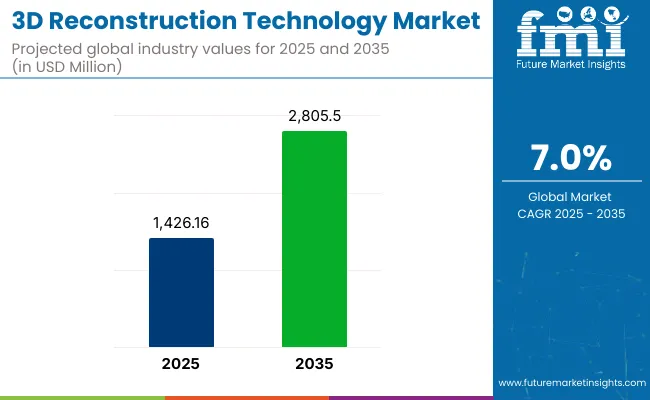

The 3D Reconstruction Technology Market is estimated to reach USD 1,426.16 million by 2025. Between 2025 and 2035, the market is expected to grow at a CAGR of 7.0%, reaching a total value of USD 2,805.5 million by the end of the assessment period.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 1,426.16 million |

| Projected Industry Value (2035F) | USD 2,805.5 million |

| CAGR (2025 to 2035) | 7.0% |

The 3D reconstruction technology market is experiencing robust expansion, driven by accelerated adoption across industries such as healthcare, construction, entertainment, and autonomous systems. Investor presentations and corporate disclosures have indicated that demand has been strengthened by the need for precise digital replicas that enable simulation, visualization, and measurement in real time. Advances in photogrammetry, structured light scanning, and computer vision algorithms have significantly improved reconstruction accuracy and processing speed.

Regulatory support for digital transformation initiatives and funding for smart infrastructure projects have further incentivized the integration of 3D reconstruction capabilities into workflows. Cloud computing and AI-powered automation have been leveraged to reduce operational complexity and deliver scalable solutions to enterprises of all sizes. The future outlook is expected to be influenced by technological convergence with augmented reality, digital twins, and metaverse applications, reinforcing the strategic value of reconstruction platforms.

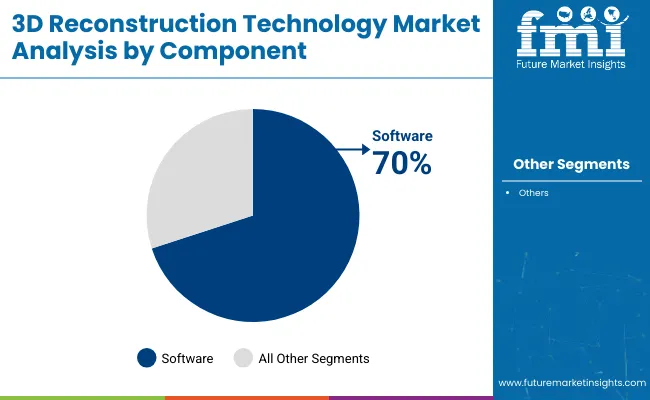

In 2025, software is anticipated to hold a 70% revenue share in the 3D reconstruction technology market. This dominance has been attributed to the software’s pivotal role in capturing, processing, and rendering spatial data into high-fidelity 3D models.

The segment’s growth has been driven by continuous advances in machine learning algorithms and photogrammetric processing engines, which have enhanced accuracy and automation. Integration capabilities with CAD platforms and simulation tools have been recognized for improving cross-functional workflows in architecture, medical imaging, and industrial design.

The scalability of cloud-based reconstruction solutions has further supported adoption among enterprises seeking flexibility and cost efficiency. Regulatory encouragement for digital asset management and infrastructure modernization has also reinforced software demand. Collectively, these factors have secured software’s position as the primary revenue generator within the component segment.

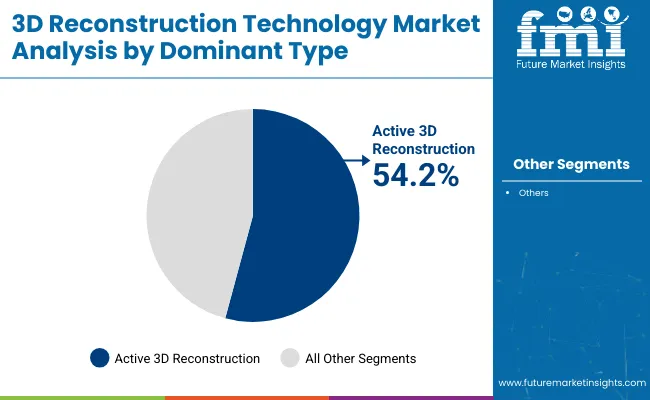

Active 3D reconstruction is projected to account for 54.2% of the market share in 2025. This segment’s leadership has been supported by its capacity to deliver highly accurate depth and surface data through technologies such as structured light and laser scanning. It has been observed that active methods are preferred in applications requiring consistent resolution and precision, including quality inspection, robotics, and heritage preservation.

Advancements in sensor miniaturization and data fusion techniques have been credited with improving usability and reducing system costs. The growing deployment of autonomous systems and intelligent machinery has further elevated the relevance of active reconstruction methods. Industry initiatives promoting standardization and interoperability have also been instrumental in sustaining demand. As a result, active 3D reconstruction has been positioned as a cornerstone technology for high-accuracy applications across industries.

(Survey Conducted in Q4 2024, n=500 stakeholder participants evenly distributed across software developers, hardware manufacturers, cloud service providers, and end users in the USA, Western Europe, China, Japan, and South Korea)

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Regional Variance:

Shared Challenges:

Regional Differences:

Software Developers:

Hardware Manufacturers:

Cloud Service Providers:

Alignment:

Divergence:

High Consensus:

AI-driven automation, cloud-based modeling, and cost pressures are common concerns worldwide.

Key Variances:

Strategic Insight:

A standardized approach will not work. Companies must adapt solutions regionally-AI and automation in the USA, sustainable processing in Europe, AI-led smart city modeling in China, and compact, high-precision solutions in Japan and South Korea.

For a deep dive into stakeholder priorities and customized strategic recommendations, contact FMI today and gain an edge in the evolving industry.

| Country | Policies, Regulations & Mandatory Certifications |

|---|---|

| United States | Government-funded infrastructure programs are accelerating the adoption of 3D reconstruction for urban planning. The National Institute of Standards and Technology (NIST) provides guidelines for digital twin applications. Strict FCC regulations govern LiDAR-based data collection, particularly for mapping and surveillance applications. |

| United Kingdom | The National Digital Twin Programme mandates standardized 3D data integration for public infrastructure projects. GDPR compliance is required for cloud-based 3D modeling to ensure data privacy. Construction projects must adhere to Building Information Modeling (BIM) Level 2 regulations, requiring high-precision 3D models for public-sector developments. |

| France | The BIM 2022 Mandate requires all public construction projects to use 3D modeling for efficiency and sustainability. CNIL (Commission Nationale de l'Informatique et des Libertés) enforces strict data privacy laws, impacting cloud-based 3D reconstruction platforms. LiDAR use in public spaces requires approval from the Ministry of Ecological Transition due to environmental concerns. |

| Germany | The EU Digital Twin Strategy influences 3D reconstruction for smart cities and industrial automation. DIN EN ISO 19650 compliance is required for 3D modeling in large-scale projects. The Federal Cartography and Geodesy Agency regulates photogrammetry-based mapping for urban planning and infrastructure. |

| Italy | The National Recovery and Resilience Plan (NRRP) encourages 3D reconstruction for heritage preservation and construction. UNI 11337-2017 certification is mandatory for digital modeling in public infrastructure. General Data Protection Regulation (GDPR) applies to cloud-based 3D applications. |

| South Korea | The Smart City Act mandates AI-driven 3D reconstruction for urban development. Korean Spatial Information Quality Certification (K-SQC) is required for geospatial and mapping-based 3D modeling. Government incentives are offered for 3D reconstruction in robotics and industrial automation. |

| Japan | The Digital Transformation Act promotes AI and 3D modeling in infrastructure projects. Japan BIM Standards (J-BIM) require standardized adoption of digital twins in construction. The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) regulates LiDAR and photogrammetry applications for public projects. |

| China | The National AI Development Plan prioritizes 3D reconstruction for smart cities and defense applications. The Cybersecurity Law of China imposes strict data localization requirements on cloud-based 3D services. Companies must obtain Surveying and Mapping Qualification Certificates to conduct large-scale geospatial 3D modeling. |

| Australia & New Zealand | The BIM Acceleration Committee enforces 3D modeling standards in public construction. New Zealand Geospatial Strategy regulates photogrammetry-based mapping. Privacy Act 2020 governs cloud-based 3D data storage and processing. |

The 3D reconstruction technology industry is set for robust growth, supported by the evolution of AI-based modeling, higher immersion in development and heritage protection and its applications in AR/VR and smart city projects.

Users of automation and cloud-based 3D reconstruction tools will be the beneficiaries, while the manual modeling method will be rendered unnecessary. High-precision 3D reconstruction services will only rise in demand as businesses place a value on effectiveness and digitalization.

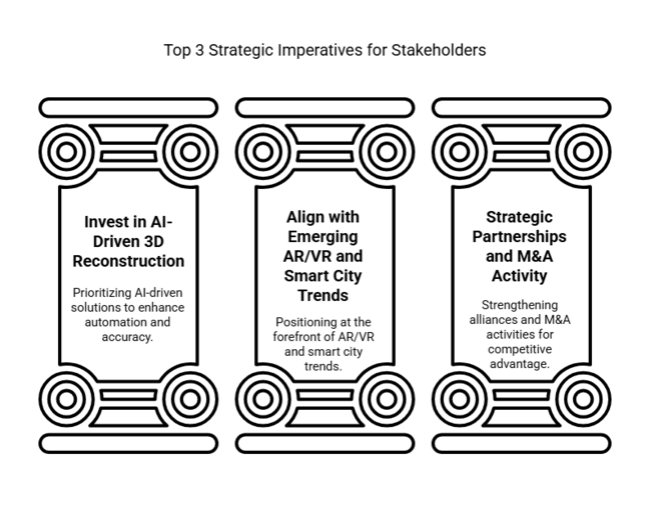

Invest in AI-Driven 3D Reconstruction

Executives should prioritize AI-powered modeling solutions to enhance automation, reduce processing time, and improve accuracy. Investing in machine learning and cloud-based platforms will enable seamless scalability and integration across industries.

Align with Emerging AR/VR and Smart City Trends

Companies must position themselves at the intersection of 3D reconstruction, augmented reality, and smart infrastructure development. Collaborating with urban planners, gaming studios, and metaverse developers will unlock new revenue streams and expand technological capabilities.

Strengthen Strategic Partnerships and M&A Activity

To stay competitive, businesses should pursue strategic alliances with hardware manufacturers, software developers, and cloud service providers. Mergers and acquisitions in niche 3D reconstruction segments will help consolidate expertise, enhance product portfolios, and accelerate innovation.

| Risk | Probability & Impact |

|---|---|

| Supply Chain Disruptions in 3D Hardware - The industry's reliance on LiDAR sensors and photogrammetry equipment makes it vulnerable to semiconductor shortages, trade restrictions, and production bottlenecks. Limited component availability could delay project timelines and increase costs, necessitating diversified sourcing and supplier partnerships. | High Probability, Severe Impact |

| Data Privacy & Security Concerns - The widespread adoption of cloud-based 3D reconstruction raises risks related to data breaches, intellectual property theft, and compliance with regional data protection laws. Strengthening cybersecurity frameworks and ensuring regulatory compliance will be essential to maintaining trust and mitigating legal risks. | Moderate Probability, Significant Impact |

| Regulatory Challenges in Heritage & Infrastructure Projects - Stringent government policies on digital mapping, historical site documentation, and urban planning approvals can create project delays and compliance burdens. Proactive engagement with policymakers and aligning solutions with regulatory frameworks will be crucial for sustained growth. | Moderate Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| AI-Powered 3D Reconstruction Adoption | Conduct feasibility studies on integrating generative AI for automated 3D modeling and rendering. Assess software capabilities, invest in AI-driven tools, and collaborate with tech firms to enhance automation and scalability. |

| Cloud Security & Compliance Strategy | Implement enhanced encryption and regulatory frameworks to address data security concerns in cloud-based 3D reconstruction. Conduct cybersecurity audits, ensure compliance with regional data protection laws, and develop contingency plans for data breaches. |

| 3D Hardware Supply Chain Resilience | Develop alternative sourcing strategies and establish direct partnerships with LiDAR and photogrammetry hardware manufacturers. Secure long-term contracts, diversify supplier networks and explore localized manufacturing to mitigate component shortages and cost volatility. |

To stay ahead, the companies must invest aggressively in AI-based 3D reconstruction, strengthen cloud security infrastructure as well as achieve long-term hardware supply chain stability. This insight points to automation direction, which needs to be ushered in with generative AI for improving modeling efficiency on an urgent basis.

Enhancing cybersecurity protocols is essential as cloud-based uptake widens, achieving compliance and confidence. The client also needs to diversify LiDAR and photogrammetry sources for protecting operations against supply chain dynamics.

By leveraging these priorities, the client can speed up innovation, lower operating risks, and seize upcoming opportunities in construction, heritage conservation as well as AR/VR technologies.

CAGR for the USA from 2025 to 2035 is projected at 7.8%. Strong government backing for smart infrastructure and adoption of the digital twin is fueling expansion. Increased investments in AI-driven 3D modeling for urban planning, construction, and forensic applications are creating lucrative opportunities.

The demand for high-resolution 3D models in construction is surging, particularly in large-scale commercial and residential projects. The adoption of LiDAR technology for geospatial mapping and heritage preservation has gained momentum. Additionally, the entertainment industry is utilizing 3D reconstruction for immersive gaming and virtual production in filmmaking.

Regulatory compliance and privacy laws, particularly regarding AI-driven surveillance applications, pose challenges. However, government funding and incentives for smart city projects provide sustained growth. Increasing collaboration between tech firms and research institutions is expected to drive innovation in automated reconstruction solutions.

The CAGR for the UK from 2025 to 2035 is expected to be 7.2%. Adoption of digital twin technology in infrastructure development and compliance with BIM Level 2 regulations drive growth. Government initiatives to modernize urban planning and transportation further boost demand for advanced 3D modeling solutions.

The UK construction industry is integrating AI-based 3D modeling tools to enhance project efficiency and cost control. The cultural preservation sector is also leveraging 3D reconstruction for the digital archiving of historical sites. Moreover, media and entertainment companies are increasingly investing in 3D scanning for virtual and augmented reality applications.

Data protection laws such as GDPR create compliance challenges for cloud-based 3D services. However, strong public and private sector collaboration in research and innovation fosters technological advancements. Expanding investments in AI-powered automation and LiDAR technology is expected to solidify the UK’s position.

CAGR for France from 2025 to 2035 is projected at 7.0%. France’s ongoing BIM strategy and the EU Digital Twin Strategy are accelerating adoption across infrastructure, real estate, and cultural heritage sectors. Government investments in smart cities and historical site digitization further drive expansion.

The construction sector is experiencing high demand for automated 3D modeling tools, ensuring compliance with sustainability regulations. Meanwhile, France is leading Europe in utilizing 3D reconstruction for historic preservation, with advanced photogrammetry techniques being used to restore heritage sites such as Notre Dame. Growth is also evident in gaming and animation.

Stringent regulatory requirements for data privacy and security pose hurdles for cloud-based solutions. However, strong industry-government collaboration ensures continued innovation. France’s commitment to sustainability and smart city development will drive further advancements in AI-driven 3D technologies.

CAGR for Germany from 2025 to 2035 is projected at 7.0%. The country's leadership in precision engineering and manufacturing accelerates the adoption of industrial automation, construction, and geospatial applications. The EU Digital Twin Strategy further drives demand for high-accuracy 3D modeling solutions.

Germany’s construction sector is integrating advanced 3D modeling tools to enhance energy efficiency and structural safety. The automotive industry is also leveraging 3D reconstruction for prototyping and quality control. Additionally, government investments in smart city initiatives support the expansion of geospatial mapping applications.

Regulatory complexity, particularly in compliance with EU data protection laws, presents challenges. However, Germany’s focus on research-driven innovation fosters breakthroughs in AI-powered automation. Increased adoption of hybrid Photogrammetry-LiDAR solutions is expected to fuel long-term growth.

CAGR for Italy from 2025 to 2035 is forecasted at 6.5%. Investments in cultural heritage preservation and the National Recovery and Resilience Plan (NRRP) are major drivers. The growing adoption of 3D modeling in architecture and restoration projects further accelerates expansion.

Italy’s tourism and heritage sectors are utilizing 3D reconstruction for site restoration and digital archiving. The construction industry is also embracing AI-driven modeling tools for project optimization. Additionally, demand is increasing in medical imaging and virtual surgery planning, enhancing healthcare applications.

Challenges include limited technological infrastructure in certain regions and high costs of advanced 3D reconstruction systems. However, government-backed initiatives and rising private-sector investments in automation and AI are expected to bridge these gaps, ensuring steady growth.

CAGR for South Korea from 2025 to 2035 is expected at 7.4%. The government’s Smart City Act and heavy investments in AI-driven urban planning solutions are major growth catalysts. Increased adoption in robotics, manufacturing, and digital healthcare further strengthens the sector.

South Korea’s gaming and entertainment industry is fueling demand for high-resolution 3D modeling. The country is also leading in robotic automation, utilizing 3D reconstruction for AI-driven industrial processes. Additionally, advancements in medical imaging are enhancing applications in virtual surgery and diagnostics.

Regulatory oversight on AI and data privacy presents challenges for cloud-based 3D services. However, ongoing investments in R&D and technological innovation continue to enhance competitiveness. Government-backed funding and corporate collaborations will drive future advancements.

The projected CAGR for Japan during the period from 2025 to 2035 is 6.3%. Further growth in infrastructure and automation is being spurred on by the Digital Transformation Act. And with the acceptance of robotics, AI-driven manufacturing, and work on cultural preservation, one further boost to growth emerges.

Japan's automotive and electronics industries are harnessing 3D reconstruction for product development and quality control. The nation is also embarking on investing in a digital twin for smart city purposes. What is trending also in Japan is healthcare applications such as 3D medical imaging and virtual surgery planning.

Still emerging are high costs and relatively slow adoption of cloud-based 3D reconstruction. However, these challenges are expected to be countered by R&D projects sponsored by the government and by cooperation between technology companies and research institutes to spur innovation and further growth.

The CAGR for China from 2025 to 2035 is estimated to be at 8.2%. The National AI Development Plan and smart city initiatives are driving rapid adoption of such systems. AI-driven automation and geospatial development leadership will further grease the wheel of acceleration.

The Chinese construction industry is now integrating 3D reconstruction in large-scale urban developments. Similarly, the high-resolution 3D modeling offered by the manufacturing industry is being used for automation and AI-powered quality control. Furthermore, the surge in demand for 3D imaging for e-commerce and virtual retail applications is further bolstering industry prospects.

Strict adherence to data localization and cybersecurity laws has posed several hurdles for cloud applications; nevertheless, robust support from the government for AI and automation would ensure sustained growth. Investment in AI photogrammetry and LiDAR applications will further condition the acceleration.

The 3D reconstruction technology market is highly dynamic and innovation-driven, spanning applications in architecture, construction, healthcare imaging, gaming, autonomous navigation, and digital twins. Leading companies are investing in advanced photogrammetry, LiDAR integration, and AI-powered reconstruction pipelines to improve accuracy, scalability, and automation of 3D model generation.

Strategic acquisitions, cross-platform integrations, and partnerships with hardware manufacturers and enterprise software providers are central to expanding adoption across industries. Additionally, demand for real-time 3D capture, cloud-based collaboration, and immersive visualization tools is fueling growth in both professional and consumer segments. Emphasis on end-to-end workflows, GPU acceleration, and compatibility with AR/VR ecosystems is reshaping competitive differentiation.

Key Development

In 2025, 3D Systems announced the world's first Medical Device Regulation (MDR)-compliant 3D-printed PEEK facial implant manufactured at the point-of-care. In collaboration with the University Hospital Basel, the implant was designed and produced using 3D Systems’ EXT 220 MED printer, enabling tailored, efficient, and potentially lower-cost patient-specific solutions in maxillofacial reconstruction.

In 2025, Johnson & Johnson MedTech's digital orthopaedics innovations, including VELYS™ robotics for knees and spine, and TRUMATCH™ for shoulders, implicitly leverage 3D reconstruction technology. This enables precise surgical planning and guidance by converting patient imaging data into detailed 3D anatomical models, enhancing personalized care and efficiency.

By component, the industry is segmented into software and services.

In terms of type, the industry is segmented into active 3D reconstruction and passive 3D reconstruction.

Based on enterprise size, the industry is segmented into large enterprises and SMEs.

By Deployment Model, the industry is segmented into On-premise and Cloud.

In terms of application, the industry is segmented into Education, Healthcare, Aerospace & Defense, Media & Entertainment, Construction & Architecture, and Government & Public Safety.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

It is used to create accurate digital models for applications in healthcare, construction, gaming, and archaeology.

Photogrammetry uses overlapping images to generate models, while LiDAR relies on laser pulses for precise depth measurements.

Healthcare, real estate, media, entertainment, construction, and defense are among the fastest adopters.

AI enhances automation, improves object recognition, refines textures, and accelerates image-based modeling.

High costs, skilled labor requirements, data processing limitations, and security concerns hinder widespread adoption.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA