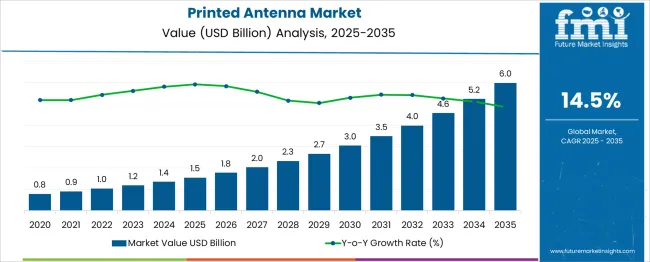

The Printed Antenna Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 6.0 billion by 2035, registering a compound annual growth rate (CAGR) of 14.5% over the forecast period.

The printed antenna market demonstrates a robust growth trajectory over the decade, increasing from USD 0.8 billion in 2021 to USD 2.7 billion by 2030, representing an absolute dollar opportunity of USD 1.9 billion and a strong CAGR of approximately 14.8%. Year-wise, the market begins at USD 0.8 billion in 2021, grows to USD 0.9 billion in 2022, and reaches USD 1.0 billion by 2023. This early growth phase reflects increasing adoption of printed electronics and the demand for lightweight, flexible antennas in various connected devices.

By 2024, the market expands to USD 1.2 billion, and by 2025, it climbs to USD 1.4 billion, driven by advances in additive manufacturing and the growing prevalence of IoT applications. The second half of the decade exhibits even stronger momentum. The market scales to USD 1.5 billion in 2026, USD 1.8 billion in 2027, and USD 2.0 billion by 2028, supported by the integration of 5G networks, wearable technology, and connected automotive systems. By 2029, the value rises to USD 2.3 billion, ultimately reaching USD 2.7 billion in 2030. This steep growth pattern indicates that printed antennas are becoming critical in supporting high-frequency communication, compact device designs, and cost-efficient manufacturing processes.

The rising need for antennas that can be embedded in flexible substrates for smart devices, RFID systems, and aerospace applications further accelerates adoption. Manufacturers focusing on scalable production techniques, advanced conductive materials, and partnerships with electronics OEMs will gain a significant competitive edge as printed antenna solutions become a cornerstone of next-generation connectivity ecosystems.

| Metric | Value |

|---|---|

| Printed Antenna Market Estimated Value in (2025 E) | USD 1.5 billion |

| Printed Antenna Market Forecast Value in (2035 F) | USD 6.0 billion |

| Forecast CAGR (2025 to 2035) | 14.5% |

The printed antenna industry accounts for a relatively small yet growing share within these broader markets. In the overall antenna market, printed antennas hold an estimated share of around 4-5%, as they serve as cost-effective and lightweight alternatives to conventional designs. Within the RF antenna segment, their contribution is modest, likely 2-3%, since traditional dipole and patch antennas dominate critical applications.

In the IoT device ecosystem, printed antennas capture approximately 6-7%, driven by their integration into compact, low-power connected devices. Within the wearable technology and smart electronics sector, their share is slightly higher, around 8-9%, as flexibility and thin form factors are prioritized. In the broader telecommunication equipment market, their contribution remains below 3%, given the prevalence of established antenna technologies in large-scale deployments.

Despite these relatively small shares, printed antennas are gaining traction rapidly due to their ability to support 5G networks, automotive connectivity, and embedded wireless systems. The market is further supported by advancements in conductive inks, roll-to-roll printing, and substrate innovation, which enable mass production at reduced costs. With the increasing demand for miniaturized antennas in consumer electronics, medical devices, and smart infrastructure, printed antennas are expected to evolve as a critical enabler for next-generation wireless communication systems, positioning them for substantial growth over the next few years.

As the global demand for high-speed, wideband connectivity surges across satellite communications, autonomous systems, and 5G infrastructure, printed antennas are emerging as essential components due to their thin profile, ease of integration, and design flexibility.

Industry players are accelerating the use of additive manufacturing techniques and advanced substrates, enabling complex geometries and rapid prototyping for varied use cases. Increased defense modernization programs and the proliferation of IoT devices have further enhanced the relevance of printed antennas in mission-critical and space-constrained environments.

Ongoing investments in flexible electronics and aerospace-grade RF technologies are also contributing to market momentum. In the near future, widespread adoption of printed antennas is expected to intensify, supported by continued innovation in dielectric materials, tunable components, and high-frequency circuit design, making them indispensable for evolving communication and sensing platforms.

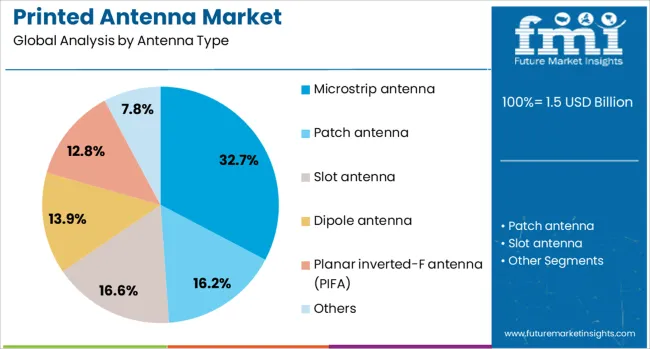

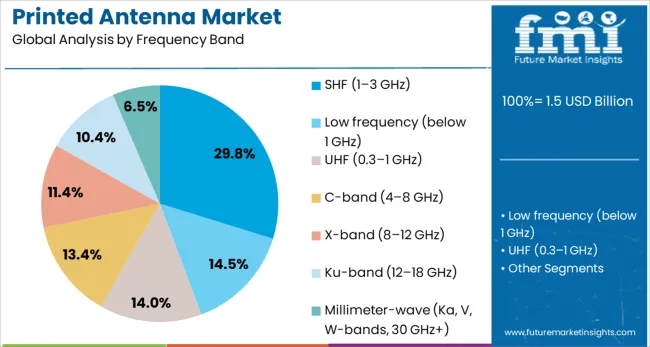

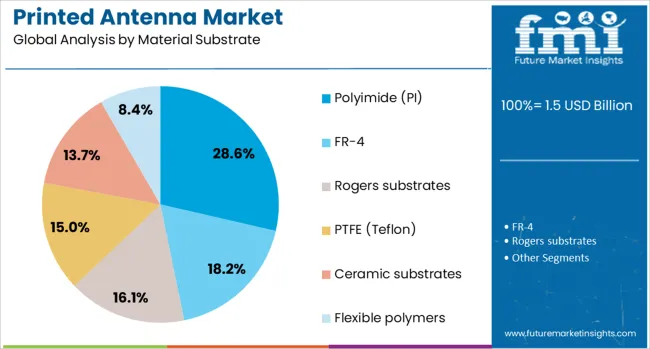

The printed antenna market is segmented by antenna type, frequency band, material substrate, end‑use industry, and geographic regions. The printed antenna market is divided by antenna type into Microstrip antenna, Patch antenna, Slot antenna, Dipole antenna, Planar inverted‑F antenna (PIFA), and Others. In terms of frequency band of the printed antenna market is classified into SHF (1–3 GHz), Low frequency (below 1 GHz), UHF (0.3–1 GHz), C‑band (4–8 GHz), X‑band (8–12 GHz), Ku‑band (12–18 GHz), and Millimeter‑wave (Ka, V, W‑bands, 30 GHz+).

Based on material substrate of the printed antenna market is segmented into Polyimide (PI), FR‑4, Rogers substrates, PTFE (Teflon), Ceramic substrates, and Flexible polymers. By end‑use industry of the printed antenna market is segmented into Telecommunications & 5G infrastructure, Consumer electronics (smartphones, wearables, laptops), Aerospace & defense, Automotive (telematics, V2X), Healthcare (medical implants, RFID tags), and Industrial IoT & logistics. Regionally, the printed antenna industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microstrip antenna segment is expected to hold 32.7% of the printed antenna market revenue share in 2025, positioning it as the leading antenna type. This dominance is being driven by the compact structure, low fabrication cost, and planar profile of microstrip antennas, which make them ideal for integration into modern communication devices.

Their suitability for conformal and embedded applications has enabled wide adoption in aerospace, automotive radar, and consumer electronics. The ability to design multiband and circularly polarized configurations through photolithographic processes has further contributed to their scalability.

With the increasing reliance on satellite communication, navigation, and real-time data links, microstrip antennas have become preferred for applications requiring reliable performance in space-limited designs. The growth of advanced driver-assistance systems and 5G-enabled devices has also reinforced demand for these antennas, as they support diverse frequency bands while maintaining mechanical robustness and lightweight features essential for mobile and wearable platforms.

The SHF frequency band segment is projected to contribute 29.8% to the overall printed antenna market revenue in 2025. The segment's expansion is being fueled by the rising demand for high-frequency communication in radar systems, satellite links, and point-to-point data transmission.

Printed antennas operating in the SHF band have gained traction due to their ability to support high data rates and narrow beamwidths, which are essential for precision-based applications in defense and telecommunication. With the deployment of 5G infrastructure and increased bandwidth requirements across industrial automation and UAV communication systems, SHF-enabled antennas are being increasingly integrated into embedded systems.

Their compatibility with high-speed transceivers and ability to minimize interference through focused radiation patterns have added to their market appeal. The segment's growth is also being reinforced by innovations in substrate materials and circuit miniaturization techniques that enable efficient performance across diverse SHF-based deployments in compact form factors.

The polyimide material substrate segment is anticipated to account for 28.6% of the printed antenna market revenue share in 2025, reflecting its growing importance in flexible and high-frequency electronics. The superior thermal stability, dielectric consistency, and mechanical durability of polyimide have made it the material of choice for fabricating antennas used in dynamic and harsh environments.

Printed antennas built on polyimide substrates offer excellent performance in bendable, foldable, and curved form factors, which is essential in aerospace, defense, and wearable technology applications. The rise of flexible electronics and compact communication modules has driven manufacturers to adopt polyimide for high-reliability operations at millimeter-wave frequencies.

Moreover, the compatibility of polyimide with roll-to-roll and inkjet printing processes supports high-throughput manufacturing while ensuring precision and repeatability. As the demand grows for lightweight, conformal antennas with high integration density, polyimide substrates are expected to play a critical role in the expansion of advanced communication infrastructure.

Printed antennas are gaining traction due to their integration in 5G, IoT, automotive, and aerospace systems, driven by compact design and high-frequency efficiency. Material advancements with polymers and conductive inks are enabling cost-effective, lightweight, and customizable solutions for next-generation communication devices.

Printed antennas have been amplified due to their integration in wireless communication systems and compact electronic devices. High-frequency compatibility has made these antennas preferable for advanced communication protocols such as 5G and IoT networks. Lightweight structure and cost efficiency have positioned printed antennas as a competitive choice for manufacturers seeking performance-driven designs. Industries focusing on miniaturized electronics have adopted these solutions to enhance signal transmission without compromising device dimensions. Rapid adoption in automotive connectivity and aerospace communication highlights their relevance in mission-critical systems where reliability and low-profile configurations are required. This trend indicates an acceleration of market penetration across both consumer and industrial ecosystems with greater emphasis on design flexibility and operational efficiency.

Material optimization has become a critical factor in printed antenna development as manufacturers seek substrates capable of supporting high-frequency applications without compromising signal integrity. Printed antennas are being engineered with advanced polymers and conductive inks to achieve high gain and directional performance. Design flexibility has enabled their inclusion in unconventional device architectures, fostering adoption in wearable electronics and portable medical devices. Integration with millimeter-wave technologies is enhancing their compatibility with next-generation communication systems, strengthening the commercial feasibility of large-scale deployments. Increasing preference for cost-effective and lightweight solutions positions printed antennas as a strategic choice for high-volume electronics production where performance consistency and affordability remain primary concerns.

The printed antenna market is being shaped by rapid progress in additive manufacturing and advanced conductive materials. Innovations such as inkjet and screen printing techniques allow high-precision fabrication on flexible substrates, enabling antennas to be integrated into wearable devices, smart textiles, and IoT sensors. The use of advanced conductive inks, including silver nanoparticle formulations, enhances performance while reducing production costs. These technological improvements have significantly lowered barriers to entry for electronics manufacturers looking for scalable and lightweight antenna solutions. As industries shift toward miniaturization and high-frequency performance, printed antennas are increasingly seen as a preferred choice for applications where space, weight, and cost optimization are critical.

The adoption of printed antennas is accelerating with the growth of IoT, automotive connectivity, and 5G communication networks. Their ability to offer compact designs with low power consumption makes them ideal for connected devices such as smart meters, healthcare wearables, and industrial sensors. Automotive manufacturers are incorporating printed antennas into vehicle-to-everything (V2X) systems for improved connectivity, while telecom infrastructure providers are exploring them for small-cell 5G deployments. Additionally, the rise in smart home automation and consumer electronics is creating new demand for these antennas. As 5G rollouts intensify and IoT device proliferation continues, printed antennas are positioned to become an essential component in enabling reliable wireless communication across multiple sectors.

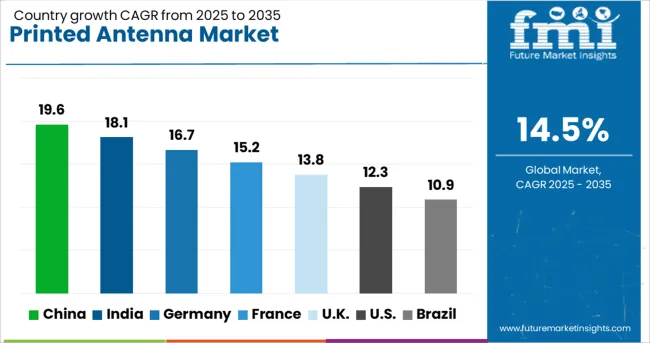

| Country | CAGR |

|---|---|

| China | 19.6% |

| India | 18.1% |

| Germany | 16.7% |

| France | 15.2% |

| UK | 13.8% |

| USA | 12.3% |

| Brazil | 10.9% |

The printed antenna industry, projected to expand at a global CAGR of 14.5% from 2025 to 2035, exhibits diverse performance across leading regions. China is expected to record a CAGR of 19.6%, driven by high-volume manufacturing capabilities and strong integration within consumer electronics and automotive connectivity segments. India follows with an 18.1% CAGR, supported by rapid adoption in telecom infrastructure and growing demand for cost-efficient wireless solutions in industrial applications.

Germany is set to achieve a 16.7% CAGR due to its advanced engineering focus and rising incorporation of printed antennas in automotive electronics and industrial automation. The United Kingdom is projected to grow at 13.8%, benefitting from increasing adoption in defense and medical device sectors. The United States anticipates a 12.3% CAGR, influenced by strong research investments and integration in aerospace and IoT ecosystems. The report provides detailed coverage of 40+ countries, with these five markets serving as prime indicators of industry evolution.

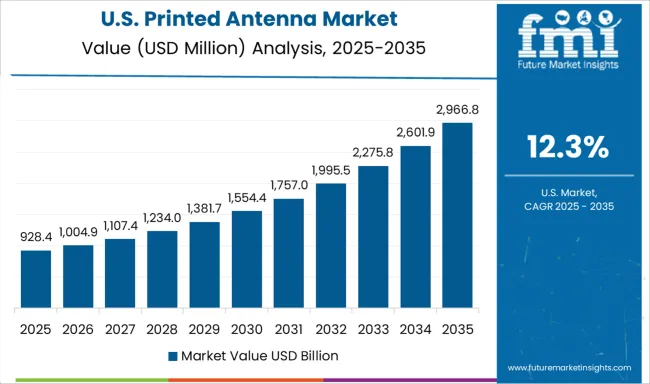

The CAGR of the USA printed antenna market improved from nearly 9.4% during 2020–2024 to 12.3% between 2025–2035, driven by the rapid incorporation of advanced wireless communication solutions in aerospace and IoT ecosystems. Early growth was relatively modest as adoption remained concentrated in research labs and prototype development for defense systems. A significant boost occurred after 2024 with increased 5G infrastructure investments and the emergence of millimeter-wave-based designs for automotive connectivity. Printed antennas became essential in low-profile communication devices, influencing telecom companies to scale commercial integration. The expansion of cloud-connected industrial systems created additional demand for high-frequency antennas compatible with smart manufacturing.

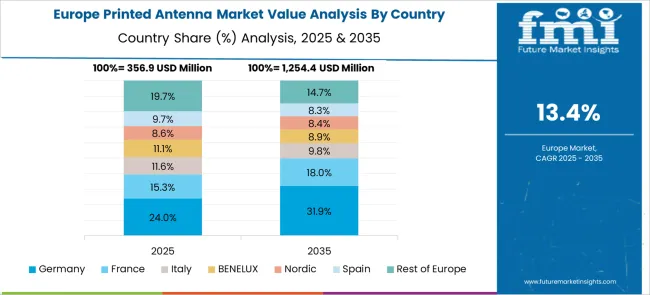

Germany witnessed a CAGR shift from about 11.5% in 2020–2024 to 16.7% during 2025–2035, reflecting increased demand for automotive electronics and industrial automation. Initial growth was moderate, as high-cost substrates and limited pilot projects restricted scalability. This trend changed after domestic automakers started integrating compact antenna systems into autonomous and connected vehicles. Printed antennas enabled lightweight structures in next-generation vehicles, improving performance without compromising energy efficiency. Growth was reinforced by the push for seamless factory connectivity under Industry 4.0 programs, where reliable antennas became mandatory for machine-to-machine communication. Strong collaboration between research institutions and manufacturing giants accelerated technology transfer.

The UK CAGR climbed from around 8.1% during 2020–2024 to 13.8% in the 2025–2035 period, driven by strong demand in defense electronics and medical imaging systems. Initial adoption was restrained due to limited supplier ecosystems and stringent performance certifications. Growth accelerated post-2024 as defense procurement prioritized low-profile antenna systems for communication-sensitive platforms. Healthcare device manufacturers integrated printed antennas into diagnostic equipment, capitalizing on their lightweight and flexible structure. Government-backed R&D initiatives further supported commercialization, while private telecom firms invested in millimeter-wave deployment to enhance network reliability. These combined factors pushed the UK market toward a significantly higher growth path.

China moved from an estimated 13.9% CAGR in 2020–2024 to 19.6% between 2025–2035, supported by massive 5G rollout programs and aggressive localization of antenna manufacturing. Initial years saw strong government funding for telecom equipment R&D, which laid the foundation for high-volume printed antenna production. The acceleration post-2024 was driven by large-scale IoT deployments in smart factories and expansion in electric vehicle communication systems. Domestic firms adopted printed antennas in consumer electronics, creating cost advantages through advanced ink-based printing technologies. Strategic collaborations with global players ensured knowledge transfer and compliance with international standards, positioning China as a manufacturing hub.

India recorded an increase from approximately 12.7% CAGR during 2020–2024 to 18.1% in the 2025–2035 horizon, supported by telecom network expansion and localization of antenna production. Early growth was steady due to limited infrastructure for advanced substrate manufacturing, but this changed as government-backed initiatives boosted domestic electronics production. The surge in mobile broadband penetration and the deployment of rural 5G networks amplified demand for cost-effective printed antennas. Innovation hubs across Bengaluru and Hyderabad played a pivotal role in driving low-cost, high-frequency design solutions, enabling faster adoption in smart cities and connected healthcare ecosystems.

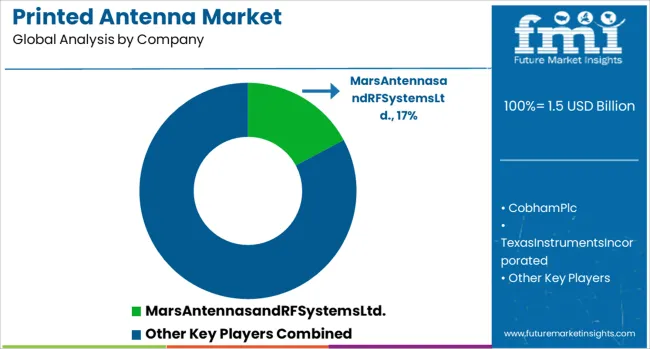

The printed antenna market is evolving with a strong emphasis on technological innovation, scalability, and application diversity as demand for lightweight, cost-effective, and high-performance antennas rises across multiple industries. Leading companies such as Mars Antennas and RF Systems Ltd., Cobham Plc, and Texas Instruments Incorporated dominate through advanced material engineering and development of high-frequency compatible antennas optimized for IoT devices, automotive systems, and aerospace applications.

These firms are leveraging flexible substrates and enhanced conductive ink technologies to improve durability, reduce weight, and achieve better integration with compact wireless systems. Meanwhile, emerging players like Galtronics Corporation, GSI Technologies, Optisys Inc., GammaNU Inc., Optomec Inc., and TIL-TEK Antenna Inc. are disrupting the market through additive manufacturing and 3D-printed designs, offering precision-engineered solutions for next-generation networks and customized industrial applications.

Their strategies include heavy investment in research for hybrid printing methods, optimized antenna geometries, and multi-band capabilities that support the growing 5G and V2X communication ecosystems. Furthermore, these players are focusing on providing cost-efficient and rapid prototyping services, catering to telecom, defense, and smart electronics manufacturers seeking faster time-to-market solutions. As adoption accelerates in connected cars, wearables, healthcare devices, and satellite communication systems, the competitive landscape is expected to intensify with strategic collaborations, material innovations, and localized production models driving long-term market expansion.

In January 2024, Texas Instruments Incorporated announced the AWR2544 single-chip radar sensor featuring launch-on-package technology, which integrates a 3D waveguide antenna on PCB.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Antenna Type | Microstrip antenna, Patch antenna, Slot antenna, Dipole antenna, Planar inverted‑F antenna (PIFA), and Others |

| Frequency Band | SHF (1–3 GHz), Low frequency (below 1 GHz), UHF (0.3–1 GHz), C‑band (4–8 GHz), X‑band (8–12 GHz), Ku‑band (12–18 GHz), and Millimeter‑wave (Ka, V, W‑bands, 30 GHz+) |

| Material Substrate | Polyimide (PI), FR‑4, Rogers substrates, PTFE (Teflon), Ceramic substrates, and Flexible polymers |

| End‑Use Industry | Telecommunications & 5G infrastructure, Consumer electronics (smartphones, wearables, laptops), Aerospace & defense, Automotive (telematics, V2X), Healthcare (medical implants, RFID tags), and Industrial IoT & logistics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MarsAntennasandRFSystemsLtd., CobhamPlc, TexasInstrumentsIncorporated, GaltronicsCorporation, GsiTechnologies, OptisysInc, GammaNUInc., OptomecInc, and TIL-TEKAntennaInc. |

| Additional Attributes | Dollar sales, share by application and frequency band, competitive positioning, pricing trends, raw material cost impact, growth by IoT and 5G deployment, regulatory standards, and future demand forecasts. |

The global printed antenna market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the printed antenna market is projected to reach USD 6.0 billion by 2035.

The printed antenna market is expected to grow at a 14.5% CAGR between 2025 and 2035.

The key product types in printed antenna market are microstrip antenna, patch antenna, slot antenna, dipole antenna, planar inverted‑f antenna (pifa) and others.

In terms of frequency band, shf (1–3 ghz) segment to command 29.8% share in the printed antenna market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Printed Labels Market Size and Share Forecast Outlook 2025 to 2035

Printed Chipless RFID Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Printed Sensors Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Printed Aluminium Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Printed and Flexible Sensors Market Report - Growth & Demand 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Printed Plastic Films Market Insights - Growth & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Printed Aluminium Foil Packaging

Market Share Distribution Among Printed Carton Manufacturers

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA