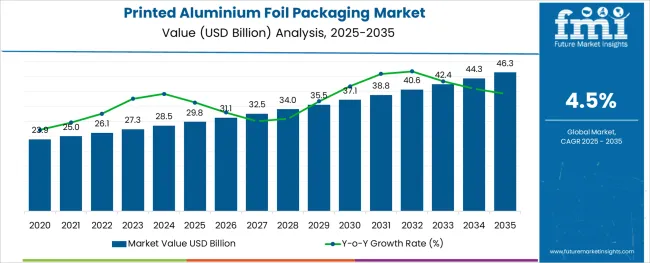

The Printed Aluminium Foil Packaging Market is estimated to be valued at USD 29.8 billion in 2025 and is projected to reach USD 46.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The printed aluminium foil packaging market is witnessing accelerated growth owing to increased demand for lightweight, flexible, and protective packaging solutions that also offer strong branding potential. This growth is underpinned by advancements in rotogravure and flexographic printing technologies that enable high-resolution graphics, enhancing shelf appeal and consumer engagement.

Regulatory pressure to reduce plastic packaging and the need for materials with excellent barrier properties are pushing manufacturers toward aluminium-based alternatives. In sectors like food, pharmaceuticals, and cosmetics, the ability of printed foil to offer protection against light, moisture, and oxygen has positioned it as a premium choice.

Furthermore, rising consumption of packaged food and convenience products in emerging economies is expanding the application footprint of this material. The market outlook remains robust as sustainability initiatives, consumer preference for premium packaging, and the increasing role of branding through packaging continue to influence adoption across industries.

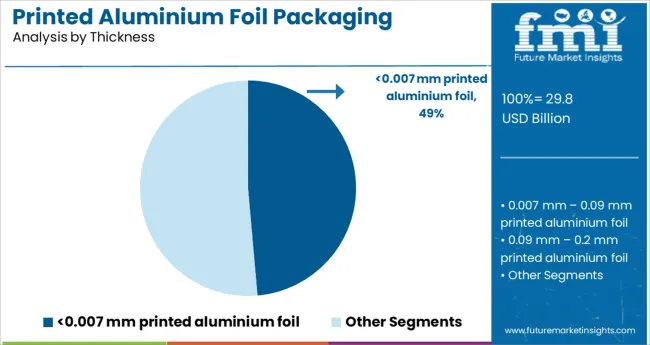

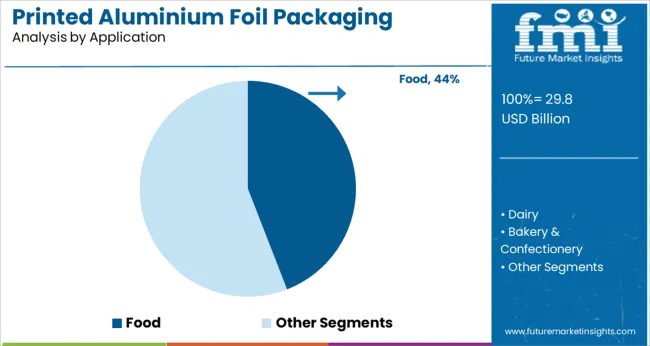

The market is segmented by Thickness, Application, and End Use and region. By Thickness, the market is divided into <0.007 mm printed aluminium foil, 0.007 mm – 0.09 mm printed aluminium foil, 0.09 mm - 0.2 mm printed aluminium foil, and 0.2 mm - 0.4 mm printed aluminium foil. In terms of Application, the market is classified into Food, Dairy, Bakery & Confectionery, Ready-to-eat, Others, Beverages, Pharmaceuticals, Personal care & cosmetics, and Others.

Based on End Use, the market is segmented into Bags & pouches, Wraps & rolls, Blisters, Lids, Laminated tubes, and Trays. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 0.007 mm printed aluminium foil segment is projected to account for 48.60 percent of the total market revenue by 2025, making it the leading thickness category. This dominance is attributed to its superior flexibility, lightweight nature, and compatibility with high-speed printing and conversion processes.

The segment’s popularity is reinforced by its wide applicability in food, pharmaceutical, and personal care packaging where fine gauge foils are preferred for wrapping, sealing, and laminating. Additionally, the use of ultra-thin foil contributes to material cost savings and supports sustainability goals by reducing overall aluminium consumption.

Manufacturers are favouring this thickness range due to its adaptability across automated packaging lines, efficient heat sealing, and excellent barrier performance. These operational and environmental benefits have positioned this segment as the preferred choice across multiple end-use sectors.

The food application segment is expected to hold 44.10 percent of market revenue in 2025, establishing it as the most prominent end-use category. This share is driven by the increasing demand for hygienic, tamper-evident, and long shelf-life packaging in the food industry. Printed aluminium foil has gained traction in ready-to-eat meals, dairy, confectionery, and snack categories where preservation and visual appeal are critical.

Its ability to maintain product freshness while supporting vibrant branding and labeling has made it a staple in food packaging. In addition, consumer preferences for portion-controlled and single-serve formats have supported increased use of printed foils.

Stringent food safety regulations and the need for compliant, inert materials have further strengthened the case for aluminium-based solutions. As a result, the food segment continues to lead in driving volume and innovation in the printed aluminium foil packaging market.

The global packaging industry has undergone significant transformation in the last few decades, driven by an absolute need for customization. Manufacturers of aluminium foil printing machines are focusing on machines which can print on a variety of products such as blister foil, aluminium foil, labels, PVC, and paper, among others. Embossing is also done on aluminium foil and is considered as one of the formats of printed aluminium foil packaging.

Printed aluminium foil packaging caters to a wide range of industries such as the food & beverages industry, pharmaceuticals industry, and the personal care & cosmetics industry, among others. High quality rotogravure and flexographic printing is used on aluminium foil to impart a vibrant appearance to the package.

The growth in demand for flexible packaging products such as bags, pouches, wraps, rolls, lids, and blisters, among others is expected to play a critical role in the growth of the global printed aluminium foil packaging market during the forecast period.

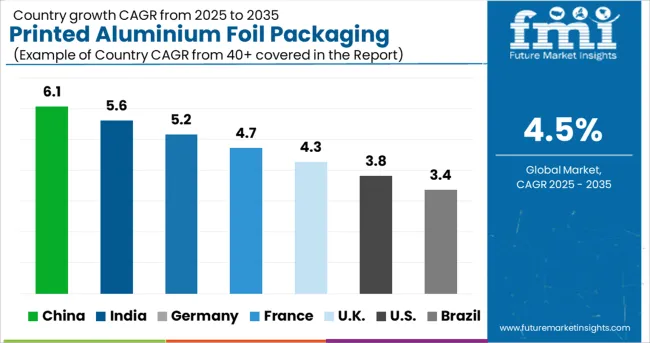

The Asia Pacific is expected to be the leading region during the forecast period, miles ahead in terms of aluminium foil packaging production. Certain factors might prove to be a hurdle for the growth of the printed aluminium foil packaging market.

Some of the recent trends observed in the global printed aluminium foil packaging market are -

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Some of the key players whose aluminium foil packaging products are printed by brands include:

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The global printed aluminium foil packaging market is estimated to be valued at USD 29.8 billion in 2025.

It is projected to reach USD 46.3 billion by 2035.

The market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types are <0.007 mm printed aluminium foil, 0.007 mm – 0.09 mm printed aluminium foil, 0.09 mm – 0.2 mm printed aluminium foil and 0.2 mm – 0.4 mm printed aluminium foil.

food segment is expected to dominate with a 44.1% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

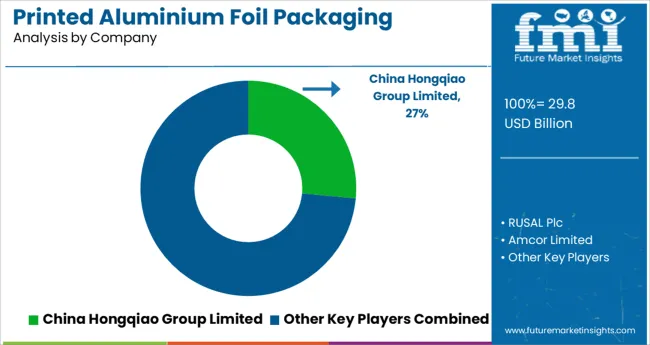

Industry Share & Competitive Positioning in Printed Aluminium Foil Packaging

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Printed Labels Market Size and Share Forecast Outlook 2025 to 2035

Printed Chipless RFID Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Printed Sensors Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Printed Antenna Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Printed and Flexible Sensors Market Report - Growth & Demand 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Printed Plastic Films Market Insights - Growth & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Market Share Distribution Among Printed Carton Manufacturers

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

3d-Printed Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA