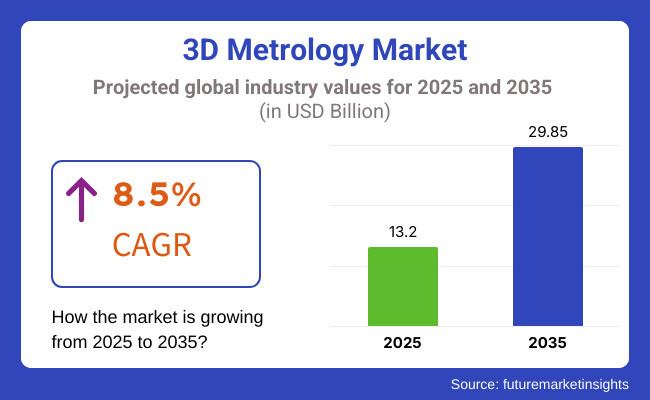

The 3D Metrology Market is set for steady growth between 2025 and 2035, driven by increasing demand across various industries, including aerospace, automotive, healthcare, and manufacturing. The market is expected to reach USD 13.2 billion in 2025 and expand to USD 29.85 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.5% over the forecast period.

The increasing utilization of 3D metrology solutions in quality control, reverse engineering, and precision measurement applications is emerging as a key driver of market growth.

3D Metrology system market is likely to grow due to the recent developments in optical and laser scanning technologies. The market is further propelled by the increasing emphasis on automation and digital transformation, spurring innovation in measurement and inspection solutions.

The changing industries in emerging economies and the advances in sensor technology, as well as, software integration, continue to drive the market growth. Moreover, strategic alliances between metrology equipment manufacturers and end-use sectors are bolstering the product efficiency and application range.

But such measures are often complicated by high implementation costs, difficulties in processing vector data and a lack of personnel. To ensure constant market stability, companies are preferring to invest in the R&D for cost-effective and high-precision 3D metrology solutions.

North America has a major hold on the 3D metrology market, owing to advancements in precision measurement technologies and their large implementation in aerospace, automotive, and manufacturing industries.

The USA and Canada dominate the regional market, as major companies investing on R&D to improve accuracy, automation, and integration with solutions for the Industry 4.0.

Advancements in artificial intelligence and machine learning further drive strong demand for 3D metrology solutions to be used in quality control, reverse engineering, and digital twin applications.

This market is also affected by regulatory frameworks, such as the ones issued by the National Institute of Standards and Technology (NIST) or industry standards and compliance with calibration and accuracy regulations. Challenges to the widespread adoption of these cutting-edge technologies include high implementation costs and complex integration processes.

Germany, France, and the United Kingdom, all known for their robust industries, industrial automation, and precision engineering, contribute to making Europe a prime market for 3D metrology. Growth of 3D Measurement Solutions in the Region As a result of the industry's collective focus on Industry 4.0 and smart manufacturing in the region, adoption of 3D measurement solutions is accelerating.

Market growth is further driven by the increasing adoption of 3D metrology in automotive production, aerospace engineering, and medical device manufacturing. Nevertheless, strict quality assurance standards and changing regulatory compliance requirements influence how 3D measurement technologies are used.

To maintain growth patterns in the metrology systems market, European manufacturers are working on improving efficiency by ensuring compliance with changing industrial standards.

Asia-Pacific has emerged as the largest region in terms of growth for 3D metrology market, predominantly due to growing industrialization along with increasing need for precision measurement solutions in countries such as China, Japan, South Korea and India.

Ortho-new trends in accurate measurement on the surfaces in industries such as electronics, automotive, and heavy can be attributed to the growing adoption of optical measurement technologies along with laser scanning and coordinate measuring machines (CMMs), a trend which is further contributing to the growing demand for 3D metrology systems.

Regional manufacturing ecosystem and cost-effective manufacturing capabilities allow large-scale deployment of 3D metrology solutions Regulatory frameworks regarding quality control standards, protection of intellectual property rights, and standardization of tech remain in development and will force firms to find ways to adapt.

Upcoming market dynamics of smart factory, Artificial intelligence powered automation, and digital transformation is driving the investment in next-generation metrology solutions.

High Implementation Costs and Complex Integration

The 3D metrology market is expected to grow significantly; however, high implementation costs and a complex integration process are major factors hampering this growth. This calls for sophisticated metrology solutions that combines hardware, precision software and skilled professionals, which result in high operational cost. It also poses a technical challenge for integrating 3D metrology systems into existing production workflows without grinding production to a halt. To mainstream and indeed create an industry, companies should innovate cost effectively and develop marketplace-friendly products.

Growth in Industrial Automation and Quality Control

All industries increasingly demand precision measurement, quality control, and quality assurance, which serve as a tremendous growth opportunity for the 3D metrology market, particularly in automotive, aerospace, and healthcare.

With the growth of Industry 4.0, and industries moving towards the increasing use of automation, there is a demand for high-accuracy 3D scanning and inspection tools. In addition, AI-driven metrology solutions and real-time analytics will further increase efficiency and reduce production errors, thereby accelerating market growth.

The period from 2020 to 2024 witnessed growing adoption in manufacturing, automotive, and aerospace industries for the 3D metrology landscape. Nonetheless, limited implementations were confined due to prohibitively expensive costs and integration difficulties. Snap and developers tackled these issues by refining hardware precision, building up software capabilities, and smoothing the path for data to flow into the right systems.

And finally, the future technologies such as AI-powered metrology, automated quality control and noncontact measurement technology will be the key in the market from 2025 within 2035. The proliferation of smart factories, digital twins, and cloud-enabled metrology solutions will serve to broaden market applications. Also, adoption of sustainable and energy-efficient creation of metrology systems will support adoption in multiple industries.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with industry-specific quality standards |

| Technological Advancements | Growth in optical and laser-based metrology |

| Industry Adoption | Increased use in automotive and aerospace sectors |

| Supply Chain and Sourcing | Dependence on specialized hardware suppliers |

| Market Competition | Presence of specialized metrology providers |

| Market Growth Drivers | Demand for precision measurement and defect detection |

| Sustainability and Energy Efficiency | Initial adoption of eco-friendly measurement systems |

| Integration of Smart Monitoring | Limited real-time measurement tracking |

| Advancements in Measurement Innovation | Use of traditional coordinate measuring machines (CMM) |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of AI-powered compliance monitoring and global standardization |

| Technological Advancements | AI-driven automated inspection, real-time analytics, and digital twin integration |

| Industry Adoption | Expansion into medical, electronics, and additive manufacturing |

| Supply Chain and Sourcing | Integration of cloud-based metrology and remote calibration solutions |

| Market Competition | Growth of AI-enhanced metrology firms and major industrial automation players |

| Market Growth Drivers | Integration with Industry 4.0, IoT, and real-time quality monitoring |

| Sustainability and Energy Efficiency | Full-scale implementation of sustainable, energy-efficient metrology solutions |

| Integration of Smart Monitoring | AI-enhanced predictive maintenance and automated defect detection |

| Advancements in Measurement Innovation | AI-powered non-contact metrology, 3D scanning, and robotic-assisted inspection |

"Across the United States, the 3D metrology market is growing steadily and consistently owing to its applications in aerospace, automotive, healthcare and industrial manufacturing." Demand is driven by increasing adoption of automated quality control, precision measurement and non-contact inspection technologies.

Many crucial manufacturing and research powerhouses furthering metrology software, portable coordinate measuring machines (CMMs), and laser scanners—Detroit, Chicago, and Silicon Valley, to name a few. The proliferation of Industry 4.0 and smart factories also fuel market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

The market for 3D metrology in the UK is growing, as a result of demand in precision engineering, industrial automation and healthcare applications. London and Manchester are pioneers in the development of 3D scanning and digital twin technologies, particularly when it comes to additive manufacturing, aviation, and automotive quality control. Further growth is fuelled by government support for advanced manufacturing technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.8% |

Germany, France, and Italy are at the forefront of the market, with robust application in automotive, robotics, and industrial automation segments.

Germany, a world leader in precision manufacturing, launches investment in AI metrology solutions, laser scanning, and high-accuracy CMMs. Growth across Europe is bolstered through the expansion of smart factories, aerospace R&D, and digital measurement technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.9% |

The semiconductor, industrial automation, and automotive industries are driving growth in Japan's 3D metrology market. Mitutoyo and Nikon Metrology, for example, are developing high-precision measuring instruments and automated inspection systems. Robot technology and high-precision engineering in Japan make the market expected to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.1% |

3D Metrology for the South Korea Market, 3D Metrology for 3D Development and include Hardware, Software and Industrial Applications. Companies such as Samsung and Hyundai are focusing on investing in automated measurement solutions and real-time quality inspection solution technologies. As the South Korean government embraces smart manufacturing and drives the economy forward, Seoul and Busan have emerged as significant centers for AI-powered metrology and digital quality control.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.2% |

Coordinate measuring machines (CMMs), 3D scanners, and optical digitizers are part of this segment, which accounts for the largest share in the market. Industries are focusing on contact and non-contact metrology solutions for error-free production, real-time defect detection, and process efficiency.

When it comes to accuracy and repeatability in the realm of automated dimensional measurement and high-accuracy verification, CMMs still reign supreme, particularly in industries such as automotive and aerospace, where precision is paramount to the assembly of components, structural integrity, and quality control. On the other hand, laser and structured light-based 3D scanners are trending as they can capture complex geometries and allow for a fast non-destructive inspection process.

Over 70% of manufacturers are deploying 3D metrology hardware directly into production lines to achieve greater precision in machining, tooling, and part validation. The rise of market share at portable metrology systems and portable CMM Mounted over robotics & AI powered 3D scanning devices further foster the growth of the systems as automation of wells in various industries.

In the face of prohibitive equipment costs and complexities of system integration, advancements in miniaturized, wireless and cloud-enabled metrology hardware are making precision measurement more affordable and scalable. Further optimization can be achieved in industrial quality assurance processes with tools powered by AI-driven measurement, automated robotic inspection systems and real-time metrology analytics.

The software segment is being expanded swiftly as the professional background transitions to AI-based metrics, predictive statistics, and integrated cloud-linked metrology stages.

Unlike manual inspection techniques, which are performed straight through the naked eye, metrology software automatically detects defects, improving accuracy and original CAD models integration by ensuring that measurement data can effortlessly become part of the quality control process and help optimize processes.

For example, the automotive and aerospace sectors carry high demands for AI-driven 3D measurement tools, with manufacturers turning toward virtual simulation (virtual simulated inspection), dynamic flaw analysis, and digital twin modelling for production workflow optimization.

According to research, more than 65% of smart manufacturing sites have implemented AI-enabled metrology software for automated measurement, error prediction and process monitoring.

Adding to this, cloud-based metrology solutions are transforming the space by allowing remote quality control, collaborative defect analysis and the real-time sync of measurement data across global production sites. They are investing in low-code AI-driven software, self-learning measurement algorithms, and digital twin integration to improve process efficiency, minimize material waste, and avoid production errors.

And although the software licensing cost and software compatibility challenges persist, the adoption of AI-assisted metrology software, real-time 3D modelling platform and machine-learning-powered inspection platform is on the rise.

The growth of metrology software segment in last few years has been powered by such technologies as automated measurement analytics, digital twin simulation, and cloud-based defect prediction.

Significant growth opportunities in the market are provided by the increasing demand for 3D metrology across industries including automotive, aerospace, healthcare, and manufacturing. The market's growth will be aided by developments in laser scanning technology, precision measurement solutions powered by AI, and the growing use of Industry 4.0 technologies. Therefore, firms in this sector are using tech advancements, like machine learning-based automated inspection, improved measuring accuracy, and advanced analytics to fuel efficiency, guarantee quality control, and elevate productivity. Companies in the market include manufacturers of key metrology equipment and software, as well as research-oriented companies dedicated to 3D solutions for high-performance measurement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hexagon AB | 20-25% |

| FARO Technologies | 15-20% |

| Nikon Metrology | 10-15% |

| Keyence Corporation | 8-12% |

| Creaform (AMETEK) | 5-10% |

| Other Manufacturers (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hexagon AB | A 3D metrology solutions provider, providing laser scanners, CMM and software. |

| FARO Technologies | Adept also works on portable 3D measurement solutions, laser trackers, 3D scanners, and inspection software. |

| Nikon Metrology | Manufacture mature precision measurement and industrial inspection system solutions such as X-ray CT and laser scanning transcender technology. |

| Keyence Corporation | Providing high-end 3D measurement systems to automation, manufacturing and quality control applications. |

| Creaform (AMETEK) | Specialises in manufacturing portable and handheld 3D scanning and imaging technologies for industrial and healthcare sectors. |

Key Company Insights

Hexagon AB (20-25%)

Hexagon dominates the 3D metrology market with innovative laser scanning solutions, AI-enhanced quality inspection, and high-precision measurement technologies.

FARO Technologies (15-20%)

FARO specializes in portable 3D measurement devices, integrating AI-driven automation for industrial and engineering applications.

Nikon Metrology (10-15%)

Nikon offers high-precision industrial metrology solutions, including computed tomography (CT) scanning and advanced optical measurement systems.

Keyence Corporation (8-12%)

Keyence provides high-speed, high-accuracy 3D measurement solutions designed for manufacturing and automation industries.

Creaform (AMETEK) (5-10%)

Creaform leads in portable 3D scanning technologies, offering versatile metrology-grade solutions for industrial applications.

Emerging players and independent manufacturers are driving innovations such as AI-powered metrology software, automation-integrated measurement systems, and high-speed 3D scanning for various industrial applications. These companies include:

What was the overall size of the 3D Metrology Market in 2025? The overall market size for the 3D Metrology Market was USD 13.2 billion in 2025.

The 3D Metrology Market is expected to reach USD 29.85 billion in 2035.

The demand for the 3D Metrology Market will be driven by the increasing need for precision measurement in manufacturing, advancements in automation, growth in aerospace and automotive industries, rising adoption of Industry 4.0, and the expanding use of metrology in healthcare and construction.

The top five countries driving the development of the 3D Metrology Market are the USA, Germany, Japan, China, and the UK.

The 3D Metrology Market is expected to grow at a CAGR of 8.5% during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: MEA Market Attractiveness by Component, 2023 to 2033

Figure 158: MEA Market Attractiveness by Application, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Somatosensory Virtual Fitting Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA