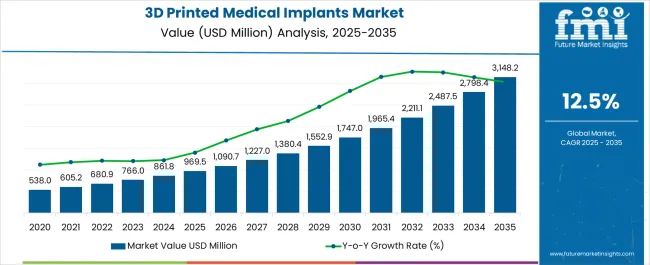

The 3D Printed Medical Implants Market is estimated to be valued at USD 969.5 million in 2025 and is projected to reach USD 3148.2 million by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

| Metric | Value |

|---|---|

| 3D Printed Medical Implants Market Estimated Value in (2025 E) | USD 969.5 million |

| 3D Printed Medical Implants Market Forecast Value in (2035 F) | USD 3148.2 million |

| Forecast CAGR (2025 to 2035) | 12.5% |

The 3D printed medical implants market is experiencing rapid evolution, driven by advancements in additive manufacturing, patient-specific healthcare solutions, and the need for minimally invasive procedures. The ability to produce customized, anatomically accurate implants with reduced lead times is reshaping clinical workflows and improving surgical outcomes.

Regulatory approvals for 3D printed implants have accelerated over recent years, further legitimizing their adoption across orthopaedic, cranial, and dental applications. Improvements in biocompatible materials and porous structures that promote osseointegration have enhanced product performance and longevity.

Increasing demand for precision medicine and cost-efficiency in preoperative planning are supporting the integration of 3D printing technologies in hospital settings and implant manufacturing facilities. Future growth is expected to be catalyzed by the continued convergence of medical imaging, AI-based modeling software, and material innovation—creating scalable, patient-centered implant solutions.

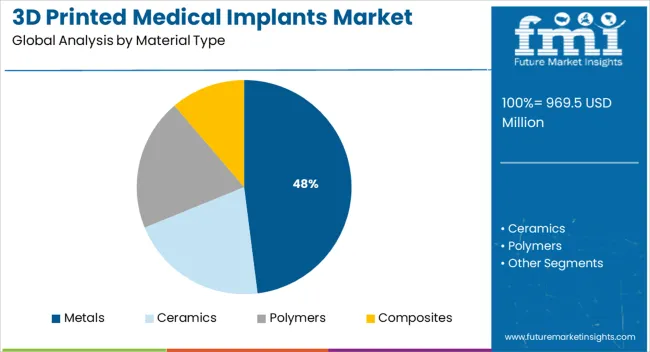

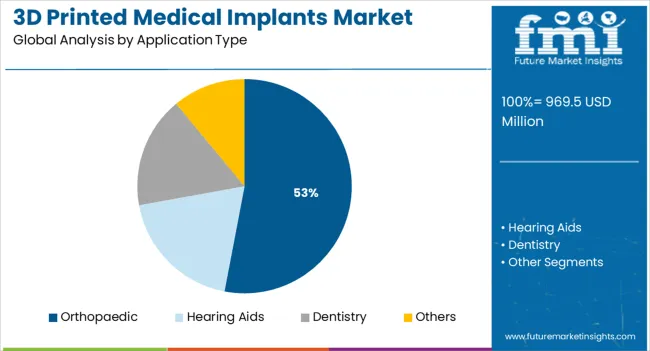

The market is segmented by Material Type and Application Type and region. By Material Type, the market is divided into Metals, Ceramics, Polymers, and Composites. In terms of Application Type, the market is classified into Orthopaedic, Hearing Aids, Dentistry, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Metals are projected to contribute 48.0% of the total revenue in the 3D printed medical implants market by 2025, positioning them as the leading material category. This dominance is being driven by the high mechanical strength, corrosion resistance, and excellent biocompatibility of materials such as titanium and cobalt-chrome alloys.

These properties make metals particularly well-suited for load-bearing applications in orthopaedics and craniofacial reconstruction. Advanced powder bed fusion and electron beam melting technologies have enabled the production of lightweight, lattice-structured implants that enhance bone in-growth and reduce stress shielding.

The ability to precisely control density and microstructure has further increased confidence among surgeons and regulatory bodies alike. As demand for high-performance, long-lasting implants rises—especially for aging populations—metal-based 3D printed implants are expected to remain the preferred option across surgical specialties.

Orthopaedic applications are expected to account for 53.0% of the total market revenue by 2025, making them the most prominent use case within the 3D printed medical implants landscape. This leadership is being supported by the growing burden of musculoskeletal disorders, rising incidence of joint degeneration, and demand for personalized prosthetics.

3D printing allows for the creation of implants that conform precisely to patient-specific bone morphology, improving surgical fit and reducing revision rates. The use of additive manufacturing in orthopaedics has also enabled the development of integrated porous surfaces that support biological fixation and faster recovery.

Hospitals and surgical centers are increasingly adopting in-house 3D printing for preoperative modeling and implant prototyping, enhancing procedural accuracy and cost efficiency. As healthcare systems seek solutions that improve long-term outcomes and reduce implant failure rates, orthopaedics is anticipated to remain at the forefront of clinical innovation in this market.

The 3D printed medical implants market is driven by the surging prevalence of various medical issues. With the rising number of people facing orthopedic, cardiac, and dental diseases, the demand for 3D dental bridges, 3D dental crowns, shoulder implants, and 3D acetabular hip implants, among many other implants, is observing heightened demand.

In 2025, World Health Organization (WHO) reported that about 14% of the global adult population is estimated to be witnessing severe periodontal diseases, which results in infection and inflammation in the ligaments and bones that uphold the teeth. Similarly, the growing prevalence of other medical conditions is boosting the demand for 3D printed medical implants.

Regionally, North America is expected to contribute to the highest market share due to the rising number of product launches and the heightened presence of key regional players.

Further, the market is also expected to be positively influenced by the presence of high-quality and widespread healthcare facilities, particularly hospitals and diagnostic imaging centers, and the surging infrastructure for the 3D printer in healthcare facilities.

The Asia Pacific market is expected to observe healthy growth due to ongoing market expansion by key market players in the region. For instance, in July 2020, Oxford Performance Materials Inc. (OPM), upon receiving accreditation as a foreign medical device producer by the Japanese Ministry of Health, Labour, and Welfare, partnered with JSR Corp. (JSR), a Tokyo-based materials provider, to form OPM Asia. The manufacturing of 3D printers of PEKK implants began in Japan, with products for sale in Asia in 2020.

The market is predicted to foster over the forecast period attributable to recent collaborations between the market players. For instance, in July 2025, Oxford Performance Materials announced an agreement with Fuse Medical, Inc. (Fuse), a producer and distributor of inventive medical devices, to construct new, premium-quality spinal, extremity and sports medicine implant product lines by using OPM’s patented OsteoFab® PEKK technology.

As per the 3D printed medical implants market study, 3D printing, also known as additive manufacturing, is a process by which a three-dimensional object is constructed from a digital model, layer by layer. Although it is still in its infancy, this technology holds great promise for a variety of medical implant applications.

Increased demand for medical implantation due to the prevalence of bone-dental problems, and strategic investments by key players are all factors propelling the 3D printed medical implants market.

There has been a huge increase in public and private funding to support various efforts in the 3D printing sector in recent years. In turn, the global demand for 3D printed medical implants is expected to expand during the forecast period as a result of these research and funding initiatives.

The demand for 3D printed medical implants is growing rapidly and addressing a significant unmet need. Training surgeons with computer simulations before actual operations can boost healthcare efficiency. Products in the global 3D printing medical implants market also aid in the reconstruction of lost facial features, tissue, and even limbs due to serious conditions like arthritis.

In addition, thanks to developments in technology like nanomaterials, clinicians can now construct accurate duplicates of individual anatomy, allowing them to expand their services naturally. As a result of the 3D printing technology and the virtual planning and supervision it provides, major surgeries like total joint replacement and heart replacement are now feasible.

There is optimism that the 3D printed medical implants market is likely to grow at a healthy rate over the next few years. Medical devices are being constructed using 3D printing technology, which is a form of additive manufacturing.

Medical device designers benefit from 3D printing's adaptability because it makes it simple to install new machinery, do away with the need for specific tools, or implement alterations. The result is anticipated to be a 1.3-fold increase in market demand for 3D printed medical implants over the forecast period.

After expanding at a CAGR of 15.9% between 2020 and 2024, Future Market Insights predicts the 3D printing medical devices market is likely to slow to a CAGR of 12.5% between 2025 and 2035.

Driver: Increased Funding for 3D printing projects from both the public and private sectors

In recent years, public and private funding for 3D printing projects have increased significantly. The development of 3D printing products and technologies are anticipated to be stimulated by such research and funding activities, which in turn is expected to drive the expansion of the 3D printing medical devices market.

The following are some recent advances that are shaping up the printed medical implants market. The top software platform for additive manufacturing processes is likely to be developed with USD 861.8 million that topology (US) raised in September 2024.

The The University of Huddersfield in the United Kingdom received USD 538 million (EUR 2.25 million) from Innovate UK in March 2020 to create a new generation of electron-beam additive manufacturing (EBAM) printers.

Restraint: Reduced Availability of Skilled Workers Owing to Insufficient Additive Manufacturing Training

Without a properly trained workforce, additive manufacturing and 3D printing are forecasted to struggle to gain widespread acceptance. The rapid pace of evolution of the 3D printing medical devices market in terms of technology and materials has exacerbated the already severe shortage of personnel knowledgeable in 3D printing processes.

Additive manufacturing education options are limited, and it can be challenging to bridge the gap between classroom theory and real-world practice. In additive manufacturing, product quality can suffer from a lack of skilled workers due to a gap in knowledge about the design and manufacturing processes. Without this kind of labour force, the medical device industry would be unable to fully embrace 3D printing.

The market for medical devices made using 3D printing is largest in North America, where they account for 46.7% of the total. During the years 2025-2035, the regional demand for 3D printed medical implants is anticipated to grow at a CAGR of 14.3 per cent.

The rising prevalence of healthcare facilities like hospitals and diagnostic centres, as well as the rising prevalence of 3D printers in these settings, are driving the industry's expansion.

How is the Performance of the North America 3D Printed Medical Implants Market?

The market for medical devices made using 3D printing is largest in North America, where they account for 46.7% of the total. During the years 2025-2035, the regional demand for 3D printed medical implants is anticipated to grow at a CAGR of 14.3%.

The rising prevalence of healthcare facilities like hospitals and diagnostic centres, as well as the rising prevalence of 3D printers in these settings, are driving the industry's expansion.

What is the Growth Outlook for the Asia-Pacific 3D Printed Medical Implants Market?

With respective shares of 19.5% and 18.7%, East and South Asia are major contributors to the 3D printing medical devices market in the Asia-Pacific region. Together, they control 31.1% of the global demand for 3D printed medical implants.

However, it is predicted that the region is expected to be the fastest growing 3D printed medical implants market, expanding at a CAGR of 15.3 per cent over the forecast period. This is because there is a higher demand for healthcare overall, and medical device sales have been increasing rapidly.

It is also a prime location for medical device manufacturing and sourcing, so many companies in this industry are looking to set up shop there. In the years to come, this is likely to be a driving force in the 3D printed medical implants market.

To improve clinical workflow, the medical and dental industries have become increasingly digitised over the years. In the 3D printing medical implants market, digital dentistry and operations are replacing conventional surgical procedures. The term "direct digital manufacturing" refers to the process whereby a physical object is made from a digital design using computer-controlled procedures.

Owing to developments in 3D printing, direct digital manufacturing is quickly replacing more conventional methods of production. The time from design to production is shortened, the output is increased, and tooling costs are nullified, making it a compelling option.

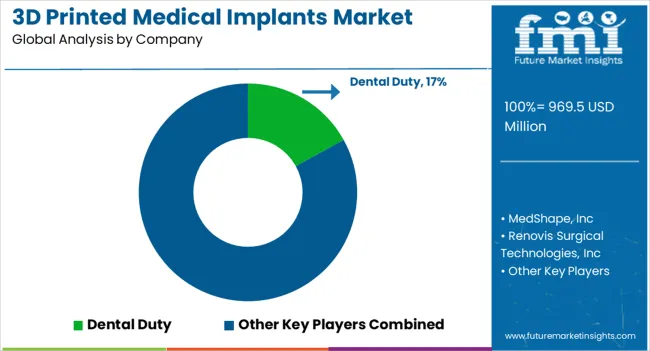

Competition in the international demand for 3D printed medical implants is fierce because of the large number of local vendors. Key players engage in a wide range of promotional activities, including mergers and acquisitions, expansions, collaborations, and partnerships.

Top companies also use new product development as a means of increasing their consumer base and cementing their position as industry leaders. As a result of these efforts, cutting-edge 3D printed medical tools are now routinely used.

Cerhum SA, Oxford Performance Materials Inc., Straumann Group, MedShape, Inc., Renovis Surgical Technologies, Inc., BioArchitects, 3D Medical Manufacturing, Inc., EOS GmbH, Stratasys Ltd., and Emerging Implant Technologies GmbH among others

Some of the recent developments in the 3D Printed Medical Implants market are:

In March of 2024, Stratasys Ltd. unveiled the J5 DentaJet 3D Poly Jet printer for use in dental labs through their SLM Solutions partnership with Canwell Medical. Canwell Medical is expected to now be able to use SLM machines to create 3D printed surgical implant products thanks to this collaboration.

Canwell Medical is projected to receive an application and technical assistance, as well as research and development support, as it moves forward with serial production and product certification.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 12.5% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Material, Application, and Region. |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Cerhum SA; Oxford Performance Materials Inc.; Straumann Group; MedShape, Inc.; Renovis Surgical Technologies, Inc.; BioArchitects; 3D Medical Manufacturing, Inc.; EOS GmbH; Stratasys Ltd.; and Emerging Implant Technologies GmbH among others |

The global 3D printed medical implants market is estimated to be valued at USD 969.5 million in 2025.

The market size for the 3D printed medical implants market is projected to reach USD 3,148.2 million by 2035.

The 3D printed medical implants market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in 3D printed medical implants market are metals, ceramics, polymers and composites.

In terms of application type, orthopaedic segment to command 53.0% share in the 3D printed medical implants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Printed Medical Devices Market is segmented by drug type, treatment and distribution channel from 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Hip and Knee Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

3d-Printed Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Kit Market Analysis Size and Share Forecast Outlook 2025 to 2035

3D Printed Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Surgical Models Market Analysis - Size, Share, and Forecast 2025 to 2035

3D Printed Wearable Market - by Product Type, Material Type, Technology, Sales Channel, End-User, Application, and Region - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of 3D Printed Packaging Manufacturers

Market Share Breakdown of 3D-Printed Stickers & Labels Manufacturers

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

3D-Printed Stickers & Labels Market Growth – Trends & Forecast 2024-2034

3D Printed Brain Model Market Analysis – Trends & Forecast 2024-2034

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Human Tissue Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA