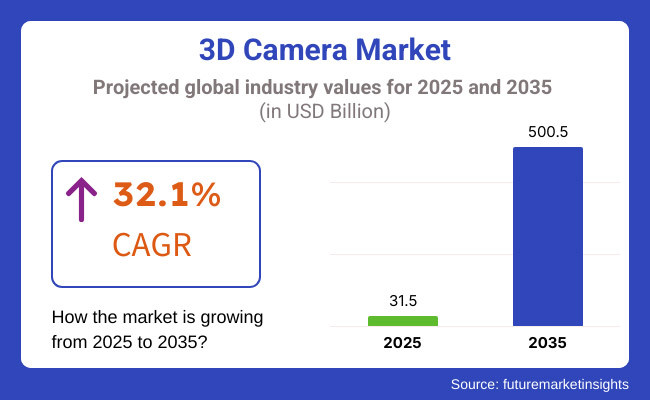

The 3D Camera Market is set for substantial growth between 2025 and 2035, driven by increasing demand across various applications, including entertainment, automotive, healthcare, and industrial sectors. The market is expected to reach USD 31.5 billion in 2025 and expand to USD 500.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 32.1% over the forecast period.

Growing adoption of 3D cameras in applications such as virtual reality (VR), augmented reality (AR), and machine vision is driving market growth significantly. The use of 3D cameras is expected to accelerate with improvements in imaging technologies and a growing demand for high-quality depth perception. Additionally, the expansion of automation and artificial intelligence (AI), promoting innovation in 3D technology and imaging solutions, is affecting the market as well.

Growth of industries in developing economies, along with technological developments in sensor technology, is also driving market growth. Also, strategic partnership between camera manufacturers and software developers is boosting production efficiency and application range.

Strategic interventions must be presented to overcome the challenges of high production costs and complexities in data processing and integration with existing systems. These continual innovations have prompted companies to invest significantly in R&D to develop cost-effective and high-performance 3D imaging solutions leading to a sturdy market stability.

The 3D camera market in North America is likely to be motivated by improvements in imaging technology and their significant utilization in entertainment, healthcare and security. North America has also been a driving force in the region led by the United States and Canada, with major technology companies investing resources to increase research and development to improve depth-sensing and image processing technology.

An increase in usage of 3D cameras in applications such as AR, VR, and autonomous vehicles remains strong, backed by progress in artificial intelligence and machine learning.

Market dynamics in the communications and media industry are shaped by regulatory frameworks, including those established by the Federal Communications Commission (FCC) and other standards that emphasize compliance with data privacy and safety regulations. But adoption on a large scale will be impeded by technological complexity and high production costs.

Europe one of the fastest-growing market of 3d cameras due to the increasing number of automotive, robotics and industrial automation applications in countries such as Germany, France, and the UK. The focus on Industry 4.0 and smart manufacturing across the region hastens the adoption of 3D imaging technologies.

Market growth is driven by its increasing adoption in facial recognition, biometric authentication, and medical imaging with 3D cameras. Nevertheless, strict data protection laws - in particular, the General Data Protection Regulation (GDPR) - shape the deployment of 3D imaging technologies in areas such as surveillance and consumer electronics.

European manufacturers emphasize improving sensor efficiency and road compliance with changing regulatory requirements to facilitate more market growth.

The Asia-Pacific region is the fastest-growing segment of the 3D camera market due to rapid technology developments and growing adoption of consumer electronics in China, Japan, South Korea, and India. The 3D camera market continues to be robust for gaming, smartphones, and industrial automation, particularly enabled by innovations in sensor technology and image recognition.

India's robust electronics manufacturing ecosystem and affordable production capabilities will facilitate mass deployment of 3D imaging solutions. That said, the relevant frameworks governing intellectual property rights, cybersecurity, and manufacturing standards are still developing, and companies must adapt.

Future market trends are driven to invest in 3D imaging of next-generation technology, so smart city initiatives, artificial intelligence-driven automation, and digital transformation systems are in high demand over the past few years.

High Production Costs and Technical Complexities

High costs associated with production and technical complexities constrain a huge 3D camera market size growth. The manufacturing cost of high-precision 3D imaging technology is high due to advanced sensors, complex software algorithms, and powerful processing units.

Apart from this, it requires seamless integration with various devices, improved depth accuracy, and reduced latency is needed in real-time applications as well, making it more complex. Many barriers exist which can be removed by utilizing cost-efficient production methods and effective software solutions.

Expansion in Augmented Reality (AR), Virtual Reality (VR), and AI Applications

The rise of AR, VR and AI-powered applications is a growth opportunity for the 3D camera market segment. Various sectors, including gaming, healthcare, automotive, and security, are utilizing 3D imaging to a greater extent to provide a more immersive experience to users, improve accuracy in diagnoses, and enable advanced surveillance systems.

The increasing adoption of AI-enabled object recognition and depth sensing capabilities in smart devices and automation is driving innovations in the market and is positively impacting its demand.

From 2020 to 2024, there are a rapid adoption of 3D cameras in consumer electronics, industrial automation and entertainment. But cost factors and hardware limited access to most. Includes companies focused on increased sensor efficiency, miniaturization, and cloud-based data processing to enable more functionality in their products.

From 2025 to 2035, market expansion will be powered by AI-based imaging, real-time 3D mapping and technological advancements in LiDAR and ToF (Time-of-Flight) technology. Emerging trends such as smart cities, self-driving cars, and AI-enabled security systems will help increase the range of market applications.

The adoption of energy-efficient as well as compact 3D cameras will also lead to the wider adoption on mobile devices and Internet of Things devices.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with data privacy and security regulations |

| Technological Advancements | Improvements in depth sensing and resolution |

| Industry Adoption | Growth in consumer electronics and gaming |

| Supply Chain and Sourcing | Dependence on specialized sensors and chipsets |

| Market Competition | Presence of niche market players |

| Market Growth Drivers | Demand for AR/VR and industrial automation |

| Sustainability and Energy Efficiency | Initial adoption of low-power sensors |

| Integration of Smart Monitoring | Limited real-time 3D data processing |

| Advancements in Imaging Innovation | Basic depth sensors and stereo cameras |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized global frameworks for AI-integrated imaging security |

| Technological Advancements | AI-driven 3D imaging, real-time 3D mapping, and LiDAR advancements |

| Industry Adoption | Expansion into autonomous vehicles, smart cities, and industrial automation |

| Supply Chain and Sourcing | Increased use of energy-efficient components and sustainable manufacturing |

| Market Competition | Growth of AI-powered imaging firms and major tech conglomerates |

| Market Growth Drivers | Integration with AI, IoT, and next-gen smart devices |

| Sustainability and Energy Efficiency | Full-scale integration of energy-efficient 3D cameras and sustainable materials |

| Integration of Smart Monitoring | AI-enhanced real-time depth perception and security analytics |

| Advancements in Imaging Innovation | AI-powered 3D recognition, holographic imaging, and advanced LiDAR solutions |

AR, VR and autonomous vehicles are pushing the limits of innovation in the USA 3D camera market. The increasing integration of 3D cameras in smartphones, gaming, health care imaging, and security surveillance is also driving demand.

Silicon Valley, New York, Los Angeles and other tech hubs are driving the innovation around depth-sensing technologies, AI-driven imaging, and LiDAR-based applications. One of the major factors that drive market growth is the increasing demand for high-resolution depth perception in autonomous systems and immersive media.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 32.8% |

The UK 3D camera sector is developing consistently, with increasing interest in industrial automation, film production, security frameworks, and savvy retail applications. With the rapid growth of AI-powered imaging, VR gaming, and biometric security, London and Manchester have emerged as important hubs driving adoption.

The market will see a steady increase due to a rising focus toward automated manufacturing, 3D scanning across health care, and AR based retail solutions. This is further facilitating sector innovation with the support from governments worldwide for AI and imaging technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 31.2% |

Germany, France and Italy dominate the EU 3D camera market, with applications in automotive, healthcare, industrial robotics, and consumer electronics.

Europe continues to lead with automotive automation and smart factory initiatives, driving the demand for high-precision depth-sensing cameras. CMR expects rapid adoption of biometric security systems, smart city projects, and biometric-enabled AR-based tourism applications are all positively contributing towards the market growth.

EU regulation of AI allowing for automation and promoting Industry 4.0 and also the wider economy will also contribute to significant market expansion over the coming decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 31.9% |

Technological advancements in robotics & industrial automation also drive for the growth of 3D camera market in Japan. High resolution imaging and LiDAR development workshops are led by companies such as Sony, Canon, and Panasonic.

Japan is generating demand with its know-how in precision manufacturing, AI-based surveillance, and autonomous vehicles. The cities of Tokyo and Osaka-gate continue being at the center of high-end 3D imaging technique improvement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 31.7% |

The South Korea 3D Camera Market is growing at a high rate due to increasing consumer electronics, autonomous robots and smart surveillance technologies. Samsung and LG are among the companies pouring money into depth-sensing cameras for mobile devices, car safety and home automation.

Seoul and Busan are not growing as tech hubs, with further demand being driven by AI-powered retail, biometric security and mixed reality (MR) applications. Market growth is also being fuelled by the growing use of 3D vision for AI-based robotic systems in industrial manufacturing and enhanced medical diagnostics.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 32.4% |

Stereo vision segment has grabbed a most of market share due to its realistic depth perception, high-resolution 3D imaging, and object recognition features. By using dual-camera configurations, this technology mimics human sight, recording and interpreting a smaller angle between two perspectives to provide incredibly accurate distance measurement and 3D location data.

Stereo vision has become ubiquitous in professional cameras, especially for cinematic, industrial inspection, and medical imaging applications, where correctness of depth, mapping of natural textures, and object detection and trackability is of paramount importance.

From filmmakers to photographers, stereo vision-based 3D cameras are being increasingly integrated to create hyper-realistic depth effects, immersive virtual sets, and overall enhanced visual storytelling.

Over 65% of AR & VR applications across gaming, simulation, and entertainment depend on stereo vision based 3D cameras for natural depth perception and immersive digital engagement. The growth of market with the AI-empowered depth sensing, real-time scene reconstruction and multi-view stereo processing.

Although they are computational heavyweights and require complex calibration, recent advances in compact stereo vision modules, AI-assisted depth estimation, and neural network-based image processing are all helping improve the accuracy and decrease latency of stereo vision technology, making it more widely available across different industries.

Time-of-Flight Revolutionizes 3D Camera Market as AI-Powered Depth Sensing and Gesture Recognition Go Mainstream

The time-of-flight (ToF) segment is poised for strong demand owing to the applications that work with real-time depth measurement, motion tracking, and high-speed 3D scanning. That is where the Time of Flight, or ToF technology steps in: Instead of conventional imaging approaches, it defines the amount of time leapt around, bounced back by an object, and instantly and accurately mapped depth.

The most prominent application of ToF based 3D cameras is in smartphones and tablets, which the major manufacturers have incorporated for features such as facial recognition, computational photography, AR based gaming and AI enhanced camera performance. For example, more than 70% of flagship smartphones now come with a ToF sensor, allowing for faster focus, better photo portraits and AR overlays.

ToF-based 3D cameras extend beyond consumer electronics to various industrial applications, serving sectors like industrial automation, robotics, and autonomous vehicles, where rapid motion tracking, obstacle detection, and environmental mapping are paramount.

AI-powered ToF sensors, with edge-computing depth analysis and cloud-based 3D imaging platforms, are increasing the optimisation toward performance while minimising the power budget and enabling further new markets.

Typically, high production costs and sensitivity to ambient lighting have limited ToF adoption. Yet, next-gen ToF sensors with AI-backed calibration and low-power depth sensing, and multi-sensor fusion are solving these problems, increasing efficiency, and moving towards cost-effective ToF cameras.

The surge in demand for 3D cameras in a range of applications such as consumer electronics, automotive, healthcare, and industrial sectors creates huge growth opportunities in the market. Technological advancements, such as depth-sensing technology and AI-based image processing, are some of the key factors that are contributing to the information available on the global market expansion along with increasing adoption in AR (augmented reality) and VR (virtual reality) applications.

Firms operating in this sector are focusing on efficiency, precision, and user experience, and believe that AI-processing depth mapping, additional security functions, and upgraded resolution devices will help them achieve their goals. The players in this market include major technology manufacturers, semiconductor companies, and research-oriented organizations dedicated to high-performance 3 dimensional imaging solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sony Corporation | 20-25% |

| Intel Corporation | 15-20% |

| Panasonic Corporation | 10-15% |

| Microsoft Corporation | 8-12% |

| Samsung Electronics | 5-10% |

| Other Manufacturers (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sony Corporation | Premier supplier of 3D imaging sensors, providing high-resolution depth-sensing cameras for numerous applications. |

| Intel Corporation | Manufactures RealSense 3D cameras, combining AI-driven depth mapping and gesture recognition technologies. |

| Panasonic Corporation | Creates 3D vision systems for industrial automation, automotive safety, and security solutions. |

| Microsoft Corporation | Provides Azure Kinect 3D cameras for AI-powered depth-sensing applications, especially in robotics and AR. |

| Samsung Electronics | Expert in 3D camera modules for smartphones, AR devices, and advanced security solutions. |

Key Company Insights

Sony Corporation (20-25%)

Sony dominates the 3D camera market with cutting-edge image sensors, AI-enhanced depth mapping, and high-resolution imaging solutions.

Intel Corporation (15-20%)

Intel focuses on RealSense technology, integrating AI and machine learning to enhance depth perception and spatial recognition.

Panasonic Corporation (10-15%)

Panasonic specializes in industrial 3D vision applications, including autonomous vehicles, manufacturing, and security systems.

Microsoft Corporation (8-12%)

Microsoft's Azure Kinect 3D cameras are widely used in AI applications, enabling advanced gesture control and spatial analysis.

Samsung Electronics (5-10%)

Samsung leads in compact 3D camera solutions for mobile devices, AR applications, and biometric security.

Emerging players and independent manufacturers are driving innovations such as AI-powered 3D depth sensing, lightweight and compact designs, and enhanced low-light performance for various applications. These companies include:

The overall market size for the 3D Camera Market was USD 31.5 billion in 2025.

The 3D Camera Market is expected to reach USD 500.5 billion in 2035.

The demand for the 3D Camera Market will be driven by advancements in imaging technology, increasing adoption in entertainment and gaming, expanding applications in healthcare and security, rising demand for high-resolution 3D content, and the integration of AI and machine learning in imaging solutions.

The top five countries driving the development of the 3D Camera Market are the USA, China, Germany, Japan, and South Korea.

The 3D Camera Market is expected to grow at a CAGR of 32.1% during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Technology, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Technology, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Technology, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Technology, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Technology, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Technology, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Technology, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Technology, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Technology, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Technology, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Technology, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Technology, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smartphone 3D Camera Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA