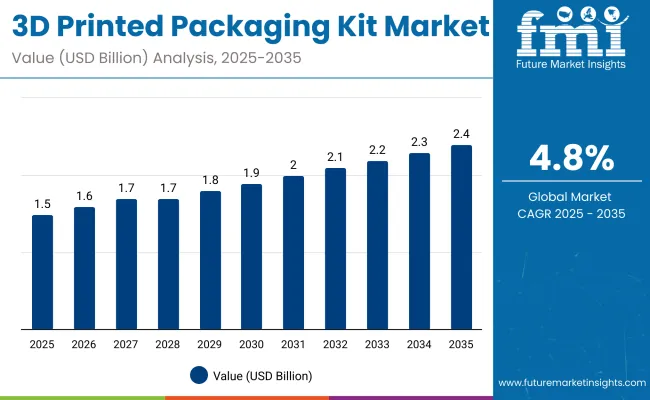

The 3D printed packaging kit market is expected to grow from USD 1.5 billion in 2025 to USD 2.4 billion by 2035, resulting in a total increase of USD 0.9 billion over the forecast decade. This represents a 60.0% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 4.8%. Over ten years, the market grows by a 1.6 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 2.4 billion |

| CAGR (2025 to 2035) | 4.8% |

In the first five years (2025-2030), the market progresses from USD 1.5 billion to USD 1.9 billion, contributing USD 0.4 billion, or 44.4% of total decade growth. This phase is shaped by demand for customization, rapid prototyping, and cost-efficient short runs in consumer goods and healthcare. Sustainability trends, emphasizing reduced waste, also drive early adoption.

In the second half (2030-2035), the market grows from USD 1.9 billion to USD 2.4 billion, adding USD 0.5 billion, or 55.6% of the total growth. This acceleration is supported by advances in bioplastics, multi-material 3D printing, and smart packaging integration. Expanding applications in food, cosmetics, and luxury goods strengthen market penetration, positioning 3D printed kits as a premium packaging solution.

From 2020 to 2024, the 3D printed packaging kit market expanded from USD 1.1 billion to USD 1.4 billion, driven by the rise of customization in e-commerce, medical devices, and luxury goods. Over 65% of revenues were held by OEMs providing tailored designs and rapid prototyping solutions. Leaders such as Stratasys, HP Inc., and Materialise emphasized lightweight materials, structural resilience, and cost-effective customization. Differentiation focused on print speed, sustainable polymers, and design flexibility, while AI-driven generative packaging design remained a secondary revenue driver. Service models for on-demand prototyping accounted for less than 20% of value, with capital investment in in-house printers favoured by large brands.

By 2035, the 3D printed packaging kit market will reach USD 2.4 billion, growing at a CAGR of 4.80%, with software-enabled design ecosystems and service-driven business models capturing over 40% of value. Competition will intensify as solution providers deliver AI-assisted structural optimization, digital twin testing, and cloud-linked 3D design libraries. Established players are shifting toward hybrid models, embedding automation, recyclable biopolymers, and just-in-time production services. Emerging companies such as Xometry, Sculpteo, and Protolabs are gaining share through distributed manufacturing networks, biodegradable material adoption, and end-to-end customization platforms, addressing sustainability goals and supply chain agility.

The increasing demand for customized, on-demand, and cost-efficient packaging solutions is driving growth in the 3D printed packaging kit market. These kits enable brands to create unique designs, reduce waste, and shorten production cycles. Expansion in e-commerce, luxury goods, and personalized gifting is further supporting adoption across industries.

Packaging kits produced with 3D printing technologies offer lightweight structures, precise detailing, and enhanced material efficiency. Their adaptability for small batch runs and rapid prototyping supports innovation and branding flexibility. Eco-friendly materials and reduced logistics footprints align with sustainability goals, while design freedom provides competitive advantages for businesses seeking differentiation in consumer-driven markets.

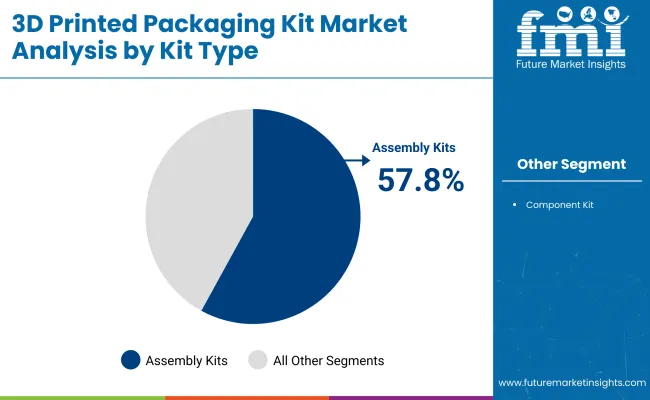

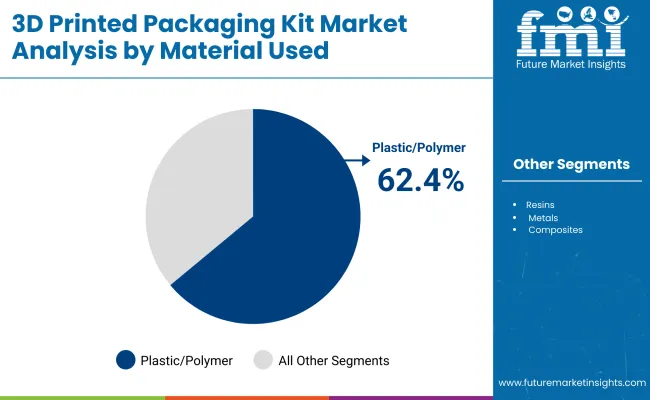

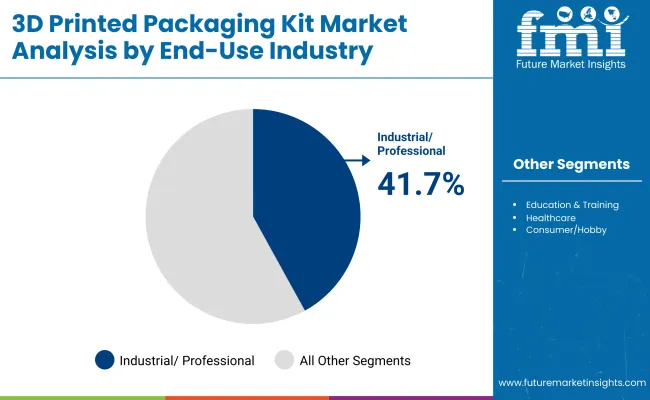

The market is segmented by kit type, material used, end-use industry, and region. Kit type segmentation includes assembly kits such as FDM/FFF printer kits, resin printer kits, metal 3D printer kits, and hybrid CNC + 3D print kits. Component kits cover educational kits, medical/anatomical kits, industrial prototyping kits, consumer kits, and repair & spare-part kits, offering versatile functionality across sectors. Material segmentation includes plastics/polymers such as PLA, ABS, PETG, and nylon, along with resins, metals, composites, and bioprinting materials, supporting innovation in additive manufacturing. End-use industries include education & training, healthcare, industrial/professional, and consumer/hobby applications. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Assembly kits are projected to command a 57.8% share in 2025, driven by their accessibility for beginners and adaptability for professionals. These kits provide pre-configured components and step-by-step assembly guidance, reducing barriers for small businesses and individuals adopting 3D printing. Their affordability and flexibility make them the most widely adopted kit type.

The popularity of assembly kits is reinforced by growing demand in education and small-scale packaging design. Their modular nature allows users to upgrade printers with advanced nozzles or build plates, ensuring long-term usability. These features make assembly kits the entry point for mass adoption in 3D-printed packaging.

Plastics and polymers are expected to account for 62.4% of the market in 2025, reflecting their widespread use in producing lightweight, durable, and cost-effective packaging prototypes. Materials such as PLA, ABS, and PETG offer flexibility in design while maintaining structural strength. Their ease of printing and low cost make them dominant in this space.

This segment benefits from advancements in bio-based polymers, aligning with sustainability trends. Polymers’ adaptability to diverse printing technologies, from FDM to resin-based systems, enhances their role in packaging innovation. Their recyclability and compatibility with food-safe applications further strengthen adoption.

The industrial and professional segment is forecast to represent 41.7% of the market in 2025, driven by demand for customized, small-batch packaging solutions. Businesses use 3D printing kits to prototype molds, fixtures, and packaging components without relying on traditional tooling. This reduces lead times and improves design flexibility.

Adoption is supported by industries such as electronics, consumer goods, and automotive, where tailored packaging enhances protection and brand identity. Professionals benefit from the ability to test multiple iterations quickly, supporting innovation cycles. The segment’s reliance on precision and scalability ensures continued investment in 3D-printed packaging systems.

The 3D printed packaging kit market is gaining traction as industries embrace customization, lightweight structures, and on-demand production capabilities. Growing demand from food, cosmetics, and e-commerce for innovative, sustainable packaging designs is driving growth. However, high equipment costs, material limitations, and slow printing speeds restrain scalability. Advances in biodegradable filaments, rapid prototyping, and smart packaging integration are expected to accelerate adoption across diverse industries.

Customization, Sustainability, and Supply Chain Flexibility Driving Adoption

3D printed packaging kits enable brands to create highly customized shapes, logos, and interactive packaging designs that enhance consumer engagement. Their ability to produce lightweight, durable prototypes reduces product development cycles, supporting faster time-to-market strategies. Sustainable materials such as biodegradable PLA filaments align with rising eco-conscious consumer demand. Additionally, on-demand production reduces inventory holding and waste, offering greater flexibility for small and mid-sized enterprises. This combination of personalization, agility, and sustainability is fueling adoption in consumer-focused sectors.

High Capital Costs, Material Constraints, and Speed Limitations Restraining Growth

Despite strong potential, widespread adoption is restrained by expensive 3D printers, maintenance costs, and limited material compatibility. Most current packaging-grade filaments lack the barrier properties required for food and pharmaceutical applications. Printing large volumes remains time-intensive compared to conventional manufacturing, restricting use in mass production. Smaller companies also face steep learning curves and require skilled staff for design optimization. These challenges hinder scalability and confine 3D printed packaging kits mainly to prototyping and premium applications.

Biodegradable Filaments, Smart Packaging, and Rapid Prototyping Trends Emerging

Key trends include the adoption of recyclable and compostable 3D printing materials that align with circular economy goals. Smart packaging integration, such as embedded QR codes or NFC tags, is being explored to enhance consumer interactivity and product authentication. Advances in high-speed 3D printing technologies are enabling faster prototyping and limited series production. Hybrid approaches combining 3D printing with traditional packaging processes are also gaining attention, allowing cost efficiency while retaining design flexibility. These innovations position 3D printed packaging kits as a future-ready solution for sustainable and highly personalized packaging.

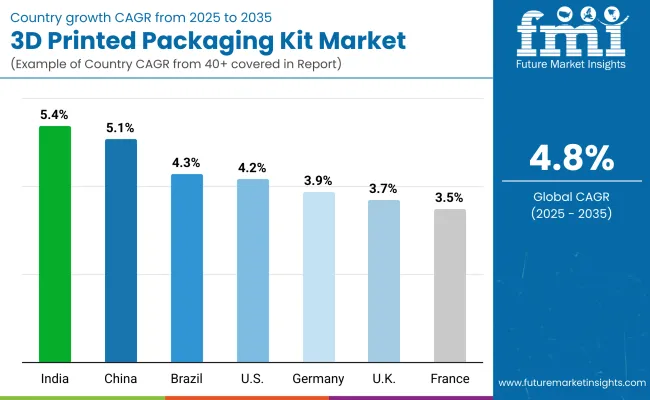

The global 3D printed packaging kit market is expanding steadily, fuelled by rising demand for customization, rapid prototyping, and sustainable packaging solutions. Asia-Pacific is emerging as the fastest-growing region, with India and China investing heavily in additive manufacturing for packaging innovation and scaling. Developed markets such as the USA, Germany, and Japan are focusing on advanced materials, design flexibility, and automation-driven efficiency, ensuring compliance with regulatory standards and supporting eco-friendly practices across diverse industries, including FMCG, healthcare, and e-commerce.

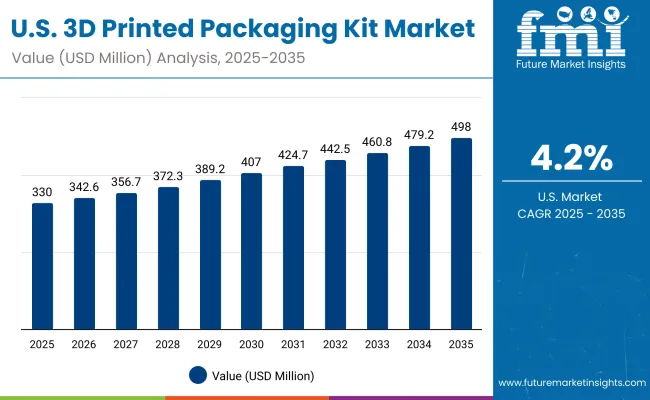

The USA market is projected to grow at a CAGR of 4.2% from 2025 to 2035, driven by the adoption of customized packaging for consumer goods, healthcare, and premium e-commerce brands. Companies are investing in high-resolution 3D printing systems to produce lightweight, recyclable kits tailored to specific product dimensions. The focus is on reducing packaging waste while enhancing speed-to-market and customer experience through design flexibility and advanced digital prototyping.

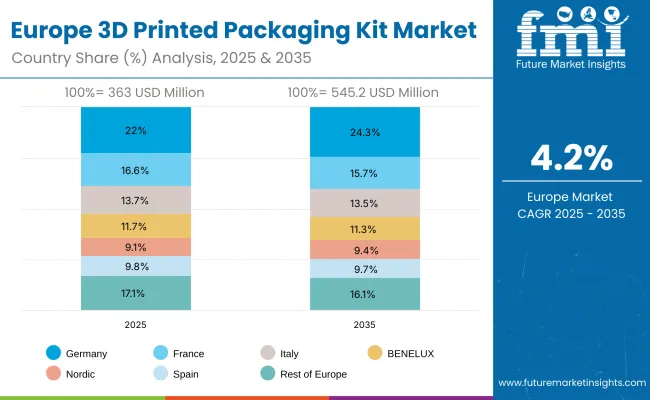

Germany’s market is expected to grow at a CAGR of 3.9%, supported by its strong engineering ecosystem and strict EU packaging sustainability goals. 3D printed kits are being used for premium consumer goods, industrial products, and food packaging requiring precision and durability. Manufacturers are focusing on recyclable materials and automated systems to streamline production. Increasing emphasis on waste reduction and circular economy compliance is shaping innovations in packaging kit designs and reusable components for long-term applications.

The UK market is projected to grow at a CAGR of 3.7%, driven by demand in luxury goods, food packaging, and retail customization. Brands are leveraging 3D printing for personalized packaging formats that align with sustainability commitments. Startups and SMEs are playing a key role by offering flexible, short-run production capabilities. Regulatory pressures around packaging waste are encouraging rapid adoption of bio-based printing materials and reusable designs. Adoption is further enhanced by e-commerce growth and customer personalization demand.

China’s market is forecast to grow at a CAGR of 5.1%, fuelled by rapid digital manufacturing adoption, e-commerce expansion, and government incentives for 3D printing innovation. Packaging companies are increasingly using 3D printing for customized designs, faster prototyping, and localized production. Domestic players are scaling cost-efficient solutions using biodegradable and recyclable materials. Rising consumer demand for premium, eco-conscious packaging is accelerating market growth, particularly in cosmetics, electronics, and specialty food sectors.

India is projected to record the fastest growth at a CAGR of 5.4%, supported by expanding FMCG, pharmaceuticals, and export-focused industries. SMEs are adopting 3D printed packaging kits to cut production costs and improve speed-to-market. Demand is rising for lightweight, customizable designs that enhance product presentation while reducing material waste. Government initiatives in additive manufacturing and sustainability regulations are boosting adoption, making India a hub for both domestic and export-oriented 3D packaging solutions.

Japan’s market is expected to grow at a CAGR of 4.0%, driven by high adoption in electronics, precision equipment, and premium food packaging. Companies are innovating with 3D printed packaging kits that ensure high durability and compactness while reducing excess materials. Minimalist designs aligned with Japan’s cultural aesthetics are becoming prominent. Innovation focuses on eco-friendly polymers and rapid prototyping to align with sustainability standards. Manufacturers emphasize precision and reliability in 3D printing packaging systems for sensitive goods.

South Korea’s market is projected to grow at a CAGR of 3.6%, led by adoption in cosmetics, electronics, and e-commerce sectors. Local companies are exploring innovative designs combining smart technology with sustainable packaging. Demand is rising for personalized, reusable kits aligned with global export standards. With strong connectivity and manufacturing infrastructure, South Korea is focusing on scaling digital packaging solutions that integrate smart tags, traceability, and premium finishing for enhanced consumer engagement.

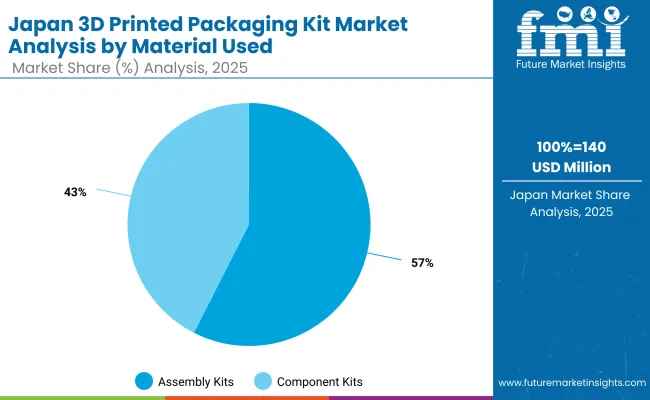

Japan’s 3D printed packaging kit market in 2025 is valued at USD 140 million, with assembly kits taking the lead at 55.8% (USD 78 million). Component kits follow at 44.2% (USD 62 million). Assembly kits dominate due to their efficiency in providing ready-to-use solutions, especially for industries seeking faster prototyping and functional packaging. Component kits remain important for flexibility, customization, and advanced design needs across diverse applications.

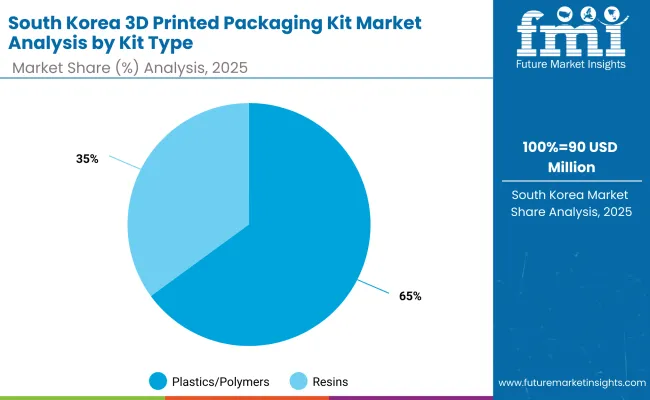

South Korea’s 3D printed packaging kit market, estimated at USD 90 million in 2025, is primarily driven by plastics/polymers holding 65.1% (USD 59 million). Resins capture 34.9% (USD 31 million), while metals, composites, and bioprinting materials show minimal activity. Polymers dominate due to cost-effectiveness, adaptability, and strong mechanical performance in packaging applications. Resins, though smaller, are gaining ground with their role in producing high-precision and specialized packaging solutions.

The 3D printed packaging kit market is moderately fragmented, with additive manufacturing leaders, material innovators, and digital prototyping firms competing across consumer goods, healthcare, and luxury packaging sectors. Global leaders such as Stratasys Ltd., HP Inc., and 3D Systems hold notable market share, driven by advanced polymer printing, high-resolution prototyping, and compliance with packaging safety standards. Their strategies increasingly emphasize mass customization, sustainable material use, and integration with digital design platforms.

Established mid-sized players including EOS GmbH, Carbon, Inc., and Desktop Metal, Inc. are supporting adoption of 3D printed packaging kits featuring lightweight lattice structures, recyclable polymers, and rapid tooling technologies. These companies are especially active in personalized packaging, protective inserts, and high-performance prototypes, offering scalable production, precision detailing, and cost-effective short-run solutions for premium brands.

Specialized providers such as Protolabs, Sculpteo, and Voxeljet AG focus on tailored solutions for regional markets and niche applications. Their strengths lie in on-demand 3D printing services, rapid turnaround, and multi-material integration, enabling brands to experiment with complex geometries, reduce lead times, and adopt eco-friendly innovations in packaging for consumer engagement and supply chain efficiency.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| By Kit Type | Assembly Kits, FDM/FFF Printer Kits, Resin Printer Kits, Metal 3D Printer Kits, Hybrid CNC + 3D Print Kits, Component Kits, Educational Kits, Medical/Anatomical Kits, Industrial Prototyping Kits, Consumer Kits, Repair & Spare-Part Kits |

| By Material Used | Plastics/Polymers, PLA, ABS, PETG, Nylon, Resins, Metals, Composites, Bioprinting Materials |

| By End-Use Industry | Education & Training, Healthcare, Industrial/Professional, Consumer/Hobby |

| Key Companies Profiled | Stratasys Ltd., HP Inc., 3D Systems, EOS GmbH, Carbon, Inc., Desktop Metal, Inc., Protolabs, Sculpteo, Voxeljet AG |

| Additional Attributes | Expanding adoption of educational kits to promote 3D printing literacy, increasing demand for healthcare anatomical models and medical kits, rising preference for FDM/FFF and resin kits among consumers and professionals, hybrid systems integrating CNC and 3D printing gaining traction in industrial prototyping, growing use of sustainable materials like PLA and composites, and rapid development of bioprinting kits for specialized applications in research and personalized healthcare. |

The global 3D printed packaging kit market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the 3D printed packaging kit market is projected to reach USD 2.4 billion by 2035.

The 3D printed packaging kit market is expected to grow at a CAGR of 4.8% between 2025 and 2035.

The key materials used in the 3D printed packaging kit market include plastics/polymers (PLA, ABS, PETG, Nylon), resins, metals, composites, and bioprinting materials.

The plastics/polymers segment is projected to account for the highest share of 62.4% in the 3D printed packaging kit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Display Market Size and Share Forecast Outlook 2025 to 2035

3D Neuroscience Market Size and Share Forecast Outlook 2025 to 2035

3D Glasses Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Automotive Market Size and Share Forecast Outlook 2025 to 2035

3D Printing In Construction Market Size and Share Forecast Outlook 2025 to 2035

3D Laser Scanner Market Growth - Trends & Forecast 2025 to 2035

3D Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

3D Scanning Market Size and Share Forecast Outlook 2025 to 2035

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

3D Reconstruction Technology Market Analysis & Forecast by Component, Type, Enterprise Size, Deployment Model, Application, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA