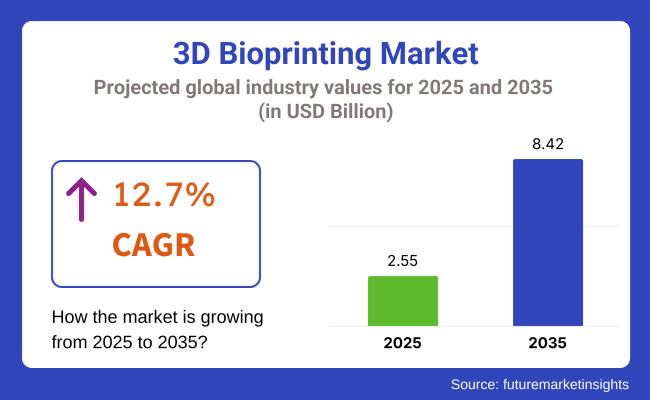

The global 3D bioprinting market is estimated to be valued at USD 2.55 billion in 2025 and is projected to reach USD 8.42 billion by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period. The 3D bioprinting market is witnessing accelerated growth driven by the convergence of precision manufacturing, biomaterials science, and regenerative medicine. Significant investments into tissue engineering and organ regeneration are catalyzing new adoption cycles.

Advancements in bio-inks composing of hydrogels, collagen and stem-cell enriched materials are enhancing the structural integrity and biological viability of printed tissues. The growing incidence of chronic organ failure and increasing demand for personalized tissue models for drug screening are creating stable revenue streams across multiple verticals. Additionally, Regulatory authorities are increasingly providing adaptive frameworks for clinical-grade bioprinted tissues, further encouraging translational research.

Leading manufacturers such as CELLINK (BICO Group), Organovo, Aspect Biosystems, and 3D Systems are shaping the 3D bioprinting market through aggressive R&D pipelines, strategic partnerships, and vertical integration. Key drivers include increasing clinical translation of bioprinted tissues, automation of multi-material printing processes, and customized software platforms that enhance scalability. In 2025, TissueLabs launches new TissuePro extrusion-based bioprinter.

“TissuePro is the result of everything we’ve learned, reinvented and reimagined,” said Dr. Gabriel Liguori, Founder and CEO of TissueLabs. On the other hand, BIO INX to introduce new biomaterials for Readily3D's volumetric 3D printing technology. The first commercially available bioink is the READYGEL INX gel-MA based ink designed for high reproducibility and unparalleled performance.

“Thanks to the speed of this technology, with the newly developed highly biocompatible resin, the futuristic idea of harvesting cells, printing directly alongside the patient in the operating room prior to reimplantation becomes an attainable reality,” said Coralie Gréant, COO at BIO INX. These product launches are expected to facilitate adoption in pharmaceutical R&D and preclinical validation platforms.

North America dominates the 3D bioprinting market, accounting for the largest revenue share due to its mature biomedical research ecosystem, substantial NIH and DoD funding, and early adoption across pharmaceutical toxicology platforms. Key players such as Organovo and CELLINK have established collaborations with USA pharma giants to co-develop customized tissue models for oncology and metabolic disorder drug pipelines. Venture capital influx into start-ups working on vascularized organoids and neural tissue scaffolds further amplifies regional innovation density.

Europe is emerging as a fast-growth region, primarily driven by regulatory flexibility under EMA’s Advanced Therapy Medicinal Products (ATMP) classification and robust public-private partnerships. Germany, the UK, and Sweden have established translational bioprinting hubs integrating academic research with clinical pilot programs, particularly in orthopedics, dental scaffolding, and wound healing. The market is expected to grow with rising collaborations between hospitals and bioprinting companies for patient-specific implants are gaining traction, particularly in complex bone and cartilage regeneration procedures.

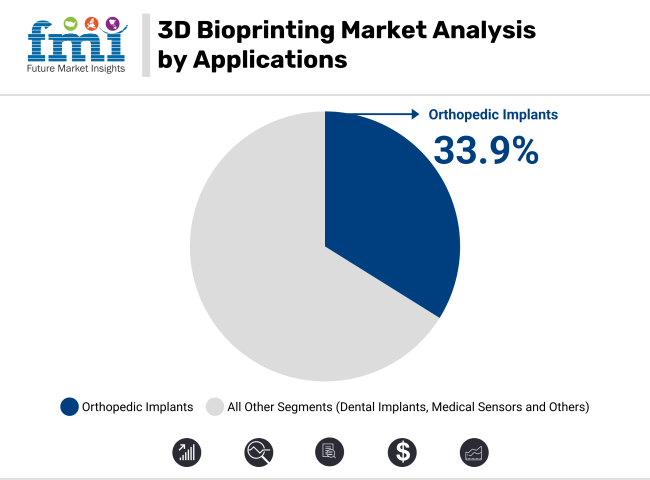

In 2025, orthopedic implants are expected to capture 33.9% of the revenue share in the 3D bioprinting market. This leadership is attributed to the growing demand for personalized and patient-specific implants that can better integrate with the body’s natural structures. The segment’s growth has been fueled by advancements in bioprinting materials, such as bio-inks, which mimic human bone tissue and promote cell growth.

Furthermore, the ability to print complex, intricate designs not achievable through traditional manufacturing methods has positioned 3D bioprinting as a critical tool in orthopedic surgery. As the technology continues to improve in terms of precision and material capabilities, the orthopedic implant segment is expected to remain a dominant application area in the 3D bioprinting market.

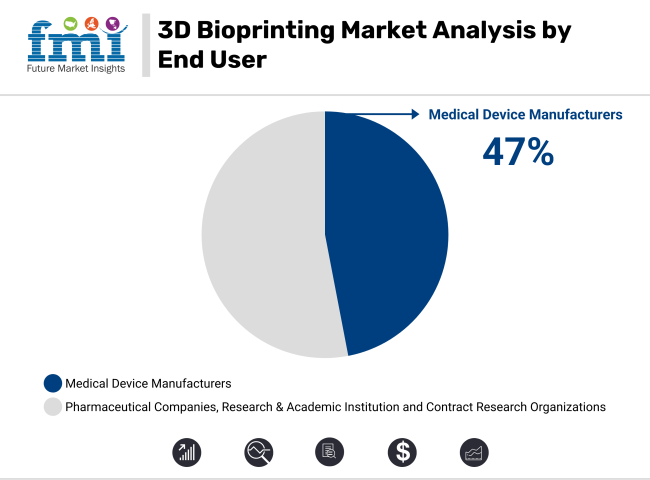

In 2025, medical device manufacturers are projected to hold 47.0% of the revenue share in the 3D bioprinting market. This dominance is driven by the growing need for innovation and customization in medical devices, particularly in the creation of personalized implants, prosthetics, and surgical tools. Medical device manufacturers are increasingly adopting 3D bioprinting technology to develop more precise and effective solutions that cater to specific patient needs.

The ability to quickly prototype and produce complex, individualized designs has significantly enhanced manufacturing efficiency and reduced production costs, leading to a growing number of manufacturers investing in bioprinting capabilities. Additionally, the demand for personalized and functional medical devices across various healthcare sectors, including orthopedics and dental applications, has further reinforced the market position of medical device manufacturers in the 3D bioprinting space.

Overcoming Bioprinting Barriers: Addressing Cost, Ethics, and Regulatory Challenges for Future Medical Breakthroughs

The bioprinting industry is faced with major obstacles due to the high expenses, moral issues, and government restrictions. One of the most significant challenges is that researchers are not able to exactly reproduce the complex organ structures that can be provided with the blood supply and properties as specific as the organs are to be able to develop all these fully functional bio-printed organs.

It is also essential to assure biocompatibility through the designing of bio-inks and the scaffolding this way that the tissues integrate into the human body perfectly without the immune system to respond. The rules of drug approval agencies are the main way of making sure the safety and efficiency of bioprinted tissues in use in the market.

This situation of the long process of validation in companies' perspectives is both bad for speeding up renditions and preventing patients from getting new therapies too long. They need to keep on top of the high production quality and make the bio-prints uniform as well.

The existing protocols and clinical experience can be a stopgap to the healthcare providers' utilization of bioprinting techniques on a scale that is large enough. In patient care, the resolution to these challenges is a concerted effort of the entire industry, an increase in research funding, and the introduction of regulatory frameworks that serve as a tool for innovation and safety at the same time.

Advancing Bioprinting: AI-Driven Bioinks Revolutionizing Drug Discovery, Regenerative Medicine, and Personalized Healthcare

3D-Printed bio-inks have been used for drug discovery and have been invested in for skin grafts and prosthetics which has made the bioprinting industry a very promising field. Because of this ongoing development, bioinks are designed with improved biocompatibility and mechanical strength to bring bioprinted tissues closer to clinics.

In fact, the pharmaceutical industry is utilizing bioprinting to come up with more realistic tissue models for better drug testing and decreasing the need for animal trials. The rise in the adoption of regenerative medicine urges the creation of patient-specific bio-printed issues previously untapped.

The merge of artificial intelligence (AI) and robotics in the bioprinting processes leads to more precise actions that minimize material waste, and faster production. These technological breakthroughs reduce expenses, thus enabling the accessibility of bio-printed tissues in hospitals and research institutions.

As the industry continues to improve its technology and the regulatory frameworks advance, bioprinting will be able to change the tissue engineering and regeneration sector, offering new treatments for transplantation and personalized healthcare.

Bioprinting Breakthroughs: Accelerating Tissue Engineering for Organ Regeneration and Transplantation

Scientist are taking rapid steps ahead by printing complex tissue structures in a short time which greatly are advancing research in organ regeneration and transplantation.

With vascularized tissues that are improved live the viability, the researchers are on the edge to close the gaps between laboratory experiments and real-life clinical applications. The innovations in scaffold-free printing techniques are diminishing the need for extra support materials and this, in turn, allows cells to be self-assembled into the functional tissue.

The development of the advanced bioreactor systems is also a step in the tissue maturation improvement that creates optimal conditions for cell growth and integration. These groundbreaking discoveries have opened the way to bio-printed organs that are almost identical to the natural ones, thus are closer to human physiology.

Bio-printed tissues are becoming more versatile as scientists work on their techniques thus the possibility of using them in personalized medicine and transplantation is increasing. The synergy of biomaterial advancements, improved cell differentiation protocols, and enhanced bio-fabrication strategies are the drivers for tissue engineering to lead the bioprinting revolution.

AI-Driven Precision: Enhancing Bioprinting Accuracy, Efficiency, and Tissue Viability

One of the ways the AI is transforming bioprinting is by improving the placement of cells, figuring out the most suitable bio-ink forms, and correcting the printing process. The biological algorithms driven by AI monitor the behavior of the cells to predict the growth pattern of the tissue. The printer parameters are corrected in real time by the adjustment of the AI. Thus, the precision of bio-fabrication is increased, and reproducibility is improved, while material waste is minimized.

Also, the AI-powered photography and machine learning models are assisting the researchers to witness the structural integrity of the bio-printed constructs and unearth the existing flaws before implantation. By incorporating AI into the real-time QC processes, the researchers will be able to realize problems and troubleshoot them during the printing process, which will result in more consistent and reliable tissue production.

The use of AI to automate the complex bioprinting workflows is another application whose significance cannot be overemphasized because it allows for the rapid production of regenerating tissues. It is anticipated that as AI-based bioprinting develops the production of bio-printed organs and tissues will be streamlined and their accessibility will be improved for medical applications.

Shaping the Future: Evolving Regulations Ensure Safe and Ethical Adoption of Bio-Printed Tissues

Governments and medical authorities are actively developing new regulatory frameworks to standardize and oversee the use of bio-printed tissues and implants. As bio-printing advances from experimental research to clinical applications, regulatory bodies are working to set the standards required for safety and effectiveness of the new technologies that will need to be met before they become commercially available.

Companies like NanoCellect Biomedical have already gone through the process to be used in a healthcare setting. Agencies like the FDA and EMA are bringing together academic and industry representatives through collaboration to put out formulated protocols that guarantee the bio-printed tissues function precisely and do not compromise medical and ethical standards.

These rules want to address concerns related to biocompatibility, quality control, and long-term stability of bio-printed tissues. What is more, the alignment of global regulatory policies which will lead to bio-printing being adopted all over the world.

By cooperating intensively with research institutions and biotech companies, regulatory agencies are creating conditions that combine innovation with patient safety. The world will see a drastic change in the future of bio-printed medical treatments through the continuous evolution of the regulatory field.

Revolutionizing Drug Testing and Personalized Medicine with 3D Bio-Printed Tissue

A new era of pharmaceutical companies is being created by the ability of 3D bio-printed tissues in the testing of drugs to improve the accuracy and ethics, what will reduce the dependence on animal testing. Human-relevant tissue models are the main supporters of successful drug screening and toxicity assessments, which in their way lead to the quicker and more reliable clinical trials.

In addition, the utilization of 3D bio-printed disease models is directing researchers towards a deeper appreciation of the notion of cancer progression and therapy works, which is a pivotal point in precision oncology.

Personalized Medicine Advancements: The device of brain having patient-specific bio-printed implants and prosthetics is reshaping the future of personalized healthcare. 3D bio-printing is being utilized by surgeons and medical professionals to make implants that can perfectly fit the anatomy of an individual resulting in better surgical outcomes.

Moreover, advances in the bio-printed cartilage and bone regeneration technology are opening the door for new solutions in the fields of orthopedics and reconstructive medicine resulting in the considerable improvement in the healing time and the general quality of life for patients.

Market Outlook

The USA 3D bioprinting market is mainly witnessing its growth owing to increased investments in research and development; established healthcare systems; and significant technological advancements. The increasing demand for organ transplantation and the growing development in tissue engineering are also contributing to the growth of the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 14.1% |

Market Outlook

Germany 3D bioprinting market continues to receive good measures of investment from research and development, advanced manufacturing capabilities, and science-based healthcare services. The country also believes in precision engineering biotechnology from which bioprinting derives its applications.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 14.9% |

Market Outlook

Drives in investment into improved healthcare infrastructure, awareness about regenerative medicine, and technological advancement are responsible for the growth of the Indian market in 3D bioprinting. Collaboration between institutes for research and industrial players is necessary for innovation in this area.

Market Drivers for Growth

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 13.0% |

Market Outlook

Japan's 3D bioprinting market is currently benefiting from technology capabilities, a focus on medical innovation, and funding activities toward regenerative medicines. The country's elderly population also fosters the demand for solutions in the areas of tissue engineering and organ regeneration.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.6% |

Market Outlook

The 3D bioprinting market in China is rising rapidly due to the immense push from the government, improvements in healthcare infrastructure, and greater attention to innovative medical technologies. The country is now taking big steps toward using bioprinting to combat health concerns and enhance patient care.

Factors Driving Growth in the Market

By focusing on these critical areas, China is gearing up to be the front-runner in 3D bioprinting and in turn impact healthcare positively at home and abroad.

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 13.9% |

The 3D bioprinting market is characterized by competition owing to the global key players and the emerging biotech firms bringing in innovation and growth. All these have allowed considerable market improvements through advancements in tissue engineering, regenerative medicine, and pharmaceutical research.

In order to compete, companies invest in high-precision bioprinting, bioinks, and scaffold-free printing techniques. The market is being impacted by established 3D printing companies, specialized biotech companies, and research institutions, all of which contribute to shaping the bioprinting applications.

3D Systems, Inc.

The early pathways into 3D printing have led up to bioprinting science into which cells are made very precisely to study tissue structures for research purposes within a medical context. These bioprinting solutions advance all sorts of things in drug discovery, tissue engineering, and regenerative medicine.

GE Healthcare (Concept Laser, Arcam AB)

GE Healthcare, through its subsidiaries, is advancing bioprinting, creating biocompatible implants, prosthetics and medical devices. This work is helping tissue engineering research and advancements related to additive manufacturing.

EOS GmbH Electro Optical Systems

Their medical grade bioplastics offer high volume perfused tissue engineering solutions for healthcare, developing complex tissue models to be used in research, personalised medicine and regenerative therapies.

Renishaw plc.

In particular, Renishaw focuses on precision bioprinting, allowing for the production of complex structures of biomaterials and tissue for research and medical use, such as regenerative medicine and personalized health care.

Other Key Players

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of 3D bioprinting technologies, offering competitive pricing and cutting-edge innovations to meet diverse research and clinical needs.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.55 billion |

| Projected Market Size (2035) | USD 8.42 billion |

| CAGR (2025 to 2035) | 12.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Technology | Stereolithography (SLA), Selective Laser Sintering, Electron Beam Melting, Fused Deposition Modeling (FDM), Laminated Object Manufacturing (LOM), Inkjet Printing, Multi-phase Jet Solidification |

| By Application | Surgical Simulation and Training Models, Prosthetic Devices, Tissue Engineering and Regenerative Medicine, Orthopedic Implants, Dental Implants, Medical Sensors, Others |

| By End User | Medical Device Manufacturers, Pharmaceutical Companies, Research & Academic Institutions, Contract Research Organizations |

| Regions Covered | North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | 3D Systems, Inc, GE Healthcare (Concept Laser, Arcam AB), EOS, Optomec, Renishaw plc., ExOne, Organovo Holding, Inc, Advanced Solutions Life Sciences, LLC (BioBots), Cyfuse Biomedical K.K., Bio3D Technologies Pte. Ltd, EnvisionTEC, Stratasys Ltd., Cellink, Advanced BioMatrix, Formlabs, Inc, Others |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

Stereolithography (SLA), Selective Laser Sintering, Electron Beam Melting, Fused Deposition Modeling (FDM), Laminated Object Manufacturing (LOM), Inkjet Printing And Multi-phase Jet Solidification

Surgical Simulation and Training Models, Prosthetic Devices, Tissue,Engineering and Regenerative Medicine, Orthopedic Implants, Dental Implants, Medical Sensors,Others

Medical Device Manufacturers, Pharmaceutical Companies, Research & Academic Institution, Contract Research Organizations

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for 3D bioprinting market was USD 2.55 billion in 2025.

The 3D bioprinting market is expected to reach USD 8.42 billion in 2035.

Frequent request for the transplantation of organs and tissues all over the world and the chronic diseases to drive growth in the 3D bioprinting market during the forecast period.

The top 5 countries which drives the development of 3D bioprinting market are USA, Germany, China, Japan and India.

Fused Deposition Modeling (FDM) is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Technology, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 17: Global Market Attractiveness by Technology, 2024 to 2034

Figure 18: Global Market Attractiveness by Application, 2024 to 2034

Figure 19: Global Market Attractiveness by End User, 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 37: North America Market Attractiveness by Technology, 2024 to 2034

Figure 38: North America Market Attractiveness by Application, 2024 to 2034

Figure 39: North America Market Attractiveness by End User, 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 57: Latin America Market Attractiveness by Technology, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 59: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Technology, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Technology, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Technology, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Technology, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Technology, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 137: East Asia Market Attractiveness by Technology, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 139: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Technology, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Technology, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA