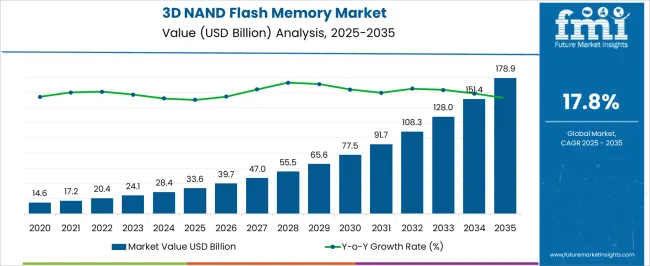

The 3D NAND Flash Memory Market is estimated to be valued at USD 33.6 billion in 2025 and is projected to reach USD 178.9 billion by 2035, registering a compound annual growth rate (CAGR) of 17.8% over the forecast period.

| Metric | Value |

|---|---|

| 3D NAND Flash Memory Market Estimated Value in (2025 E) | USD 33.6 billion |

| 3D NAND Flash Memory Market Forecast Value in (2035 F) | USD 178.9 billion |

| Forecast CAGR (2025 to 2035) | 17.8% |

The 3D NAND flash memory market is advancing steadily, underpinned by escalating demand for high-capacity and energy-efficient storage solutions across consumer and enterprise domains. Industry disclosures and technology press releases have emphasized the role of 3D NAND in overcoming density limitations of planar NAND through vertical stacking, delivering improved performance and lower cost per bit.

Continuous investment by semiconductor manufacturers into advanced process nodes and higher-layer architectures has supported rapid capacity scaling and enhanced endurance. Smartphone adoption, growth in connected devices, and expansion of cloud computing have further driven consumption of 3D NAND across multiple applications.

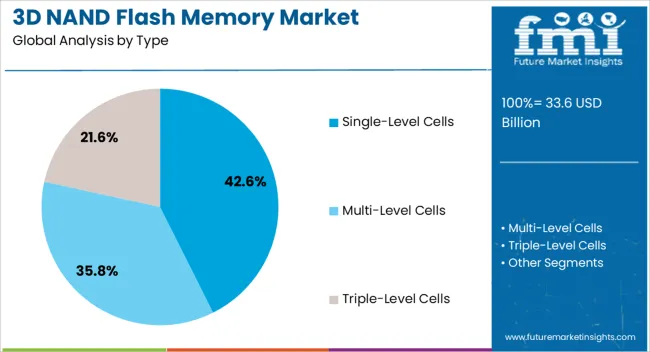

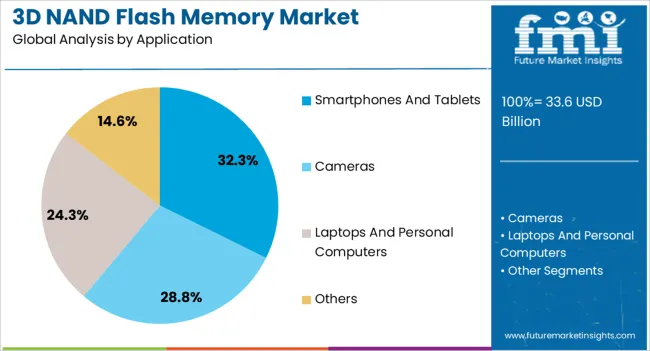

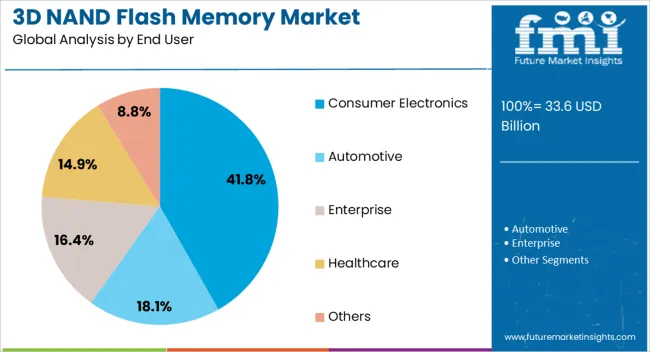

The market outlook remains favorable as the technology continues to enable next-generation use cases in 5G devices, IoT systems, and data-intensive computing. Segmental expansion is being led by Single-Level Cells for their reliability, Smartphones and Tablets for their mass adoption of high-performance memory, and Consumer Electronics due to the sheer scale of demand for portable storage, entertainment systems, and digital appliances.

The Single-Level Cells (SLC) segment is projected to hold 42.6% of the 3D NAND flash memory market revenue in 2025, securing its position as the leading type. Growth in this segment has been shaped by its superior reliability, faster write speeds, and higher endurance compared to multi-level or triple-level alternatives. Semiconductor industry updates have highlighted that SLC memory continues to be favored in applications where data integrity and durability are critical.

Manufacturers have optimized production processes to deliver SLC with enhanced performance while addressing cost challenges, sustaining its adoption in high-performance devices. Additionally, its low error rates and longer lifespan have reinforced its deployment in systems requiring consistent and stable operation.

These factors have positioned SLC as the preferred choice for applications demanding robust memory performance, maintaining its significant market share within the broader 3D NAND landscape.

The Smartphones and Tablets segment is projected to contribute 32.3% of the 3D NAND flash memory market revenue in 2025, representing the dominant application category. Market growth has been driven by increasing consumer demand for devices with greater storage capacity to support high-resolution media, mobile gaming, and app ecosystems. Device makers have integrated 3D NAND flash memory to deliver compact storage with faster data access speeds and reduced power consumption, meeting user expectations for performance and battery efficiency.

Industry reports have noted that the widespread adoption of 5G-enabled smartphones has further accelerated the integration of higher-capacity 3D NAND solutions. The growing reliance on mobile devices for both personal and professional use has ensured steady demand, while the need for differentiated device features has reinforced the role of advanced memory technologies.

This trajectory is expected to sustain Smartphones and Tablets as the leading application segment for 3D NAND flash memory.

The Consumer Electronics segment is projected to account for 41.8% of the 3D NAND flash memory market revenue in 2025, establishing itself as the leading end-user category. Growth in this segment has been supported by the rising proliferation of smart devices, digital entertainment platforms, and home automation systems. Consumer electronics brands have relied on 3D NAND flash memory to deliver faster storage, compact form factors, and cost-efficient scalability, addressing the evolving expectations of digital consumers.

Press releases and corporate presentations from major manufacturers have highlighted continuous innovation in storage density and durability, ensuring alignment with consumer product lifecycles. Additionally, the expansion of wearables, gaming consoles, and personal computing devices has amplified memory consumption.

As consumer lifestyles become increasingly digital and data-intensive, the Consumer Electronics segment is expected to maintain its dominance, driven by ongoing demand for enhanced device functionality and user experience.

As the demand for high-capacity storage solutions increases, the technology is being increasingly adopted in other electronic devices such as smartphones, laptops, tablets, and enterprise storage systems. Advancements in the industry have led to manufacturers curating higher-layer 3D NAND technology to increase storage densities and reduce manufacturing costs.

The emergence of Quad-Level Cell (QLC) NAND flash, which has better storage capabilities as compared to the conventional vertical NAND components, has revolutionized the industry. Manufacturers are also focusing on increasing the performance of 3D NAND flash memory so that they can cater to a wide spectrum of consumers and businesses in the industrial landscape.

The section below explains different segments and their shares in the global market. As per type, single-level cells are anticipated to remain at the forefront by accounting for a 42.6% share in 2025. By application, the smartphone and tablet category is projected to lead by holding a share of 32.3% in 2025.

3D NAND flash memory storage devices are categorized by type on the basis of levels, including single-cell, multi-level cell, triple-level cell, and others. Among these, the single-level cell segment holds an industry share of 42.6% in 2025.

| Attributes | Details |

|---|---|

| Type | Single-level Cell |

| Share (2025) | 42.6% |

The demand for single-level cell (SLC) flash memory has skyrocketed in the past few years as it has the highest endurance among all flash memory types. This is because it stores only one bit of data per cell, making it suitable for applications that require frequent read/write operations over an extended period.

The prominence of SLC flash memory across industries is also rising as they offer faster read and write speeds compared to Multi-Level Cell (MLC) or Triple-Level Cell (TLC) flash memory.

The newly launched 3D NAND flash memory technology is being integrated into various electronic devices, such as cameras, laptops & personal computers, smartphones & tablets. Among these, the smartphones and tablets segment holds the maximum share of 32.3% of the overall industry in 2025.

| Attributes | Details |

|---|---|

| Applications | Smartphones and Tablets |

| Share (2025) | 32.3% |

The use of these technologies among smartphone and tablet manufacturing companies has skyrocketed in the past few years. This is primarily due to their capability of storing large quantities of data in a smaller physical footprint compared to planar NAND.

With technological breakthroughs, 3D NAND flash memory is able to offer faster read and write speeds. This leads to better overall performance and responsiveness of smartphones and tablets.

The section discusses the region-wise insights of this market. Considering these figures, it can be projected that the market is spread across the globe and is not confined to any region. Developed and developing economies like Australia, China, the United States, Japan, and Germany are considered to become some of the most lucrative countries in this industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Australia | 21.7% |

| China | 18.7% |

| United States | 12.3% |

| Germany | 7.7% |

| Japan | 7% |

Australia, as a country, has experienced a tremendous rise in the sales of consumer electronics products, such as smartphones, tablets, laptops, personal computers, etc., in the last few decades. These devices are equipped with advanced 3D NAND memory chipsets so that they can store significant amounts of data in smaller spaces.

This has generated a huge demand for vertical NAND chips in the country, the market for which is slated to rise at a CAGR of 21.7% through 2035. Besides this, the influx of multinational corporate companies with rapid globalization, has also benefitted the industry in the country.

China is one of the largest manufacturers of electronics, especially smartphones and tablets. The country witnesses the presence of a multitude of smartphone manufacturers that have a consumer base not just within China but also worldwide. Companies like Huawei, Oppo, Xiaomi, Vivo, OnePlus, etc., generate huge demand for 3D NAND flash memory solutions.

Ongoing trends in the Chinese industrial landscape justify the estimated 18.7% CAGR through 2035. Apart from this, the country is expanding its data center infrastructure to support its growing digital economy. Government as well as the private sector entities are investing heavily in the construction of large-scale data centers which are further contributing to the industry’s growth.

Several industry giants, such as Intel, Micron Technology, and Western Digital, are located in Silicon Valley, United States. This strong presence of leading companies in the country, with hefty investments and extensive research & development activities, is driving innovation in 3D NAND flash memory technology.

The United States market is set to report a 12.3% CAGR through 2035. Besides this, the expansion of cloud computing and data center sectors in the United States has increased the adoption of vertical NAND flash memory solutions.

Germany is one of the top countries in this industry. It is slated to progress at a considerable CAGR of 7.7% through 2035.?

Germany is home to some of the world's leading automotive manufacturers, including Volkswagen, BMW, and Mercedes-Benz. These companies generate an excellent demand for high-performance storage solutions based on 3D NAND flash memory.

They are one of the essential components in advanced electronic systems, including infotainment systems, navigation systems, and ADAS. The emergence of Industry 4.0 in Germany’s engineering manufacturing landscape is also contributing positively to the industry.

Japan, from the beginning of the century, has been welcoming technological innovation and is known for its strong prominence in the semiconductor manufacturing industry. The sector is anticipated to showcase a CAGR of 7% through 2035 due to the existence of companies like Toshiba Memory Corporation and Kioxia Corporation. These companies are investing heavily in curating novel breakthroughs in 3D NAND flash memory technology.

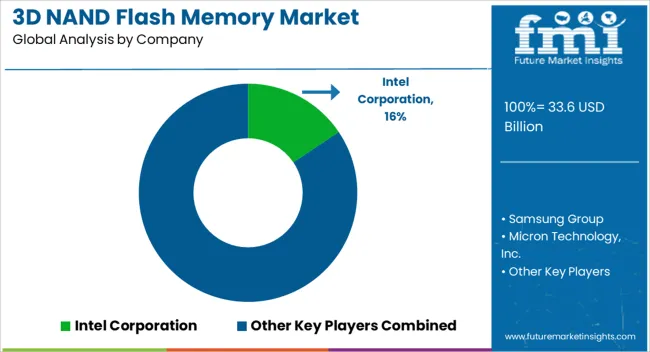

The 3D NAND flash memory market is a very mature one with a multitude of tech companies competing for international dominance. These companies, who already have established themselves in the tech background are investing a substantial amount of their financial capital in the development of more powerful, smaller, and interoperable memory chips.

They are also collaborating with electronics manufacturing players so that they can take advantage of each other's expertise.

Some of the prominent companies in the sector are Samsung Electronics, SK Hynix, Micron Technology, Intel Corporation, Kioxia Corporation, Western Digital Corporation, SanDisk, Nanya Technology Corporation, and Powerchip Technology Corporation.

Recent Developments:

On the basis of type, the 3D NAND flash memory market is segmented into single-level cells, multi-level cells, and triple-level cells.

Based on applications, the 3D NAND flash memory market is divided into cameras, laptops and personal computers, smartphones and tablets, and others.

Based on end-users, the 3D NAND flash memory market is segmented into automotive, consumer electronics, enterprise, healthcare, and others.

As per regions, the 3D NAND flash memory market is divided into North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa

The global 3D NAND flash memory market is estimated to be valued at USD 33.6 billion in 2025.

The market size for the 3D NAND flash memory market is projected to reach USD 178.9 billion by 2035.

The 3D NAND flash memory market is expected to grow at a 17.8% CAGR between 2025 and 2035.

The key product types in 3D NAND flash memory market are single-level cells, multi-level cells and triple-level cells.

In terms of application, smartphones and tablets segment to command 32.3% share in the 3D NAND flash memory market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

3D IC and 2.5D IC Packaging Market Size and Share Forecast Outlook 2025 to 2035

3d-Printed Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA