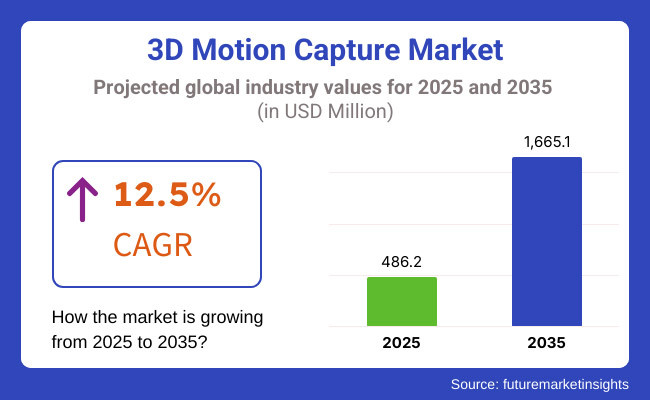

The global 3D Motion Capture market is projected to grow significantly, from USD 486.2 million in 2025 to USD 1,665.1 million by 2035 an it is reflecting a strong CAGR of 12.5%. The 3D Motion Capture Market is expanding rapidly as most companies are now dependent on external vendors and technology partners to provide advanced motion tracking solutions.

High-precision motion capture systems are being adopted by various industries including media & entertainment, healthcare, and engineering to facilitate animation, biomechanics research, and industrial simulations. The increasing need for accurate real-time motion tracking has resulted in growing demand for optical and non-optical motion capture technologies.

As various industries are adopting 3D motion capture into their workflows, they face challenges in terms of technology compatibility and scalability. It is essential for enterprises that their hardware and software ecosystems work together in a unified way to ingest, process, and analyze large amounts of motion data.

Thus, demand for the interoperable solutions is requiring vendors to make motion capture systems cost-efficient, cloud enabled, flexible, and AI-enabled, so that the systems will meet the widespread needs of industries.

The growing role of digital transformation is accelerating utilization motion capture for new virtual production and immersive simulations, AI-powered applications. Industries like automotive and manufacturing are using motion tracking to help optimize processes, study human factors and even train robotics.

As human and machine interactions are going to be the predominant paradigm of everything, the ability to capture, analyze, and optimize those interactions will be key to efficiency, safety, and automation in many sectors.

The 3D Motion Capture Market is Tenably impacted by the growth of AI and machine learning based motion analysis. The allowed real-time tracking, predictive modeling and enhanced automation, improving data accuracy and decision making. Newer usage for AI-based motion capture solutions on sports, healthcare, and also industrials settings, where ISU is fundamental for data insights regarding movement behaviours and risks.

North America holds the largest 3D Motion Capture Market share, as this region has a large market for entertainment, sports, healthcare industry, and is home to several key motion capture solution and service providers.

Elsewhere, in the Asia-Pacific region, rapid growth is observed due to growing industries including gaming, animation, and research industries in nations, including China and India. Rising adoption of immersive technologies and digital twin solutions are also accelerating the growth of the market over several key region.

| Company | Vicon Motion Systems |

|---|---|

| Contract/Development Details | Partnered with a leading animation studio to provide advanced 3D motion capture systems for character animations. |

| Date | April 2024 |

| Contract Value (USD Million) | Approximately USD 5 |

| Renewal Period | 5 years |

| Company | OptiTrack |

|---|---|

| Contract/Development Details | Secured a contract with a major sports organization for 3D motion capture technology in athlete performance. |

| Date | September 2024 |

| Contract Value (USD Million) | Approximately USD 7 |

| Renewal Period | 4 years |

Rising adoption in media & entertainment for animation, VFX, and virtual production

3D motion capture technology for animation & visual effects (VFX), and virtual production in media & entertainment have been increasingly adopted in recent years. As studios seek new and more realistic ways of bringing characters to life in films, TV shows, and virtual reality video games, more and more are turning to motion capture systems to build out high-fidelity animated characters with human-level movements.

In addition, the trend of real-time rendering and virtual production processes has multiplied the requirements for even more advanced motion capture solutions in blockbuster films and streamed content.

On a global scale, governments are fueling the adoption of digital production technologies, through funding programs and tax incentives. In 2023, one European government pledged a USD 100 million fund to animation and VFX studios, and to help integrate advanced motion capture technology into the filmmaking pipeline.

This initiative expects to support the region to become a global leader in the composition of digital creations, continuing the journey towards the adoption of 3D motion capture solutions in domestic and international studios.

Adoption of 3D motion capture in sports for performance tracking and injury prevention

The sports business is using 3D motion capture technology to track athlete performance, biomechanics and injury prevention. Motion analysis systems are being incorporated into a wide range of professional teams and sports organizations to evaluate movement efficiency, optimize training programs, and to prevent injuries.

By sensing an athlete’s motion in real time, coaches and sports scientists are able to identify irregular movement patterns and recommend corrective measures that can help improve performance and aid in recovery.

Sports technology initiatives are also being supported by governments to enhance athlete development programs. In 2024, a national athletic training program in Asia is implemented for USD 50 million utilizing motion capture simulations for biomechanical assessment.

The funding contributes to the installation of high-speed motion tracking systems in Olympic training centers, enabling athletes to develop their techniques through AI-powered motion analysis. Once confined to elite training environments, those initiatives are now pushing professional and amateur sports to adopt 3D motion capture at a global scale.

Growth of real-time motion tracking for live performances and interactive experiences

Real-time motion tracking is making a difference in live performances and interactive experiences, allowing artists, dancers, and performers to engage in real-time with digital environments. From concerts and theatrical endeavors to theme park spectacles and immersive art installations, motion capture technology has inspired dynamic, responsive performances. This also enables real-world motion to be in sync with virtual graphics to provide levels of audience interaction that have never been seen before.

The creative arts industry is catching up with various governments investing in technology-led performance spaces. In October 2023, a North American government announced USD 75 million in grants to fund digital innovation in performing arts, including projects such as real-time motion tracking systems installed in major theaters and cultural institutions. This initiative aims to elevate the use of motion capture within live entertainment, creating engaging and visually spectacular experiences.

High initial investment costs limit adoption among small businesses and independent creators

3D motion capture technology is still out of reach of most small businesses, independents, and startups, due to relatively high costs. Professional motion capture systems, especially optical rigs, involve multiple high-speed cameras and specialized sensors, and can cost tens or even hundreds of thousands of dollars. This is expensive not only in hardware but also in software licenses, calibration, tools, and post-processing infrastructure, making it difficult for a smaller entity to justify the cost.

Outside of the system itself are extra costs associated with a potential studio space, if the outfit is larger than one or two people, plus lighting and trained personnel. In contrast to huge production studios and research centers with dedicated funds to obtain cutting-edge tech, independent filmmakers, game creators, and small animation studios face difficulties when budgeting for motion capture implementation.

This challenge limits many - forcing them to work with traditional animation techniques or at lower-cost alternatives, which diminishes their market competitiveness against high-end productions employing realistic motion capture-driven animations.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Adoption of motion capture data protection policies in entertainment and healthcare. |

| Technological Advancements | Advancements in markerless motion capture improved ease of use. |

| Industry Adoption | Increased adoption in gaming, film production, and biomechanics. |

| AI & Real-Time Processing | AI-driven motion capture enhanced real-time animation and sports analysis. |

| Market Growth Drivers | Surge in demand for immersive digital experiences and sports analytics. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven compliance frameworks ensure ethical use of motion capture data. |

| Technological Advancements | Quantum-based motion sensors enable real-time ultra-precise movement analysis. |

| Industry Adoption | Expansion into autonomous robotics, virtual reality simulations, and digital twins. |

| AI & Real-Time Processing | Predictive AI-powered body tracking enhances healthcare diagnostics and rehabilitation. |

| Market Growth Drivers | Integration with metaverse applications and hyper-realistic virtual interactions. |

The section highlights the CAGRs of countries experiencing growth in the 3D Motion Capture market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.4% |

| China | 14.3% |

| Germany | 10.9% |

| Japan | 13.5% |

| United States | 12.3% |

China’s esports industry has experienced substantial expansion, fueled by the government’s recognition of esports as a legitimate profession as well as massive investments in gaming infrastructure. As China played host to some of the biggest international gaming tournaments and there are more than 500 million esports viewers in China, the market has increased the need for ultra-realistic in-game character plays.

High motion capture becomes an essential tool for any game that must be dished out to make a game feel silky smooth and realistic in a competitive environment like a battle royale, RPGs, or MOBAs.

The Chinese government has taken initiatives to foster esports, offering regulations that support game development, esports training programs, and digital content creation. Last year, local governments in areas like Guangdong and Shanghai distributed more than USD 1.5 billion on esports venues and gaming innovation centers.

These programs have encouraged game authors and esports corporations to use-movement trap image capture technology to enhance real-time animation functionality and artificial intelligence motion system. China is anticipated to see substantial growth at a CAGR 14.3% from 2025 to 2035 in the 3D Motion Capture market.

India’s digital content sector, which includes providers of animation, VFX, gaming, OTT platforms, and others, is witnessing rapid growth due to market stabilizing efforts led by the government itself to grow digital media. In 2022, the Indian government announced Animation, Visual Effects, Gaming and Comics (AVGC) Promotion Task Force to provide policy support and funding for content creators and studios.

The initiative seeks to make India a global content production destination leading to greater adoption of motion capture in film, advertising and gaming projects.

In 2023, the Indian Ministry of Information & Broadcasting made a USD 96 million allocation for advancing digital content infrastructure and skill development in motion capture and VFX.

Over the last few years, this funding has allowed small and mid-sized animation studios to adopt affordable motion tracking solutions, setting a level playing field for local filmmakers and game developers with international production standards. India's 3D Motion Capture market is growing at a CAGR of 15.4% during the forecast period.

With its utilization of training and simulation, the United States has already embraced VR with the military, healthcare, and aviation industries leading the charge. Simulation precision is achieved in the virtual environment by having a component of motion capture technology that takes real-world physical movements and replicates them in the VR space.

Improving situational awareness and tactical decision-making are some of the goals of VR-based training programs being developed for military personnel and emergency responders, which the USA government has been heavily investing in over the past couple of years.

In 2023, the USA Department of Defense devoted more than USD 600 million to VR-based training programs for soldiers, which included motion capture to generate realistic combat environments. The Federal Aviation Administration (FAA) has also approved the use of VR flight simulators using motion capture technology to train pilots - a move that lessens the need for physical aircraft simulators.

With these initiatives, motion tracking adoption has surged in defense and aviation training, making these simulated experiences more immersive and sensitive to errors. USA is anticipated to see substantial growth in the 3D Motion Capture market significantly holds dominant share of 73.2% in 2025.

The section contains information about the leading segments in the industry. By System, the Non-optical 3D Motion Capture Systems segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Application, Media and Entertainment segment hold dominant share in 2025.

| System | CAGR (2025 to 2035) |

|---|---|

| Non-Optical 3D Motion Capture Systems | 13.9% |

Non-Optical 3D Motion Capture Systems segment is expected to grow at a CAGR of 13.9% from the period 2025 to 2035. Non-optical 3D motion capture systems are becoming increasingly popular due to their low cost and simple implementation when compared with optical systems.

Non-optical solutions avoid the use of multiple cameras and extensive calibration setups that are common in traditional marker-based optical systems by relying on inertial sensors, magnetic tracking, and depth-sensing cameras. This has made them the go-to option for independent developers, researchers, and budget-conscious studios.

In recent times, motion tracking technology has been a sector many governments have been gearing towards. For instance, in 2023, the USA Department of Defense awarded contracts worth more than USD 200 million for wearable motion tracking systems for soldier training, with a preference for non-optical solutions because of portability and markerless tracking [35].

Likewise, the Indian Space Research Organisation (ISRO) has made in-house investments in motion capture suits for astronaut training purposes using non-optical technology for zero-gravity simulations to provide real-time analysis of the astronaut’s body during flight.

| Application | Value Share (2025) |

|---|---|

| Media and Entertainment | 24.6% |

The Media and Entertainment is poised to capture share 24.6% in 2025. The media and entertainment industry continues to hold the largest share of 3D motion capture technology consumption owing to the growing demand for realistic animation, VFX, and virtual production. Motion capture is heavily utilized by Hollywood studios, gaming industry, and digital content creators for lifelike character animations, real-time filmmaking, and immersive storytelling.

Governments are also investing in the production of digital content to propel their domestic entertainment industries. This of course has an economic component too, with the Chinese government approving over USD 1.2 billion in subsidies in 2023 for film and gaming studios to invest in cutting-edge CGI and motion capture solutions.

Also, the French government introduced tax incentives for digital content creators, giving producers a rebate of up to 30% on production expenses that utilize motion capture-driven animation and VFX.

The 3D Motion Capture Market is poised to move forward with the growing demand and adoption of motion capture in animation, gaming, sports science, biomechanics, and healthcare. The key player’s element with advanced technological solutions, extensive research and development (R&D), and strategic alliances. There are both established businesses and disruptive new firms in this competitive space, and thus this space is evolving constantly.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Vicon Motion Systems | 20-25% |

| OptiTrack | 15-20% |

| Xsens | 10-15% |

| Motion Analysis Corporation | 8-12% |

| Qualisys | 7-10% |

| Other Companies (combined) | 28-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Vicon Motion Systems | Provides high-precision motion capture systems for life sciences, entertainment, and engineering. Innovates with real-time processing and AI-powered tracking solutions. |

| OptiTrack | Specializes in motion tracking solutions for virtual reality (VR), sports science, and industrial applications. Offers cost-effective, scalable solutions with high accuracy. |

| Xsens | Develops wearable 3D motion capture technology for gaming, film production, and healthcare. Focuses on AI-driven algorithms for real-time motion data analysis. |

| Motion Analysis Corporation | Designs optical motion capture systems catering to animation, biomechanics, and military applications. Invests in precision tracking and automation. |

| Qualisys | Offers flexible and scalable motion tracking solutions for animation, robotics, and clinical research. Expands cloud-based processing capabilities. |

Strategic Outlook

Vicon Motion Systems (20-25%)

Vicon Motion Systems leads the 3D motion capture market with cutting-edge optical and AI-powered solutions. The company is focused on investing in AI and machine learning for enhanced motion analysis. The company also collaborating with the film and gaming industries, expanding its role in high-precision motion capture for blockbuster productions. Its innovation in real-time tracking enhances applications in sports and rehabilitation.

OptiTrack (15-20%)

OptiTrack is a strong competitor, offering cost-effective and high-accuracy motion capture solutions for diverse industries. Its investment in VR and industrial motion tracking strengthens its market position. OptiTrack’s focus on user-friendly, scalable systems makes it an attractive choice for researchers and developers looking for high-quality, accessible motion capture technology.

Xsens (10-15%)

Xsens is a leader in wearable 3D motion capture technology, excelling in animation, game development, and biomechanical research. The company's real-time AI-driven motion data solutions help industries optimize motion capture for digital humans and ergonomic studies. Xsens is expanding its ecosystem with cloud integration and software enhancements, making motion capture more accessible and streamlined.

Motion Analysis Corporation (8-12%)

Motion Analysis Corporation specializes in optical motion capture, offering solutions for biomechanics, military training, and industrial simulations. The company’s focus on automation and precision tracking enables high-fidelity motion data collection. With growing investments in healthcare and engineering applications, Motion Analysis Corporation strengthens its market reach.

Qualisys (7-10%)

Qualisys continues to grow in the motion capture space by offering flexible and scalable tracking solutions. The company is investing in cloud-based processing and automation, improving usability in research, sports, and industrial applications. Its commitment to precision and adaptability positions it well for market expansion.

Other Key Players (28-40% Combined)

Smaller firms and new entrants, including Noitom, Rokoko, Noraxon USA, STT Systems, and Perception Neuron, contribute to the industry with innovative and budget-friendly solutions. These companies focus on niche applications, such as indie gaming, medical motion tracking, and affordable motion capture systems for startups. Their role in democratizing motion capture technology makes them essential to industry diversification and expansion.

In terms of System, the segment is segregated into Optical 3D Motion Capture Systems and Non-optical 3D Motion Capture Systems.

In terms of Component, the segment is segregated into Hardware, Software and Services.

In terms of Application, it is distributed into Media & Entertainment, Biomechanical Research and Medical, Engineering Design and Industrial Applications, Education, Automotive, Manufacturing, BFSI, IT & Telecom, Retail & Wholesale and Travel & Hospitality.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global 3D Motion Capture industry is projected to witness CAGR of 12.5% between 2025 and 2035.

The Global 3D Motion Capture industry stood at USD 486.2 million in 2025.

The Global 3D Motion Capture industry is anticipated to reach USD 1,665.1 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 14.2% in the assessment period.

The key players operating in the Global 3D Motion Capture Industry Vicon Motion Systems, OptiTrack, Xsens, Motion Analysis Corporation, Qualisys, Noitom, Rokoko, Noraxon USA, STT Systems, Perception Neuron.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by System, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Attractiveness by System, 2023 to 2033

Figure 18: Global Market Attractiveness by Component, 2023 to 2033

Figure 19: Global Market Attractiveness by Application, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by System, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 37: North America Market Attractiveness by System, 2023 to 2033

Figure 38: North America Market Attractiveness by Component, 2023 to 2033

Figure 39: North America Market Attractiveness by Application, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by System, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 57: Latin America Market Attractiveness by System, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by System, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 77: Europe Market Attractiveness by System, 2023 to 2033

Figure 78: Europe Market Attractiveness by Component, 2023 to 2033

Figure 79: Europe Market Attractiveness by Application, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by System, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 97: South Asia Market Attractiveness by System, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by System, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: East Asia Market Attractiveness by System, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by System, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: Oceania Market Attractiveness by System, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by System, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 157: MEA Market Attractiveness by System, 2023 to 2033

Figure 158: MEA Market Attractiveness by Component, 2023 to 2033

Figure 159: MEA Market Attractiveness by Application, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA