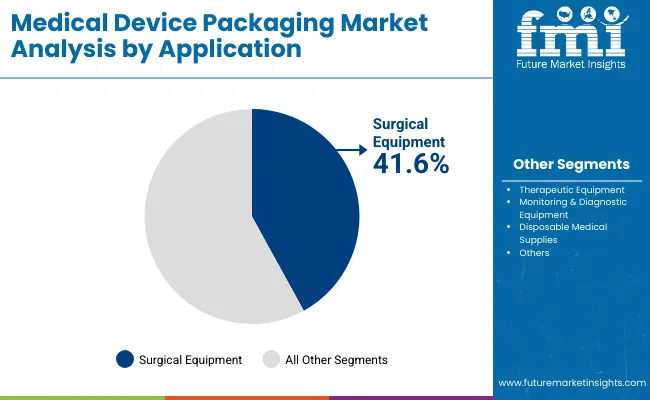

The surgical equipment segment is projected to account for 41.6% of the medical device packaging market in 2025, supported by its demand for sterile barrier systems and high-volume packaging formats. Pre-packaged scalpels, forceps, scissors, and drapes have required validated packaging with strong microbial barriers. Compliance with ISO 11607 and FDA requirements has necessitated structured pack integrity testing and documentation. Single-use surgical kits have reinforced the shift toward sealed, disposable formats.

Customization of packaging configurations for surgical instruments has been aided by thermoformed rigid trays with peelable lids. Antimicrobial coatings and tamper-evident designs have improved safety during handling and storage. Clear labeling and RFID tags have supported traceability within surgical suites. Packaging solutions tailored for hospital sterilization workflows have ensured product protection until the point of use.

Increased Emphasis on Sterility & Safety Spurs Medical Device Packaging Demand

With increasing patient safety and sterility being emphasized globally, the market for medical device packaging is experiencing high growth. An increased emphasis on preventing healthcare-associated infections requires the need for packaging solutions to be sterile to prevent contamination of devices until the moment of use. Healthcare providers who want to avoid infection are focusing on maintaining device sterility in packaging.

High-level regulations such as ISO 11607 on packaging make strict requirements for the level of sterility, strength, and conformity to be observed, forcing the development of new, advanced packaging technologies. Sterile, protective packaging is therefore a necessity for the safe usage of surgical instruments, diagnostic equipment, implants, and syringes. It's a resultant regulatory pressure, combined with emphasis on safety, which generates great demand for quality medical device packaging solutions.

Trend of Home Healthcare Monitoring Elevates Demand for Medical Device Packaging

As medical treatments become more available at home, there is an emerging need to ensure that packaging solutions for remote patient monitoring devices are safe and convenient. These devices, shipped directly to the patient's home, need sterility during transport and flexibility to open and label, thus enabling the use of device applications safely and rightly without any form of professional assistance.

Such packaging innovations are very much needed for increasing patient compliance and reducing errors in home healthcare. For instance, CGMs come in sterile pouches that make the monitoring user-friendly and efficient for the patients at home, and this drives the growth of the home healthcare market, in turn propelling the global medical device packaging market.

Rising Raw Material Costs and May Hamper Medical Device Packaging Growth

One significant challenge for the medical device packaging market is rising raw material cost. Typically, volatility in material prices such as plastics, foils, and specialized polymers is occasioned by supply chain disruptions, geopolitical factors, or material shortages. This causes uncertainties in the costing structure for producers, making it challenging to set stable prices on packaging solutions.

There is a lesser supply of both sustainable as well as eco-friendly packaging materials, such as biodegradable plastics and recyclable options. With the growing demand for environmentally responsible options, scarcity and high cost of these products can limit manufacturers' capabilities to meet both regulations as well as sustainability goals simultaneously. Consequently, this can restrain growth in the market.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Amcor plc, Berry Global Group, Inc., AVERY DENNISON CORPORATION, and Sonoco Products Company.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include Sealed Air Corporation, Oliver Healthcare Packaging, Wipak (Wihuri Group), Lindar Corp., Tekni-Plex, Inc., Nelipak Corporation, rose plastic medical packaging USA, LLP, Gary Manufacturing, Dordan Manufacturing Company, Brentwood Industries, Inc., and Janco, Inc.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

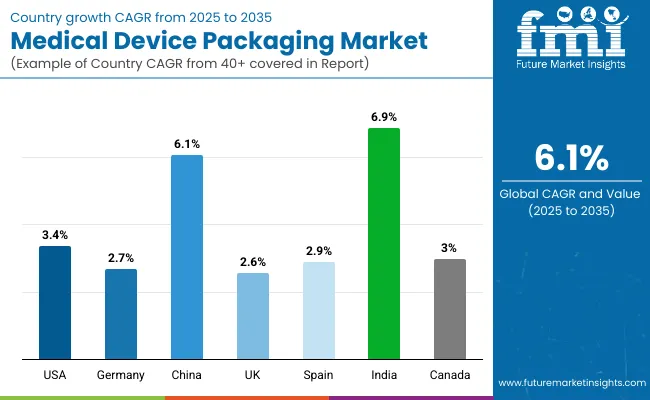

The section below covers the future forecast for the medical device packaging market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 3.4% through 2035. In Europe, Spain is projected to witness a CAGR of 2.9% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.4% |

| Germany | 2.7% |

| China | 6.1% |

| UK | 2.6% |

| Spain | 2.9% |

| India | 6.9% |

| Canada | 3.0% |

As the elderly population within the USA continue to increase, healthcare products and medical devices will be in increasing demand to manage chronic conditions and enhance quality of life. For older adults, a multitude of devices are often used, including joint replacements, monitoring equipment, and respiratory aids.

With this increased demand, the medical device packaging needs to be adapted to ensure safety, sterility, and integrity of the products. The sterile pouch, thermoformed trays, and blister packs play a crucial role in maintaining the quality of the devices and convenience in use by elderly patients. An aging population drives demand for healthcare products and medical devices and therefore creates a need for innovative packaging solutions in the USA.

With extensive manufacturing capabilities for medical devices, Germany is a leading player for the global health sector. Advanced production capabilities and a strongly built industrial base make this country a significant production base for high-quality medical devices, such as surgical instruments, diagnostic tools, and implantable devices.

As more and more of these devices are needed, so do new, special packaging solutions to ensure safety, sterility, and compliance with regulations. In Germany, manufacturers concentrate more on innovation for packaging designs which ensure protection against damage during transport and storage. Packaging also ensures inclusion of advancements in materials as well as sustainability; hence it ensures continuous demand for advanced packaging technologies within the country.

| Manufacturer | Vendor Insights |

|---|---|

| Amcor plc | Amcor is a global leader in packaging, with a focus on providing sustainable and innovative solutions for medical device packaging. It emphasizes material science, regulatory compliance, and sterilization compatibility. |

| Berry Global Group, Inc. | Berry Global offers a wide range of packaging solutions, including flexible and rigid plastic packaging. Their medical packaging is known for high-quality protective features and meeting sterilization standards. |

| AVERY DENNISON CORPORATION | Avery Dennison focuses on labeling and packaging materials that support medical device manufacturers in compliance with regulatory standards, offering tamper-evident and security-enhancing features. |

| Sonoco Products Company | Sonoco provides sustainable medical device packaging solutions, such as rigid plastic containers and thermoformed trays, ensuring product safety and regulatory compliance for the healthcare sector. |

| Oliver Healthcare Packaging | Oliver specializes in advanced thermoforming techniques to provide sterile barrier packaging solutions for medical devices, including customizable options for a wide range of device types. |

| Wipak (Wihuri Group) | Wipak offers sterile barrier packaging systems and flexible packaging solutions, with a focus on environmentally friendly materials and compliance with ISO 11607 and other regulatory standards. |

| Lindar Corp. | Lindar produces innovative thermoformed packaging solutions, focusing on high-quality, customizable trays and pouches for the medical device industry, ensuring safe, sterile delivery to healthcare professionals. |

| Tekni-Plex, Inc. | Tekni-Plex is known for its custom thermoformed and flexible packaging products, with a focus on high-barrier packaging materials to extend shelf life and protect medical devices from contamination. |

| Nelipak Corporation | Nelipak provides thermoformed packaging solutions for the medical device industry, offering a range of packaging materials that ensure sterilization, shelf-life extension, and product safety. |

| Sealed Air Corporation | Sealed Air provides protective packaging solutions, including advanced barrier materials and high-performance sterilization options, with a strong focus on automation and sustainability in packaging. |

The global medical device packaging industry is projected to witness CAGR of 4.6% between 2025 and 2035.

The global medical device packaging industry stood at USD 41.7 billion in 2024.

Global medical device packaging industry is anticipated to reach USD 22.1 billion by 2035 end.

East Asia is set to record a CAGR of 6.7% in assessment period.

The key players operating in the global medical device packaging industry include Amcor plc, Berry Global Group, Inc., AVERY DENNISON CORPORATION, and Sonoco Products Company.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Understanding Market Share Trends in Medical Device Packaging

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA