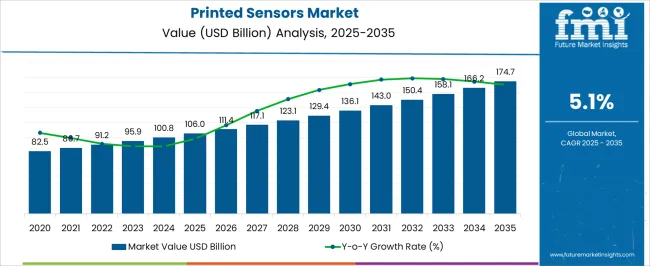

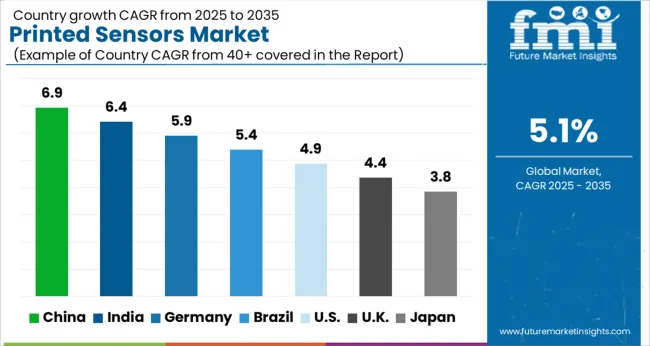

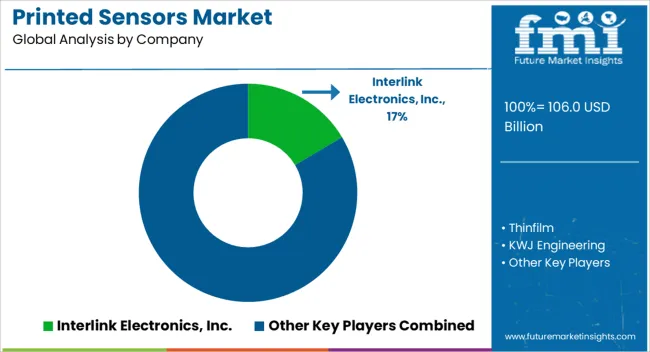

The Printed Sensors Market is estimated to be valued at USD 106.0 billion in 2025 and is projected to reach USD 174.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Printed Sensors Market Estimated Value in (2025 E) | USD 106.0 billion |

| Printed Sensors Market Forecast Value in (2035 F) | USD 174.7 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The Printed Sensors market is witnessing robust growth, driven by increasing demand for cost-effective, flexible, and miniaturized sensing solutions across diverse industrial and commercial applications. Rising adoption is supported by advancements in printing technologies and material science, which enable scalable production of high-performance sensors at lower costs compared with conventional counterparts. Integration of printed sensors with IoT platforms, wearable devices, and industrial automation systems is enhancing real-time monitoring and data-driven decision-making capabilities.

Growing emphasis on predictive maintenance, operational efficiency, and process optimization in manufacturing and industrial sectors is further fueling adoption. Regulatory requirements related to safety, environmental monitoring, and quality assurance are encouraging the deployment of accurate and reliable printed sensors.

Additionally, the ability to customize sensor designs for specific applications, coupled with low power consumption and lightweight form factors, is driving interest from manufacturers As research in functional inks, flexible substrates, and additive manufacturing continues to advance, the market is expected to sustain long-term growth with opportunities across industrial, healthcare, and environmental monitoring applications.

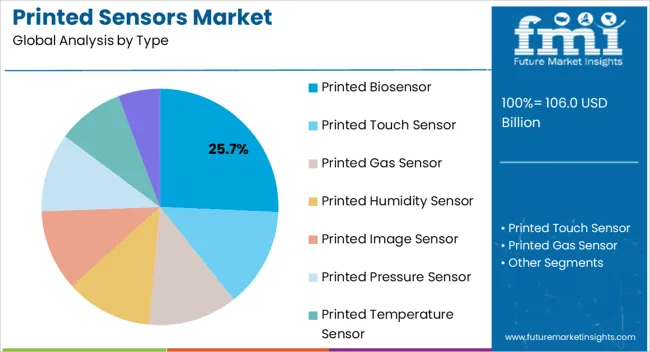

The printed biosensor segment is projected to hold 25.7% of the market revenue in 2025, establishing it as the leading sensor type. Its growth is being driven by the increasing demand for rapid, accurate, and non-invasive detection solutions in medical, environmental, and industrial applications. Printed biosensors leverage flexible substrates and advanced bioinks to enable scalable production and customization for specific detection requirements.

The ability to integrate these sensors with real-time monitoring systems and IoT networks enhances operational efficiency and decision-making. Reduced manufacturing costs, combined with high sensitivity and reproducibility, strengthen adoption among enterprises and healthcare providers.

Continued research into enzyme-based, electrochemical, and optical biosensor designs is improving accuracy, response time, and durability As industries increasingly require compact, lightweight, and cost-efficient sensing solutions for continuous monitoring, the printed biosensor segment is expected to maintain its leading position, supported by technological innovation and scalability in production processes.

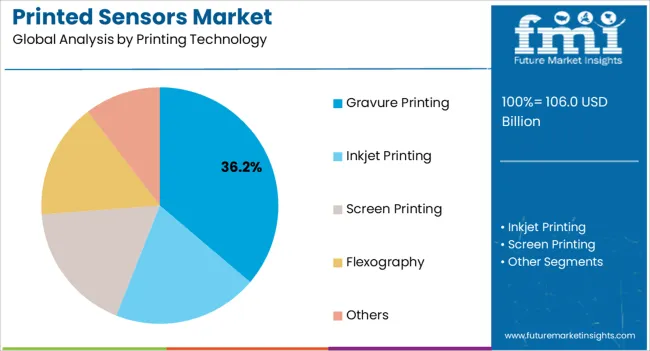

The gravure printing technology segment is expected to account for 36.2% of the market revenue in 2025, making it the leading printing method. Its adoption is being driven by the ability to produce high-resolution, consistent, and repeatable printed sensor patterns at large scale. Gravure printing enables precise deposition of conductive inks, ensuring accuracy and reliability for industrial and biomedical sensor applications.

The process supports flexible substrates and high-speed production, which reduces costs while maintaining performance quality. Continuous advancements in gravure press equipment and ink formulations are enhancing efficiency, resolution, and durability of printed sensors. Integration with roll-to-roll manufacturing techniques further strengthens scalability and market acceptance.

Industries requiring continuous and reliable monitoring, such as manufacturing, healthcare, and environmental analysis, are increasingly leveraging gravure-printed sensors for their precision and reproducibility As demand for high-throughput, cost-effective, and technologically advanced printing methods grows, gravure printing is expected to remain the preferred technology, driving market growth and adoption.

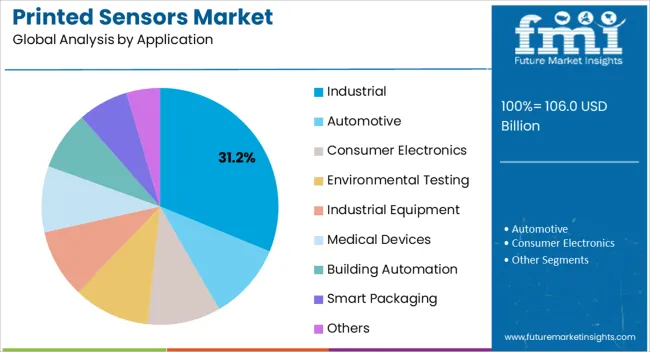

The industrial application segment is projected to hold 31.2% of the market revenue in 2025, establishing it as the leading application area. Growth in this segment is driven by increasing demand for real-time monitoring, predictive maintenance, and process optimization across manufacturing and production environments. Printed sensors offer cost-effective and flexible solutions for detecting parameters such as temperature, pressure, humidity, and chemical composition, which are critical for ensuring operational efficiency and safety.

Integration with IoT and automation platforms allows industrial operators to collect, analyze, and respond to data in real time, improving productivity and reducing downtime. Regulatory compliance, quality assurance, and environmental monitoring requirements further reinforce adoption.

The scalability and customization offered by printed sensors enable industries to implement multi-sensor networks tailored to specific operational needs As industries prioritize smart manufacturing and data-driven process control, the industrial application segment is expected to remain the primary driver of market growth, supported by technological advancements and increased adoption of connected sensing solutions.

It is anticipated that the growing application of printed sensors in wearable medical devices and consumer electronics is a key driver in the market. In recent years, printed sensors have gained huge attention from researchers, owing to their significant potential for wearable electronics and IoT applications. Further, the adoption of printed sensors in device-engineering technologies has resulted in the creation of foldable, light, and flexible sensors.

Printed sensors are widely gaining adoption as they eliminate the use of silicon and metal oxides that are harmful in nature. Instead, with the help of innovative printing technologies, the printed sensors are manufactured over various flexible substrates like paper, plastic, rubber-like polymers, and foils, which render printed sensors to be thin and light with high flexibility for mechanical purposes. This factor is highly driving the printed sensors industry.

The introduction of printed sensors has governed the portability of the product, which has resulted in increased sales of printed sensors in the medical sector. Moreover, it is also projected that some significant opportunities in the future for printed sensors are the growing trends for touch-enabled electronic devices and IoT, augmenting the sales of printed sensors globally.

An important factor driving the sales of printed sensors is the declining prices as printed sensors are becoming compatible with diversified application areas such as packaging, consumer electronics, and more, leveraging printed sensors technology at a low cost. Additionally, the rising demand for printed electronic devices corresponds to the growth of the printed sensors industry as well.

It is anticipated that certain prevailing factors might hinder the demand for printed sensors in the upcoming years, besides the numerous growth factors. Further, the printed sensors have a very complex manufacturing process, and this acts as a key restraint for small and medium-sized companies, limiting the research and development capabilities of these firms.

There are also challenges involved with conductive ink printing and insufficient technological accessibility, such as organic light-emitting diode displays. In addition to that, another challenge faced by the printed sensors industry is that it is still in its development stage.

Enabling technologies like ultra-thin chip technology is expected to address the existing bottlenecks in microelectronics, such as 3D integration, which in turn can open up new opportunities for the growth of the demand for printed sensors in the market.

| Region | North America |

|---|---|

| Market Share % (2025) | 30.4% |

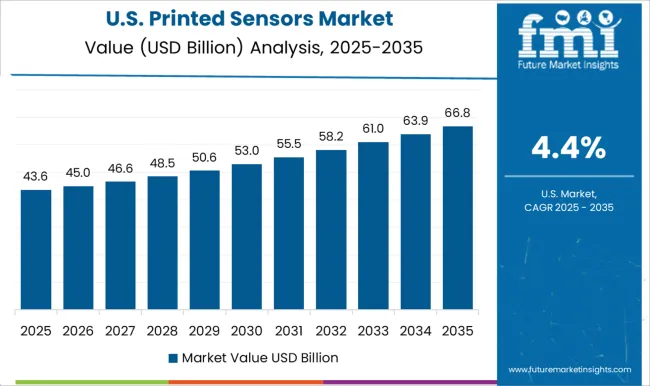

The North America region is anticipated to lead the printed sensors industry share in the upcoming years. Currently, this region is accountable for more than 30.4% of the total market printed sensors share.

The market demand for printed sensors is getting augmented by a wide margin, owing to the high technological advancement and adoption in the North American region. In addition, the populace is getting indulged in healthcare spending, which is bolstering the sales of printed sensors as well. With notable growth in the economy and growing demand for consumer electronics, the printed sensors industry share is likely to witness a notable expansion during the forecast period.

| Region | Europe |

|---|---|

| Market Share % (2025) | 23.1% |

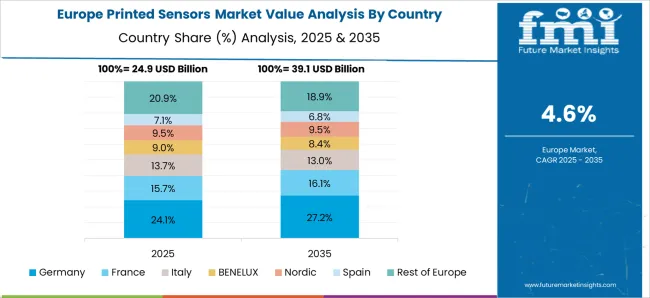

At present, Europe holds 23.1% of the total printed sensors industry share. The Europe region is expected to have significant growth in sales of printed sensors in the coming years. Due to support provided by the government, and grants received for manufacturing, this region is expected to have an increased demand for printed sensors in the coming years.

The start-up ecosystem in the printed sensors industry is intense with frequent innovations being made. Moreover, Startups in the printed sensors industry are focusing on improvising the devices for maximized implications in medical and electronic devices, creating further demand for printed sensors in these sectors. For example,

Who are the Key Market Players for the Printed Sensors?

Some of the leading printed sensors global players include Interlink Electronics, Inc., Thinfilm, KWJ Engineering, Peratech Holdco Limited, ISORG, Integrated Device Technology, Inc., Tekscan, Inc., FUJIFILM Holdings America Corporation, GSI Technologies, LLC, and PST sensors.

The key players in the industry are continuously collaborating, upgrading, and making efforts to expand the printed sensors industry. Further modifications of the sensors to enhance the end-user experience further bolster the adoption of printed sensors in maximum industry verticals.

Recent Developments in the Market:

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 5.4% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Application, Printing Technology, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; The Middle East and Africa |

| Key Countries Profiled | The United States, Canada, Brazil, Argentina, Germany, The United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC, South Africa |

| Key Companies Profiled | Interlink Electronics, Inc.; Thinfilm,; KWJ Engineering; Peratech Holdco Limited; ISORG; Integrated Device Technology, Inc.; Tekscan, Inc.; FUJIFILM Holdings America Corporation; GSI Technologies; LLC; PST sensors |

| Customization | Available Upon Request |

The global printed sensors market is estimated to be valued at USD 106.0 billion in 2025.

The market size for the printed sensors market is projected to reach USD 174.7 billion by 2035.

The printed sensors market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in printed sensors market are printed biosensor, printed touch sensor, printed gas sensor, printed humidity sensor, printed image sensor, printed pressure sensor, printed temperature sensor and printed proximity sensor.

In terms of printing technology, gravure printing segment to command 36.2% share in the printed sensors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Printed and Flexible Sensors Market Report - Growth & Demand 2025 to 2035

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Printed Labels Market Size and Share Forecast Outlook 2025 to 2035

Printed Chipless RFID Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Printed Antenna Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Printed Aluminium Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Printed Plastic Films Market Insights - Growth & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Printed Aluminium Foil Packaging

Market Share Distribution Among Printed Carton Manufacturers

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA