About The Report

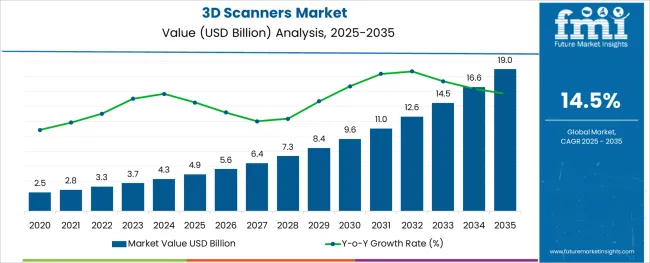

The 3D Scanners Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 19.0 billion by 2035, registering a compound annual growth rate (CAGR) of 14.5% over the forecast period.

The 3D scanners market is witnessing accelerating growth driven by widespread adoption across industries such as aerospace, automotive, healthcare, architecture, and cultural preservation. Increasing precision requirements in manufacturing workflows and quality control systems have elevated the role of 3D scanning hardware in digital transformation initiatives.

Investments in advanced metrology systems and industrial automation are enabling greater reliance on 3D capture technologies for prototyping, reverse engineering, and real-time inspection. Additionally, expanding applications in medical imaging, augmented reality, and digital modeling are reinforcing demand across both professional and consumer domains.

Innovation in laser, structured light, and photogrammetry-based scanning methods is enhancing accuracy and speed, while software-hardware integration is improving usability and data processing capabilities. Continued progress in portability, range, and scanning resolution is expected to unlock new use cases, especially with the growth of Industry 4.0, smart factories, and digital twin technologies.

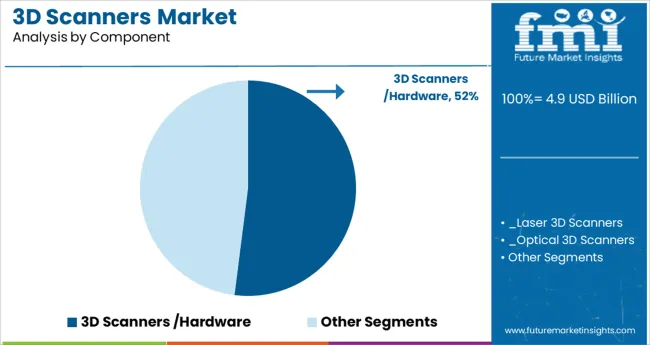

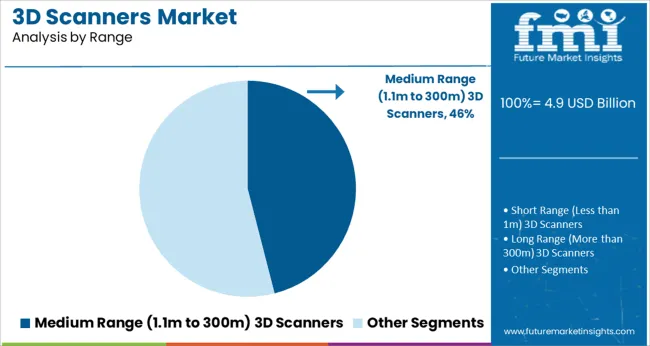

The market is segmented by Component, Type, Range, and End User and region. By Component, the market is divided into 3D Scanners /Hardware, 3D Scanning Software, and Services. In terms of Type, the market is classified into Portable/Handheld 3D Scanners, Desktop-based 3D Scanners, Fixed-mount 3D Scanners, and Robot-mount 3D Scanners. Based on Range, the market is segmented into Medium Range (1.1m to 300m) 3D Scanners, Short Range (Less than 1m) 3D Scanners, and Long Range (More than 300m) 3D Scanners. By End User, the market is divided into Automotive, Aerospace & Defense, Civil and Architecture, Healthcare, Education, Manufacturing, Media & Entertainment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, which includes the 3D scanners themselves, is expected to contribute 52.0% of the total market revenue by 2025, making it the dominant component. This leadership is being reinforced by increased capital expenditure on high-precision scanning devices by industrial manufacturers and engineering firms.

Hardware advancements have significantly enhanced device durability, scan resolution, and compatibility with downstream CAD and PLM systems. As organizations seek to streamline inspection, quality control, and dimensional analysis, hardware upgrades remain a strategic priority.

Furthermore, the integration of AI-enabled processors within the scanning hardware is enabling real-time feedback and intelligent data filtering. Continued miniaturization and ruggedization of devices are further expanding deployment across field environments.

Portable and handheld 3D scanners are anticipated to hold 39.0% of the market share in 2025, establishing themselves as the leading type within the segment. This growth is being driven by the increasing demand for on-site, flexible scanning solutions across industries like automotive repair, heritage conservation, and construction.

The segment’s advantage lies in its mobility, ease of use, and capability to capture detailed geometry of objects without the need for fixed setups. These devices have become increasingly accurate and ergonomic, allowing operators to perform quick and precise scans in tight or remote spaces.

Portability also reduces operational downtime and increases field application versatility, making handheld scanners a preferred choice for tasks requiring rapid diagnostics and real-time modeling.

Medium range 3D scanners, covering distances from 1.1 meters to 300 meters, are forecast to account for 46.0% of the total market by 2025, securing their position as the top range category. This segment’s dominance is underpinned by its optimal balance between scanning depth and accuracy, allowing it to serve a wide array of use cases-from industrial site mapping to building information modeling (BIM) and infrastructure assessment.

Medium range scanners offer enhanced versatility for both indoor and outdoor environments, combining portability with long-range precision. Their deployment is especially prevalent in industries requiring structural surveys, equipment analysis, and spatial documentation at scale.

The ability to capture mid-distance data with high fidelity has reinforced the segment’s appeal among surveyors, engineers, and facility managers seeking reliable 3D datasets.

Applications, such as reverse engineering of objects to produce CAD data, volume measurement of engineering parts, motion and environment capture for augmented reality games, body measurements for fashion retailing, automated optical inspection in high-speed manufacturing lines, and obstacle detection systems on unmanned aircraft, have been actively deploying structured light scanners.

By offering capabilities, such as fast and no setup time, handheld 3D scanners conveniently integrate the same. Thus, multiple handheld 3D scanners for 3D printing have been deploying structured light technology. The technology uses trigonometric triangulation by projecting a pattern of light onto the object to scan.

In December 2020, Polyga Inc., a Canadian developer of 3D scanning and mesh processing technologies, announced the launch of the HDI Compact S1 entry-level professional 3D scanner at Formnext. The exact pricing has been kept at USD 5,999 to cater to applications, such as 3D printing, reverse engineering (Scan to CAD), and scientific research, along with an essential quality inspection.

3D scanner sales accounted for 55% share of the global scanning devices market in 2024.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 14.0% |

| H1,2025 Projected (P) | 14.2% |

| H1,2025 Outlook (O) | 14.5% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (+) 31 ↑ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (+) 54 ↑ |

Future Market Insights predict a comparison and review analysis for the dynamics of the 3D scanners market, which is predominantly subjected to an array of industry factors along with a few certain influences concerning the growth of the market.

According to FMI analysis, the variation between the BPS values observed in the 3D scanners market in H1, 2025 - Outlook over H1, 2025 Projected reflects a spike of 31 units. 3D scanning has become one of the significant tool in product lifecycle management (PLM) process. At every stage of the PLM process which include concept, design, manufacturing and servicing stage the 3D scanning is used.

In the gaming industry, 3D scanning have completely revolutionized the way company design, model and envision the real environment. Thus, increase in the use of 3D scanning is one of the main reasons for this change in growth rate.

Moreover, compared to H1, 2024, the market is expected to spike by 54 BPS in H1 -2025. The growing awareness of the advanced medical treatments which involves 3D scanners is also responsible for this change in growth rate. Advancement in the scanning process have improved and simplified the measuring and documenting process in various verticals from manufacturing to healthcare.

“Increasing Technological Advancements in 3D Scanning Technology”

From 2020 to 2024, global sales of 3D scanners surged at a CAGR of around 13.3%

3D scanning is a method of capturing an object's three-dimensional properties as well as data such as color and texture. This technology aids in the reduction of time, cost, and effort in the production process while improving the output quality. It supports the clear visualization of a component as well as the accurate visualization of the particle.

Numerous technologically-advanced imaging applications are being introduced in the market. To support printing applications and imaging, 3D scanners are an important part of the overall value chain.

3D scanning is excessively used in healthcare applications and is increasingly being adopted in the media and entertainment industry. In addition, technological advancements have helped end users perform in-depth scanning across various industry verticals with such technologies.

Sales of 3D scanners are expected to reach USD 4.9 Bn by registering a CAGR of 14.5% over the forecast period (2025-2035).

“Evolution of New 3D Scanner Software & Services”

Improved hardware performance along with better Internet connectivity has allowed increased user access to advanced tools from remote locations, particularly hospitals/clinics or research institute departments.

Advanced 3D scanner software is moving towards more specialized applications requiring unique post-processing. This includes apps for chronic obstructive pulmonary disease, surgical planning, oncology management, radiation treatment, and liver analysis.

Customers of advanced 3D scanner software and services now use cloud-computing-based services to host these various applications over the web. Therefore, technological advancements are likely to offer significant opportunities in the 3D scanners market in the near future.

3D metrology software has been making gradual progress, as manufacturing is a crucial aspect of several sectors such as automotive and healthcare, and requires quality assurance, although it accents high infrastructure expense. In addition, the technology finds extensive usage in industries - media & entertainment, aerospace & defense, healthcare, oil & gas, energy, automotive, and manufacturing.

Major providers of 3D scanning equipment, such as FARO and Hexagon, have introduced new 3D scanners with automation, high speed, and user-friendly features to gain a major share of the market over the coming years. Thus, the introduction of advanced technologies and the industry 4.0 revolution are significant factors driving growth of the market for 3D scanning products.

“High Initial Cost Associated with 3D Scanning Solutions to Hinder Adoption”

One of the primary challenges that could slow demand growth of the 3D scanning solutions market is that the innovation is still in its early stages of commercial acceptance around the world. High costs of 3D scanners have been a great obstacle to their widespread adoption.

Furthermore, the 3D scanning devices market is constrained by fierce competition among existing 3D orthopedic scanner system makers, advancement of alternate scanning technologies, and product defects.

“Rising R&D Investments for Development of 3D Scanning Technology Driving North America Market”

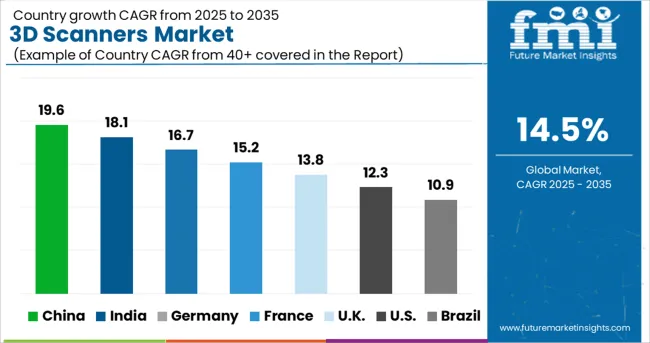

North America continues to capture a leading tranche of the total 3D scanners market size. Upswing in R&D expenditure in tandem with at-scale deployment of 3D scanning technology in the automotive sector and environmental scanning and modeling operations are driving the regional market growth.

Growing demand for handheld scanning devices and companies' increasing attention on 3D scanning technology and 3D machine vision are also contributing to the market growth of 3D scanning solutions in North America.

“Rising Popularity of Animation and Entertainment Industry to Boost Sales of Optical 3D Scanners”

The USA 3D scanners market is being driven by end-user sectors such as aviation, military, healthcare, and media. Furthermore, animation film production in the United States has increased as production firms have demonstrated an increasing interest in investing in animation films.

Furthermore, businesses in the USAare spending on optical 3D scanners since they reduce time and enhance product manufacturing rates.

“Automation and Infrastructure Sectors Creating Opportunities for Laser 3D Scanners”

The 3D scanning equipment market in China will experience demand growth from several use cases such as reverse engineering, civil surveying, architecture, and urban topography.

Rapidly growing automation and infrastructure industries are driving up the need for laser 3D scanners. China is the world's largest automobile manufacturer, with a lion's share of the global automotive market.

Due to manufacturing disruptions, rising research and development efforts, and increased regulatory support from government bodies, the 3D scanning products market in China is expected to grow at the fastest rate during the forecast period.

“Portable/Handheld 3D Scanners are Most Preferred Owing to Their Flexibility”

Portable/handheld 3D scanners are expected to account 37% share of the 3D scanners market in 2025. Demand for portable/handheld 3D scanners is likely to increase as these scanners enable in reaching difficult-to-reach locations.

In comparison to fixed 3D scanners, these scanners are more versatile and flexible. These scanners can take three-dimensional images of things of varied sizes. Handheld scanners can catch items of varying sizes, ranging from little objects to vehicles.

Moreover, portable/handheld 3D scanners are used to capture the interiors of damaged automobiles, enabling for the recording, measurement, and analysis of internal defects. Handheld 3D scanners check all boxes in terms of safety, speed, and adaptability, allowing for complete obstacle detection while also reducing traffic flow impact.

“Implementation of Advanced 3D Scanners in Healthcare Industry Enabling Professionals to Precisely Measure Patients’ Anatomy”

3D scanners have been triggering step-change transformations in the healthcare sector, owing to increasing scope of applications. They help healthcare organizations upgrade their existing processes accurately and effectively.

Integration of advanced 3D scanners and mixed reality (MR) in healthcare spaces incorporates real-time interactive imaging for aiding medical students and professionals in their medical practice.

Moreover, because advanced 3D scanners enable medical experts to analyze body parts in depth before surgical treatment, the healthcare industry is predicted to have the highest CAGR over the coming years.

Leading players in the 3D scanners market are distributing their products majorly via direct sales channels. Moreover, they are leveraging value added resellers (VAR), original equipment manufacturers (OEMs), and system integrators to market their product offerings.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value in USD Million, Volume in Units |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Mexico, Argentina, Germany, Italy, France, UK, Nordic, Spain, Japan, China, India, Malaysia, Thailand, Australia, GCC Countries, South Africa, Turkey |

| Key Market Segments Covered | Component, Type, Range, End User, Region |

| Key Companies Profiled |

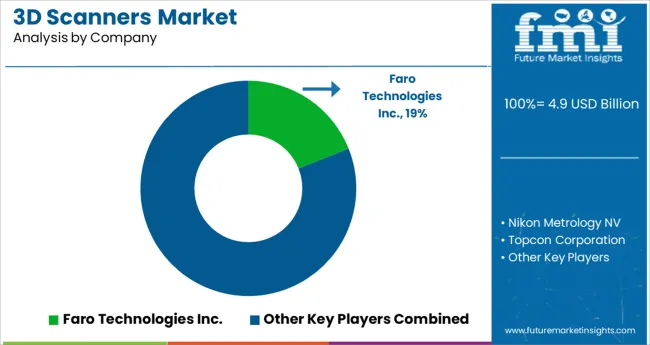

Hexagon AB; Faro Technologies Inc.; Nikon Metrology NV; Topcon Corporation; Trimble Inc.; Creaform, Inc.; Perceptron Inc.; GOM MBH; Konica Minolta; Maptek Pty Ltd |

| Pricing | Available upon Request |

The global 3d scanners market is estimated to be valued at USD 4.9 billion in 2025.

It is projected to reach USD 19.0 billion by 2035.

The market is expected to grow at a 14.5% CAGR between 2025 and 2035.

The key product types are 3d scanners /hardware, _laser 3d scanners, _optical 3d scanners, _structured-light 3d scanners, 3d scanning software, services, _3d design & modelling, _integration & deployment, _consulting and _support & maintenance.

portable/handheld 3d scanners segment is expected to dominate with a 39.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The 3D Printing in Aerospace and Defense Market is segmented by Application (Aircraft, Unmanned Aerial Vehicles, and Spacecraft), Material (Alloys and Special Metals), and Region. Forecast for 2026 to 2036.

3D Printed Medical Devices Market is segmented by drug type, treatment and distribution channel from 2026 to 2036

3D Printed Drugs Market Outlook - Growth, Demand & Forecast 2026-2036

3D Printed Surgical Models Market Analysis - Size, Share, and Forecast 2026 to 2036

3D Camera Market Size and Share Forecast Outlook 2026 to 2036

3D Cell Culture Plasticware Market Size and Share Forecast Outlook 2026 to 2036

3D Printed Aerospace Fasteners Market Size and Share Forecast Outlook 2026 to 2036

3D Ground Penetrating Radar Market Size and Share Forecast Outlook 2026 to 2036

3D Printed Drones Market Size and Share Forecast Outlook 2026 to 2036

3D-Printed Implant Polypropylenes Market Size and Share Forecast Outlook 2026 to 2036

3D Printed Sleep Apnea Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Somatosensory Virtual Fitting Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.