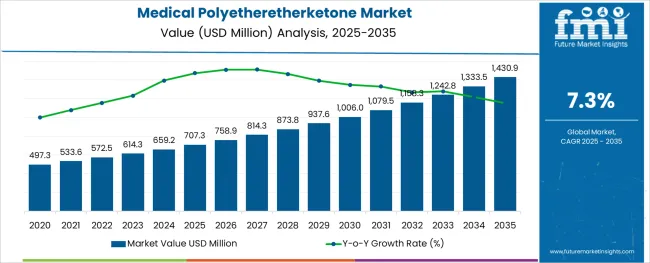

The Medical Polyetheretherketone Market is estimated to be valued at USD 707.3 million in 2025 and is projected to reach USD 1430.9 million by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

The medical polyetheretherketone market is advancing steadily as demand rises for high-performance polymer-based implants that offer radiolucency, chemical resistance, and biocompatibility. Increasing adoption of polyetheretherketone in spinal, orthopedic, dental, and trauma surgeries is being supported by its favorable mechanical strength and elastic modulus closer to that of human bone.

Medical device manufacturers are utilizing the material in customized implants through additive manufacturing and machining techniques that reduce intraoperative time and improve patient outcomes. Regulatory acceptance in clinical trials and expanded indications are accelerating product commercialization, especially in trauma and cranial applications.

Furthermore, the growing preference for metal-free implants due to allergy concerns and imaging compatibility is strengthening market penetration. As healthcare infrastructure develops in emerging economies and surgical volumes rise globally, demand for polyetheretherketone-based components is expected to expand across multiple application segments, positioning the material as a sustainable alternative to traditional implant metals.

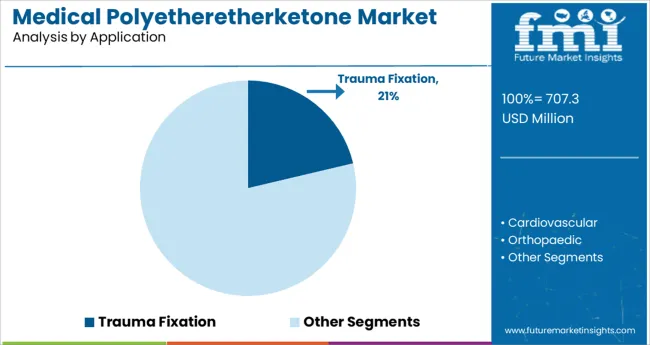

The market is segmented by Application and region. By Application, the market is divided into Trauma Fixation, Cardiovascular, Orthopaedic, Dental Implants & Fixtures, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The trauma fixation application segment is projected to contribute 21.3% of the total market revenue in 2025, marking it as a key contributor to overall growth. Its strong positioning is attributed to the material's mechanical strength, fatigue resistance, and inert properties which enable safe and durable fixation in high-stress anatomical regions. Polyetheretherketone is increasingly being used in trauma plates, screws, and rods where metal implants have previously dominated.

Surgeons and hospitals have recognized the benefits of radiolucency, which improves post-operative imaging and monitoring without artifacts, aiding in accurate recovery assessments. Additionally, advancements in design flexibility and surface modification techniques have enhanced osteointegration and reduced the likelihood of implant rejection.

The growing rate of fracture-related procedures, driven by aging populations and trauma incidents, has supported adoption in both developed and emerging markets. As trauma care continues to evolve toward lightweight and patient-specific solutions, polyetheretherketone is expected to maintain and expand its footprint in the trauma fixation segment.

The medical polyetheretherketone market share is anticipated to be bolstered by an increase in the adoption of medical polyetheretherketone as a replacement for metals. Aluminium, carbon steel, bronze, stainless steel, brass, titanium, and magnesium are just a few of the metals that medical polyetheretherketone has begun to replace in large quantities.

Medical and automotive manufacturers are forced to improve fuel efficiency, reduce maintenance requirements, and reduce noise levels due to stringent environmental regulations. As a result of these regulations, automobile light-weighting is driving the preference for lighter vehicles. For both reducing emissions and increasing fuel efficiency, polyetheretherketone is a significant upgrade over metals.

The demand for medical polyetheretherketone is likely to decline as medical polyetheretherketone is more expensive than other medical-grade polymers. However, these plastics can't replace medical polyetheretherketone as it is a high-performance polymer with better qualities like high flexural strength, resistance to impact, resistance to chemicals and heat, and compatibility with living organisms.

Furthermore, strict rules about medical devices also make it hard to use medical polyetheretherketone in medical devices and implants. As a result, these factors are anticipated to impede the growth of the medical polyetheretherketone market share.

More than 30 percent of medical polyetheretherketone market revenue is anticipated to be generated in 2024 by the spine implantation segment. To track changes in the spinal cord and soft tissue structures, diagnostic imaging like MRI or CT scans is critical. As a result, the sales of medical polyetheretherketone are increasing as they are being used in spine implants instead of stainless steel or titanium because these metals do not work well with these imaging techniques. These devices are used in the treatment of degenerative spine conditions like spondylolisthesis, degenerative disc disease, spinal narrowing, and scoliosis.

During the forecast period, the cardiovascular segment of the medical polyetheretherketone market is expected to grow at the fastest rate in revenue. Flexible modulus, high temperature and electrical resistance, biocompatibility and sterilization ease are just some of the advantages of medical polyetheretherketone. Melt processing allows it to be formed into vascular catheter tubes with a small inner diameter.

With the rise of medical polyetheretherketone as an alternative to polyimides, tubes and catheters are becoming more commonplace in vascular medical devices. Stent implantation, transfemoral heart valve implantation and ablation catheters are all examples of procedures with high adoption of medical polyetheretherketone.

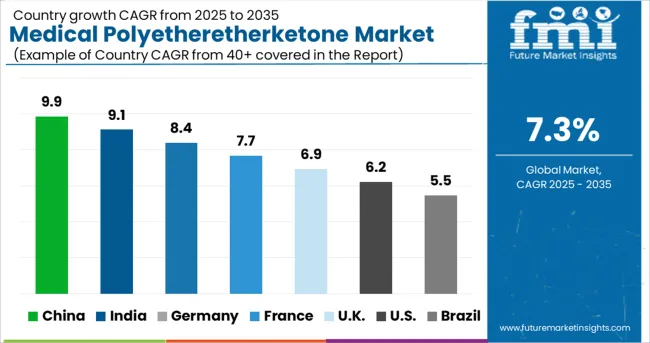

The medical polyetheretherketone market in the United States is projected to rise rapidly during the projected period, owing to an increase in the number of healthcare institutions and medical device advances. The expanding population in the United States is predicted to raise the demand for spine implants, stents, heart valves, and knee and hip implants, which is likely to drive the use of medical-grade plastics even further.

Furthermore, the United States has a large number of medical component and device manufacturers who are progressively incorporating PEEK into their products. Another major element boosting the medical polyether ether ketone market in the country is the presence of key manufacturers.

Due to Europe's strict regulations, the global medical polyetheretherketone market is anticipated to be dominated by Europe. In turn, this increased demand for transportation services led to regional dominance as a result of the strict environmental and fuel consumption guidelines.

In 2024, Europe held the largest share of 45 per cent in the medical polyetheretherketone market. The adoption of medical polyetheretherketone is primarily in the automotive, insulation, electronics & electrical, industrial, and general engineering sectors in Europe and the USA.

In terms of revenue, the Asia Pacific region is expected to grow at a rate of 8.7 per cent over the forecast period. With a medical polyetheretherketone market share of USD 659.2 Million in APAC in 2024, cardiovascular application emerged as the largest segment in the region. Sedentary lifestyles among young and elderly populations in countries like China and India are to blame for this. To meet the growing demand for dental implants and dentures in the region, medical polyetheretherketone denture base material is expected to increase in popularity. Dental implants and fixtures are predicted to grow at a 9.3% CAGR in the Asia Pacific region over the forecast period.

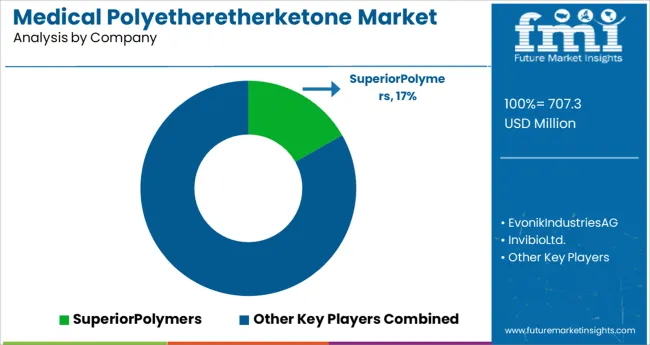

As a result of a small number of regional players, the global medical polyetheretherketone market is consolidated. Panjin Zhongrun High-Performance Polymers Co. Ltd., Victrex Plc., Jrlon Inc., and Quadrant EPP Surlon India Ltd. are major key participants in the market.

The widening industry service provider business is a result of increasing overall application in a variety of fields, including medical, aerospace, and automotive. Prototype & Plastic Mold Co. Inc., Parkway Products Inc., A. Schulman AG and Stern Industries Inc. are just some of the major service providers that use the item for injection moulding and other purposes across a variety of different industries.

Many industries, including healthcare, aerospace, electronics, packaging, and automobiles, are expected to benefit from the growing product application scope of the market. Medical polyetheretherketone -based end-use technologies are being patented by the industries themselves in order to gain a competitive edge over others.

Recent Developments in the Medical Polyetheretherketone Market

Startups in the medical polyetheretherketone market are focusing on making new products and working together as their main ways to grow in the global market. In May 2024, the FDA approved a new Creed Cannulated Screw System made by Carbon22 from Solvay's Zeniva (PEEK) for foot and ankle surgery. Since there are already well-known players in the market, competition is high. The companies that make medical polyetheretherketone work with other market players to increase their market share.

The global medical polyetheretherketone market is estimated to be valued at USD 707.3 million in 2025.

It is projected to reach USD 1,430.9 million by 2035.

The market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types are trauma fixation, cardiovascular, orthopaedic, _spine implantation, _knee & hip implantation, dental implants & fixtures and others.

segment is expected to dominate with a 0.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA