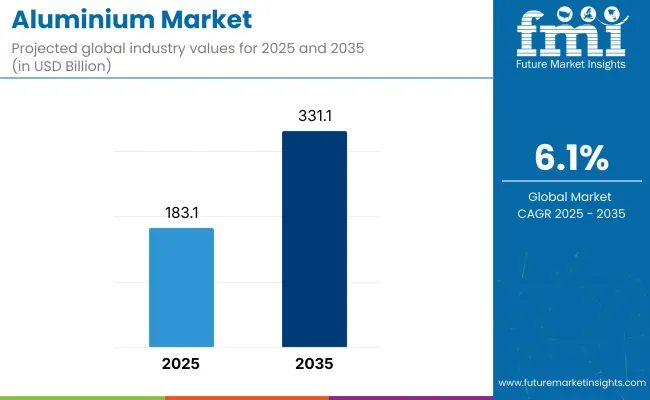

The global aluminium market is valued at USD 183.1 billion in 2025 and is estimated to reach USD 331.1 billion by 2035. The market is poised to expand at a CAGR of 6.1% during the forecast period. This robust growth reflects aluminium’s rising significance in modern industrial economies where the need for strong, lightweight, and corrosion-resistant materials is increasing.

As industries worldwide transition to greener and more efficient solutions, aluminium is proving indispensable across a range of high-growth sectors. Its durability, recyclability, and strength-to-weight ratio make it highly adaptable for both structural and functional applications in automotive, aerospace, and construction industries.

The growing shift toward electric vehicles (EVs) is a major driver of aluminium demand. Automakers are replacing traditional steel components with aluminium to reduce vehicle weight, thereby improving fuel efficiency and battery range in EVs. Regulatory mandates aimed at reducing emissions and achieving energy efficiency are further accelerating this transition.

Similarly, the aerospace sector depends heavily on aluminium for critical components such as fuselages and wing structures, driven by performance optimization and stringent safety standards. At the same time, governments across North America, Europe, and Asia are prioritizing infrastructure renewal and green energy projects. These investments are increasing aluminium consumption in power grids, public works, smart cities, and renewable energy systems such as solar panels and wind turbines.

Sustainability is playing an equally important role in shaping the aluminium market’s future. The push toward a circular economy has enhanced aluminium recycling initiatives and innovations in low-carbon smelting. Technologies such as hydro-powered smelting and hydrogen-based production processes are reducing energy use and emissions.

With global industries increasingly aligning operations with environmental goals, aluminium’s recyclability and adaptability are placing it at the core of next-generation material strategies. This evolution ensures the aluminium market will remain vital to global development well beyond 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 183.1 billion |

| Industry Value (2035F) | USD 331.1 billion |

| CAGR (2025 to 2035) | 6.1% |

The global aluminium market is segmented by series into series 1 aluminum, series 2 aluminum, series 3 aluminum, series 4 aluminum, series 5 aluminum, series 6 aluminum, series 7 aluminum, and series 8 aluminum. By processing, the market is categorized into castings, flat rolled aluminum, rods & bars, extrusions, pigments & powder, and forgings. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

Series 5 aluminum is projected to grow at the highest CAGR of 7.2% from 2025 to 2035, owing to its exceptional corrosion resistance, weldability, and strength. Comprising aluminum-magnesium alloys, it is widely used in marine applications such as ship hulls and offshore platforms, where durability in saltwater environments is essential.

In the automotive sector, its lightweight properties make it ideal for vehicle body panels and frames, supporting fuel efficiency and lower emissions. The rise of electric vehicles further amplifies its demand for battery enclosures and structural components. Its use in infrastructure, bridges, stadiums, and facades underscores its strength and low maintenance benefits.

Other aluminium series also serve distinct applications. Series 6, made of aluminum-magnesium-silicon alloys, is crucial for aircraft structures, auto chassis, and industrial machinery due to its heat-treatable strength. Series 1, known for high purity, is prominent in electrical and chemical storage. Series 2 and Series 7, copper-based alloys, are valued in aerospace and defense, offering high strength but requiring corrosion protection.

Series 3 is suitable for cookware, siding, and roofing, while Series 4 finds use in automotive and welding. Series 8 is specialized for packaging and cables, where flexibility and strength are key. Each series fulfills critical performance needs across global industries.

| Series | CAGR (2025 to 2035) |

|---|---|

| Series 5 Aluminium | 7.2% |

Extrusions are expected to be the fastest-growing processing segment in the global aluminium market, registering a CAGR of 7.4% from 2025 to 2035. The demand for extruded aluminium profiles is rising sharply due to their widespread application in construction, automotive, renewable energy, and industrial automation.

These profiles offer design flexibility, high strength-to-weight ratio, and corrosion resistance, making them ideal for window frames, curtain walls, solar panel supports, EV battery frames, and industrial machinery. The trend toward lightweight and modular construction components is also fueling extrusion adoption in infrastructure and manufacturing.

Castings continue to hold a significant market share due to their critical role in automotive, aerospace, and heavy machinery. Engine blocks, suspension parts, and electric motor housings benefit from cast aluminium’s durability and thermal performance. Flat rolled aluminium, including sheets and plates, is used extensively in packaging, transportation, and consumer electronics, owing to its formability and surface finish.

Rods and bars serve in electrical applications, frames, and connectors, especially where machinability is essential. Pigments and powders, while a smaller segment, find niche uses in coatings, automotive finishes, and 3D printing. Forgings offer high-strength solutions for aerospace components, pressure vessels, and military hardware, where performance under stress is critical. Each processing type supports key end-use industries through its unique attributes.

| Processing | CAGR (2025 to 2035) |

|---|---|

| Extrusions | 7.4% |

North America remains at lead for aluminium because of strong demand from the automotive, aerospace, and construction industries. The United States and Canada are experiencing increase in use of aluminium in electric and lightweight vehicles. Fuel efficiency regulations imposed by authorities such as the Environmental Protection Agency are pushing automakers to employ greater usage of aluminium for vehicle platforms. The development of infrastructure and government policies for clean energy sources are all driving the demand.

The North American space industry is another major user of aluminium, as Boeing and Lockheed Martin are also investing in aluminium alloys that have high strength yet are lightweight and used in producing aircraft. On top of this, recycling industries in the area are well set up, leading to the usage of aluminium sustainably.

Europe also retains a prominent position in the aluminium market with Germany, France, and the UK dominating the developments in automotive and aerospace applications. The European Union's aggressive regulations pertaining to carbon emissions and sustainability have promoted the uptake of aluminium in electric vehicles as well as in renewable energy applications.

The European construction industry is also fueling demand, especially in energy-efficient buildings and green building projects. The fact that there are key aluminium producers like Norsk Hydro and Rio Tinto in the region also increases the market potential of the region. The move towards circular economy practices and aluminium recycling programs also boosts market growth.

The Asia-Pacific region is going to experience the biggest growth in the aluminium industry due to rising industrialization, urbanization, and infrastructure development. South Korea, Japan, India, and China are key aluminium consumers and producers, with the top position taken by China. The country's strong manufacturing sector and green energy and electric vehicle-friendly policies continuously increase aluminium demand.

India's expanding infrastructure sector, combined with the 'Make in India' initiative, is fueling the nation's domestic aluminium sector. The dominance of the region in electronics, packaging, and construction sectors further fuels demand. Environmental concerns over bauxite mining and aluminium refining remain a cause of concern, and firms are gravitating towards sustainable and energy-efficient ways of producing.

Challenges

One of the critical problems in the aluminium sector is the energy-intensive production process. Aluminium refining takes a lot of electricity, making production costs high and causing environmental problems. Raw material price fluctuation, particularly bauxite and alumina, also causes market instability. Pressure from regulatory bodies regarding emission and carbon footprint reduction is another challenge for players in the industry.

Recycling is a critical area of focus, since aluminium manufacturing entails large amounts of waste. While aluminium is highly recyclable, recycling is constrained by the technology and logistics for effective recycling. The firms must invest in new technologies to render aluminium manufacturing more environmentally friendly.

Opportunities

The growing use of aluminium in electric vehicles represents a substantial opportunity for growth. As the world moves towards EVs and lighter vehicle parts, aluminium is a material of choice for battery housing, chassis, and body parts. Technological improvements in aluminium alloys and composite materials also have opportunities in the aerospace and high-performance markets.

Sustainability drives are pushing investment in green aluminum production, such as hydro-smelting and carbon capture technologies. Those firms that specialize in minimizing their carbon footprint and facilitating environmentally friendly aluminium solutions are going to benefit at the cost of others. Further, large infrastructure projects, especially in emerging economies, are poised to generate a huge demand for aluminium in infrastructure and transport segments.

During 2020 2024, the aluminum industry witnessed growth with rising demand in automotive, aerospace, construction, packaging, and electronic industries. Growing demand for lightweight, high-strength, and corrosion-resistant materials drove the evolution of aluminum application in transportation, renewable energy, and consumer products.

Governments and industries set their sights on sustainability and energy efficiency and hence recycled aluminum became very common, along with low-carbon smelting technology. The shift towards electric cars (EVs) and high-performance infrastructure once more stimulated the demand for aluminum alloys and advanced manufacturing methods.

The automotive sector was the primary driver of market expansion, with aluminum being used in vehicle bodies, battery compartments, wheels, and body panels to enhance fuel efficiency and minimize emissions. The building sector applied aluminum for windows, facades, structural framing, and roofs, taking advantage of its high strength and low maintenance needs. In addition to this, the aerospace sector led to the integration of aluminum alloys in aircraft wings, fuselages, and interior parts with weight saving and improved fuel efficiency.

The packaging sector experienced skyrocketing demand for aluminum cans and foils attributed to rising beverages consumption and environment-friendly packaging technology. Despite the strong growth, the industry struggled with supply chains, raw material price volatility, and carbon footprints. But technological advancements in smelting, refining, and alloys guaranteed consistent market growth as well as competitiveness.

With sustainability at top, businesses invested in low-carbon aluminum production techniques, such as hydroelectricity in smelting, carbon capture technology, and hydrogen reduction processes. Recycling rates of aluminum improved considerably as industries aimed at minimizing raw material reliance and optimizing material circularity. The advancements in smart manufacturing methods and automation of processes facilitated increased efficiency, waste minimization, and reduced costs in producing aluminum.

While geopolitical tensions and trade barriers from time to time influenced aluminum supply chains, localized production investments and strategic alliances smoothed market volatility. On the whole, the aluminum market demonstrated robustness and maintained innovativeness in gearing up for even greater revolutionizing events in the subsequent decade.

The period stretching from 2025 to 2035 is indeed undergoing drastic changes in the aluminum industry owing to technological advances, sustainability requirements, and changes in industrial applications. With carbon footprints of aluminum products minimized, increased recyclable levels, and the development of entirely new lightweight alloys for automotive, aerospace, and renewable energy applications, the future looks bright. Innovations in robotics and AI will change the face of aluminum production from ore to alloy by streamlining the entire process.

Green aluminum production through renewable energy, hydrogen-based smelting, and carbon capture will seal the upcoming decade's fate. The energy transition is becoming more accelerated worldwide, leading to debris derived demand in aluminum for electric vehicles, their battery technology, and frames of solar panels. 3D printing and additive manufacturing naturally allow for customization in the production of aluminum parts, improved performance, and material efficiency, with little waste and production costs.

The next-gen aluminum alloys are promising to disrupt aerospace applications with their significantly higher strength-to-weight ratio and thermal stability in hypersonics and space applications. The demand for biodegradable coatings and smart packaging would also increase in the packaging sector, thereby enabling further diversification toward a more sustainable and intelligent product delivery.

Industries will most likely be developing systems for closed-loop aluminum recycling in the era of the circular economy, causing a lot less waste and a more efficient resource use. The durability of aluminum will be enhanced using advanced coatings, embedded nanotechnology, and AI predictive maintenance.

Construction must evoke self-repairing aluminum structures spatially and temporally adaptive materials and green building solutions that enhance sustainability and energy efficiency. Lightweight, high-strength alloys will spur advances in electric aviation, rail transport, and autonomous vehicles. This will lead to improved performance while consuming less energy.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments enforced carbon emission limits, recycling mandates, and energy efficiency standards. |

| Technological Advancements | Industries adopted advanced smelting processes, lightweight alloys, and high-strength aluminum. |

| Industry Applications | Aluminum was widely used in automotive, aerospace, packaging, and construction sectors. |

| Environmental Sustainability | The industry transitioned toward recycled aluminum, low-VOC coatings, and eco-friendly production. |

| Market Growth Drivers | Demand was driven by lightweight materials, renewable energy, and electric vehicle adoption. |

| Production & Supply Chain Dynamics | Supply chains faced fluctuations in raw material availability, geopolitical risks, and logistics challenges. |

| End-User Trends | Consumers prioritized sustainable packaging, lightweight transportation, and durable building materials. |

| Investment in R&D | Funding focused on low-carbon smelting, improved alloy compositions, and additive manufacturing. |

| Infrastructure Development | Aluminum played a critical role in urban development, transport infrastructure, and industrial expansion. |

| Global Standardization | Regulations varied across regions and industry segments. |

| Advanced Aerospace & Defense Applications | Aluminum alloys enhanced aircraft fuselages, military armor, and structural components. |

| Smart Aluminum Coatings & Surface Treatments | Early research focused on corrosion-resistant, high-durability aluminum finishes. |

| Electrification & Renewable Energy | Aluminum played a role in solar panels, wind turbine components, and power grid infrastructure. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter policies will mandate low-carbon aluminum production, hydrogen-based smelting, and carbon-neutral supply chains. |

| Technological Advancements | The market will integrate AI-driven production, additive manufacturing, and self-repairing aluminum coatings. |

| Industry Applications | New applications in battery technology, hydrogen storage, space exploration, and AI-enhanced manufacturing will emerge. |

| Environmental Sustainability | Full adoption of carbon-free aluminum production, circular economy principles, and closed-loop recycling systems. |

| Market Growth Drivers | The focus will shift to high-performance alloys, energy-efficient production, and autonomous aluminum processing plants. |

| Production & Supply Chain Dynamics | Companies will invest in localized production, AI-optimized supply chains, and energy-independent aluminum smelting plants. |

| End-User Trends | Future demand will emphasize intelligent aluminum structures, self-healing alloys, and climate-adaptive materials. |

| Investment in R&D | Increased investment in hydrogen-powered aluminum production, AI-driven predictive maintenance, and next-gen aerospace applications. |

| Infrastructure Development | The industry will transition to self-repairing materials, climate-resistant aluminum structures, and green infrastructure solutions. |

| Global Standardization | A unified framework for net-zero aluminum production, recycling efficiency, and AI-driven compliance monitoring. |

| Advanced Aerospace & Defense Applications | Next-gen aerospace materials will feature hypersonic aluminum alloys, space-grade coatings, and AI-enhanced structural integrity. |

| Smart Aluminum Coatings & Surface Treatments | Future developments will integrate self-healing, conductive, and AI-responsive aluminum coatings. |

| Electrification & Renewable Energy | The industry will expand into hydrogen storage solutions, ultra-lightweight battery enclosures, and next-gen EV chassis design. |

United States aluminum market is recording slow growth driven by rising demand from the building, automotive, aerospace, packaging, and alternative energy industries. Rising trends of light-weight and fuel-efficient cars have led to the use of aluminum in automobiles widely by replacing heavier metals like steel to reduce fuel consumption and comply with Corporate Average Fuel Economy (CAFE) standards. Apart from this, the demand for aluminium and eco-friendly products from recycling is leading the use of aluminium in packaging for food and beverages, largely through the aluminium can and foil package type.

The Infrastructure Investment and Jobs Act (IIJA) has continued to propel the development of the aluminium market through investment in advanced, capital-intensive infrastructure construction, power grid development, and transportation development, all of which demand high-performance aluminium technology. The expanding aerospace market is also a driver of growth, as Boeing and Lockheed Martin expand aluminium use for aircraft frames and fuselage components because of its high strength-to-weight ratio and corrosion resistance.

Though all these are optimistic tendencies, the USA aluminium industry is still subject to raw material price fluctuations, carbon-intensive high-carbon energy use, and escalating environmental challenges. To offset such issues, the industry is focusing on low-carbon production and recycling technology of aluminium that is cost-friendly in the long run and is also sustainable.

| Country | CAGR (2025 to 2035) |

|---|---|

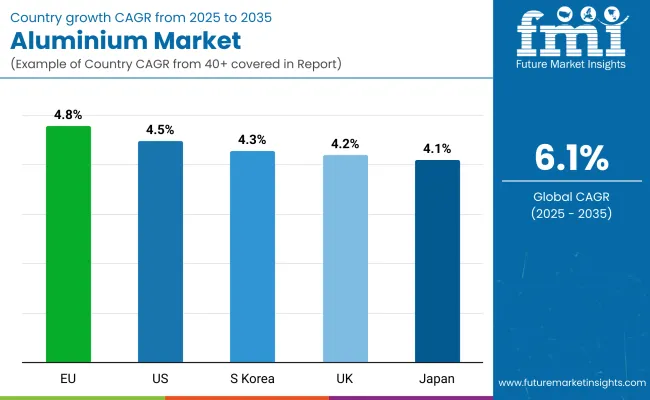

| USA | 4.5% |

The UK aluminium industry is consistently growing behind building, transport, and sustainability. It strongly motivates the major demand among all sectors such as automotive, packaging, and renewables for low-carbon aluminium, due to the UK's Net Zero drive, which aims at achieving net zero carbon emissions by 2050 in this country. Expansion of electric vehicle manufacturing in the UK, especially backed by Rolls-Royce and Jaguar Land Rover, enhances the demand for lighter aluminium parts to improve the energy efficiency and range of such vehicles.

The UK government's infrastructure investment is also supporting demand for aluminium, as new projects in railway development, commercial building construction, and green energy solutions gain momentum. In addition, increased recycling activities have encouraged companies to invest in aluminium scrap processing as well as circular economy initiatives to make aluminium supply chain sustainable.

However, after-Brexit trading regimes, unstable energy prices, and supply chain disruptions remain issues for the UK aluminium sector. Despite these issues, companies are investing in onshore aluminium production facilities and renewable energies in an effort to reduce carbon prints and boost the efficiency in production.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The European aluminium sector has been enjoying boom times thanks to soaring demand from important end-use industries such as automotive, construction, packaging, and renewable energy. Besides, the fact that the EU has economic targets toward carbon neutrality and circular economy policies imposed on the manufacturers was continuously driving more and more production of green and low-carbon aluminium solutions.

Increasing demand is being recorded for lightweight aluminium parts for use as chassis, battery enclosures, and structural components in electric vehicles, as production has been ramped up in the likes of Germany, France, and Sweden. The growing solar and wind energy projects are further elevating the consumption of aluminium for solar panel frames and wind turbine components in the European Union.

The dramatic growth that Europe's aluminium recycling industry is now experiencing is on account of heavy capital inflow into secondary aluminium production aimed at reducing dependence on energy-intensive primary production. Significantly, the European Union has worked to give a competitive edge to domestic producers of low-carbon aluminium by imposing a ban on high-carbon aluminium imports.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

Auto innovations, electronics manufacturing, and construction activities affect Japanese aluminium. Being a leader in hybrid and electric vehicle (EV) manufacture, Japan increasingly creates demand for lightweight aluminium components every day.

The consumer electronics sector, powered with giants like Sony and Panasonic, is also a major consumer of aluminium in products such as smartphone enclosures, laptops, and semiconductor devices. High-strength aluminium alloys are also driven by Japan's ongoing high-speed rail network and earthquake-resistant construction activities.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The South Korean aluminium market is gaining further momentum with rising investments in EV production, renewable energy, and smart infrastructure. The automobile and battery manufacturers require aluminium, with companies such as Hyundai and Samsung SDI fuelling the demand.

Steel consumption in South Korea is increased by its advanced shipbuilding and electronics industries, with lightweight ship components and 5G infrastructure displaying increased applications for aluminium. Additional governmental incentives for green energy and smart city projects will further enhance aluminium adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

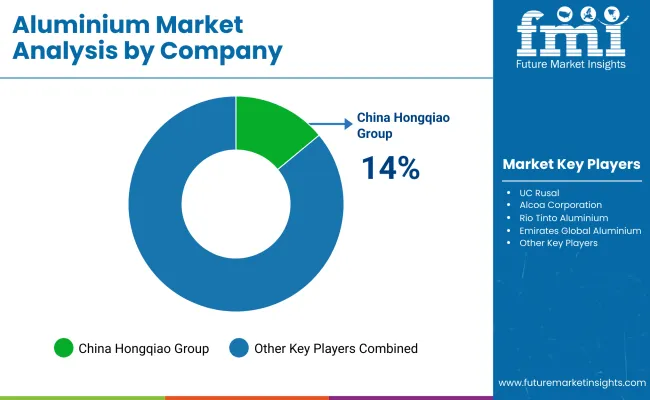

The aluminium market is a dominant segment of the global metals business that is pushed by demand in automotive, aerospace, construction, and packaging industries. Global industrial giants and local players are mainly responsible for guaranteeing a smooth flow of aluminium and emphasizing sustainability, lightweight design, and low-carbon production. The aluminium market is influenced by the advancements in recycling technologies, growing industrial applications, and initiatives by the government to enhance sustainable alternatives.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| China Hongqiao Group | 14-19% |

| UC Rusal | 9-13% |

| Alcoa Corporation | 7-11% |

| Rio Tinto Aluminium | 5-9% |

| Emirates Global Aluminium (EGA) | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| China Hongqiao Group | The world’s largest aluminium producer, focusing on cost-efficient production with a vertically integrated supply chain. |

| UC Rusal | A leader in sustainable aluminium production, known for low-carbon aluminium and a strong presence in global markets. |

| Alcoa Corporation | Specializes in high-performance aluminium alloys, emphasizing energy-efficient production and recycling initiatives. |

| Rio Tinto Aluminium | Develops high-quality aluminium products, investing in hydro-powered smelting technology to reduce carbon footprint. |

| Emirates Global Aluminium (EGA) | A key producer of premium-grade aluminium, catering to the automotive and aerospace industries with innovative solutions. |

Key Company Insights

China Hongqiao Group (14-19%)

China Hongqiao Group is the market leader in aluminium due to its cost-effective, mass production. Its vertically integrated supply chain ensures streamlined operations and lower overall costs. It is constantly increasing its global presence while keeping a strong domestic base in China.

UC Rusal (9-13%)

UC Rusal excels in ensuring sustainable aluminium production, with one of the industry's lowest-carbon aluminium products. The fact that the company uses hydropower for smelting is environmentally friendly, contributing to meeting the world's sustainability objectives.

Alcoa Corporation (7-11%)

Alcoa is a major player known for its high-performance aluminium alloys and emphasis on recycling and energy-efficient production. The company actively invests in technology to lower energy consumption while maintaining high-quality output.

Rio Tinto Aluminium (5-9%)

Rio Tinto Aluminium is a pioneer in sustainable aluminium production, leveraging hydro-powered smelting to minimize carbon emissions. The company is involved in advanced R&D efforts to develop eco-friendly solutions for various industries.

Emirates Global Aluminium (EGA) (4-8%)

EGA plays a vital role in supplying premium aluminium to the automotive and aerospace sectors. The company focuses on innovation and efficiency, ensuring high-quality products while adhering to strict environmental standards.

A significant portion of the market is held by regional producers and specialized aluminium suppliers contributing to innovation, sustainability, and efficiency. These include:

The overall market size for Aluminium market was USD 183.1 Billion in 2025.

The Aluminium market is expected to reach USD 331.1 Billion in 2035.

Rising demand for lightweight, corrosion-resistant, and high-strength materials across various industries will propel the aluminium market. Expanding applications in automotive, construction, and aerospace further boost market growth. Moreover, advancements in aluminium processing technologies and increasing investments in recycling and sustainable production will accelerate market expansion.

The top 5 countries which drives the development of Aluminium market are USA, UK, Europe Union, Japan and South Korea.

Series 5 and Series 6 Aluminum Alloys to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Series, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Series, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Processing, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Processing, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Series, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Series, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Processing, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Processing, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Series, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Series, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Processing, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Processing, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Series, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Series, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Processing, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Processing, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Series, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Series, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Processing, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Processing, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Series, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Series, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Processing, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Processing, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Series, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Series, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Processing, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Processing, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Series, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Series, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Processing, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Processing, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Series, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Processing, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Series, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Series, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Series, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Series, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Processing, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Processing, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Processing, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Processing, 2023 to 2033

Figure 16: Global Market Attractiveness by Series, 2023 to 2033

Figure 17: Global Market Attractiveness by Processing, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Series, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Processing, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Series, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Series, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Series, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Series, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Processing, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Processing, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Processing, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Processing, 2023 to 2033

Figure 34: North America Market Attractiveness by Series, 2023 to 2033

Figure 35: North America Market Attractiveness by Processing, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Series, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Processing, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Series, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Series, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Series, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Series, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Processing, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Processing, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Processing, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Processing, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Series, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Processing, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Series, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Processing, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Series, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Series, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Series, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Series, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Processing, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Processing, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Processing, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Processing, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Series, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Processing, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Series, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Processing, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Series, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Series, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Series, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Series, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Processing, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Processing, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Processing, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Processing, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Series, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Processing, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Series, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Processing, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Series, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Series, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Series, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Series, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Processing, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Processing, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Processing, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Processing, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Series, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Processing, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Series, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Processing, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Series, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Series, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Series, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Series, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Processing, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Processing, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Processing, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Processing, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Series, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Processing, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Series, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Processing, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Series, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Series, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Series, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Series, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Processing, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Processing, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Processing, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Processing, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Series, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Processing, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminium Cladding System Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Foil Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Foil Seal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium-Free Deodorant Market Analysis - Trends, Growth & Forecast 2025 to 2035

Competitive Breakdown of Aluminium Cup Suppliers

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Market Share Insights for Aluminium Bottle Providers

Aluminium Cup Market Trends - Size, Growth & Demand 2025 to 2035

Aluminium Ion Battery Market Growth - Trends & Forecast 2025 to 2035

Aluminium Bottle Market Growth – Size, Demand & Forecast 2025 to 2035

Aluminium Foil Sachet Market

Aluminium Production Chemicals Market

Aluminium Composite Panels Market

Aluminium Nitride Market

USA Aluminium Bottle Market Insights – Demand, Size & Industry Trends 2025-2035

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA