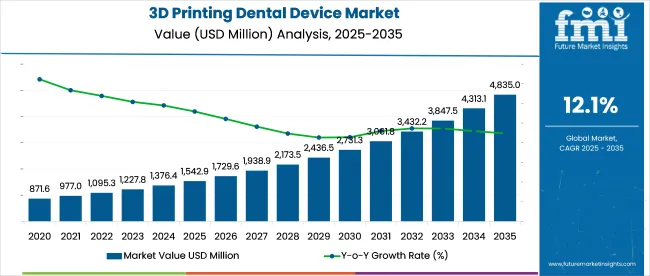

The global 3D Printing Dental Devices Market is estimated to be valued at USD 1,542.9 million in 2025 and is projected to reach USD 4,835.0 million by 2035, registering a compound annual growth rate of 12.1% over the forecast period.

The 3D printing dental devices market is evolving rapidly due to rising demand for personalized, precise dental solutions and the shift toward digital dentistry. Key growth drivers include technological innovation, such as AI-integrated design software and biocompatible materials, which are enhancing efficiency, accuracy, and patient outcomes.

The aging population and increasing cases of dental disorders are further amplifying the need for customized dental prosthetics and implants. Additionally, the market is benefiting from strong collaboration between dental labs, clinics, and tech providers, leading to the creation of integrated digital dental ecosystems. This shift is streamlining production, reducing waste, and enabling faster turnaround times making the industry more responsive and cost-effective while paving the way for sustained future growth.

The segment of 3D printing materials has been positioned as the leading category in 2025, accounting for an estimated 50.30% revenue share. This dominance is being driven by the expanding need for biocompatible, high-precision materials that support the development of tailored dental solutions. The adoption of advanced materials such as photopolymer resins, biocomposites, and titanium alloys has been prioritized to meet aesthetic, mechanical, and safety requirements across prosthodontic and orthodontic applications.

In recent years, material innovation has been accelerated by R&D activities led by dental OEMs and specialty resin producers. Moreover, the increasing integration of multi-material workflows within CAD/CAM environments has enabled seamless, high-throughput production. Clinical preference for resin-based models for surgical guides and aligners has further strengthened this segment’s commercial viability. Additionally, regulatory approvals of dental-specific resin classes by authorities such as the FDA and CE Mark have built confidence among practitioners and manufacturers, accelerating material consumption.

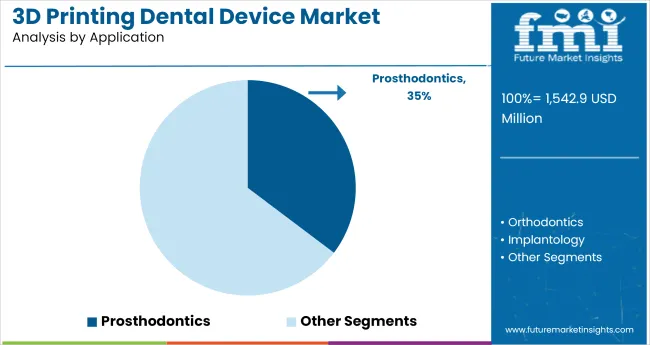

The prosthodontics segment has emerged as the largest application category in 2025, capturing a 35.30% revenue share in the global 3D printing dental devices market. This leadership has been supported by the rising incidence of tooth loss and dental decay, particularly among aging and geriatric demographics in North America, Europe, and parts of East Asia. Demand for crowns, bridges, veneers, and denture frameworks has surged due to their essential role in functional and aesthetic dental rehabilitation.

Precision-fit restoration enabled through 3D-printed prosthodontics has reduced turnaround times and manual effort in dental laboratories. Additionally, dental service providers have preferred digital workflows to eliminate the need for physical impressions, thereby improving patient comfort and chairside efficiency. The adoption of CAD-based modeling software and automated production techniques has facilitated the expansion of this segment. High acceptance rates among dentists, coupled with scalable production capabilities, have further ensured the strong position of prosthodontic applications within the market landscape.

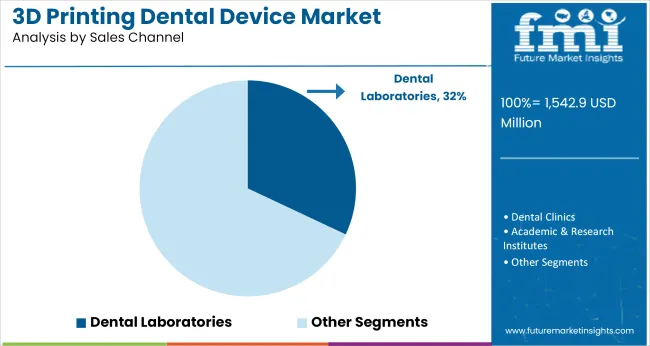

The dental laboratories channel has been identified as the dominant sales route in 2025, holding a 32% revenue share. This leadership has been attributed to the centralized nature of production across most countries, where laboratories serve as hubs for precision-based manufacturing of prosthetics, aligners, and implants. Dental labs have increasingly integrated 3D printing systems to streamline production and reduce dependency on traditional casting and milling processes. Investments in automation, digital scanning, and CAM technologies have enabled high-volume output and faster turnaround.

Furthermore, dental labs offer flexibility in accommodating various printer types and materials, making them ideal for multi-application use. The ability to process diverse patient orders from multiple clinics at scale has positioned labs as essential service partners. Additionally, regulatory and compliance support offered by certified labs has been instrumental in assuring end-use quality, particularly for personalized prosthodontics and Implantology.

Challenges Impacting the Growth of the 3D Printing Dental Devices Market

The 3D printing dental devices market faces challenges such as high costs of advanced dental 3D printers, regulatory hurdles in obtaining approvals for patient-specific devices, and risks of material degradation in long-term dental restorations. The need for improved printing speed and precision in dental manufacturing, challenges in ensuring long-term biocompatibility of printed dental prosthetics, and disparities in access to 3D printing technologies across different regions create barriers to market expansion.

Additionally, challenges in integrating AI-powered dental treatment planning into routine practice, high costs associated with training dental professionals on 3D printing techniques, and resistance to transitioning from traditional dental fabrication methods to 3D-printed alternatives impact market growth.

Advancements and Innovations Driving Growth in the 3D Printing Dental Devices Market

The increasing adoption of AI-powered dental implant design optimization, expansion of bioresorbable and patient-specific dental prosthetics, and rising investment in hybrid 3D printing techniques present significant growth opportunities in the market. The development of smart dental implants with embedded sensors for real-time monitoring, increasing focus on integrating 3D-printed solutions with digital orthodontics, and expansion of bioprinting applications for tissue regeneration are fueling market growth.

Additionally, increasing research into bioactive coatings for 3D-printed dental implants, expansion of digital dentistry manufacturing hubs, and growing collaborations between academic institutions and dental device manufacturers for optimizing implant performance are expected to create new avenues for industry expansion. The rise of cost-efficient 3D printing technologies and increasing consumer preference for minimally invasive, highly customized dental solutions are further enhancing accessibility and long-term market potential.

The rising adoption of hybrid and biocompatible implant materials is expanding market opportunities in full-mouth reconstructions, pediatric dentistry, and digital orthodontics. Governments and healthcare agencies are expanding support for medical 3D printing research, streamlining approval pathways for patient-specific dental implants, and implementing policies to improve accessibility of advanced dental solutions.

Market Outlook

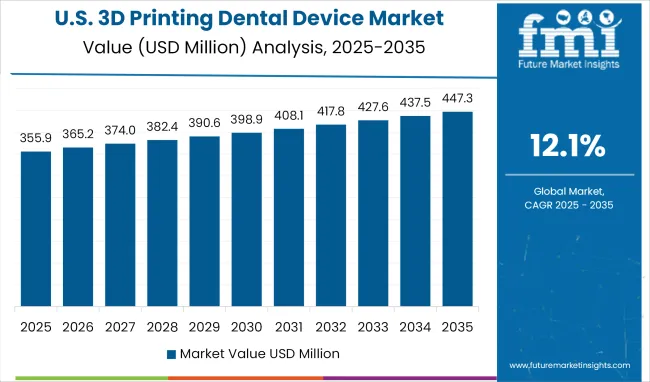

The adoption of cutting-edge dental technology, a large number of dental labs, and the rising need for individualized dental care have put the USA at the forefront of the 3D printing dental device industry. The growing usage of additive manufacturing for dental implants, crowns, bridges, and aligners is helping the market. Additionally, dental prosthetics are becoming more accurate and efficient thanks to the incorporation of AI and digital scanning technology is driving the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 11.4% |

Market Outlook

The United Kingdom is experiencing significant growth in the 3D printing dental devices market due to increasing adoption of digital dentistry, NHS funding for dental restorations, and the rise in private dental clinics offering high-end solutions. The country’s strong regulatory framework and focus on sustainable materials in 3D printing are also shaping market trends.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.3% |

Market Outlook

India's 3D printing dental devices market is growing fast with the rise in the number of dental clinics, medical tourism, and the affordability of 3D printing technologies. Although conventional dental prosthetics are still used on a large scale, the transition to digital dentistry is gaining traction, especially in urban centers where advanced dental care is available.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 13.2% |

Market Outlook

Germany is a leader in the 3D printing dental devices market due to its strong dental industry, advanced research in dental biomaterials, and high adoption of CAD/CAM systems. The country’s focus on precision engineering and high-quality dental prosthetics is driving demand for digitally printed dental implants and restorations.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 11.9% |

Market Outlook

China’s 3D printing dental devices market is growing rapidly due to the expansion of dental healthcare services, rising disposable incomes, and strong domestic manufacturing capabilities. The country is becoming a major producer of affordable 3D-printed dental products, making digital dentistry more accessible.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 12.5% |

The 3D printing dental devices market is witnessing robust competition, fueled by advancements in printer technology, material science, and digital workflow integration. Companies are heavily investing in R&D to develop high-precision printers and biocompatible materials that cater to customized dental solutions.

Strategic partnerships with dental laboratories, service organizations, and tech startups are being leveraged to expand production capabilities and clinical reach. Additionally, efforts are focused on integrating AI-driven design tools and cloud-based platforms to enhance automation and reduce operational costs. Mergers and acquisitions are also shaping the competitive landscape, allowing players to broaden their product portfolios and enter new markets. This innovation-driven competition is enhancing efficiency, accuracy, and accessibility, thereby accelerating market growth globally.

Key Development:

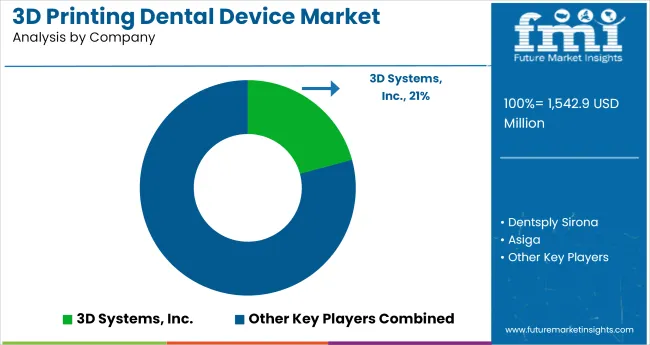

The overall market size for 3D Printing Dental Devices Market was USD 1,542.9 million in 2025.

The 3D Printing Dental Devices Market is expected to reach USD 4,835.0 million in 2035.

Increasing adoption of digital dentistry, technological advancements in 3d printing and rising demand for dental restorations and prosthetics are some factors that drive the 3D printing dental devices market.

The top key players that drives the development of 3D Printing Dental Devices Market are 3D, Systems Corporation, Stratasys Ltd., Dentsply Sirona, Formlabs and Carbon Inc.

Removable partial dentures in 3D Printing Dental Devices market is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D IC and 2.5D IC Packaging Market Size and Share Forecast Outlook 2025 to 2035

3d-Printed Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

3D Display Market Size and Share Forecast Outlook 2025 to 2035

3D Neuroscience Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Kit Market Analysis Size and Share Forecast Outlook 2025 to 2035

3D Glasses Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA