The 3D printing photopolymers industry is valued at USD 1.31 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 18.3% and reach USD 7.06 billion by 2035.

In 2024, the 3D Printing Photopolymers or polymer-based printing resin industry expanded significantly, as a result of increasing use in several prescribed fields like the medical, automotive, and aerospace industries, according to FMI research.

The development of high-performance polymers and bio-compatible resins led to even wider applications, especially in the field of dental prosthetics and personalized implants. The auto sector adopted them for rapid prototyping and lightweight parts, increasing output in production.

FMI predicts that 2025 will see a growth in material innovation, with producers relying on sustainable, high-strength resins. Investments in R&D reduce production costs and enhance polymer durability. Moving forward, the leap from prototyping to production will become more real, establishing photopolymers as indispensable for industrial 3D printing applications.

By 2035, however, multi-material printing, resin recycling, and related advancements will revolutionize the industry and will make it even more relevant in future manufacturing.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.31 billion |

| Industry Value (2035F) | USD 7.06 billion |

| CAGR (2025 to 2035) | 18.3% |

As per our analysis, companies prioritizing sustainable and durable materials will gain a competitive edge, while traditional manufacturers relying on conventional moulding techniques will be severely affected.

As photopolymers transition from prototyping to large-scale production, firms that capitalize on additive manufacturing see savings that allow the creation of previously undreamt designs.

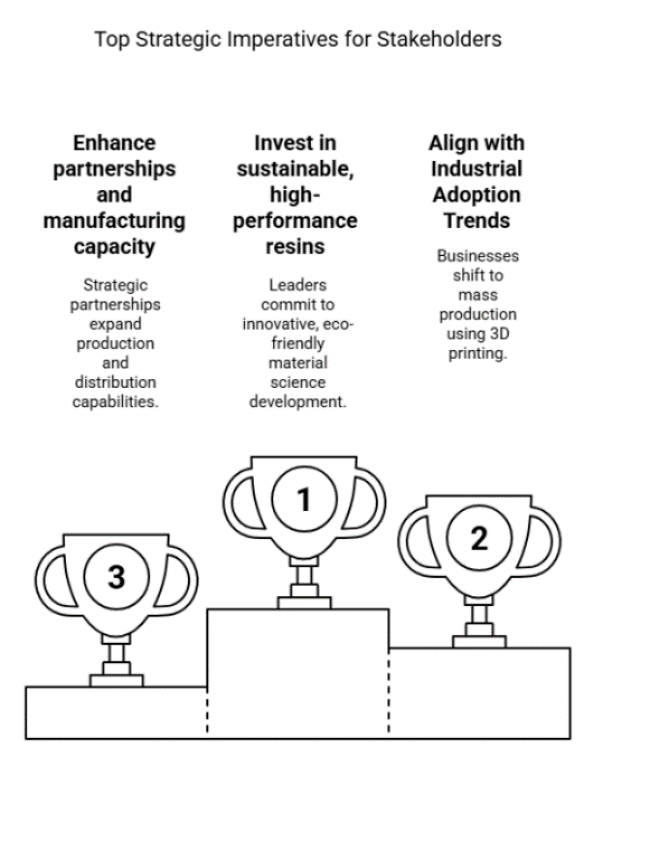

Invest in sustainable, high-performance resins

Leaders need to commit to research and development of biocompatible, high-strength, and recyclable photopolymers in order to keep up with changing industry needs and environmental goals. Leaders in the industry will be those who invest in innovative material science versus players who lag behind.

Align with Industrial Adoption Trends

Businesses must transition from product prototyping to mass production, leveraging the power of 3D printing in production for final use.

Automation, digital processes, and on-demand production are among the features that will provide the most value to companies, as per FMI.

Enhance partnerships and manufacturing capacity

Strategic partnerships with OEMs, material suppliers, and 3D printing services will play a vital role in ensuring industry penetration. Firms that are likely to stand out include players who are expanding production capacity along with the acquisition of global distribution channels (as per FMI research).

| Risk | Probability / Impact |

|---|---|

| Supply Chain Disruptions in Raw Materials | High Probability / High Impact |

| Regulatory and Environmental Compliance | Medium Probability / High Impact |

| Competition from Emerging Additive Technologies | High Probability / Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Material Innovation for High-Performance Resins | Accelerate R&D on bio-compatible and recyclable photopolymers |

| Scaling Industrial Adoption | Establish OEM partnerships to integrate 3D printing in end-use production |

| Global Supply Chain Resilience | Diversify raw material sourcing and secure alternative suppliers |

To stay ahead, companies need to drive R&D in high-performance polymers at a faster rate, increase the production capacity, and secure differentiated raw material supplies to reduce the risk.

The polymer-based printing resin industry is shifting from prototyping to mass production, leading to a growing demand for investments in future materials, industrial integration, and supply chain resilience.

The FMI study found that companies that focus on sustainable resins and establish strategic OEM collaborations will be first movers. To stay ahead of the competition in the long term, this insight shows how important it is to connect roadmaps with automation, digital manufacturing, and next-generation photopolymers.

79% of industry players surveyed by FMI said that new material innovation was key to driving growth. This is because performance, biocompatibility, and recycling of photopolymers are the most important things. 68% of respondents highlighted cost reduction in resin manufacturing as a significant factor, especially for industrial applications requiring large-scale use.

Regional Variance

According to FMI, the next decade will be driven by advancements in multi-material and smart resins.

Diverging ROI Perspectives Across Industry Players

According to FMI analysis, 74 percent of large-scale producers believed automation and high-performance materials were worth the cost. However, high equipment and material costs have hindered adoption, with 43% of small and mid-sized firms (SMEs) citing cost concerns.

Conclusion: The demand for hybrid photopolymers with strengthened mechanical features has increased across all sectors.

Manufacturers

Distributors

Alignment Across Regions

71% of global manufacturers plan to invest more in R&D within photopolymer chemistry, particularly around durability and recyclability.

Regional Divergence

Regulatory Impact

Bottom line: Demand is booming around the world for powerful green photopolymers.

Key Variances

Strategic Insight

There is no universally applicable solution. There is no one-size-fits-all solution. Companies must tailor photopolymer solutions regionally-focusing on high-strength resins in North America, bio-based materials in Europe, and cost-effective alternatives in Asia-Pacific-to drive competitive growth in the global polymer-based printing resin industry, according to FMI.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The FDA (Food and Drug Administration) oversees 3D-printed medical devices and photopolymer biocompatible materials. ASTM F2915-12 establishes material performance requirements. The EPA (Environmental Protection Agency) regulates UV-curable resin emissions. |

| United Kingdom | The UKCA (UK Conformity Assessed) Mark replaces the EU CE mark after Brexit, impacting photopolymer certification in industrial and medical uses. The Health and Safety Executive (HSE) implements VOC (volatile organic compound) emissions controls during photopolymer manufacturing. |

| France | The Agence Nationale de Sécurité du Médicament (ANSM) is responsible for governing photopolymers in medicine. France practices strict REACH (registration, evaluation, authorization, and restriction of chemicals) control over photopolymer formulations on imported materials as well. |

| Germany | It is obligatory for medical-grade photopolymers to have DIN EN ISO 10993 certification. The German Federal Environment Agency implements sustainability mandates, promoting the use of bio-sourced or recoverable resins. CE labe l ling is obligatory in the case of photopolymers for industry applications. |

| Italy | Medical and dental photopolymers should meet ISO 13485 standards for quality. The Italian Ministry of Health must rigorously validate photopolymer-based medical devices before approving their use with patients. |

| South Korea | The Korea Environmental Industry & Technology Institute (KEITI) regulates environmentally friendly standards, tending toward recyclable and low-VOC photopolymers. The Ministry of Food and Drug Safety (MFDS) regulates photopolymers used in medical contexts in accordance with ISO 10993. |

| Japan | The Pharmaceutical and Medical Device Act (PMDA) controls photopolymers in medical devices. The Japanese Industrial Standards (JIS K 5600-1) provide safety and performance standards for industrial photopolymers. |

| China | The China National Medical Products Administration (NMPA) requires safety testing of photopolymers in healthcare. GB/T 39560 to 2020 standards control 3D printing materials for industrial and consumer use. The MIIT (Ministry of Industry and Information Technology) promotes domestic photopolymer development to reduce import reliance. |

| Australia-NZ | The Therapeutic Goods Administration (TGA) regulates biocompatible photopolymers in medicine. The Australian Competition & Consumer Commission (ACCC) regulates product safety standards, impacting photopolymer imports. The Environmental Protection Authority of New Zealand (EPA NZ) regulates harmful chemical content in photopolymers. |

| India | The Bureau of Indian Standards (BIS) is developing photopolymer performance and safety guidelines. The Central Pollution Control Board (CPCB) regulates environmental laws related to photopolymer disposal waste. CDSCO (Central Drugs Standard Control Organization) regulates medical uses of 3D printing resins. |

Polymers remain the dominant material in 3D printing due to their adaptability in medical, dental, and industrial applications.

The polymer segment is likely to expand at a CAGR of 18.7% during 2025 to 2035, facilitated by developments in bio-based and high-strength formulations.

Oligomers account for a significant portion of the industry, particularly in biocompatible photopolymers used for surgical models and implants due to their strength and rapid curing properties. Oligomers led the global industry with a value share of around 44.1%.

Additives like photo-initiators and stabilizers are gaining prominence, as producers attempt to enhance resin shelf life, mechanical properties, and heat stability. As regulatory bodies like the FDA and EU MDR impose stricter standards on implantable materials, demand is rising for biocompatible, BPA-free photopolymers with improved sustainability profiles. This necessitates the development of special additive formulations for the next generation of medical applications.

Surgical models primarily utilize 3D printing photopolymers. Hospitals and research centers are making high-accuracy, patient-specific copies of anatomy to help with planning surgeries and teaching doctors.

The surgical models segment is projected to grow at a CAGR of 18.5% from 2025 to 2035, driven by increasing adoption in complex neurosurgical, orthopaedic, and oncological procedures. The implants segment by application holds an industry share of 48.2% during the forecast period.

Wearable biosensors represent a rapidly growing category. They use flexible photopolymers to make designs that are light and conformal so that they can monitor your health in real time.

The implant sector, encompassing dental and orthopaedic applications, is set for rapid expansion as resin-based 3D printing advances toward regulatory approval for bioresorbable implants.

Tailored prosthetics and exoskeletons are also gaining traction, backed by cost-effective, high-strength photopolymers customized for lightweight, long-lasting assistive devices.

Hearing aids are still widely used, with UV-curable resins offering clear sound, detailed design, and durability, which suggests that the industry will keep growing.

Forecasts indicate a CAGR of 19.2% for the 3D Printing Photopolymers industry in the United States between 2025 and 2035. Unrelenting demand from the aerospace, automotive, and healthcare sectors continues to drive development in high-performance resins.

The USA dominates the North American region with a total industry share of 95.2%. The FDA's strict regulatory controls on 3D-printed medical devices are driving businesses toward biocompatible and sterilizable photopolymers.

The presence of industry giants, substantial R&D investments, and a strong 3D printing ecosystem drive continuous growth.

Still, it might be hard to get specialty photopolymer raw materials in the future, and the environment may put more stress on resins that can't be recycled.

In the United Kingdom, the 3D Printing Photopolymers industry is projected to grow at a CAGR of 17.5% from 2025 to 2035. Post-Brexit trade realignment and UKCA certification obligations have redefined industry dynamics, where manufacturers emphasize local production to minimize dependence on imports from the EU.

The United Kingdom holds an industry share of 14.8% in the European market. Sustainability is a strong impetus as firms transition toward bio-based and recyclable resins to meet government-sponsored environmental regulations.

Industrial take-up is increasing in aerospace, defense, and automotive applications but may be held back by a higher price for specialty photopolymers and a reduced manufacturing base than in Germany and the US.

From 2025 to 2035, projections indicate a CAGR of 16.8% for the 3D Printing Photopolymers industry in France. Stringent REACH compliance and carbon neutrality policies fuel the industry, necessitating sustainable resin formulations.

Photopolymers are growing quickly in medical uses because they can be used to make personalized implants and dental prosthetics, according to ANSM rules.

The automotive industry is also investing in UV-stable and high-temperature-resistant resins for use in vehicle parts. Apart from these, high costs of production and regulatory burdens for imported photopolymers are issues for mass industrial use.

From 2025 to 2035, projections indicate a CAGR of 18.1% for Germany's 3D Printing Photopolymers industry. Germany is the frontrunner in EU sustainability initiatives, prioritizing recyclable and biobased photopolymers for industry use.

DIN EN ISO 10993 certification is required in medical-grade resins, further enhancing Germany's lead in 3D-printed healthcare solutions.

The automotive and aerospace industries are important adopters, with companies including multi-material 3D printing for high-strength, lightweight components.

The rigor of CE certification and competition from cheaper alternatives in Eastern Europe and Asia could dampen the rate of industry penetration.

The projections indicate a CAGR of 15.9% for the 3D Printing Photopolymers industry in Italy between 2025 and 2035. The nation's strength is in medical and dental 3D printing technology, with rigorous ISO 13485 standards guaranteeing product quality. The automotive industry is another key adopter, with high-end automobile manufacturers increasingly utilizing photopolymer-based lightweight components.

However, the high production costs and slower industrial digitalization compared to Germany and France pose significant challenges.

Italian SMEs are slowly looking to cost-saving resin formulations, but dependence on imported raw materials and regulatory hurdles can restrict aggressive expansion in the industry.

Estimates indicate that the 3D Printing Photopolymers industry in South Korea will grow at a compound annual growth rate (CAGR) of 18.5% from 2025 to 2035.

The country’s advanced electronics and automotive industries are key drivers, with manufacturers investing in UV-resistant and high-performance photopolymers.

KEITI’s eco-friendly regulations are pushing companies to develop sustainable resins with low VOC emissions.

South Korea's emphasis on automation and smart manufacturing has driven the take-up of resin-based 3D printing in industrial manufacturing forward.

Nevertheless, reliance on foreign raw materials and high R&D expenses for sophisticated formulations are still possible bottlenecks to sustainable growth.

The projections indicate a CAGR of 16.2% for the 3D Printing Photopolymers industry in Japan from 2025 to 2035. In line with JIS K 5600-1 standards for photopolymer performance, the country is focusing on precise manufacturing for uses in medicine, dentistry, and cars.

Yet Japan has been lagging behind South Korea and China in embracing high-speed, production-scale 3D printing, at least in part out of cost-effectiveness and over-engineering anxieties for minor applications.

More investment is being done into biocompatible and UV-resistant photopolymers, but problems like high material costs and a lack of resin production in the country could slow growth.

The projections indicate a CAGR of 20.1% for the 3D Printing Photopolymers industry in China from 2025 to 2035. Government policies favouring localized production of photopolymers and the adoption of 3D printing in manufacturing, healthcare, and construction are fuelling high growth.

China and Taiwan hold a share of around 46.7% in the South Asian industry. The GB/T 39560 to 2020 standards govern material performance, guaranteeing quality enhancements.

Chinese producers are focusing on producing low-cost, mass-produced resins for consumer and industrial applications, aiming to outbid their Western competitors on pricing.

However, intellectual property protection issues, consistency in resin quality, and environmental regulations may pose challenges to the international use of photopolymers made in China.

3D Printing Photopolymers industry in New Zealand and Australia is projected to grow at a CAGR of 15.5% from 2025 to 2035. The TGA rules for medical-grade photopolymers and their increasing use in mining, construction, and aeronautical applications stimulate the industry.

The Australian EPA and New Zealand's ACCC are driving the development of low-toxicity, environmentally friendly photopolymers, which in turn influences the selection of material formulations.

Despite robust research efforts, scalability issues arise due to low domestic production capacity and high import dependence for niche resins, with affordability being a major concern for manufacturers.

India is projected to witness the 3D Printing Photopolymers industry grow at a CAGR of 19.5% for the period from 2025 to 2035. Increasing use of 3D printing in automotive, medical, and consumer goods is driving the application in India's emerging low-cost manufacturing base.

The BIS and CPCB are enforcing stringent material and environmental safety regulations. These rules will make people even more interested in photopolymers that are safe and can be recycled.

Development is driven by government incentives for making resins in the country, but problems like a lack of high-performance materials and slow regulatory approvals could slow down the pace of industrial growth.

Pricing strategies, material innovation, strategic collaborations, and global expansion are the primary competitive strategies of the other actors in the 3D Printing Photopolymers market.

The demand for medical implants and wearable biosensors is surging, prompting industry players to invest in next-generation biocompatible resins. In hospitals and research institutes, strategic collaborations are developing next-generation photopolymers.

There has been ongoing consolidation through mergers and acquisitions recently, and the growth of regional Asia-Pacific and European markets manifests competition.

And companies are optimizing supply chains and ramping production to lower costs and improve availability. Sustainable photopolymers and partially recyclable resins are becoming key differentiators for long-term industry leadership.

Industry Share Analysis

Stratasys Ltd.

3D Systems Corporation

BASF SE (via BASF 3D Printing Solutions)

Henkel AG & Co. KGaA (Loctite 3D Printing)

Carbon, Inc.

Formlabs

Key Developments in 2024

The industry is segmented into polymers, oligomers, monomers and additives.

It is segmented into surgical models, wearable biosensors, implants (cardiovascular implant, orthopaedic implant, dental implant & others), customized prosthetic, exoskeleton and hearing aids.

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, The Middle East and Africa (MEA)

Sales are driven by a growing need for high-precision uses in medicine, like surgical models, implants, and custom prosthetics, along with advancements in biocompatible resins.

More adoption in healthcare, dentistry, and industrial manufacturing will fuel the market's robust growth, which will continue through 2035.

The major producers in the given industry are Bomar, Polysciences Inc., 3D Systems Corporation, Ineos, Röhm GmbH, BASF, SOLTECH LTD., Mohini Organics Pvt. Ltd., Fushun Donglian Anxin Chemical Co., Ltd., Henkel AG & Co. KGaA, Gelest Inc., Stratasys Ltd., Kyoeisha Chemical Co., Ltd., AGC, Allnex GmbH, Formlabs Inc., Sartomer Arkema, and Miwon.

Polymers are likely to dominate, with strong demand for tough and biocompatible photopolymers utilized in medical and industrial applications.

According to estimates, the industry will reach USD 7.06 billion in 2035, growing at a CAGR of 18.3% from 2025 to 2035.

Table 01: Global Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 02: Global Market Volume (Metric Ton) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 03: Global Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Application

Table 04: Global Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Region

Table 05: Global Market Volume (Metric Ton) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Region

Table 06: North America Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 07: North America Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 08: North America Market Volume (Metric Ton) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 09: North America Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Application

Table 10: Latin America Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 11: Latin America Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 12: Latin America Market Volume (Metric Ton) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 13: Latin America Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Application

Table 14: Europe Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 15: Europe Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 16: Europe Market Volume (Metric Ton) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 17: Europe Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Application

Table 18: South Asia Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 19: South Asia Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 20: South Asia Market Volume (Metric Ton) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 21: South Asia Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Application

Table 22: East Asia Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 23: East Asia Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 24: East Asia Market Volume (Metric Ton) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 25: East Asia Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Application

Table 26: Oceania Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 27: Oceania Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 28: Oceania Market Volume (Metric Ton) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 29: Oceania Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Application

Table 30: Middle East & Africa Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 31: Middle East & Africa Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 32: Middle East & Africa Market Volume (Metric Ton) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Material

Table 33: Middle East & Africa Market Size (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Application

Figure 01: Global Market Volume Analysis and Forecast 2022 to 2032 (Metric Ton)

Figure 02: Global Average Pricing Analysis Benchmark (US$/Kg) (2022)

Figure 03: Polymers Pricing Analysis (US$/Kg) for Per Unit , By Region, 2022

Figure 04: Oligomers Pricing Analysis (US$/Kg), By Region, 2022

Figure 05: Monomers Pricing Analysis (US$/Kg), By Region, 2022

Figure 06: Additives Pricing Analysis (US$/Kg), By Region, 2022

Figure 07: Global Market Value, 2017 to 2022

Figure 08: Global Market Value (US$ Million) & Y-o-Y Growth (%), 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity, 2023 to 2032

Figure 10: Global Market Share Analysis (%), By Material, 2022 & 2033

Figure 11: Global Market Y-o-Y Analysis (%), By Material, 2023 to 2033

Figure 12: Global Market Attractiveness Analysis By Material, 2023 to 2033

Figure 13: Global Market Share Analysis (%), By Application, 2022 & 2033

Figure 14: Global Market Y-o-Y Analysis (%), By Application, 2023 to 2033

Figure 15: Global Market Attractiveness Analysis By Application, 2023 to 2033

Figure 16: Global Market Share Analysis (%), By Region, 2022 & 2033

Figure 17: Global Market Y-o-Y Analysis (%), By Region, 2023 to 2033

Figure 18: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 19: North America Market Split By Country, 2022 (A)

Figure 20: North America Market Split By Material, 2022 (A)

Figure 21: North America Market Split By Application, 2022 (A)

Figure 22: North America Market Value Analysis (US$ Million), 2017 to 2022

Figure 23: North America Market Value Forecast (US$ Million), 2023 to 2033

Figure 24: North America Market Attractiveness Analysis, By Country

Figure 25: North America Market Attractiveness Analysis, By Material

Figure 26: North America Market Attractiveness Analysis, By End User

Figure 27: USA Market Value Proportion Analysis, 2022

Figure 28: Global Vs USA Y-o-Y Growth Comparison, 2023 to 2033

Figure 29: USA Market Share Analysis (%) by Material, 2022 & 2033

Figure 30: USA Market Share Analysis (%) by Application, 2022 & 2033

Figure 31: Canada Market Value Proportion Analysis, 2022

Figure 32: Global Vs Canada Y-o-Y Growth Comparison, 2023 to 2033

Figure 33: USA Market Share Analysis (%) by Material, 2022 & 2033

Figure 34: USA Market Share Analysis (%) by Application, 2022 & 2033

Figure 35: Latin America Market Split By Country, 2022 (A)

Figure 36: Latin America Market Split By Material, 2022 (A)

Figure 37: Latin America Market Split By Application, 2022 (A)

Figure 38: Latin America Market Value Analysis (US$ Million), 2017 to 2022

Figure 39: Latin America Market Value Forecast (US$ Million), 2023 to 2033

Figure 40: Latin America Market Attractiveness Analysis, By Country

Figure 41: Latin America Market Attractiveness Analysis, By Material

Figure 42: Latin America Market Attractiveness Analysis, By End User

Figure 43: Brazil Market Value Proportion Analysis, 2022

Figure 44: Global Vs Brazil Y-o-Y Growth Comparison, 2023 to 2033

Figure 45: Brazil Market Share Analysis (%) by Material, 2022 & 2033

Figure 46: Brazil Market Share Analysis (%) by Application, 2022 & 2033

Figure 47: Mexico Market Value Proportion Analysis, 2022

Figure 48: Global Vs Mexico Y-o-Y Growth Comparison, 2023 to 2033

Figure 49: Mexico Market Share Analysis (%) by Material, 2022 & 2033

Figure 50: Mexico Market Share Analysis (%) by Application, 2022 & 2033

Figure 51: Argentina Market Value Proportion Analysis, 2022

Figure 52: Global Vs Argentina Y-o-Y Growth Comparison, 2023 to 2033

Figure 53: Argentina Market Share Analysis (%) by Material, 2022 & 2033

Figure 54: Argentina Market Share Analysis (%) by Application, 2022 & 2033

Figure 55: Europe Market Split By Country, 2022 (A)

Figure 56: Europe Market Split By Material, 2022 (A)

Figure 57: Europe Market Split By Application, 2022 (A)

Figure 58: Europe Market Value Analysis (US$ Million), 2017 to 2022

Figure 59: Europe Market Value Forecast (US$ Million), 2023 to 2033

Figure 60: Europe Market Attractiveness Analysis, By Country

Figure 61: Europe Market Attractiveness Analysis, By Material

Figure 62: Europe Market Attractiveness Analysis, By End User

Figure 63: Germany Market Value Proportion Analysis, 2022

Figure 64: Global Vs Germany Y-o-Y Growth Comparison, 2023 to 2033

Figure 65: Germany Market Share Analysis (%) by Material, 2022 & 2033

Figure 66: Germany Market Share Analysis (%) by Application, 2022 & 2033

Figure 67: United kingdom Market Value Proportion Analysis, 2022

Figure 68: Global Vs United kingdom Y-o-Y Growth Comparison, 2023 to 2033

Figure 69: United kingdom Market Share Analysis (%) by Material, 2022 & 2033

Figure 70: United kingdom Market Share Analysis (%) by Application, 2022 & 2033

Figure 71: France Market Value Proportion Analysis, 2022

Figure 72: Global Vs France Y-o-Y Growth Comparison, 2023 to 2033

Figure 73: France Market Share Analysis (%) by Material, 2022 & 2033

Figure 74: France Market Share Analysis (%) by Application, 2022 & 2033

Figure 75: Italy Market Value Proportion Analysis, 2022

Figure 76: Global Vs Italy Y-o-Y Growth Comparison, 2023 to 2033

Figure 77: Italy Market Share Analysis (%) by Material, 2022 & 2033

Figure 78: Italy Market Share Analysis (%) by Application, 2022 & 2033

Figure 79: Spain Market Value Proportion Analysis, 2022

Figure 80: Global Vs Spain Y-o-Y Growth Comparison, 2023 to 2033

Figure 81: Spain Market Share Analysis (%) by Material, 2022 & 2033

Figure 82: Spain Market Share Analysis (%) by Application, 2022 & 2033

Figure 83: Russia Market Value Proportion Analysis, 2022

Figure 84: Global Vs Russia Y-o-Y Growth Comparison, 2023 to 2033

Figure 85: Russia Market Share Analysis (%) by Material, 2022 & 2033

Figure 86: Russia Market Share Analysis (%) by Application, 2022 & 2033

Figure 87: BENELUX Market Value Proportion Analysis, 2022

Figure 88: Global Vs BENELUX Y-o-Y Growth Comparison, 2023 to 2033

Figure 89: BENELUX Market Share Analysis (%) by Material, 2022 & 2033

Figure 90: BENELUX Market Share Analysis (%) by Application, 2022 & 2033

Figure 91: NORDICS Market Value Proportion Analysis, 2022

Figure 92: Global Vs NORDICS Y-o-Y Growth Comparison, 2023 to 2033

Figure 93: NORDICS Market Share Analysis (%) by Material, 2022 & 2033

Figure 94: NORDICS Market Share Analysis (%) by Application, 2022 & 2033

Figure 95: South Asia Market Split By Country, 2022 (A)

Figure 96: South Asia Market Split By Material, 2022 (A)

Figure 97: South Asia Market Split By Application, 2022 (A)

Figure 98: South Asia Market Value Analysis (US$ Million), 2017 to 2022

Figure 99: South Asia Market Value Forecast (US$ Million), 2023 to 2033

Figure 100: South Asia Market Attractiveness Analysis, By Country

Figure 101: South Asia Market Attractiveness Analysis, By Material

Figure 102: South Asia Market Attractiveness Analysis, By End User

Figure 103: India Market Value Proportion Analysis, 2022

Figure 104: Global Vs India Y-o-Y Growth Comparison, 2023 to 2033

Figure 105: India Market Share Analysis (%) by Material, 2022 & 2033

Figure 106: India Market Share Analysis (%) by Application, 2022 & 2033

Figure 107: Malaysia Market Value Proportion Analysis, 2022

Figure 108: Global Vs Malaysia Y-o-Y Growth Comparison, 2023 to 2033

Figure 109: Malaysia Market Share Analysis (%) by Material, 2022 & 2033

Figure 110: Malaysia Market Share Analysis (%) by Application, 2022 & 2033

Figure 111: Thailand Market Value Proportion Analysis, 2022

Figure 112: Global Vs Thailand Y-o-Y Growth Comparison, 2023 to 2033

Figure 113: Thailand Market Share Analysis (%) by Material, 2022 & 2033

Figure 114: Thailand Market Share Analysis (%) by Application, 2022 & 2033

Figure 115: Indonesia Market Value Proportion Analysis, 2022

Figure 116: Global Vs Indonesia Y-o-Y Growth Comparison, 2023 to 2033

Figure 117: Indonesia Market Share Analysis (%) by Material, 2022 & 2033

Figure 118: Indonesia Market Share Analysis (%) by Application, 2022 & 2033

Figure 119: East Asia Market Split By Country, 2022 (A)

Figure 120: East Asia Market Split By Material, 2022 (A)

Figure 121: East Asia Market Split By Application, 2022 (A)

Figure 122: East Asia Market Value Analysis (US$ Million), 2017 to 2022

Figure 123: East Asia Market Value Forecast (US$ Million), 2023 to 2033

Figure 124: East Asia Market Attractiveness Analysis, By Country

Figure 125: East Asia Market Attractiveness Analysis, By Material

Figure 126: East Asia Market Attractiveness Analysis, By End User

Figure 127: China & Taiwan Market Value Proportion Analysis, 2022

Figure 128: Global Vs China & Taiwan Y-o-Y Growth Comparison, 2023 to 2033

Figure 129: China & Taiwan Market Share Analysis (%) by Material, 2022 & 2033

Figure 130: China & Taiwan Market Share Analysis (%) by Application, 2022 & 2033

Figure 131: Japan Market Value Proportion Analysis, 2022

Figure 132: Global Vs Japan Y-o-Y Growth Comparison, 2023 to 2033

Figure 133: Japan Market Share Analysis (%) by Material, 2022 & 2033

Figure 134: Japan Market Share Analysis (%) by Application, 2022 & 2033

Figure 135: South Korea Market Value Proportion Analysis, 2022

Figure 136: Global Vs South Korea Y-o-Y Growth Comparison, 2023 to 2033

Figure 137: South Korea Market Share Analysis (%) by Material, 2022 & 2033

Figure 138: South Korea Market Share Analysis (%) by Application, 2022 & 2033

Figure 139: Oceania Market Split By Country, 2022 (A)

Figure 140: Oceania Market Split By Material, 2022 (A)

Figure 141: Oceania Market Split By Application, 2022 (A)

Figure 142: Oceania Market Value Analysis (US$ Million), 2017 to 2022

Figure 143: Oceania Market Value Forecast (US$ Million), 2023 to 2033

Figure 144: Oceania Market Attractiveness Analysis, By Country

Figure 145: Oceania Market Attractiveness Analysis, By Material

Figure 146: Oceania Market Attractiveness Analysis, By End User

Figure 147: Australia Market Value Proportion Analysis, 2022

Figure 148: Global Vs Australia Y-o-Y Growth Comparison, 2023 to 2033

Figure 149: Australia Market Share Analysis (%) by Material, 2022 & 2033

Figure 150: Australia Market Share Analysis (%) by Application, 2022 & 2033

Figure 151: New Zealand Market Value Proportion Analysis, 2022

Figure 152: Global Vs New Zealand Y-o-Y Growth Comparison, 2023 to 2033

Figure 153: New Zealand Market Share Analysis (%) by Material, 2022 & 2033

Figure 154: New Zealand Market Share Analysis (%) by Application, 2022 & 2033

Figure 155: Middle East & Africa Market Split By Country, 2022 (A)

Figure 156: Middle East & Africa Market Split By Material, 2022 (A)

Figure 157: Middle East & Africa Market Split By Application, 2022 (A)

Figure 158: Middle East & Africa Market Value Analysis (US$ Million), 2017 to 2022

Figure 159: Middle East & Africa Market Value Forecast (US$ Million), 2023 to 2033

Figure 160: Middle East & Africa Market Attractiveness Analysis, By Country

Figure 161: Middle East & Africa Market Attractiveness Analysis, By Material

Figure 162: Middle East & Africa Market Attractiveness Analysis, By End User

Figure 163: Türkiye Market Value Proportion Analysis, 2022

Figure 164: Global Vs Türkiye Y-o-Y Growth Comparison, 2023 to 2033

Figure 165: Türkiye Market Share Analysis (%) by Material, 2022 & 2033

Figure 166: Türkiye Market Share Analysis (%) by Application, 2022 & 2033

Figure 167: GCC Countries Market Value Proportion Analysis, 2022

Figure 168: Global Vs GCC Countries Y-o-Y Growth Comparison, 2023 to 2033

Figure 169: GCC Countries Market Share Analysis (%) by Material, 2022 & 2033

Figure 170: GCC Countries Market Share Analysis (%) by Application, 2022 & 2033

Figure 171: South Africa Market Value Proportion Analysis, 2022

Figure 172: Global Vs South Africa Y-o-Y Growth Comparison, 2023 to 2033

Figure 173: South Africa Market Share Analysis (%) by Material, 2022 & 2033

Figure 174: South Africa Market Share Analysis (%) by Application, 2022 & 2033

Figure 175: North Africa Market Value Proportion Analysis, 2022

Figure 176: Global Vs North Africa Y-o-Y Growth Comparison, 2023 to 2033

Figure 177: North Africa Market Share Analysis (%) by Material, 2022 & 2033

Figure 178: North Africa Market Share Analysis (%) by Application, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

3D IC and 2.5D IC Packaging Market Size and Share Forecast Outlook 2025 to 2035

3d-Printed Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

3D Display Market Size and Share Forecast Outlook 2025 to 2035

3D Neuroscience Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Kit Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA