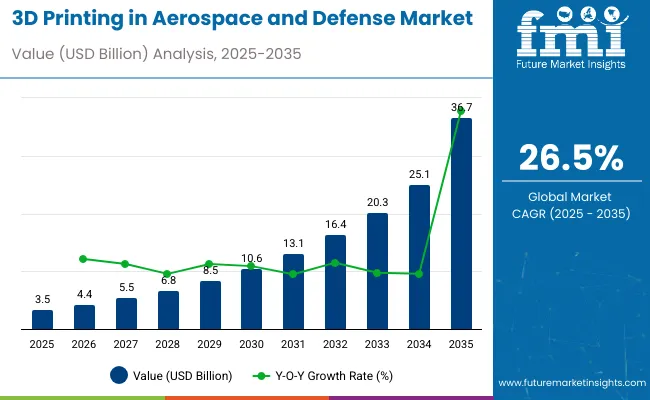

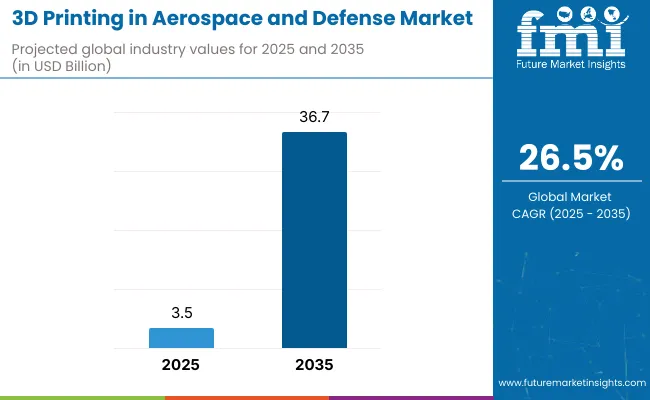

The 3D printing in aerospace and defense market is estimated at USD 3.5 billion in 2025 and is likely to attain approximately USD 36.7 billion by 2035, advancing at a CAGR of 26.5%. The multiplying factor is about 10.5x, indicating that the market size in 2035 will be more than ten times the 2025 base. An assessment of seasonality and cyclicality reveals that the market is not subject to traditional consumer-driven seasonal fluctuations but is instead shaped by defense procurement schedules and aerospace production cycles.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 3.5 billion |

| Market Forecast Value in (2035F) | USD 36.7 billion |

| Forecast CAGR (2025 to 2035) | 26.5% |

In the defense sector, budget allocations and contract approvals often occur in defined intervals, creating cyclical increases in demand for additive manufacturing technologies. Similarly, aerospace production cycles, including the introduction of new aircraft models and periodic fleet maintenance, generate recurring peaks in the utilization of 3D printing for components and parts. These cyclical trends are balanced by continuous adoption for prototyping, tooling, and lightweight structural applications, ensuring a stable foundation of demand. While short-term variations are evident due to industry-specific cycles, the long-term outlook reflects consistent adoption of 3D printing, supported by its advantages in cost efficiency, material savings, and supply chain resilience across aerospace and defense operations.

The 3D printing in aerospace and defense market is supported by multiple parent sectors. Aerospace and defense manufacturing holds about 45%, reflecting heavy adoption for engines, airframes, and mission-critical parts. Advanced materials contribute nearly 25%, supplying high-strength alloys, composites, and polymers tailored for extreme environments. Industrial machinery makes up roughly 15%, covering the printers, lasers, and finishing equipment used in production. Engineering design and simulation software accounts for around 10%, enabling digital twins, CAD, and topology optimization. Maintenance and logistics support contributes close to 5%, where field-based 3D printing enables quick spare-part replacement and reduced downtime.

The 3D printing in aerospace and defense sector is advancing through new technologies, collaborations, and material innovation. Boeing, Airbus, GE Additive, and Lockheed Martin are expanding use of additive manufacturing for lightweight aircraft components and high-performance engine parts. Defense agencies are applying 3D printing for rapid prototyping and field-deployable spare parts. Rocket Lab and other space firms are manufacturing propulsion systems with up to 80 percent 3D-printed content, proving its scalability. High-temperature alloys, carbon fiber composites, and eco-friendly materials are strengthening applications. Strategic partnerships between OEMs, defense contractors, and material suppliers are accelerating certification, scaling production, and improving supply chain resilience.

The 3D printing in aerospace and defense market is advancing with increasing adoption for production of lightweight structural components, engine parts, and tooling. Aircraft and defense programs are shifting from prototype applications to serial production, driven by weight reduction of up to 40% and lead time savings of 60-70%. The technology also reduces material waste, with buy-to-fly ratios improving from 8:1 in conventional machining to nearly 2:1 through additive manufacturing. With aircraft fleets expanding and defense agencies seeking rapid deployment readiness, the demand for additive solutions in titanium, aluminum, and high-performance polymers is strengthening.

Driving Force Efficiency in Design and Production

The adoption of 3D printing in aerospace and defense is driven by its ability to reduce costs, improve efficiency, and enhance reliability. Weight reduction in aircraft components improves fuel efficiency by 1-2% across fleets, delivering lifetime operational savings. Lead times for complex parts shrink from several months to just weeks, supporting faster delivery of aircraft and defense systems. Component consolidation reduces part counts by up to 80%, minimizing joints and improving durability. Tooling made from advanced polymers lowers production cycle time and accelerates final assembly. Combined with digital documentation and repeatable build parameters, these drivers push adoption across both commercial and military segments.

Growth Avenue Expansion of Aftermarket and Repair Solutions

Aftermarket opportunities are expanding as 3D printing supports on-demand spare parts and repair solutions. Aircraft on ground events are costly, and additive manufacturing reduces turnaround time by 25-40%. Repair methods like directed energy deposition extend service life of turbine blades and structural components, reducing replacement expenses. Digital inventories enable localized printing in depots or forward bases, reducing logistics complexity. For defense agencies, field-level printing ensures mission readiness with faster availability of non-critical parts. The ability to qualify multiple machines under a single process standard accelerates adoption, enabling consistent builds across different regions. This creates strong growth potential in the aftermarket and repair ecosystem.

Emerging Trend Industrialization and Process Monitoring

Industrialization of additive manufacturing is increasing, supported by larger build platforms, multi-laser systems, and automated post-processing. Build speeds are improving by 200-300% compared with earlier systems, reducing cost per part. Monitoring technologies such as melt pool analysis and acoustic sensors detect defects in real time, raising process reliability. Powder recycling cycles extend usability up to five times, lowering material costs. Adoption of high-performance polymers like PEEK and PEKK is also increasing, particularly for cabin components and defense applications. With digital twins and closed-loop monitoring, qualification is shifting from individual part certification toward process-based approval, allowing faster scalability across programs.

Market Challenge Cost, Certification, and Skill Gap

High costs of machines, materials, and certification remain major restraints. Aerospace-grade metal powders such as titanium alloys cost USD 200-400 per kg, while post-processing can account for up to 50% of total part cost. Printers designed for aerospace applications require investments between USD 1 million and 2.5 million per unit. Certification processes demand extensive testing, documentation, and qualification, which prolong adoption timelines. Limited availability of skilled technicians and engineers with expertise in additive processes slows capacity expansion. Additionally, ensuring consistency across multiple production sites is complex, creating challenges in scaling. These factors limit the pace of adoption despite strong demand.

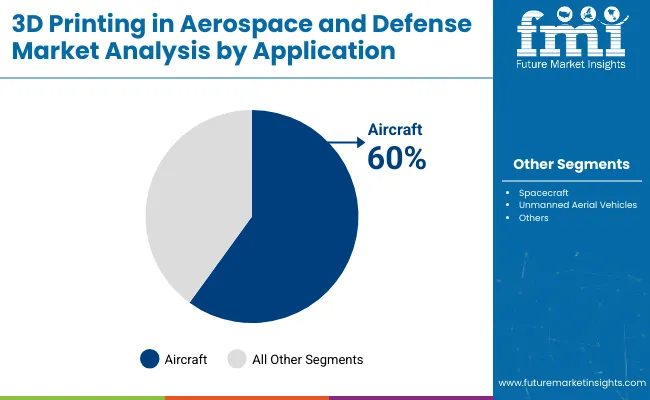

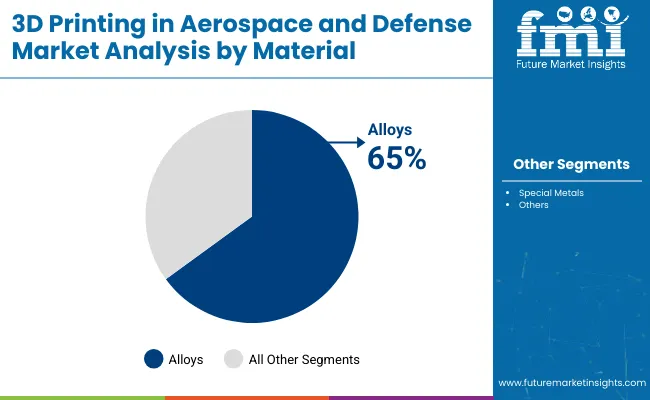

Aircraft dominate applications with 60% share, supported by lighter titanium components and production waste savings of up to 90%. Spacecraft follow at 25%, where weight savings cut launch costs by thousands per kilogram and accelerate satellite deployment. Alloys lead the material mix with 65% share, driven by titanium and aluminum, projected to support 42,000 aircraft deliveries by 2040. Special metals hold 35%, where nickel superalloys withstand over 1,300°C for propulsion systems. These segments drive performance, cost efficiency, and faster adoption of additive manufacturing technologies.

Aircraft dominate 3D printing in aerospace and defense with 60% share, largely due to demand for lighter, fuel-efficient designs. Printed titanium and aluminum parts deliver weight savings of up to 30%, translating into significant fuel cost reductions across aircraft lifecycles. The technology reduces scrap rates by as much as 90%, a critical benefit in high-cost aerospace materials. Airbus uses over 1,000 printed parts in its A350 aircraft, while Boeing integrates printed brackets and ducts. The International Air Transport Association projects global air traffic to double by 2040, pushing fleet expansion. Additive manufacturing meets this demand by enabling shorter lead times, improved part customization, and lower maintenance costs. This makes aircraft applications the largest and fastest-adopting category.

Alloys represent 65% of the material demand, primarily titanium and aluminum alloys. Titanium alloys are 40% lighter than steel and deliver high strength-to-weight ratios, ideal for aircraft frames and engine components. Aluminum alloys offer corrosion resistance and cost advantages, widely used in structural and cabin elements. Over 80% of metallic additive materials in aerospace consist of alloys, underlining their dominance. Boeing relies on titanium alloys for its Dreamliner series, while Airbus applies aluminum-based parts in its A320 line. Aircraft deliveries are projected to surpass 42,000 units by 2040, driving consistent demand for alloys. Lightweight alloy adoption supports both fuel efficiency and emission reduction goals, reinforcing their leading role in aerospace 3D printing.

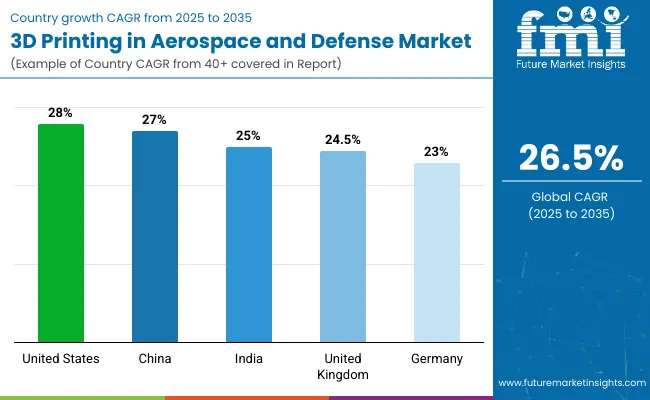

The global 3D printing in aerospace and defense market is growing at a CAGR of 26.5% from 2025 to 2035. The United States leads at 28%, +6% above the global benchmark, supported by OECD-driven defense modernization and advanced additive manufacturing adoption. China follows at 27%, +2% above the global rate, fueled by BRICS investments in aerospace capacity and technology integration. India records 25%, −6% compared with the global average, reflecting BRICS and ASEAN-linked initiatives in aircraft component manufacturing. The United Kingdom posts 24.5%, −8% below the global CAGR, backed by OECD-supported innovation in defense production. Germany stands at 23%, −13% below the global rate, influenced by gradual adoption through OECD-backed aerospace digitization. The overall trend shows OECD economies, led by the United States, advancing with strong technological capabilities, while BRICS members such as China and India continue strengthening their presence in the global aerospace supply chain.

The United States market is projected to grow at a CAGR of 28%, slightly above the global 26.5%. Strong demand comes from defense programs and NASA-backed projects focusing on lightweight structures and fuel-efficient designs. By 2030, the US is expected to account for nearly USD 7 billion of global revenue, with 40% of total military-grade 3D printed parts produced domestically. Advanced composite material usage is growing faster than global averages, reflecting innovation in high-strength polymers and titanium-based printing.

The United Kingdom is growing at a CAGR of 24.5%, below the global 26.5%. Growth is steady but tempered by smaller defense budgets compared with the US and China. By 2030, the UK market size is expected to reach USD 1.5 billion. Investments are directed toward commercial aviation parts, satellite components, and maintenance applications. More than 60% of new 3D printing projects are aimed at reducing turnaround time for replacement parts. The slightly lower CAGR reflects slower funding pace, although adoption in civil aerospace remains strong.

Germany is expanding at a CAGR of 23%, 3.5% below the global 26.5%. By 2030, the German market is projected to reach USD 2 billion. Growth is fueled by adoption in Airbus programs and strong R&D investment in metal powders and high-strength polymers. However, slower CAGR reflects Germany’s focus on gradual scaling and cost optimization rather than rapid deployment. Defense-related 3D printing programs are advancing at 18% annually, while aerospace manufacturing adoption in civil aviation is expanding at 20%.

China is projected to grow at a CAGR of 27%, slightly above the global 26.5%. By 2030, China is expected to capture USD 4 billion in market size. High investment in military aircraft and satellite programs supports rapid adoption. More than 65% of domestic aerospace suppliers are expected to integrate additive manufacturing by 2028. The higher CAGR reflects both strong government funding and the drive to achieve independence in critical aerospace technologies.

India is expanding at a CAGR of 25%, slightly below the global 26.5%. The market is projected to reach USD 1.8 billion by 2030. Adoption is focused on defense aircraft programs, missile components, and space applications. ISRO-led initiatives are expected to account for 35% of total additive manufacturing applications in aerospace by 2030. While the CAGR trails global averages, government-driven defense procurement and private partnerships are accelerating adoption.

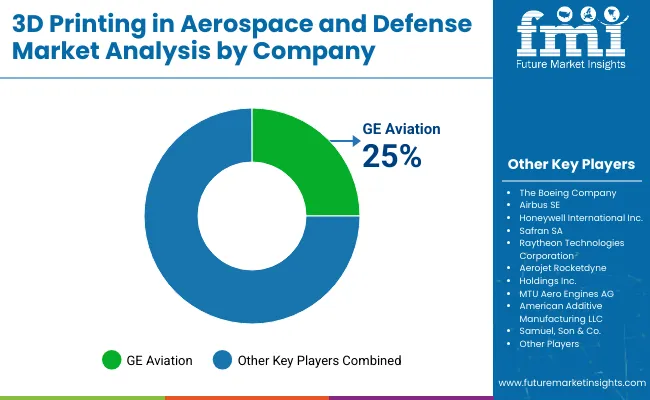

Industry leader - GE Aviation - 25%

The aerospace and defense industry is witnessing steady adoption of 3D printing, with established manufacturers expanding their capabilities to enhance production efficiency and material performance. GE Aviation leads the way by investing in large-scale additive manufacturing facilities, producing advanced fuel nozzles and turbine parts. The Boeing Company applies 3D printing for lightweight structural elements, cabin components, and defense systems, often partnering with suppliers to streamline large-batch production. Airbus SE integrates additive processes into multiple aircraft programs, especially for structural and interior parts. Honeywell International Inc. leverages additive manufacturing for engines and aerospace systems, while Safran SA uses it to refine jet engine components.

Other players are strengthening their positions through research, product launches, and collaborative projects. Aerojet Rocketdyne Holdings Inc. applies 3D printing to propulsion systems, cutting down development time for rocket engines. MTU Aero Engines AG has successfully introduced printed parts in turbine production. Raytheon Technologies Corporation uses additive techniques for missile and radar system components. Meanwhile, American Additive Manufacturing LLC and Samuel, Son & Co. provide specialized contract manufacturing to support larger industry players. These strategies, combining targeted R&D and component-level innovations, are shaping the role of 3D printing in aerospace and defense manufacturing.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.5 billion |

| Projected Market Size (2035) | USD 36.7 billion |

| CAGR (2025 to 2035) | 26.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Application Segments Analyzed | Aircraft, Unmanned Aerial Vehicles, Spacecraft |

| Material Segments Analyzed | Alloys, Special Metals |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa, others |

| Key Players | GE Aviation, The Boeing Company, Airbus SE, Honeywell International Inc., Safran SA, Raytheon Technologies Corporation, Aerojet Rocketdyne Holdings Inc., MTU Aero Engines AG, American Additive Manufacturing LLC, Samuel Son & Co. |

| Additional Attributes | Dollar sales by printing technology and material type, demand dynamics across aircraft, defense, and space applications, regional adoption trends across North America, Europe, and Asia-Pacific, innovation in metal additive manufacturing, lightweight structures, and rapid prototyping, environmental impact of reduced material waste, emerging use cases in spare part production, satellite hardware, UAV development |

The market is expected to reach nearly USD 36.7 billion by 2035.

The market is growing at a CAGR of 26.5% during this period.

Aircraft dominates with 60% market share in 2025.

Alloys hold the largest share with 65% in 2025.

GE Aviation leads with 25% industry share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D Display Market Size and Share Forecast Outlook 2025 to 2035

3D Neuroscience Market Size and Share Forecast Outlook 2025 to 2035

3D Glasses Market Size and Share Forecast Outlook 2025 to 2035

3D Laser Scanner Market Growth - Trends & Forecast 2025 to 2035

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

3D Reconstruction Technology Market Analysis & Forecast by Component, Type, Enterprise Size, Deployment Model, Application, and Region Through 2035

3D Cell Culture Market - Demand, Size & Industry Trends 2025 to 2035

3D Motion Capture Market by System, Component, Application & Region Forecast till 2035

3D TSV Packages Market Analysis by Process Realization, Application, End Users, and Region through 2035

3D Metrology Market Insights – Growth & Industry Outlook 2025 to 2035

3D Camera Market Growth – Trends & Forecast 2025 to 2035

3D Secure Payment Authentication Market Insights by Components, Application, and Region - 2025 to 2035

3D Mobile Theater Market Demand & Trends 2024 to 2034

3D ICs Market

3D Display Module Market

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA