The global 3D Cell Culture Market is estimated to be valued at USD 1,494.2 million in 2025 and is projected to reach USD 3,805.7 million by 2035, registering a CAGR of 9.8% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,494.2 million |

| Industry Value (2035F) | USD 3,805.7 million |

| CAGR (2025 to 2035) | 9.8% |

The 3D cell culture market has advanced rapidly as the pharmaceutical, biotechnology, and academic sectors have prioritized physiologically relevant in vitro models to improve translational research and reduce late-stage drug attrition.

Traditional two-dimensional cultures have shown limitations in recapitulating the complex cell-cell and cell-matrix interactions critical to disease modeling, driving accelerated adoption of scaffold-based and scaffold-free 3D systems.

Industry investments in organoids, microfluidics, and hydrogel-based technologies have supported higher throughput screening while preserving cellular phenotypes and functionality. Regulatory authorities and funding agencies have underscored the value of predictive 3D models to enhance preclinical workflows and refine animal study requirements.

Scaffold-Based 3D Cell Culture

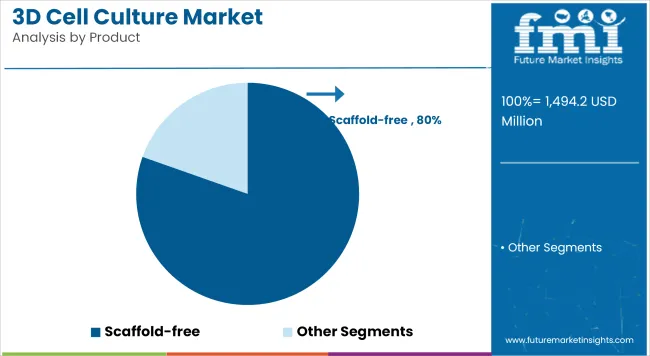

A revenue share of 80.4% has been attributed to scaffold-based 3D cell culture systems, underscoring their widespread adoption across preclinical and translational workflows. The growth of this segment has been driven by the availability of a diverse range of scaffold materials, including hydrogels, polymer matrices, and biocompatible composites that support cell proliferation, differentiation, and extracellular matrix formation.

Researchers have preferred scaffold-based platforms for their reproducibility, scalability, and ease of integration into automated screening pipelines. Sustained investments in scaffold innovation have facilitated the development of tissue-mimetic environments critical to oncology, neuroscience, and regenerative studies. Over the forecast years, this segment is expected to maintain strong momentum, propelled by increasing demand for advanced models in immuno-oncology and personalized medicine research.

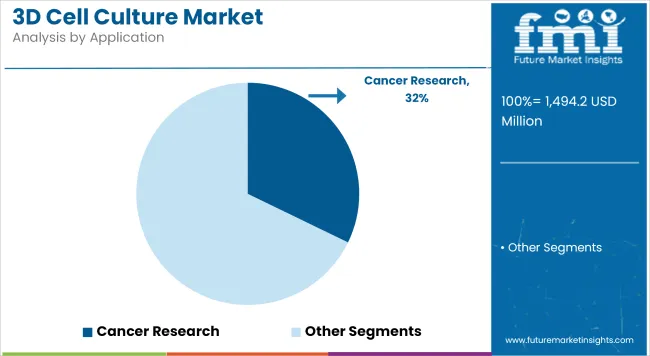

Cancer Research contributes a revenue share of 32.2% which has been attributed to the urgent need for biologically relevant tumor models that replicate microenvironmental complexity. This segment’s growth has been driven by pharmaceutical and academic efforts to improve predictive accuracy in drug discovery and evaluate combination therapies in vitro.

Scaffold-based and organoid platforms have been widely adopted to study cancer stem cell behavior, metastatic processes, and therapeutic resistance mechanisms. Investments in 3D co-culture systems and tumor-on-a-chip technologies have further reinforced the segment’s leadership. In the coming years, sustained oncology pipeline growth and regulatory encouragement for advanced preclinical models are expected to continue supporting this segment’s prominence.

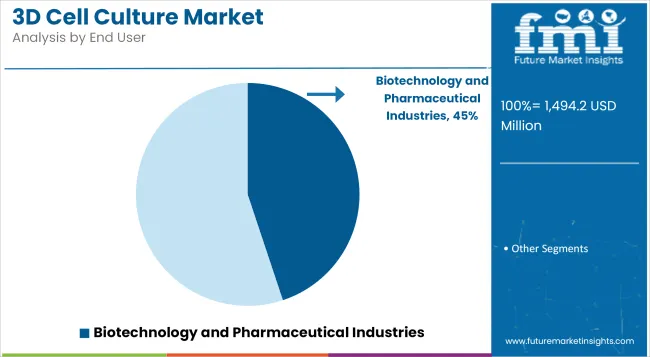

Biotechnology and Pharmaceutical Industries accounts for a revenue share of 44.9% in 2025. The segment’s leadership has been driven by the imperative to improve early-stage screening outcomes, reduce late-stage failures, and accelerate time to market for novel therapeutics.

Companies have prioritized integration of 3D models into discovery and preclinical pipelines to enhance target validation and toxicity assessment. Strategic collaborations with academic institutions and technology developers have further expanded access to cutting-edge biomimetic platforms. Rising R&D expenditure and the growing emphasis on disease-relevant models are expected to sustain adoption in the pharmaceutical sector.

Lack of Standard Protocols and Reproducibility Concerns Hinder Large-Scale Adoption.

One of the major challenges hindering the large-scale adoption of 3D cell culture technologies is the lack of standardized protocols and concerns regarding reproducibility. Unlike traditional 2D cell culture methods, which follow well-established procedures, 3D cell culture techniques vary significantly based on the type of model used, including scaffold-based, spheroid, and organoid cultures.

This variability leads to inconsistencies in experimental outcomes, making it difficult for researchers and industries to replicate results across different laboratories. Moreover, differences in cell behavior, media composition, and culture conditions further complicate standardization. Regulatory agencies also face challenges in evaluating the reliability of 3D models for drug testing and personalized medicine. Addressing these concerns requires industry-wide collaboration to develop validated, reproducible, and scalable methodologies.

Growth in Cancer Immunotherapy and Tissue Engineering Is Expanding Use Cases for Organoid And Spheroid Models.

The expanding applications of 3D cell culture in cancer immunotherapy and tissue engineering present significant market opportunities, particularly through the use of organoid and spheroid models. Organoids, which closely mimic in vivo tumor microenvironments, are increasingly being utilized in immuno-oncology research for testing novel cancer therapies, including checkpoint inhibitors and CAR-T cell therapies.

These models enhance the efficiency of drug screening and facilitate personalized treatment approaches. Similarly, spheroids are gaining traction in tissue engineering for regenerative medicine, offering more physiologically relevant cell interactions compared to 2D cultures. The growing emphasis on precision medicine and regenerative therapies, coupled with advancements in bioprinting and microfluidics, further boosts the demand for these 3D models, creating new opportunities for research institutions and biotech firms.

Microfluidics and organ-on-chip technologies are revolutionizing 3D cell culture.

Microfluidics and organ-on-chip technologies are revolutionizing 3D cell culture by enabling the creation of lab-on-chip devices that simulate dynamic physiological conditions. These systems integrate precisely controlled fluidic environments, allowing continuous nutrient supply, waste removal, and mechanical stimuli, closely mimicking in vivo conditions.

This enhances cell viability, functionality, and intercellular interactions, making these models highly relevant for drug screening, disease modeling, and toxicity testing. The ability to monitor cell responses in real-time improves the predictive accuracy of preclinical studies, reducing the reliance on animal models.

Additionally, microfluidic platforms facilitate high-throughput screening, making them valuable for pharmaceutical and biotech industries. As demand for personalized medicine grows, organ-on-chip devices are gaining traction in applications such as cancer research and regenerative medicine.

The Integration of 3D Bioprinting with Cell Culture Is Emerging as A Transformative Trend.

The integration of 3D bioprinting with cell culture is emerging as a transformative trend, enabling the fabrication of complex, physiologically relevant tissue models for drug development, regenerative medicine, and disease research. Unlike conventional 3D cell culture methods, bioprinting enables the precise spatial arrangement of cells, biomaterials, and growth factors to mimic the native tissue architecture.

This enhances cell-cell interactions, improves tissue functionality, and facilitates the creation of organoids with greater structural accuracy. In drug discovery, 3D bioprinted tissues are being utilized to assess drug efficacy and toxicity in a human-relevant environment, thereby reducing dependence on animal models. Additionally, advancements in bioinks and printing technologies are accelerating the development of engineered tissues for transplantation, offering significant potential in personalized medicine and tissue engineering.

Market Outlook

The United States dominates the 3D cell culture market, driven by significant investments in biotechnology, pharmaceutical research and development, and advanced research infrastructure. The presence of major market players, extensive funding from the National Institutes of Health (NIH), and increasing adoption of organ-on-a-chip models for drug discovery contribute to market expansion.

The USA FDA’s push for alternative testing models, particularly in reducing reliance on animal studies, is accelerating adoption. Additionally, biopharmaceutical firms and academic institutions are extensively leveraging 3D bioprinting and microfluidics for precision medicine and regenerative therapies. The rising burden of chronic diseases, including cancer and neurological disorders, further fuels demand for physiologically relevant cell culture models, making the USA a key hub for innovation in this sector.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

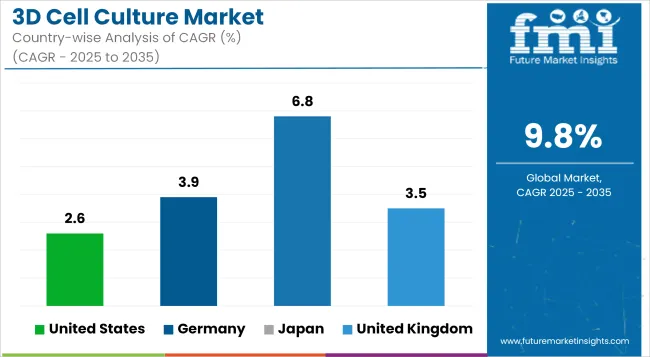

| United States | 2.6% |

Market Outlook

Germany holds a significant share in the 3D cell culture market, driven by its robust pharmaceutical industry, well-established biotech sector, and strong academic research collaborations. The country’s leadership in regenerative medicine and tissue engineering has positioned it at the forefront of 3D bioprinting and organoid research.

The German government and European Union actively promote alternatives to animal testing, increasing the adoption of 3D culture systems for drug screening and toxicology studies. Moreover, Germany's focus on developing human-relevant models for cancer research and immunotherapy is propelling market growth. With a growing emphasis on personalized medicine and substantial investments in life sciences, the country remains a critical player in the European 3D cell culture landscape.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.9% |

Market Outlook

Japan is a rapidly expanding market for 3D cell culture, driven by advancements in stem cell research, tissue engineering, and regenerative medicine. The country has been a pioneer in induced pluripotent stem cell (iPSC) technology, which is increasingly being integrated with 3D culture models for disease modeling and drug discovery. Japanese pharmaceutical companies are actively investing in organoid and organ-on-chip technologies to enhance drug screening efficiency.

Government initiatives promoting next-generation healthcare solutions, along with collaborations between academia and industry, are boosting the market. Additionally, Japan’s aging population and increasing prevalence of chronic diseases, such as cancer, are fueling demand for more physiologically relevant in vitro models to improve therapeutic research outcomes.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

Market Outlook

The United Kingdom plays a crucial role in the 3D cell culture market, with a strong emphasis on biotechnology innovation, pharmaceutical research, and government-backed initiatives supporting human-relevant testing models. The UK’s progressive stance on reducing animal testing, driven by the Medicines and Healthcare products Regulatory Agency (MHRA) and regulatory bodies, has spurred the adoption of 3D organoid and spheroid models.

Universities and research institutions are actively collaborating with biotech firms to advance applications in oncology, neurodegenerative diseases, and regenerative medicine. Additionally, significant investments in artificial intelligence (AI)-assisted cell culture analysis and bioprinting technologies are strengthening the market. The UK's focus on translational research and personalized medicine further contributes to its market expansion.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.5% |

Market Outlook

China is emerging as one of the fastest-growing markets for 3D cell culture, fueled by increasing government funding, rapid pharmaceutical sector growth, and expanding biotechnology research. The country is heavily investing in stem cell research, personalized medicine, and drug discovery, driving the adoption of advanced in vitro models.

With a strong push for biopharmaceutical innovation, Chinese companies and research institutes are exploring applications of 3D culture in cancer therapy, organoid development, and high-throughput drug screening. However, challenges such as regulatory standardization and the high costs of advanced 3D cell culture systems remain. Nonetheless, China’s expanding contract research organization (CRO) network and integration of automation in cell culture techniques are expected to accelerate market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.7% |

The competitive landscape has been shaped by companies investing in organoid platforms, synthetic hydrogels, and microfluidic 3D bioreactors. Leading players have formed strategic alliances with research institutions to accelerate validation and application development across oncology and regenerative medicine.

Expansion of product portfolios with ready-to-use kits and custom services has differentiated offerings and driven market penetration. Additionally, investment in training and digital support tools has improved researcher adoption and workflow integration. These activities are expected to sustain competition and propel innovation across the 3D cell culture market in the coming years.

Key Development:

In 2025, PHC Corporation and Cyfuse Biomedical announced a breakthrough in regenerative and cell therapy. Their joint research resulted in a new production technology enabling real-time quality monitoring of 3D cell products, paving the way for commercialization in this innovative field.

In 2024, Bioserve India has launched REPROCELL's advanced stem cell products in India. This move supports innovation in scientific research and drug development, driving advancements in regenerative medicine and therapeutic discovery within the rapidly growing Indian stem cell market.

University of Georgia startup CytoNest Inc. launched its first commercial product, the CytoSurge 3D fiber scaffold, in 2024. This innovative scaffold optimizes cell manufacturing and tissue engineering, with applications spanning cell research, biopharmaceuticals, cell therapeutics, and cultured meat/seafood development. UGA leads USA universities in commercial products from its research

Scaffold-free and Scaffold-based

Drug Discovery, Tissue Regeneration & Regenerative Methods, Cancer Research, Stem Cell Technology and Others.

Biotechnology and Pharmaceutical Industries, Hospital Laboratories, Academic Research and Institutes and Contract Research Organizations.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global 3D Cell Culture industry is projected to witness CAGR of 9.8% between 2025 and 2035.

The global 3D Cell Culture industry stood at USD 1,351.8 million in 2024.

The global rare neurological disease treatment industry is anticipated to reach USD 3,805.7 million by 2035 end.

China is expected to show a CAGR of 7.7% in the assessment period.

The key players operating in the global 3D Cell Culture industry are Merck KGaA, Lonza Group AG, 3D Biotek LLC, InSphero AG, Greiner Bio-One, Mimetas BV, CN Bio Innovations, Advanced Biomatrix and Others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA