The aluminium ammonium sulphate market is projected to grow from USD 605.5 million in 2025 to USD 879.2 million by 2035, registering a CAGR of 3.8% during the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 605.5 million |

| Market Value (2035F) | USD 879.2 million |

| CAGR (2025 to 2035) | 3.8% |

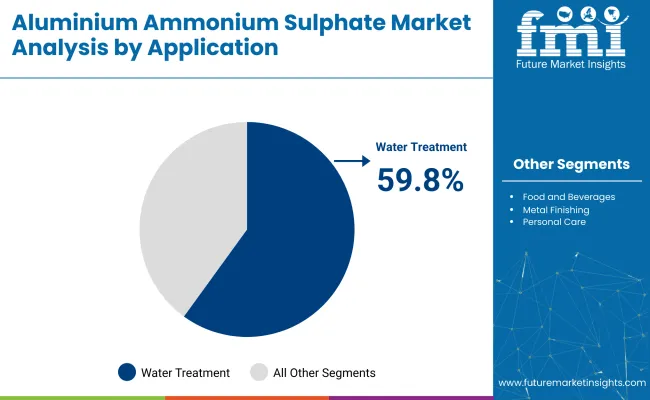

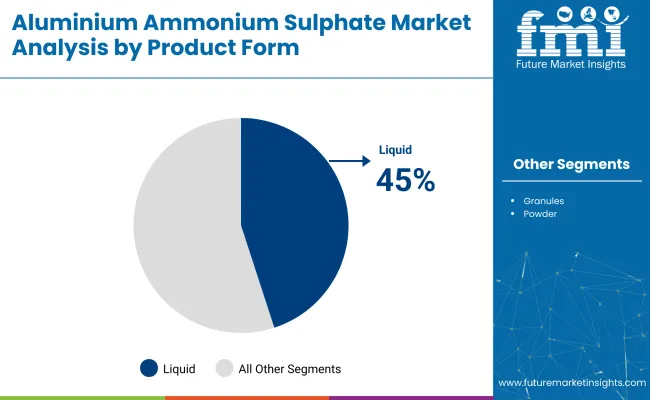

Demand remains concentrated in water treatment, paper manufacturing, and textile dyeing applications, with steady use in pharmaceutical and food additive sectors. The liquid form is emerging as the fastest-growing segment due to its ease of application and safety in dosing systems.

Powder and granular formats continue to support legacy industrial processes across Asia Pacific. Offline distribution channels dominate, with limited penetration of online sales owing to regulatory restrictions on bulk chemical transactions.

Industrial consumption of aluminium ammonium sulphate remains concentrated in Asia Pacific and Europe, where strong chemical manufacturing infrastructure supports steady demand. In India and China, consumption is supported by regional water treatment initiatives, leather processing, and dyeing industries. China is among the leading producers, supplying both domestic and export markets with technical and food-grade variants.

Pricing remains regionally influenced, with FOB values for technical-grade material generally stable between USD 280 and 340 per ton, depending on purity and form. Within the European Union, regulatory oversight under REACH continues to influence production standards, particularly for pharmaceutical and food-grade applications. German and Dutch suppliers prioritize batch consistency and low impurity thresholds to meet industrial and laboratory reagent specifications.

In the water treatment chemicals category, aluminium ammonium sulphate functions as a coagulant, contributing approximately 1-2% of the total segment due to its selective use in municipal systems. In the specialty chemicals segment, it holds around 0.3-0.5% share, given its niche role in dyeing, tanning, and analytical chemistry.

Its use as a firming agent or acidity regulator in the food additives market accounts for about 0.2-0.4% of total volume. The compound also comprises 0.5-0.7% of the industrial chemicals segment and approximately 2-3% of the laboratory reagents market due to its continued relevance in qualitative analysis procedures.

Product stability, moderate pricing, and well-defined industrial use cases ensure aluminium ammonium sulphate maintains a consistent presence across global markets, with growth anchored in Asia Pacific and select regions in Europe where chemical manufacturing infrastructure supports continuous demand.

The aluminium ammonium sulphate market is segmented by product form into powder, granules, and liquid. By application, it is categorized into food and beverages, metal finishing, detergents, personal care, fertilizers, and water treatment. The market is distributed through both online and offline channels. Geographically, the market covers North America, Latin America, Asia Pacific, Eastern Europe, Western Europe, and Japan.

Water treatment remains the central application driving demand for aluminium ammonium sulphate, accounting for 59.8% of market share by 2025. Its function as a coagulant in municipal and industrial water systems makes it indispensable.

Whether in city utilities across Asia or wastewater treatment plants in Europe, usage is embedded in long-term operations. Infrastructure upgrades and compliance with environmental standards continue to reinforce its role across both developing and developed economies.

Liquid aluminium ammonium sulphate is projected to lead the product form segment, capturing 45% of share by 2025. This shift reflects a preference for formats that integrate easily into automated dosing systems while reducing manual handling. Operators value the lower storage complexity and improved dosing precision that liquid formulations offer. Plants managing high-throughput water volumes see efficiency gains from process reliability and faster reactivity.

Despite increased interest in digital procurement, 80% of aluminium ammonium sulphate sales are still expected to occur through offline channels in 2025. Bulk industrial buyers continue to prefer established relationships with distributors, where procurement cycles, quality assurance, and contract fulfillment remain tightly integrated. Offline purchasing aligns with safety, documentation, and volume handling standards across industries such as chemicals, water utilities, and pharmaceuticals.

Manufacturers are focusing on product purity, supply chain efficiency, and meeting regulatory standards across key sectors such as municipal utilities, agriculture, and analytical chemistry.

Consistent Demand from Water Treatment and Purification Applications

Aluminium ammonium sulphate is widely used as a flocculating agent in municipal water treatment facilities. It aids in coagulation processes by removing suspended solids and impurities. The compound’s effectiveness in clarifying drinking water and treating wastewater makes it a staple in urban infrastructure projects. Agricultural irrigation systems and industrial effluents also rely on it for water quality management.

Usage in Laboratory, Textile, and Dye Industries Supports Market Stability

Aluminium ammonium sulphate serves as a mordant in textile dyeing, helping fix dyes to fabrics. It is also utilized in analytical chemistry as a reagent, particularly in crystallography and chemical analysis. Specialty applications in photography and leather tanning further contribute to its industrial relevance. The stable demand across these sectors supports year-round procurement by manufacturing and research facilities.

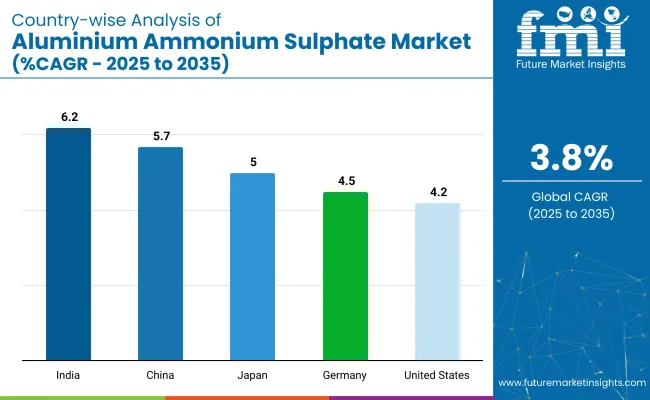

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.2% |

| China | 5.7% |

| Japan | 5.0% |

| Germany | 4.5% |

| United States | 4.2% |

Sales of aluminium ammonium sulphate are expected to advance at a 4.9%CAGR between 2025 and 2035. All five focus markets among forty analysed reveal varied trajectories. India leads at 6.2%, while China follows at 5.7%. Japan records 5.0%, Germany posts 4.5%, and the United States delivers 4.2%.

These rates translate into a growth premium ranging from +26% (India) to -14% (United States) versus the global baseline. Divergence stems from local factors: capacity expansion and municipal demand in the two BRICS economies; purity regulation and food-grade compliance in OECD nations; and niche, high-grade requirements in the United States.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Indian market is projected to grow at a CAGR of 6.2% through 2035, the fastest among the leading countries. This is fueled by growing demand from municipal water treatment plants, expanding food processing sectors, and textile finishing industries. As a BRICS and Emerging Market, India is scaling production through regional chemical hubs and low-cost sourcing of raw materials.

Domestic firms are capitalizing on government infrastructure investments and rising exports of inorganic chemicals. Growth is further supported by India's expanding role as a regional supplier across South Asia and the Middle East.

China is expected to grow at a CAGR of 5.7%, driven by the large-scale use of aluminium ammonium sulphate in textile dyeing, wastewater treatment, and agriculture. As a BRICS and Global Factory Hub, China maintains significant production capacity for alum compounds, including food-grade and industrial variants.

Government standards around water quality and stricter textile effluent controls are accelerating compound usage. China’s packaging and food preservation sectors are incorporating alum as a firming and stabilizing agent. With strong domestic demand and export-oriented manufacturing, China remains a central player in global alum supply chains.

Japan’s market is growing at a CAGR of 5.0%, underpinned by advanced use cases in precision food processing, specialty chemicals, and high-purity water treatment. As an OECD and High-Standards Compliance Market, Japan focuses on ultra-refined aluminium ammonium sulphate with consistent purity for pharmaceutical, beverage, and dye-set industries.

Domestic manufacturers emphasize minimal environmental impact and regulatory compliance under Japan’s stringent chemical safety laws. The food preservation segment, especially in pickling and baking, remains a key growth area as clean-label additives gain attention.

Germany is projected to grow at 4.5% CAGR through 2035, supported by steady demand across food preservation, environmental treatment, and industrial formulations. As a member of the EU27, OECD, and Sustainability-Focused Nations, Germany maintains strict REACH compliance, favoring eco-compatible chemical compounds like aluminium ammonium sulphate.

Its use in bakery preservatives and low-emission industrial dye processes aligns with national goals for chemical safety and reduced exposure. Innovation in automated dosing systems and smart purification processes is driving incremental growth in municipal utilities and food-grade applications.

The USA market is forecast to grow at a CAGR of 4.2%, driven by demand in high-value industrial, food additive, and laboratory reagent segments. As an OECD and Agri-food Tech Pioneer, the USA focuses on safe, food-grade usage of aluminium ammonium sulphate in baking powder, pickling, and meat preservation.

Environmental concerns and EPA guidelines are steering the market toward more controlled application in wastewater treatment. Specialty chemical suppliers are investing in refining and micronizing techniques for enhanced stability and storage. Domestic demand is further influenced by food safety trends and innovation in clean-label processing.

The market is relatively consolidated, with a few key players maintaining strong control over global production and distribution. Prominent manufacturers such as Martin Midstream and GEO Specialty Chemicals Inc.

lead the market with well-established supply chains and a broad industrial customer base. Companies like Amresco Inc., Domo Chemicals, and GFS Chemicals contribute significantly by offering high-purity formulations for applications in water treatment, laboratory reagents, and textile processing.

Sigma-Aldrich Corporation (now part of Merck) and Evonik Industries AG strengthen the market with robust R&D capabilities and specialty chemical portfolios. General Chemicals also plays a vital role by catering to regional demand across diverse end-user industries. Emerging players are increasingly entering niche segments, aiming to provide cost-effective alternatives and customized chemical solutions to a growing industrial client base.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 605.5 million |

| Projected Market Size (2035) | USD 879.2 million |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Product Forms Analyzed (Segment 1) | Powder, Granules, Liquid |

| Applications Analyzed (Segment 2) | Food & Beverages, Metal Finishing, Detergents, Personal Care, Fertilizers, Water Treatment |

| Distribution Channels Analyzed | Online, Offline |

| Regions Covered | North America, Latin America, Asia Pacific, Eastern Europe, Western Europe, Japan |

| Key Players | Martin Midstream, Amresco Inc, GEO Specialty Chemicals Inc., Domo Chemicals, GFS Chemicals, Sigma-Aldrich Corporation, Evonik Industries AG, General Chemicals, and other emerging players |

| Additional Attributes | Dollar sales across forms and applications, consistent use in water treatment and industrial processing, rising demand in food-grade compounds, and regional expansion of production capacities. |

The industry is segmented by product form into powder, granules, and liquid.

Key application areas include food and beverages, metal finishing, detergents, personal care, fertilizers, and water treatment.

The market is distributed through both online and offline channels.

Geographically, the market covers North America, Latin America, Asia Pacific, Eastern Europe, Western Europe, and Japan.

The market is expected to reach USD 879.2 million by 2035.

The market size is projected to be USD 605.5 million in 2025.

The market is expected to grow at a CAGR of 3.8% from 2025 to 2035.

Water treatment is expected to lead the application segment with a 59.8% market share in 2025.

India is projected to lead with a CAGR of 6.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminium Foil Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Foil Seal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium-Free Deodorant Market Analysis - Trends, Growth & Forecast 2025 to 2035

Competitive Breakdown of Aluminium Cup Suppliers

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Market Share Insights for Aluminium Bottle Providers

Aluminium Ion Battery Market Growth - Trends & Forecast 2025 to 2035

Aluminium Cup Market Trends - Size, Growth & Demand 2025 to 2035

Aluminium Bottle Market Growth – Size, Demand & Forecast 2025 to 2035

Aluminium Foil Sachet Market

Aluminium Production Chemicals Market

Aluminium Composite Panels Market

Aluminium Nitride Market

USA Aluminium Bottle Market Insights – Demand, Size & Industry Trends 2025-2035

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Aluminium Bottle Market Insights – Growth, Demand & Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA