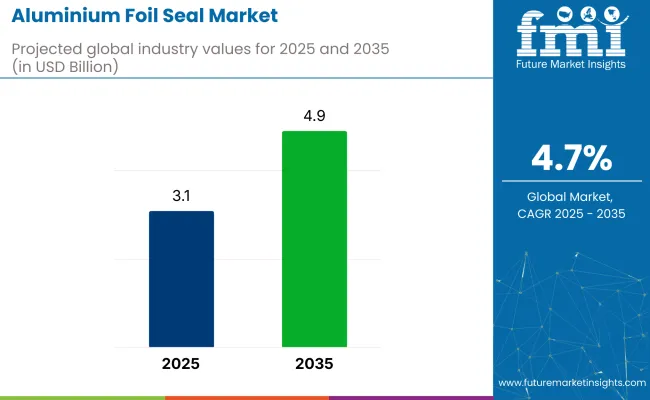

The aluminium foil seal market is experiencing strong momentum, driven by its ability to ensure product integrity, extend shelf life, and prevent leakage. In 2025, the market is valued at USD 3.1 billion and is forecast to reach USD 4.9 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.7% during the forecast period.

This growth is largely attributed to the increasing demand for safe, secure, and tamper-evident packaging solutions, especially across sectors such as food and beverages, pharmaceuticals, and personal care. Aluminium foil seals are critical in preserving the quality of products while providing a visual indication of tampering, which helps to maintain consumer trust.

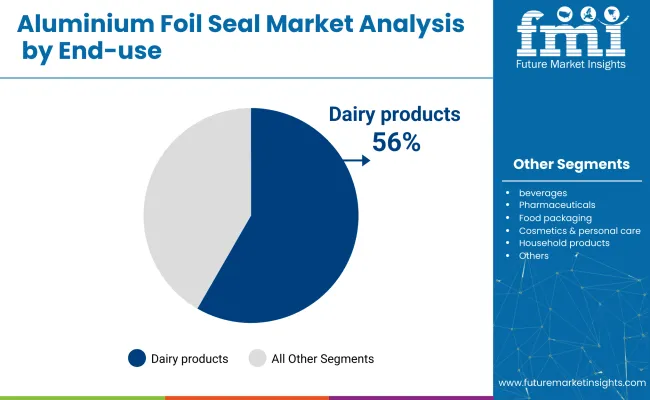

The food and beverage industry is one of the primary drivers of market growth, as manufacturers look to ensure the freshness and safety of their products. Aluminium foil seals are widely used in packaging applications such as bottles, containers, and jars to prevent contamination and preserve the shelf life of products like dairy, juices, and sauces. As consumer preferences shift towards products with longer shelf lives and better quality assurance, the demand for reliable sealing solutions like aluminium foil seals is increasing.

In the pharmaceutical and personal care industries, aluminium foil seals are used extensively in medicine packaging, ensuring the integrity and security of products. With an increasing focus on healthcare safety and the rise in counterfeit products, aluminium foil seals provide an added layer of security to prevent tampering and ensure the authenticity of medicines and cosmetics.

In the first quarter of 2025, Guido Aufdemkamp, Managing Director of the European Aluminium Foil Association (EAFA), expressed confidence in the industry's performance despite the challenges, stating, The industry is very satisfied with the start to the year.

The European aluminium foil industry remains agile in these uncertain and challenging times and is helping its customers to best manage industry conditions. Even though we expect some slowdown in growth towards the end of the year, we assess the current industry situation as stable. This quote highlights the industry's resilience and the ongoing need for aluminum foil in diverse sectors such as packaging and sealing solutions.

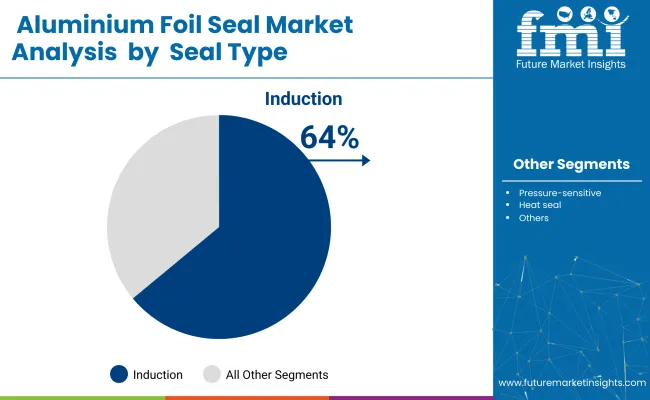

Investments in the industry are driven by the demand for high-barrier, tamper-evident packaging solutions across food, beverage, and pharmaceutical sectors. Key growth areas include induction seal technology, medium-range foil thickness (50-100 microns), and dairy product applications, all of which support both safety and resource-efficient requirements in modern packaging systems.

Induction seals are expected to dominate with a 64% share in 2025, due to their effectiveness in providing airtight and leak-proof seals.

Foils in the 50-100 micron range account for 45% of the industry in 2025. This thickness range offers a balanced combination of durability, flexibility, and compatibility with induction, pressure-sensitive, and heat-seal technologies.

Dairy products represent the leading end-use segment with 56% of the industry in 2025.

The industry is shaped by rising regulatory pressure for product safety, and extended shelf life packaging. While demand accelerates in dairy and pharma sectors, challenges persist around raw material volatility and recyclability of multi-layered seal structures.

Stringent Safety and Shelf-Life Requirements Are Driving Demand

Growth is strongly driven by the global need for tamper-evident, hygienic, and contamination-free sealing-especially in food and pharmaceutical sectors. Regulatory bodies such as the FDA, EFSA, and FSSAI enforce packaging safety norms, pushing companies to adopt foil seals that ensure complete product integrity. Induction and heat seals are becoming industry standards, especially in single-serve dairy, oral liquids, and nutraceuticals.

Leading manufacturers such as Constantia Flexibles and Toyo Aluminium Ecko Products are innovating in lacquer coatings and barrier layers that maintain foil performance while enabling easier application. With increasing e-commerce distribution, the demand for robust, leak-proof sealing has intensified.

Material Recycling Challenges Restrain Growth

Despite being lightweight and recyclable, aluminium foil seals face limitations when laminated with plastics or coated with non-recyclable adhesives. This creates challenges for post-consumer recycling and compliance with extended producer responsibility (EPR) norms in Europe and Asia. While companies like Henan Huawei Aluminum and Novel is are exploring mono-material solutions and solvent-free adhesives, scalability remains a barrier.

Rising aluminium prices, supply chain disruptions, and variability in foil gauge availability also increase production costs, affecting profit margins. As brands aim for 100% recyclable packaging, innovation in single-material foil sealing systems and biodegradable coatings will be key to overcoming these challenges.

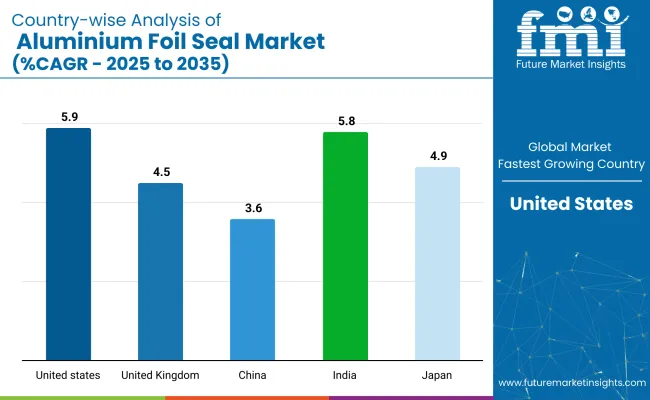

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

| United Kingdom | 4.5% |

| China | 3.6% |

| India | 5.8% |

| Japan | 4.9% |

Country-level demand for aluminium foil seals is shaped by advancements in dairy processing, pharmaceutical packaging standards, and the push toward recyclable materials. Developed regions are focused on sealing efficiency and compliance, while emerging industry prioritize cost-effective formats that maintain safety and shelf life.

The United States is projected to experience a robust 5.9% CAGR in the aluminium foil seal industry from 2025 to 2035.

The aluminium foil seal industry in the United Kingdom is forecasted to grow at a 4.5% CAGR from 2025 to 2035, driven by demand from the food, beverage, and pharmaceutical sectors.

The industry in China is expected to grow at a 3.6% CAGR from 2025 to 2035, with major contributions from the country’s strong manufacturing capabilities.

The industry in India is projected to grow at a 5.8% CAGR from 2025 to 2035, fueled by rapid urbanization and increasing consumer demand for packaged products.

The industry in Japan is expected to grow at a 5.8% CAGR from 2025 to 2035, propelled by advancements in technology and the country’s high demand for precision packaging solutions.

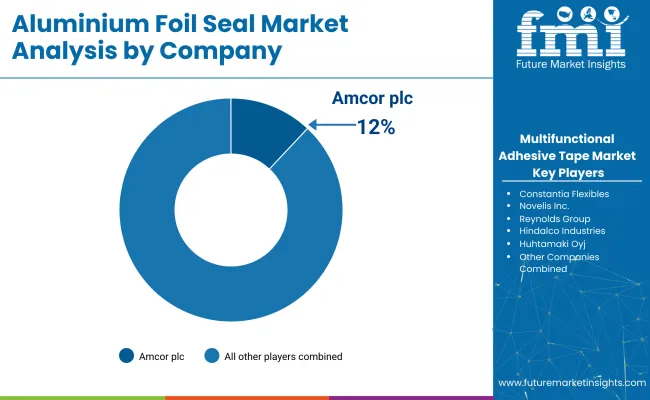

The industry features a mix of well-established players and emerging companies employing diverse strategies to capture share. Key players like LakinKemas Global, Huiyang Packaging, and Henan Real top Machinery maintain a strong presence through their extensive product portfolios and focus on technological innovation.

These companies invest heavily in R\&D to introduce new solutions, such as Renewable, recyclable foil seals, responding to the growing consumer demand for eco-friendly products. Entry barriers in the industry include high capital investment for production facilities, compliance with strict regulations, and fluctuating raw material prices, particularly aluminum.

Despite these challenges, the industry remains fragmented, with both large and small players competing. Consolidation is occurring as companies pursue strategic partnerships and collaborations to enhance their reach and technological capabilities.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.1 billion |

| Projected Market Size (2035) | USD 4.9 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million square meters for volume |

| Seal Types Analyzed | Induction, Pressure-sensitive, Heat seal, Others |

| Thickness Segmentation | Below 50 microns, 50-100 microns, Above 100 microns |

| End-Use Segmentation | Dairy Products, Beverages, Pharmaceuticals, Cosmetics & Personal Care, Food Packaging, Household Products, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Market | Lakin Kemas Global, Huiyang Packaging, Eagle seal industries , Mauli Associates, Shah and Company, Henan Realtop Machinery, Wanqi Packaging, Qingzhou Jinhua Aluminum-Packaging Materials Factory, Young Plus Corporation, and Well Pack. |

| Additional Attributes | Dollar sales by seal type, thickness, and end-use, increasing demand in dairy and pharmaceutical packaging, growing adoption in eco-friendly food packaging, technological advancements in sealing techniques, regional trends in packaging standards and regulations. |

Induction, pressure-sensitive, heat seal, and others.

50 microns, 50-100 microns, and above 100 microns.

Dairy products, beverages, pharmaceuticals, cosmetics & personal care, food packaging, household products, and others.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Middle East and Africa (MEA).

The industry is expected to reach USD 4.9 billion by 2035.

The industry is projected to grow at a CAGR of 4.7%.

Induction seals dominate with a 64% market share.

Dairy products lead the industry, accounting for 56% of the total demand.

The United States is projected to grow at the highest CAGR of 5.9% through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminium Cladding System Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Profiles for Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium-Free Deodorant Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Aluminium Bottle Providers

Competitive Breakdown of Aluminium Cup Suppliers

Aluminium Cup Market Trends - Size, Growth & Demand 2025 to 2035

Aluminium Ion Battery Market Growth - Trends & Forecast 2025 to 2035

Aluminium Bottle Market Growth – Size, Demand & Forecast 2025 to 2035

Aluminium Production Chemicals Market

Aluminium Composite Panels Market

Aluminium Nitride Market

Aluminium Foil Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Aluminium Foil Sachet Market

USA Aluminium Bottle Market Insights – Demand, Size & Industry Trends 2025-2035

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA