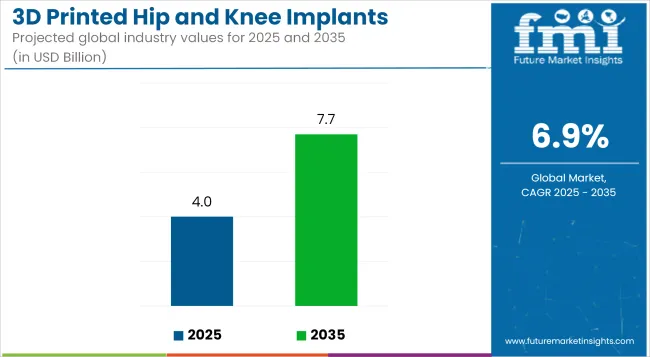

The 3D Printed Hip and Knee Implants Market is anticipated to be valued at USD 4.0 billion in 2025 and is expected to reach USD 7.7 billion by 2035, registering a CAGR of 6.9%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.0 billion |

| Industry Value (2035F) | USD 7.7 billion |

| CAGR (2025 to 2035) | 6.9% |

This market is experiencing significant growth, driven by advancements in additive manufacturing technologies and a rising demand for patient-specific orthopedic solutions. The increasing prevalence of osteoarthritis and other joint-related disorders, coupled with an aging global population, has heightened the need for customized implants that offer improved fit and functionality.

Technological innovations, such as AI-driven design optimization and the integration of biocompatible materials, are enhancing the precision and longevity of these implants. Furthermore, the shift towards minimally invasive surgical procedures is propelling the adoption of 3D printed implants, which facilitate better surgical outcomes and faster recovery times.

Healthcare providers are increasingly recognizing the long-term cost-effectiveness of these implants, despite higher initial production costs, due to reduced revision surgeries and improved patient satisfaction. As regulatory frameworks evolve to accommodate these innovations, the market is poised for sustained expansion, with opportunities emerging across both developed and emerging economies.

Key players in the 3D Printed Hip and Knee Implants Market include Stryker, Zimmer Biomet, Smith & Nephew, and Johnson & Johnson's DePuy Synthes. These companies are at the forefront of integrating advanced 3D printing technologies into their product offerings, focusing on patient-specific solutions that enhance surgical precision and outcomes. In April 2025, restor3d has secured FDA 510(k) clearance for its iTotal Identity CR 3DP Porous Total Knee Replacement System.

The new system represents the company’s first cementless offering in its patient-specific implant portfolio following the acquisition of Conformis. “For the first time, we have a truly patient-specific, cementless knee replacement option, and that’s incredibly exciting,” said Brian Palumbo, the cementless tibial baseplate is designed for optimal stability and fixation, providing maximum coverage without overhang or compromise in rotational alignment”. MD at Florida Orthopaedic Institute, Florida.

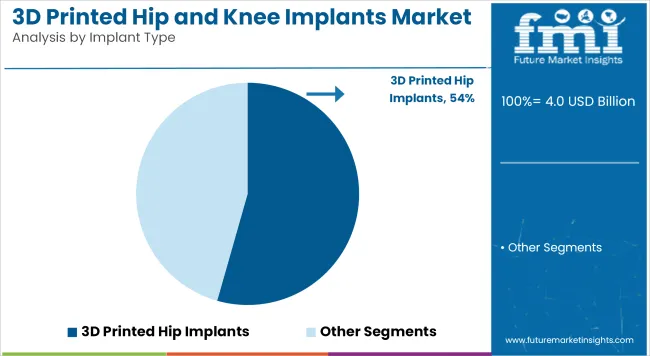

3D Printed Hip Implants have been observed to dominate the market with a 54.4% revenue share in 2025, attributed primarily to the segment’s alignment with patient-specific anatomical needs. The superior ability of hip implants to be custom-printed using patient imaging data has allowed for optimized joint restoration and reduced intraoperative complexities. Greater demand for total hip arthroplasty (THA), especially among the geriatric population, has also been noted as a significant growth factor.

The segment’s preference has been further reinforced by surgeon adoption rates, owing to reduced post-operative complications and implant rejection incidents. Moreover, regulatory clearances for 3D printed acetabular cups and femoral components have increased, particularly in North America and Europe, enabling broader commercial access.

The compatibility of hip structures with porous 3D printing matrices that support osseointegration has also enhanced segment performance. These cumulative drivers have positioned the hip implant segment as a preferred choice among orthopedic surgeons and institutional healthcare buyers alike.

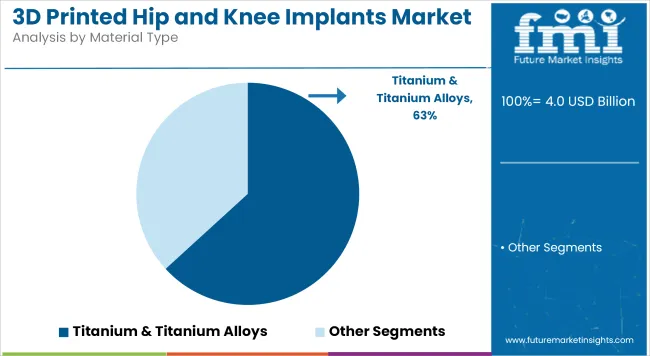

Titanium and its alloys have captured a 63.2% revenue share in 2025, making it the most preferred material in the 3D printed hip and knee implant ecosystem. The growth of this segment has been primarily driven by titanium’s high strength-to-weight ratio, corrosion resistance, and excellent osseointegration properties.

These characteristics have enabled reduced implant fatigue and extended implant longevity, particularly in load-bearing orthopedic applications. Additionally, advancements in laser powder bed fusion (LPBF) and electron beam melting (EBM) have facilitated precise 3D printing using titanium alloys, further improving fit and surface texture for bone ingrowth.

Regulatory approvals for titanium-based designs in critical joint reconstruction procedures have added to market scalability. Increased adoption of titanium in cementless implant procedures, particularly in revision hip and knee surgeries, has validated its clinical reliability. As a result, the material has remained favored by both manufacturers and orthopedic specialists focused on enhancing implant success rates and reducing revision frequency.

Hospitals accounted for a dominant 65% revenue share in the 3D printed hip and knee implants market in 2025, supported by their capacity to perform high-volume joint replacement procedures. The growth of this segment has been catalyzed by their advanced diagnostic, imaging, and surgical infrastructure, which are crucial for the customization and implantation of 3D printed components.

Hospitals also benefit from established partnerships with implant manufacturers, giving them early access to FDA-cleared or CE-marked 3D printed products. Moreover, higher insurance coverage and government reimbursement in hospital-based surgeries have driven procedural demand.

Orthopedic departments in tertiary hospitals are increasingly equipped with additive manufacturing capabilities and surgical robotics, reinforcing their position as the primary channel for 3D printed implant deployments. The availability of skilled orthopedic surgeons and post-operative care facilities within hospital settings has further contributed to favorable outcomes, thereby making hospitals the leading end-user segment in this market.

Challenges Impacting the Growth of the 3D Printed Hip and Knee Implants Market

The 3D printed hip and knee implants market faces challenges such as high costs of customized implant production, regulatory hurdles in obtaining approvals for patient-specific devices, and risks of implant failure due to material limitations.

The need for improved printing speed and precision in orthopedic manufacturing, challenges in ensuring long-term biocompatibility of printed implants, and disparities in access to 3D printing technologies across different regions create barriers to market expansion.

Additionally, challenges in integrating AI-powered implant planning into routine orthopedic practice, high costs associated with training surgeons on 3D-printed implant techniques, and resistance to transitioning from traditional metal implants to 3D-printed alternatives impact market growth.

Advancements and Innovations Driving Growth in the 3D Printed Hip and Knee Implants Market

The increasing adoption of AI-powered implant design optimization, expansion of bioresorbable and patient-specific implants, and rising investment in hybrid 3D printing techniques present significant growth opportunities in the market.

The development of smart implants with embedded sensors for real-time monitoring, increasing focus on integrating 3D-printed implants with robotic-assisted surgical platforms, and expansion of bioprinting applications for bone regeneration are fueling market growth.

Additionally, increasing research into bioactive coatings for 3D-printed implants, expansion of advanced manufacturing hubs for customized orthopedic solutions, and growing collaborations between academic institutions and implant manufacturers for optimizing implant performance are expected to create new avenues for industry expansion.

The rise of cost-efficient 3D printing technologies and increasing consumer preference for minimally invasive, personalized orthopedic solutions are further enhancing accessibility and long-term market potential.

Emerging Trends

The rising adoption of hybrid and biodegradable implant materials is expanding market opportunities in complex joint reconstructions, pediatric orthopedics, and revision surgeries.

Governments and healthcare agencies are expanding support for medical 3D printing research, streamlining approval pathways for patient-specific implants, and implementing policies to improve accessibility of advanced orthopedic solutions.

Market Outlook

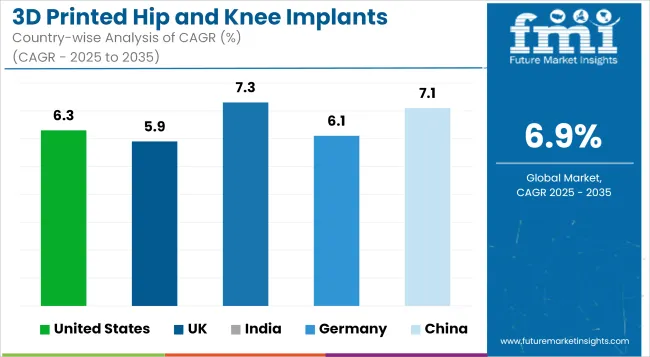

The United States is at the forefront of 3D-printed hip and knee implant adoption, spurred by technology, high rates of osteoarthritis, and a high concentration of medical device companies. The nation's sophisticated healthcare infrastructure, along with FDA clearance for patient-specific implants, has driven market growth. Moreover, increasing demand for minimally invasive orthopedic surgery and customized implants is further boosting demand.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.3% |

Market Outlook

The United Kingdom is witnessing steady growth in the adoption of 3D-printed hip and knee implants due to increased NHS investments in orthopedic care, a rising elderly population, and a growing emphasis on patient-specific treatments. The presence of leading research institutions and medical device manufacturers is fostering innovation in 3D printing technology for joint replacements.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.9% |

Market Outlook

India’s 3D-printed hip and knee implants market is growing, driven by increasing orthopedic disorders, rising healthcare investments, and a growing medical tourism industry.

While adoption is still in the early stages, advancements in local 3D printing manufacturing and affordable healthcare options are expanding market opportunities. The rise of private hospitals offering cutting-edge joint replacement surgeries is further contributing to growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.3% |

Market Outlook

Germany is at the forefront of the 3D-printed hip and knee implants market, driven by strong research in orthopedic biomaterials, a well-established medical device industry, and high adoption of digital manufacturing technologies. The country’s advanced regulatory framework ensures high-quality implant production, making it a key player in the global market.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.1% |

Market Outlook

China’s 3D-printed hip and knee implants market is growing rapidly due to increasing healthcare infrastructure investments, rising prevalence of osteoarthritis, and strong government support for medical technology innovations. Domestic companies are emerging as key players in the development of cost-effective and high-quality 3D-printed implants.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.1% |

The 3D printed hip and knee implants market is highly competitive, driven by increasing demand for patient-specific implants, advancements in additive manufacturing technology, and the growing adoption of personalized orthopedic solutions.

Companies are investing in biocompatible materials, AI-driven implant design, and cost-effective 3D printing techniques to maintain a competitive edge. The market is shaped by well-established orthopedic implant manufacturers, 3D printing technology providers, and emerging medical device firms, each contributing to the evolving landscape of customized joint replacements.

the market is segmented into 3D Printed Hip Implants and 3D Printed Knee Implants.

the market is segmented into Titanium & Titanium Alloys, Polymer, Ceramic, and Others.

the market is segmented into Hospitals and Orthopedics Clinics.

the 3D Printed Hip and Knee Implants Market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The overall market size for 3D Printed Hip and Knee Implants Market was USD 4.0 billion in 2025.

The 3D Printed Hip and Knee Implants Market is expected to reach USD 7.7 billion in 2035.

Advancements in 3D printing technology like electron beam melting, growing preference for customized implant are some factors.

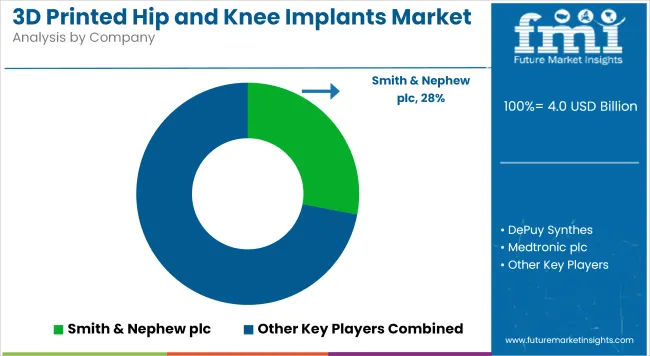

The top key players that drives the development of 3D Printed Hip and Knee Implants Market are Stryker Corporation, Zimmer Biomet Holdings, Johnson & Johnson (DePuy Synthes), Smith &, Nephew plc and Medtronic plc.

Knee implants in 3D Printed Hip and Knee Implants market is expected to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Somatosensory Virtual Fitting Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Display Market Size and Share Forecast Outlook 2025 to 2035

3D Neuroscience Market Size and Share Forecast Outlook 2025 to 2035

3D Glasses Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Automotive Market Size and Share Forecast Outlook 2025 to 2035

3D Printing In Construction Market Size and Share Forecast Outlook 2025 to 2035

3D Laser Scanner Market Growth - Trends & Forecast 2025 to 2035

3D Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

3D Scanning Market Size and Share Forecast Outlook 2025 to 2035

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA