Key companies driving innovations in the field include 3D Systems, EOS GmbH, and GE Additive. All of these are major companies pushing metal printing technology ahead of schedule as the market expands with aerospace, automotive, healthcare, and consumer goods companies clamoring for a greater supply. Using 3D metal printing for high-precision speed and customized components is providing lightweight complex pieces needed for a wide variety of applications in specific industries.

| Attributes | Details |

|---|---|

| Projected Size, 2035 | USD 12 billion |

| Value-based CAGR (2025 to 2035) | 11.2% |

Continuous improvement for vendors would focus more on the metal powders, including developments in titanium, aluminum, and stainless steel. These advancements further enhance the performance of the material, which works well in high-stress critical applications, but most importantly in aerospace and healthcare fields. Companies are also spending money on R&D to refine printing techniques and produce the next generation of printers that deliver higher speed, accuracy, and scalability.

Sustainability is an important priority; additive manufacturing minimizes material waste significantly compared to subtractive methods. It also aligns with the industry-wide sustainability goals and regulatory pressures. Further, strategic collaborations and partnerships with OEMs and industrial clients help manufacturers provide end-to-end solutions from design to production.

With a forecasted CAGR of 11.2%, and the market expected to touch more than USD 12 billion in 2035, vendors and manufacturers are exploring this growth further by innovating their portfolios, expanding their footprints globally and meeting the continuously evolving needs of customers.

Global Market Share & Industry Share (%), 2025E

| Category | Industry Share (%) |

|---|---|

| Top 3 (3D Systems, EOS GmbH, GE Additive) | 45% |

| Rest of Top 5 (Renishaw, SLM Solutions) | 10% |

| Next5 of Top 10 Players | 5% |

Type of Player & Industry Share (%), 2025E

| Type of Player | Industry Share (%) |

|---|---|

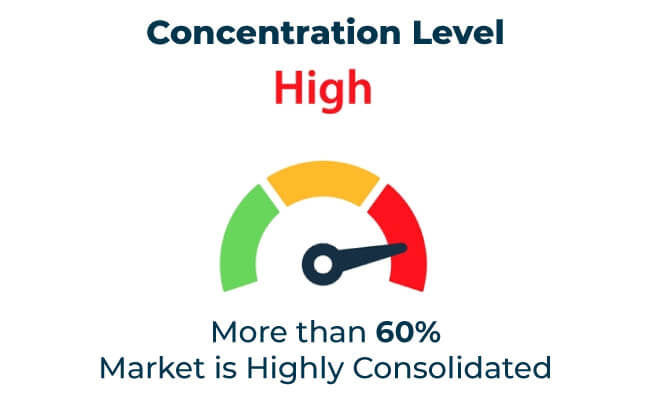

| Top 10 | 60% |

| Next 20 | 25% |

| Remaining Players | 15% |

Year-over-Year Leaders

Emerging markets in Southeast Asia, Africa, and South America provide significant export opportunities for 3D metal printing solutions. The growing demand for advanced manufacturing technologies and custom components supports market expansion.

| Region | North America |

|---|---|

| Market Share (%) | 40% |

| Key Drivers | Advanced manufacturing infrastructure and strong aerospace sector |

| Region | Europe |

|---|---|

| Market Share (%) | 30% |

| Key Drivers | High demand for precision components in automotive and healthcare |

| Region | Asia-Pacific |

|---|---|

| Market Share (%) | 20% |

| Key Drivers | Growing investments in industrial automation and additive manufacturing |

| Region | Other Regions |

|---|---|

| Market Share (%) | 10% |

| Key Drivers | Increasing adoption in emerging markets |

The 3D printing metal market will continue to grow as industries prioritize efficiency, precision, and sustainability. Companies that address challenges such as material limitations and cost barriers while investing in innovation will lead the market. Emerging applications in energy, healthcare, and aerospace will further drive adoption and market expansion.

| Tier | Key Companies |

|---|---|

| Tier 1 | 3D Systems, EOS GmbH, GE Additive |

| Tier 2 | Renishaw, SLM Solutions |

| Tier 3 | Desktop Metal, Materialise |

The 3D printing metal market transforms manufacturing by enabling efficient, precise, and sustainable production. Companies focusing on material innovations, collaborative research, and emerging applications will shape the future of this dynamic sector. Addressing challenges such as cost and technical expertise will unlock significant growth potential, ensuring 3D metal printing remains a cornerstone of industrial evolution.

Key Definitions

Research Methodology

This report synthesizes data from primary interviews, secondary research, and market modeling validated by industry experts.

The global 3D printed metal market is projected to witness a CAGR of 11.2% between 2025 and 2035

The global 3D printed metal market is expected to reach USD 12 Billion by 2035

The share of top 10 players is 60% in the global 3D printed metal market.

3D Systems, EOS GmbH, GE Additive are few of the leading manufacturers of 3D printed metal

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Somatosensory Virtual Fitting Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

3D IC and 2.5D IC Packaging Market Size and Share Forecast Outlook 2025 to 2035

3d-Printed Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

3D Display Market Size and Share Forecast Outlook 2025 to 2035

3D Neuroscience Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA