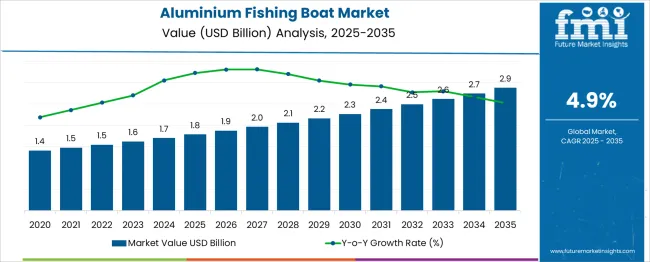

The Aluminium Fishing Boat Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

Year-on-year growth demonstrates strong consistency, averaging between 4.5% and 5.2%, with annual increments of around USD 0.1 billion, indicating a low-volatility trajectory.

By 2030, the market is projected to reach nearly USD 2.3 billion, accounting for 45% of the total incremental value, while the second half of the decade will contribute approximately USD 0.6 billion, representing 55% of cumulative growth, suggesting slightly faster expansion in later years. This pattern highlights a back-loaded growth structure, driven by increasing adoption of premium aluminium boats for recreational use and semi-commercial applications.

Demand stability is underpinned by the material’s attributes, including corrosion resistance, lightweight design, and low maintenance costs, which make aluminium an appealing choice for long-term ownership. The segment also benefits from steady replacement demand and gradual penetration in emerging boating regions.

With minimal market fluctuations, the category offers an attractive profile for strategic investments in advanced designs, fuel-efficient configurations, and integrated accessories, ensuring predictable returns and scalability across high-demand geographies.

| Metric | Value |

|---|---|

| Aluminium Fishing Boat Market Estimated Value in (2025 E) | USD 1.8 billion |

| Aluminium Fishing Boat Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The aluminium fishing boat market maintains a strong yet specialized position within broader marine and fishing-related industries. In the recreational boating market, its share is estimated at 10-12%, as aluminium boats are highly preferred for freshwater and inshore fishing activities due to durability and affordability. Within the marine vessel construction market, the contribution is relatively small at 3-4%, since this category includes large commercial vessels, ships, and yachts.

In the fishing equipment and accessories market, aluminium boats represent around 6-8%, as this market is dominated by gear such as rods, reels, and electronics. For the commercial and sport fishing market, the share stands near 7-9%, reflecting their popularity among sport anglers and small-scale fishery operators.

In the boat material and component market, aluminium boats account for approximately 5-6%, as fiberglass and composites remain widely used in boatbuilding. Although the percentage share in some categories is modest, demand for aluminium boats is steadily increasing due to their lightweight nature, resistance to corrosion, and low maintenance costs. Growth in fishing tourism, competitive angling, and preference for fuel-efficient vessels further strengthen this segment, positioning aluminium fishing boats as a practical and durable solution for both recreational and semi-commercial fishing activities.

The aluminium fishing boat market is expanding steadily as demand rises for cost-efficient, durable, and low-maintenance recreational and professional fishing vessels. Aluminium’s corrosion resistance and lighter weight compared to traditional materials have made it the material of choice in both inland and coastal fishing activities.

Increased interest in outdoor recreational activities and angling, particularly in North America and parts of Europe and Oceania, is contributing to a significant uptick in aluminium boat purchases. Additionally, the availability of customizable hull designs, enhanced navigational features, and safer buoyancy performance enables manufacturers to cater to varied user preferences across freshwater and saltwater environments.

Regulatory emphasis on lower emissions and fuel efficiency is also encouraging the adoption of lightweight aluminium designs compatible with modern propulsion systems. Over the coming years, technological innovations in boat electronics, smart controls, and hull design, combined with a rising number of boat ownership programs and fishing tournaments, are expected to support robust growth in this segment globally.

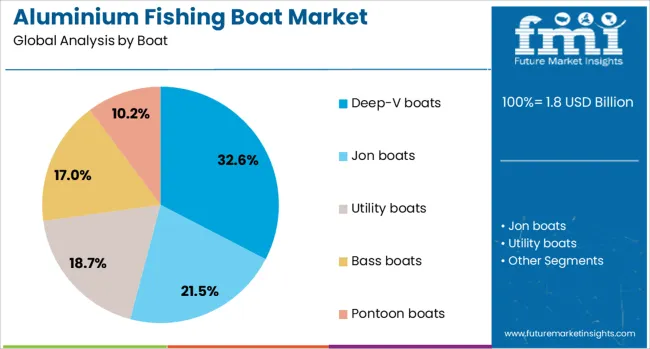

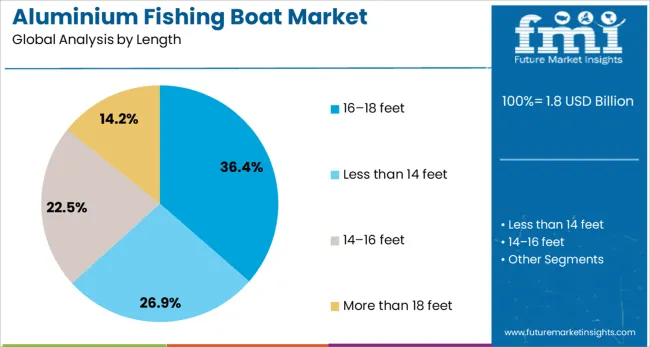

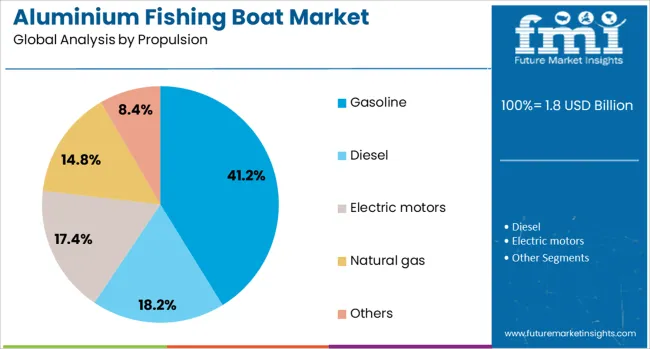

The aluminium fishing boat market is segmented by boat length, propulsion, end use and geographic regions. The aluminium fishing boat market is divided into Deep-V boats, Jon boats, Utility boats, Bass boats, and Pontoon boats. The aluminium fishing boat market is classified into 16–18 feet, less than 14 feet, 14–16 feet, and More than 18 feet. The aluminium fishing boat market is segmented based on propulsion into Gasoline, Diesel, Electric motors, Natural gas, and Others. The end use of the aluminium fishing boat market is segmented into Recreational fishing, Commercial fishing, Rental services, and Government/Rescue operations. Regionally, the aluminium fishing boat industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The deep V boats segment is expected to account for 32.6% of the aluminium fishing boat market’s revenue in 2025, making it the leading segment by boat type. This dominance is attributed to the superior handling and performance that deep V hulls offer in choppy waters, which are essential features for anglers who fish in larger lakes, rivers, or coastal areas.

The segment has benefited from design improvements that enhance stability, reduce drag, and support higher horsepower engines, enabling safer and faster navigation in varied conditions. Both recreational and tournament anglers are adopting aluminium deep V boats due to their durability, trailerability, and ease of storage.

The compatibility of deep V hulls with modern fishing electronics, livewells, and storage solutions has further contributed to their widespread use. Their ability to accommodate multiple anglers and gear without compromising maneuverability or comfort has reinforced their utility across a broad range of fishing environments.

The 16 to 18 feet length segment is projected to hold 36.4% of the total market share in the aluminium fishing boat market in 2025. This segment’s prominence is being supported by its ideal balance of portability, capacity, and affordability, which appeals to a wide range of fishing enthusiasts.

Boats within this size range are commonly selected for recreational use due to their ease of towing, storage, and navigation in smaller lakes and rivers. The compact length enables accessibility for first-time buyers, while still providing ample space for onboard equipment, seating, and storage.

Manufacturers have increasingly optimized designs in this range for stability, safety, and integration with sonar and GPS systems. The rising popularity of solo and small group fishing excursions, coupled with supportive financing options and increased distribution through online channels and marine dealers, has further cemented the 16 to 18 feet category as the most preferred length among users.

The gasoline propulsion segment is estimated to contribute 41.2% of the aluminium fishing boat market’s revenue in 2025, establishing it as the leading propulsion method. This growth is being driven by gasoline engines’ established reliability, availability, and compatibility with a wide range of boat sizes and use cases. Advancements in outboard engine technologies have led to more fuel-efficient, lower-emission gasoline systems, which comply with regulatory mandates while delivering strong performance.

The ease of refueling and widespread service infrastructure for gasoline engines has made them a practical choice for users in remote and recreational settings. Aluminium boats powered by gasoline engines offer higher speed, responsive acceleration, and superior endurance, which are critical for both professional anglers and weekend users.

The versatility of gasoline propulsion systems to operate across inland and coastal zones without major modifications has also supported their dominance. Increasing adoption of portable and quiet four-stroke models with smart diagnostics and electronic controls has reinforced the appeal of gasoline engines in the aluminium fishing boat market.

Aluminium fishing boats are being embraced by both commercial and recreational fishermen for their light weight, corrosion resistance, and ease of customization. Hull designs accommodate trolling motors, fish finders, and live wells while offering low draft and improved stability. Markets such as inland freshwater, coastal inshore, and small-scale charter operations have adopted aluminium vessels for their durability. Manufacturers supplying modular decking, tilting T-tops, and integrated seating configurations have supported both functionality and comfort for anglers across segments.

Aluminium hulls have been selected for their superior strength-to-weight ratio and resistance to rust in both freshwater and saltwater environments. Boat builders have developed hull forms that support smooth planing at reduced fuel consumption and provide stable platforms for fishing gear deployment. Custom fit features such as modular rod lockers, ergonomic console layouts, and mounting brackets for livewell systems have supported ease of angling and accessory integration. Corrosion-resistant alloys and anodized fittings have improved long-term value and low maintenance compared to fiberglass or wood alternatives. Since vessel owners have prioritized durability and personalized configurations without added ballast, aluminium designs have been strongly favored in small commercial and prosumer markets.

Cost of aluminium and specialized welding processes has made production investment higher than for conventional fiberglass or wood boats. Skilled fabrication is required to ensure watertight welds and alloy integrity, increasing labor hours and weld inspection routines. Design standardization is limited due to variations in hull geometry, accessory layout, and regional regulations, making manufacturing scaling difficult. Noise and vibration from aluminium hull resonance have required extra sound-dampening panels or foam insulation to meet passenger comfort expectations. Limited resale networks for used aluminium craft and higher depreciation of second-hand value have influenced operator decisions. As boaters have balanced upfront price against longevity benefits, growth in mainstream leisure segments has been confined primarily to dedicated fishing enthusiasts.

Significant demand has been identified in recreational fishing and angling tourism, where countries and regions are promoting outdoor water activities. Expansion of freshwater fishing zones and increasing consumer interest in leisure boating have opened avenues for aluminum boat manufacturers to widen distribution networks. Government-led angling tourism initiatives are prompting investments, with localized boat production and rental services being prioritized in emerging regions. Lightweight and corrosion-resistant characteristics have enabled enhanced fuel economy and portability, making aluminum boats appealing for inland lakes and rivers. Partnerships with rental operators and charter services have been formed to deliver customizable fishing boats. The rising popularity of mid‑sized boats (16-18‑foot range) offers scalable growth potential, especially in North America and Asia‑Pacific

A clear shift toward advanced hull design and engine efficiency has been observed, with deep‑V and multi‑species boat configurations gaining market share for stability and performance in diverse water conditions. Engine types below 200 HP remain dominant, but interest in higher‑power models is emerging for offshore use. Modular and customized boat sizes (14-16 ft and 16-18 ft) are being produced to meet varied fishing needs. Enhanced corrosion protection and lighter structural components are being incorporated to improve durability and reduce maintenance. Leading manufacturers are offering digital features such as fish-finder integration and GPS navigation to meet modern expectations. Strategic alliances between OEMs and accessory providers are reshaping product ecosystems globally

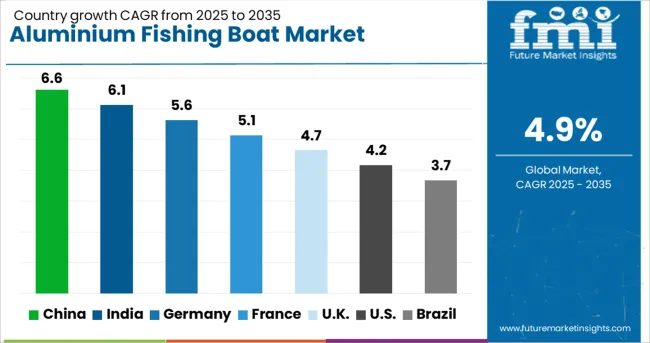

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The global aluminium fishing boat market is projected to grow at 4.9% CAGR from 2025 to 2035, driven by increasing interest in recreational boating and demand for lightweight, corrosion-resistant vessels. China leads with 6.6%, backed by coastal fishing fleet modernization and marine tourism programs. India follows at 6.1%, where mechanization of small fisheries and inland waterway development create new demand.

Germany posts 5.6%, leveraging innovations for recreational fishing and lake boating. France records 5.1%, aided by charter operators and modern fleet upgrades. The United Kingdom at 4.7% shows demand from sport fishing and family leisure activities. The analysis includes over 40 countries, with the five fastest-growing profiled below.

China is projected to grow at 6.6% CAGR, supported by modernization of coastal fisheries and rapid growth in marine tourism. Aluminium boats are widely used for both commercial and recreational purposes, owing to their durability and saltwater resistance. Domestic manufacturers are focusing on welded hull structures and modular designs for offshore performance.

The integration of advanced navigation systems and fish-finding sonar features enhances adoption in the premium boating segment. E-commerce channels and specialty dealerships are expanding access to high-quality aluminium boats for inland waterways and coastal zones. Government-backed programs that promote eco-friendly fishing operations further accelerate fleet upgrades across major provinces.

India is expected to register a 6.1% CAGR, driven by increasing mechanization of small fisheries and expansion of inland waterways for tourism. Aluminium boats are replacing wooden vessels due to their longer life and lower maintenance. Demand is concentrated in states like Kerala, Tamil Nadu, and Maharashtra, where coastal fisheries depend on lightweight boats for day-to-day operations.

Domestic manufacturers are offering affordable aluminium boats with modular features to attract both commercial fishing operators and recreational boating customers. Government schemes for motorized fishing vessels and credit incentives under fisheries programs further boost adoption. Rising interest in angling clubs and river-based leisure activities also contributes to market growth.

Germany is forecast to grow at 5.6% CAGR, supported by increasing recreational boating activities across lakes and rivers. Aluminium fishing boats dominate inland waterway usage due to their lightweight nature and superior handling capabilities. Manufacturers are introducing advanced anti-corrosion coatings, ergonomic designs, and hybrid propulsion systems to appeal to premium boating customers. Demand is also rising from organized fishing clubs and sports associations, creating opportunities for models with integrated storage, electronics, and safety features. E-commerce and dealership expansions have improved access to high-performance boats across Germany. Collaboration between marine technology firms and local boatbuilders strengthens innovation in the aluminium fishing sector.

France is projected to grow at a 5.1% CAGR, driven by marine tourism and fleet modernization initiatives for small-scale fisheries. Aluminium boats are widely favored for coastal and inland waters due to their resistance to corrosion and ease of maintenance. Charter operators along the Atlantic and Mediterranean coasts are upgrading fleets to aluminium-based designs with advanced angling features.

Domestic boatbuilders are introducing models with lightweight hulls and integrated storage systems to appeal to both recreational and semi-commercial users. Fishing associations and leisure boating clubs are fueling demand for premium models equipped with electronic navigation aids and improved safety standards.

The United Kingdom is forecast to post 4.7% CAGR, supported by growing interest in recreational fishing, sport angling, and family leisure boating. Coastal areas such as Scotland and Cornwall are witnessing increased adoption of lightweight aluminium boats for ease of handling and transportation.

Manufacturers are focusing on compact trailer-ready models equipped with navigation tools and improved flotation systems to meet safety regulations. Dealer networks and online platforms have enhanced accessibility, while second-hand aluminium boats maintain strong resale value among boating enthusiasts. The shift toward small-scale charters and guided angling trips further accelerates demand for multi-functional aluminium fishing boats.

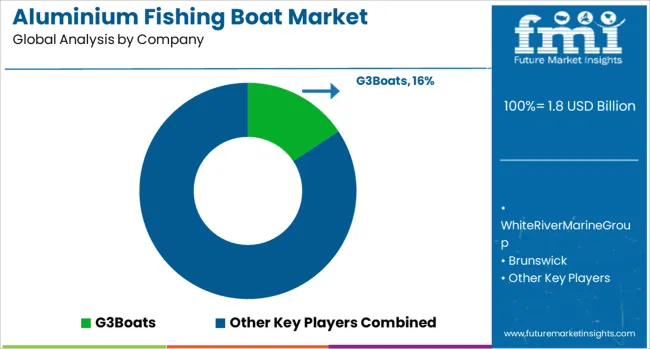

The aluminium fishing boat market exhibits a moderately concentrated structure dominated by established brands such as G3 Boats, White River Marine Group, Brunswick, Xpress Boats, and Alumacraft Boat, which leverage economies of scale, strong dealer networks, and proprietary designs to secure profitability. Entry barriers are significant due to high capital requirements, regulatory compliance, and the need for robust distribution channels, limiting the threat of new entrants.

Supplier power remains moderate as aluminium and marine-grade components are widely available, while buyer power is constrained by brand loyalty, financing programs, and customization needs, creating moderate switching costs. Substitution risks emerge from fiberglass and composite boats offering advanced aesthetics, as well as from recreational alternatives like kayak fishing, though aluminium boats maintain an advantage in durability, affordability, and ease of maintenance for inland waters.

Strategic groups are segmented into premium players such as Brunswick and White River Marine, focusing on advanced hull technologies, performance enhancements, and integrated electronics, versus value-oriented brands like Legend Boats and MirroCraft emphasizing cost efficiency. Differentiation drivers include proprietary hull design, brand reputation, and dealer servicing capabilities, while cost leadership is achieved through scale-driven manufacturing and vertical integration.

Competitive advantages are sustained by exclusive distribution agreements, established brand equity, and aftersales service ecosystems, making imitation challenging for smaller firms. Industry rivalry remains intense due to seasonal demand fluctuations, pushing innovation in lightweight materials, modular layouts, and enhanced fuel efficiency. Future dynamics will center on electrification, digital connectivity, and compliance with evolving environmental regulations, alongside performance benchmarking through market share, R&D intensity, and profitability margins.

In September 2024, Princecraft (a full subsidiary of Brunswick) unveiled its redesigned Sportfisher Series for model year 2025. This full keel-up redesign, ranging from 21′ to 23′ includes features tailored for anglers such as enlarged rear and bow livewells, redesigned stern fishing stations, and upgraded layouts to improve usability

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Boat | Deep-V boats, Jon boats, Utility boats, Bass boats, and Pontoon boats |

| Length | 16–18 feet, Less than 14 feet, 14–16 feet, and More than 18 feet |

| Propulsion | Gasoline, Diesel, Electric motors, Natural gas, and Others |

| End Use | Recreational fishing, Commercial fishing, Rental services, and Government/Rescue operations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | G3Boats, WhiteRiverMarineGroup, Brunswick, XpressBoats, AlumacraftBoat, SeaArkBoats, SmokerCraft, MirroCraft, PrincecraftBoats, and LegendBoats |

| Additional Attributes | Dollar sales by boat type (jon boats, deep-V boats, bass boats) and usage (recreational, professional fishing), with demand influenced by rising outdoor recreational activities and boating tourism. North America dominates adoption due to strong angling culture, while Europe and Asia-Pacific show steady growth. Key innovations include lightweight aluminum alloys, modular storage solutions, and integration of GPS and sonar technologies for enhanced fishing experiences. |

The global aluminium fishing boat market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the aluminium fishing boat market is projected to reach USD 2.9 billion by 2035.

The aluminium fishing boat market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in aluminium fishing boat market are deep-v boats, jon boats, utility boats, bass boats and pontoon boats.

In terms of length, 16–18 feet segment to command 36.4% share in the aluminium fishing boat market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminium Foil Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Foil Seal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium-Free Deodorant Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Aluminium Bottle Providers

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Competitive Breakdown of Aluminium Cup Suppliers

Aluminium Cup Market Trends - Size, Growth & Demand 2025 to 2035

Aluminium Ion Battery Market Growth - Trends & Forecast 2025 to 2035

Aluminium Bottle Market Growth – Size, Demand & Forecast 2025 to 2035

Aluminium Foil Sachet Market

Aluminium Production Chemicals Market

Aluminium Composite Panels Market

Aluminium Nitride Market

USA Aluminium Bottle Market Insights – Demand, Size & Industry Trends 2025-2035

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

Japan Aluminium Bottle Market Insights – Growth, Demand & Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA